DeVry University, Chicago FIN 365 Week 5 Homework WITH ASSURED GRADE A+

Document Content and Description Below

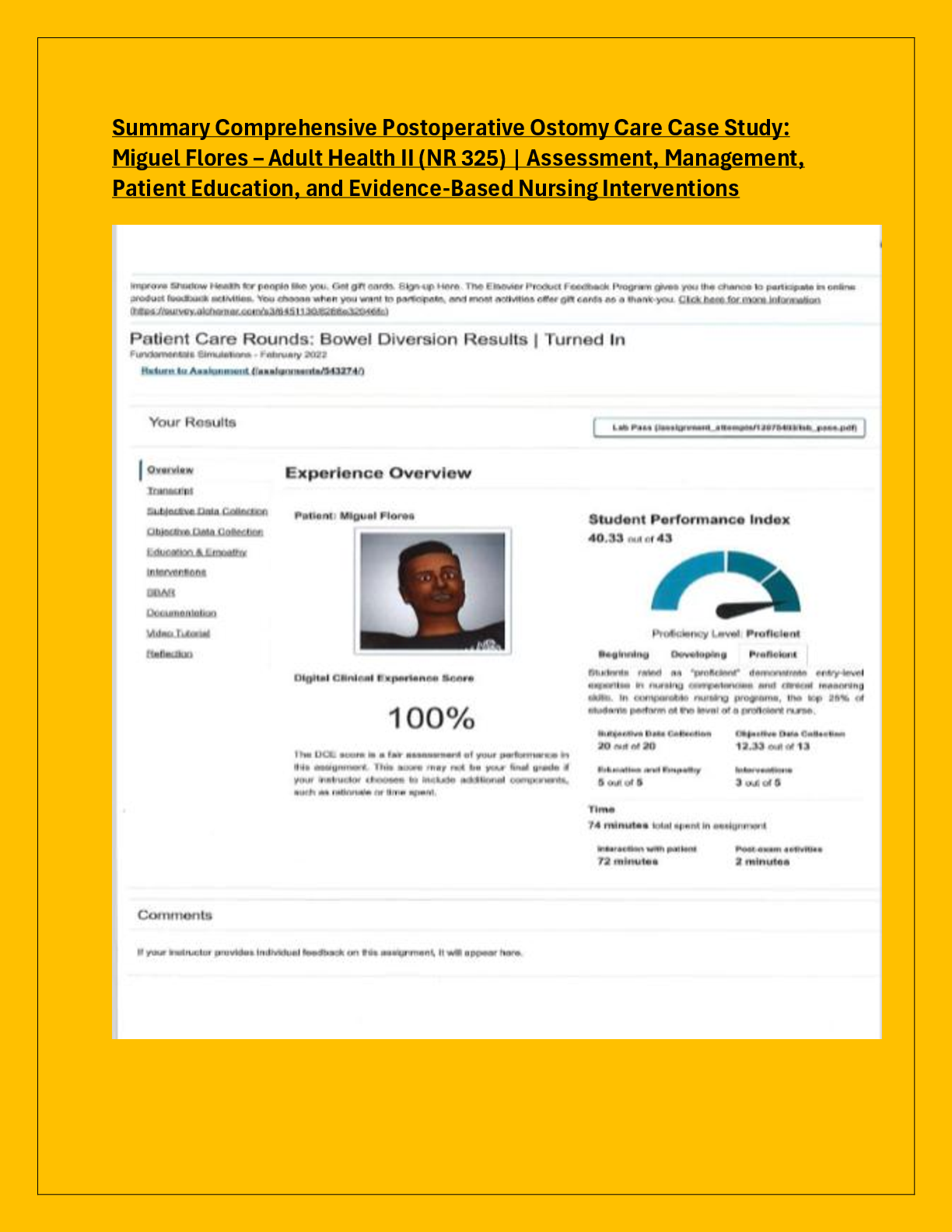

FIN 565 Week 5 Homework Solutions Question: Host Government Incentives for DFI Why would foreign governments provide MNCs with incentives to undertake DFI there? Question: DFI Location Decision De ... cko Co. is a U.S. firm with a Chinese subsidiary that produces smart phones in China and sells them in Japan. This subsidiary pays its wages and its rent in Chinese yuan, which is stable relative to the dollar. The smartphones sold to Japan are denominated in Japanese yen. Assume that Decko Co. expects that the Chinese yuan will continue to stay stable against the dollar. The subsidiary’s main goal is to generate profits for itself and reinvest the profits. It does not plan to remit any funds to Decko, the U.S. parent. Assume that the Japanese yen strengthens against the U.S. dollar over time. How would this be expected to affect the profits earned by the Chinese subsidiary? If Decko Co. had established its subsidiary in Tokyo, Japan, instead of in China, would the subsidiary’s profits be more exposed or less exposed to exchange raterisk? Why do you think that Decko Co. established the subsidiary in China instead ofJapan? Assume no major country risk barriers. If the Chinese subsidiary needs to borrow money to finance its expansion and wants to reduce its exchange rate risk, should it borrow U.S. dollars, Chinese yuan, or Japanese yen? 3. Question: Capital Budgeting Analysis A project in South Korea requires an initial investment of 2 billion South Korean won. The project is expected to generate net cash flows to the subsidiary of 3 billion and 4 billion won in the two years of operation, respectively. The project has no salvage value. The current value of the won is 1,100 won per U.S. dollar, and the value of the won is expected to remain constant over the next two years. What is the NPV of this project if the required rate of return is 13percent? Repeat the question, except assume that the value of the won is expected to be 1,200won per U.S. dollar after two years. Further assume that the funds are blocked and that the parent company will only be able to remit them back to the United States in two years. How does this affect the NPV of the project? [Show More]

Last updated: 3 years ago

Preview 1 out of 3 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

FIN 565 Homework Week 1 – 7 (Bundle) WITH CORRECT QUESTIONS AND ASWERS AND AN ASSURED GRADE A+ SCORE

FIN 565 Homework Week 1 – 7 (Bundle) Categories FIN 565 International Finance Description (FIN 565 Homework) FIN 565 Week 1 Homework Solutions Question: Imperfect Markets Explain how the e...

By Grade A Plus 4 years ago

$45.5

7

Reviews( 0 )

$13.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 24, 2021

Number of pages

3

Written in

All

Additional information

This document has been written for:

Uploaded

May 24, 2021

Downloads

0

Views

129

(1).png)