Finance > EXAM > DeVry University, Chicago FIN 565_ week 8 Final Exam LATEST OF 2021 WITH CORRECT ANSWERS AND ASSUR (All)

DeVry University, Chicago FIN 565_ week 8 Final Exam LATEST OF 2021 WITH CORRECT ANSWERS AND ASSURED GRADE A+ SCORE

Document Content and Description Below

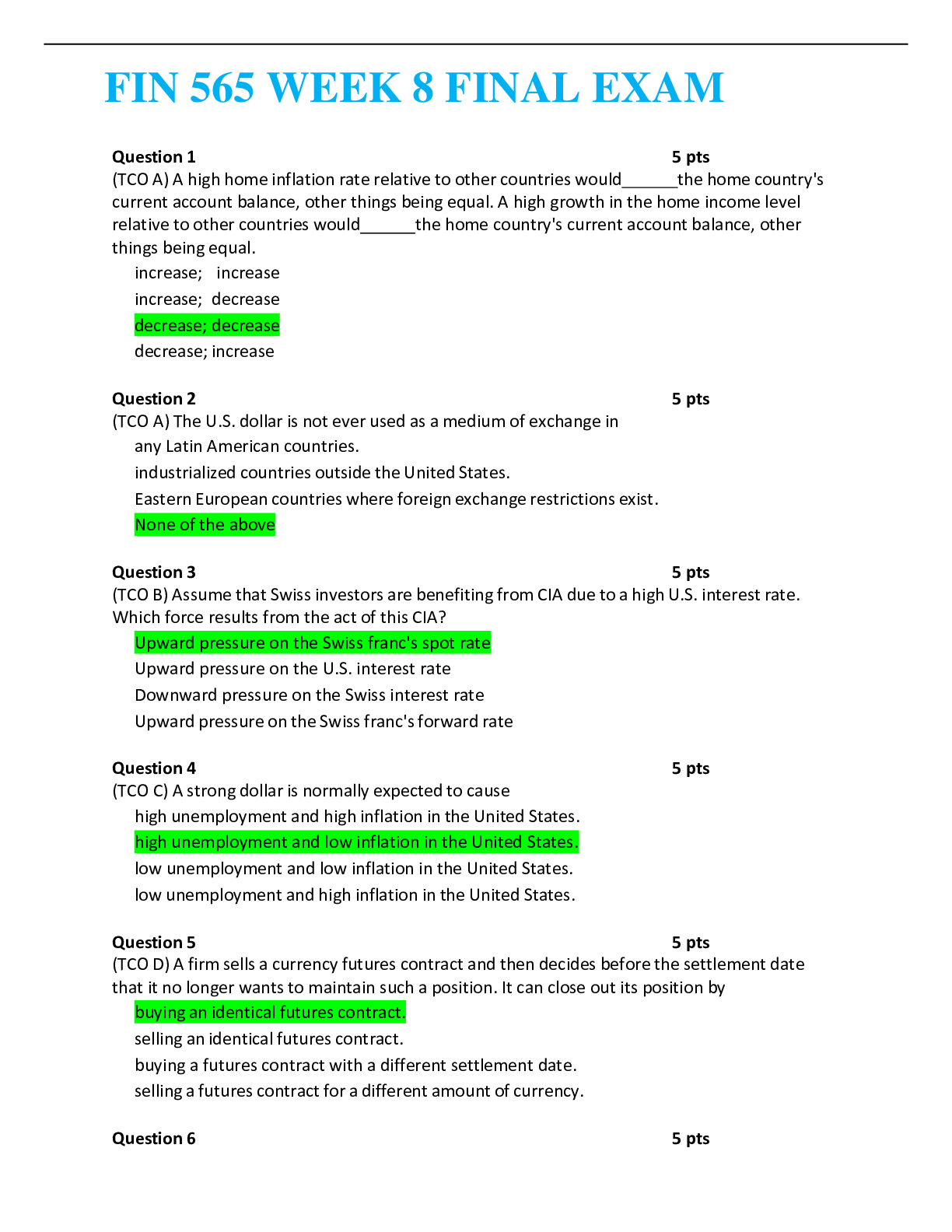

FIN 565 Week 8 Final Exam (Version 1) Question: (TCO A) A high home inflation rate relative to other countries would the home country’s current account balance, other things being equal. A high gro... wth in the home income level relative to other countries would the home country’s current account balance, other things being equal. (Points :5) Question: (TCO A) Assume the Canadian dollar is equal to $0.98 and the Brazilian real is equal to $0.28. The value of the Brazilian real in Canadian dollars is (Points : 5) Question: (TCOB) Assume that IRP holds and the euro’s interest rate is 9%, whereas the U.S. interest rate is 12%. Then, the euro’s interest rate increases to 11%, whereas the U.S. interest rate remains the same. As a result of the increase in the interest rate on euros, the euro’s forward ..will in order to maintain (Points :5) Question: (TCOC) A strong dollar is normally expected to cause(Points:5) high unemployment and high inflation in the United States. Question: (TCO D) Assume no transactions costs exist for any futures or forward contracts. The price of British pound futures with a settlement date 180 days from now will (Points : 5) Question: (TCO H) Other things being equal, the financial leverage of MNCs will be higher if the governments of their home countries are likely to rescue them (in the event of failure) and if their home countries are likely to experience a recession. (Points :5) Question: (TCO E) Other things being equal, firms from a particular home country will engageinmoreinternationalacquisitionsiftheyexpectforeigncurrenciesto against their home currency and if their cost of capital is relatively . (Points :5) Question: (TCO F) The agency costs of an MNC are likely to be lower if it (Points : 5) scatters its subsidiaries across many foreign countries. Question: (TCO I) With a(n) ,the exporter ships the goods to the importer while still retaining actual title to the merchandise. (Points :5) Question: (TCOG) If a U.S. firm’s expenses are more susceptible to exchange rate movements than revenue, the firm will if the dollar . (Points :5) Question: TCO D) A firm wants to use an option to hedge NZ$12.5 million in receivables from New Zealand firms. The premium is $0.02. The exercise price is $0.50. If the option is exercised, what is the total amount of dollars received (after accounting for the premium paid)? (Points :12) Question: (TCO B) Assume the following information. You have $300,000 to invest. The spot bid rate for the euro is $1.08. The spot ask quote for the euro is $1.10. The 180-day forward rate (bid) of the euro is $1.08. The 180-day forward rate (ask) of the euro is$1.10. … interest rate in the U.S. is6%. .. day interest rate in Europe is 8%. If you conduct CIA, what amount will you have after 180 days? Show your work. (Points :12) Question: (TCO D) You purchase a call option on pounds for a premium of $0.03 per unit, with an exercise price of $1.64; the option will not be exercised until the expiration date, if at If the spot rate on the expiration date is $1.65, what is your net profit per unit? Show your work. (Points : 12) Question: (TCO D) What are major differences between currency futures and forward contracts? List at least five of them. (Points : 14) Question: (TCO A) Why would firms issue stock in foreign markets? (Points :25) Question: (TCOC) Discuss the following scenario below and how it would affect Asian exchange rates during a crisis. A decline in Asian interest rates and capital flows and investment in the country (P Question: (TCOF) What are the three common theories as to why firms become motivated to expand their business internationally? List them and explain each (Points :25) Question: (TCOD) List the factors that affect currency call option premiums, and briefly explain the relationship that exists for (Points :25) Question: (TCO B) Respond to the following items regarding testing Describe a method for testing whether IRP exists. (10points) Why are transactions costs, currency restrictions, and differential tax laws important when evaluating whether CIA can be beneficial? (Points :25) Question: Question 6. 6. (TCO F) Snyder Golf Co., a U.S. firm that sells high-quality golf clubs in the United States, wants to expand internationally by selling the same golf clubs in Brazil. Describe the tradeoffs that are involved for each method (e.g., exporting, direct foreign investment, etc.) that Snyder could use to achieve its goal. (Points : 25) Question: (TCOG) How does translation exposure affect a business with a high percentage of business conducted by subsidiaries? What factors come into play? (Points :25) [Show More]

Last updated: 2 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$22.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 25, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

May 25, 2021

Downloads

0

Views

74

(1).png)