Mathematics > EXAM > Finance (York University) Final Exam 2019, Questions and Answers: All Answers Provided (All)

Finance (York University) Final Exam 2019, Questions and Answers: All Answers Provided

Document Content and Description Below

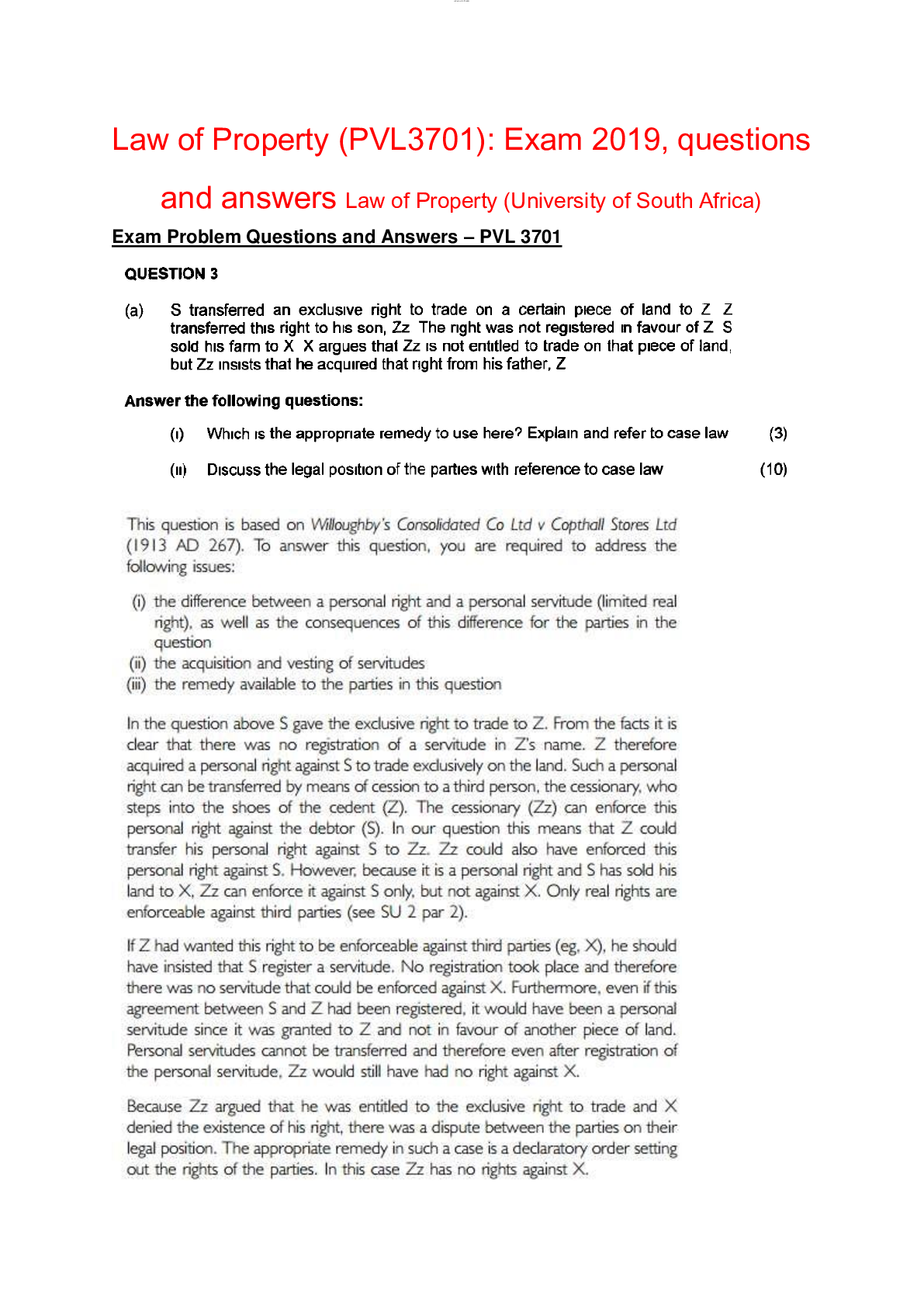

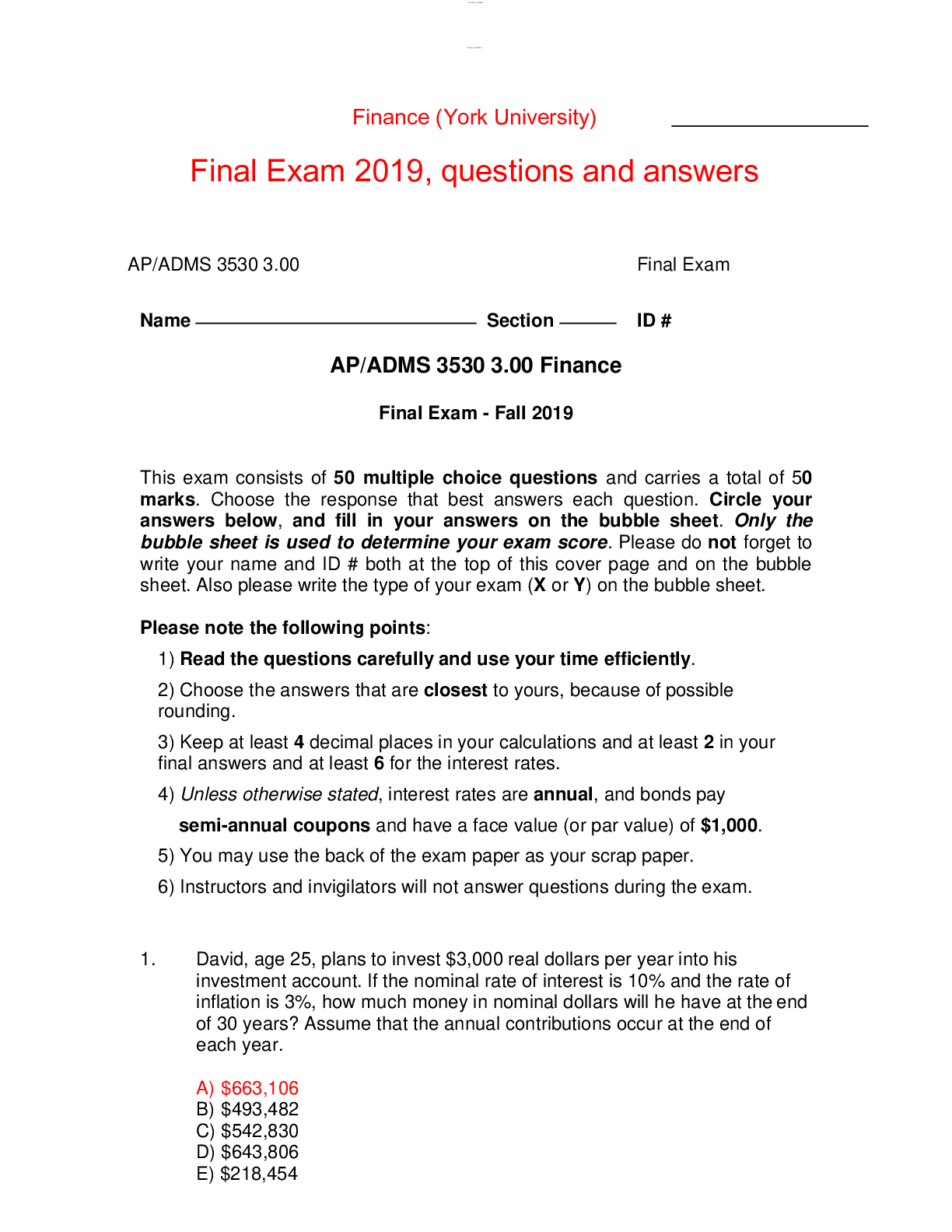

lOMoARcPSD|784381 Finance (York University) Final Exam 2019, Questions and Answers AP/ADMS 3530 3.00 Final Exam Name Section ID # AP/ADMS 3530 3.00 Finance Final Exam - Fall 2019 ... This exam consists of 50 multiple choice questions and carries a total of 50 marks. Choose the response that best answers each question. Circle your answers below, and fill in your answers on the bubble sheet. Only the bubble sheet is used to determine your exam score. Please do not forget to write your name and ID # both at the top of this cover page and on the bubble sheet. Also please write the type of your exam (X or Y) on the bubble sheet. Please note the following points: 1) Read the questions carefully and use your time efficiently. 2) Choose the answers that are closest to yours, because of possible rounding. 3) Keep at least 4 decimal places in your calculations and at least 2 in your final answers and at least 6 for the interest rates. 4) Unless otherwise stated, interest rates are annual, and bonds pay semi-annual coupons and have a face value (or par value) of $1,000. 5) You may use the back of the exam paper as your scrap paper. 6) Instructors and invigilators will not answer questions during the exam. 1. David, age 25, plans to invest $3,000 real dollars per year into his investment account. If the nominal rate of interest is 10% and the rate of inflation is 3%, how much money in nominal dollars will he have at the end of 30 years? Assume that the annual contributions occur at the end of each year. A) $663,106 B) $493,482 C) $542,830 D) $643,806 E) $218,454 2. Mr. Hope, 65, has recently retired. He will spend $45,000 in the first year, and plans to increase his annual spending at the rate of 2% per year. If the rate of interest is 6%, and he does not expect to live beyond age 85, how much money does he need today in order to support his post- retirement expenses? Assume that all annual expenses occur at the beginning of each year. A) $603,759 B) $547,115 C) $639,984 D) $516,146 E) $900,000 3. By how much will an annual coupon bond increase in price over the next year if it currently sells for $935.82, has ten years until maturity, face value of $1,000 and an annual coupon rate of 8%? Assume market interest rates remain unchanged. A) $12.50 B) $8.21 C) $7.47 D) $4.23 E) $3.16 4. Calculate the current price of a 7% semi-annual coupon bond, with a $1,000 face value which matures in 5 years. Assume a required return of 6%. A) $1,021.33 B) $1,042.65 C) $1,056.25 D) $1,068.01 E) $1,073.25 5. What should be the price for a common stock paying a constant annual dividend of $2.50 per share each year if the growth rate is zero and the discount rate is 8 percent? A) $33.75 B) $18.00 C) $22.50 D) $31.25 E) $42.00 6. Green Corp. just paid an annual dividend of $1.20 per share. The company forecasts dividends to increase by 2% each year for the foreseeable future. If the current share price is $30, what is the required rate of return on this stock? A) 5.94% B) 6.00% C) 6.08% D) 6.11 % E) 6.45% 7. Consider the two following mutually-exclusive projects Year Project A Project B 0 - $100 -$100 1 20 40 2 50 45 3 70 50 If the firm’s cost of capital is 11%, which project(s) should you accept and why? A) Project A because it has a higher NPV. B) Project B because it has a higher IRR. C) Project A because it has a higher NPV and a higher IRR. D) Both projects because both have an IRR greater than the cost of capital. E) Both projects because both have a positive NPV. 8. Blueprint Co. is considering whether or not to replace an old machine. It is expected that the old machine will last three more years, during which it will cost $5,000 in the first year, $6,000 in the second year and $7,000 in the third to operate it. A new machine costs $16,000 and has expected economic life of 7 years. To operate the new machine, it will cost $3,000 per year for the first three years and $4,000 per year for the last four years. If the discount rate is 8%, the equivalent annual cost of the old and new machine is, respectively, A) $5,949 $5,813 B) $5,949 $6,578 C) $6,747 $5,124 D) $6,747 $6,069 E) $6,747 $6,772 9. What is the profitability index for a project costing $250,000 today and providing a net cash inflow of $89,000 annually for 4 years at an opportunity cost of capital of 9% per annum? A) 0.092 B) 0.122 C) 0.135 D) 0.148 E) 0.153 10. Rilent Inc. is considering a 10 year project that has an initial cost of $X. The project will generate a positive cash flow of $45,000 a year starting in year 1. The project has a 10% cost of capital and a 12% internal rate of return (IRR). What is the project’s net present value (NPV)? A) $ 18,209 B) $ 22,245 C) $ 56,208 D) $ 63,517 E) $ 68,454 11. Mac Inc. is looking to acquire a new machine that will cost $100,000 and generate after-tax cash inflows of $35,000 for four years. Mac Inc. uses a 12 percent opportunity cost of capital. What is the NPV of the new machine? A) $6,307.23 B) $6,007.23 C) $6,107.23 D) $6,070.23 E) $6,370.32 12. What is the amount of the operating cash flow for a firm with $500,000 profit before tax, $100,000 depreciation expense, and a 35 percent marginal tax rate? A) $260,000 B) $325,000 C) $360,000 D) $425,000 E) $390,000 13. What is the present value of the incremental tax shields generated if a company purchases equipment to be used in business operations for $250,000 and the equipment has a CCA rate of 25%? You intend to sell the equipment in year 8 for a salvage value of $8,000. At the time of sale, you still anticipate having other assets in the class. The tax rate is 35% and the company uses a 12% rate of return. A) $55,109 B) $55,190 C) $55,900 D) $56,718 E) $55,954 - Use the following formula to solve the problem: 14. What is the cash flow from operations if a project generates revenues of $1000, cash expenses of $600 and depreciation charges of $200 and the tax rate is 35%? A) $300 B) $230 C) $260 D) $540 E) $330 15. How much could NPV be affected by a worst-case scenario of 30 percent reduction from the $2.8 million in expected annual cash flows on a seven- year project with 9 percent cost of capital? A) $2,141,210 B) $2,852,000 C) $3,611,030 D) $4,227,680 E) $5,155,274 16. What is the accounting break-even level of revenues for a firm with $9 million in sales, variable costs of $5.4 million, fixed costs of $3 million, and depreciation of $2 million? A) $10,837,000 B) $11,005,000 C) $12,150,000 D) $12,500,000 E) $14,120,000 17. Approximately how much of an initial investment was needed in a project that has an NPV break-even level of sales of $6 million, cash flows determined by: 15% × sales - $250,000, an eight-year life, and a 10 percent discount rate? A) $1,326,757 B) $2,780,003 C) $3,647,702 D) $4,270,143 E) $5,345,000 18. If a firm's DOL is 5.0 when its profit is $2,000,000 and its depreciation is $750,000, how much fixed cost does it have? A) $7,000,000 B) $7,250,000 C) $7,500,000 D) $7,750,000 E) $8,000,000 19. A portfolio is comprised of stock X, stock Y, and stock Z. Their weights in the portfolio are 25%, 25%, and 50%, respectively. The three stocks have the following scenario analysis. What is the expected rate of return of the three-stock portfolio? Rate of Return Scenario Probability Stock X Stock Y Stock Z Normal Economy 60% 10% 8% 15% Boom 40% 15% 14% 30% A) 12.4% B) 14.4% C) 16.1% D) 18.2% E) 20.4% 20. Consider the following scenario analysis for stock A. What is the standard deviation for stock A? Scenario Probability Rate of Return (Stock A) 9 AP/ADMS 3530 3.00 Final Exam Type X Recession 15% -10% Normal Economy 70% 15% Boom 15% 40% A) 8.62% B) 10.8% C) 13.7% D) 18.3% E) 23.6% 21. Jumanji Inc’s stock is priced today at $25.00. The company has a beta of 1.25, and a dividend yield of 6 percent. T-bills currently yield 5 percent and the market portfolio 14 percent, what is the expected stock price of Jumanji stock in two years? A) $17.56 B) $25.00 C) $30.39 D) $33.78 E) $32.15 22. Which projects should be undertaken if the risk-free rate is 6 percent and the market risk premium is 9 percent, assume that all else remains the same? Project Beta Actual Return A 2.0 25% B 1.6 22% C 1.1 15% 10 AP/ADMS 3530 3.00 Final Exam Type X D 0.8 11% A) Accept A & D. Reject B & C B) Accept C& D. Reject A & B C) Accept A & B. Reject C & D D) Accept B & C. Reject A & D E) Accept A & C. Reject B & D 23. Sammy wants to invest in stock of Bujumbura Corp but wants to ensure that his overall portfolio beta is the same as the market portfolio and is also equally weighted among the 3 stocks in his portfolio. The 2 stocks currently in the portfolio are Cheatifyoucan Inc. which has a beta of 0.9 and Imscrewed Inc. which has a beta of 1.1. What should be the beta of Bujumbura Corp. if Sammy wants to achieve his objective? A) 0.93 B) 1.00 C) 1.08 D) 1.15 E) 1.21 24. Baldguy Inc. has an investment “A” that expects to generate net cash flows of $10,000 a year forever starting next year. The firm has a beta of 0.4, the risk-free rate of return is 5% and the expected rate of return on the market portfolio is 15%. What is the value of investment “A” today? A) $54,566 B) $98,567 C) $111,111 D) $123,211 11 AP/ADMS 3530 3.00 Final Exam Type X E) $200,000 25. What is the WACC for a firm using 55% equity with a required return of 12%, 35% debt with a required return of 8%, and 10% preferred stock with a required return of 10%, and a tax rate of 30%? A) 9.42% B) 9.56% C) 10.40% D) 12.05% E) 13.33% 26. What proportion of a firm is equity financed if the WACC is 14%, the after- tax cost of debt is 7.0%, the tax rate is 35%, and the required return on equity is 16%? A) 54.00% B) 63.64% C) 70.26% D) 77.78% E) 82.65% 27. A firm is considering a project that will generate cash flows of $50,000 per year for ten years beginning immediately. The project has the same risk as the firm's overall operations. If the firm's debt-to-equity ratio is 0.75, its required return on equity is 8% and its required return on debt is 6%, what is the most it could pay (rounding to the nearest dollar) for the project? Assume the firm pays no taxes. 12 AP/ADMS 3530 3.00 Final Exam Type X A) $266,667 B) $348,918 C) $373,830 D) $454,167 E) $637,800 28. Argo Inc. has 2 million shares of common stock outstanding at a book value of $2 per share. The stock trades for $3.50 per share. It also has $2 million in face value of debt that trades at 90% of par. What is its ratio of Debt to Equity for WACC purposes? A) 20.5% B) 25.7% C) 26.5% D) 33.3% E) 42.5% 29. The following information of the Ace Manufacturing Company is given: Annual sales $10.5 million Annual cost of goods sold $8.5 million Average inventory $3 million Average trade receivables $1.5 million Average trade payables $1 million What is the cash conversion cycle? 13 AP/ADMS 3530 3.00 Final Exam Type X A) 128 days B) 138 days C) 181 days D) 152 days E) 172 days 30. Young Vigo Company Limited sells bicycles in Southern Ontario. The wholesale price of a bike is $800. The sale price is $1,200 per bike and the annual sales are $9,600,000. The cost of placing an order is $600. The annual carrying cost per bike is 2% of the wholesale price. What is the optimal ordering quantity? A) 450 B) 498 C) 611 D) 517 E) 775 31. A firm sells its products on terms of net 30 at $205 per unit. The present value of production cost is $135 per unit. The opportunity cost is 1% per month, and there are 30 days per month. It is estimated that only 70% of all orders are eventually collectible. Orders come in 100 units. What is the expected profit per order? A) $850 B) $4,900 C) $499 D) $973 E) $708 32. The Anthony Gibson Company purchases goods from its supplier on terms of 1.5/10 net 35. What is the cost of forgoing the trade discount, in terms of EAR? A) 21.9% B) 24.7% C) 18.7% D) 15% E) 18% 33. Morgan Insurance Co. sells its account receivables to a factor at a 2 per cent discount. The average collection period is one month. What is the implicit effective annual interest rate on the factoring arrangement? A) 24.0% B) 26.8% C) 21.2% D) 20.41% E) 27.43% 34. Janet needs $100 per week. She goes to the bank to withdraw money from the automated teller. The bank charges 50 cents per withdrawal. What is the optimal-sized withdrawal if the rate of interest is 3.5%? A) $188 B) $193 C) $372 D) $385 E) $200 35. Which form of the Efficient Market Theory states that stock prices rapidly reflect all publicly available information? A) Weak-form B) Semi-strong form C) Moderate form D) Inefficient form E) Technical form 36. New projects can be evaluated using the company cost of capital providing that the: A) firm does not pay taxes. B) firm is all equity financed. C) cost of debt is less than the cost of equity. D) new projects have the same risk as existing operations of the firm. E) the firm is publicly traded. 37. The costs of maintaining current assets, including opportunity cost of capital, are called: A) Carrying costs. B) Shortage costs. C) Explicit costs. D) Implicit costs. E) Transaction costs. 38. Which of the following changes will increase the NPV of a project? 16 AP/ADMS 3530 3.00 Final Exam Type X A) Decrease in the discount rate B) Decrease in the size of the cash inflows C) Increase in the initial cost of the project D) Decrease in the number of cash inflows E) Decrease in the PVCCATS 39. The procedure to determine the likelihood a customer will pay its bills is called: A) Credit analysis. B) Probability analysis. C) Capacity analysis. D) Character analysis. E) Condition analysis. 40. Financial ratios can be calculated to help determine: A) a customer’s ability to pay its bills. B) a customer’s willingness to pay its bills. C) a customer’s character to pay its bills. D) a customer’s efficiency to pay its bills. E) a customer’s collateral condition to pay its bills. 41. Of the three following investment options which has the greatest systematic risk? Security Standard Deviation Beta Dowe 35% 1.75 Cheatem 68% 1.06 Howe 24% 1.22 A) Cheatem, because it has the largest standard deviation B) Dowe, because it has the largest beta C) Howe, because it has the smallest standard deviation but a large beta D) Cheatem, because it has the highest ratio of standard deviation to beta E) It’s not possible to tell, given the information above 17 AP/ADMS 3530 3.00 Final Exam Type X 42. Para-papa-pa Corporation is able to reduce its cash fixed costs next year. If all else remains the same then which of the following will also decline next year? I. Operating leverage II. Accounting break-even III. Operating cash flow IV. Cash flow break-even A) I and II only B) II and IV only C) I, II, and III only D) I, II, and IV only E) I, II, III, and IV 43. The slope of the security market line (SML) equals: A) one. B) beta. C) beta * (Rm – Rf). D) the market risk premium. E) the expected return on the market portfolio. If a firm wishes to undertake a project with a different risk than its own, what is the best method by which to estimate the project's beta? F) A company in the same business as the firm G) A risk adjustment made to the firm's beta H) A company in the same business as the project I) Management approximation J) Average beta calculation of firms in S&P 500 Index 44. Which of the following statements is most correct? A) If Project X has a higher IRR than Project Y, then Project X must also have a higher NPV. B) The IRR calculation implicitly assumes that all cash flows are reinvested at a rate of return equal to the cost of capital. C) If a project’s internal rate of return (IRR) exceeds the cost of capital, then the project’s net present value (NPV) must be positive. D) Both statements A and C E) Both statements B and C 18 AP/ADMS 3530 3.00 Final Exam Type X 45. Which of the following statements concerning IRR is false? A) IRR can rank mutually exclusive projects. B) IRR cannot be used for projects with upward-sloping NPV profiles. C) In certain situations, projects with higher IRRs may have lower NPV’s. D) IRR is defined as the discount rate at which project NPV equals zero. E) None of the statements are false. 46. The difference between current assets and current liabilities is called: A) net working capital. B) working capital. C) financial capital. D) cash flow. E) both a) and b) above. 47. If we were to use the capital asset pricing model which of the three following investment options would have the lowest expected return? Security Standard Deviation Beta Dowe 35% 1.75 Cheatem 68% 1.06 Howe 24% 1.22 A) Howe, because it has the smallest standard deviation B) Cheatem, because it has the largest standard deviation C) Cheatem, because it has the smallest beta D) Howe, because it has the lowest ratio of standard deviation to beta E) It’s not possible to tell, given the information above 48. If you were seeking optimal portfolio diversification for your investments then which of the following is likely most important to you? A) The total volatility of each individual security in your portfolio B) The standard deviation of each individual security in your portfolio C) The correlation between the securities in your portfolio D) Achieving the risk-free rate of return for your portfolio 19 AP/ADMS 3530 3.00 Final Exam Type X E) Achieving a portfolio beta that is very close to the market portfolio 49. Which of the following should not be included when using discounted cash flow analysis to evaluate a project? A) Opportunity cost of land that you could otherwise sell B) Changes in levels of net working capital C) Reduced sales of an existing product D) Interest costs on new debt incurred to finance the project E) None of the above should be included in a DCF analysis 20 [Show More]

Last updated: 2 years ago

Preview 1 out of 19 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$14.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 12, 2020

Number of pages

19

Written in

Additional information

This document has been written for:

Uploaded

Jul 12, 2020

Downloads

0

Views

157