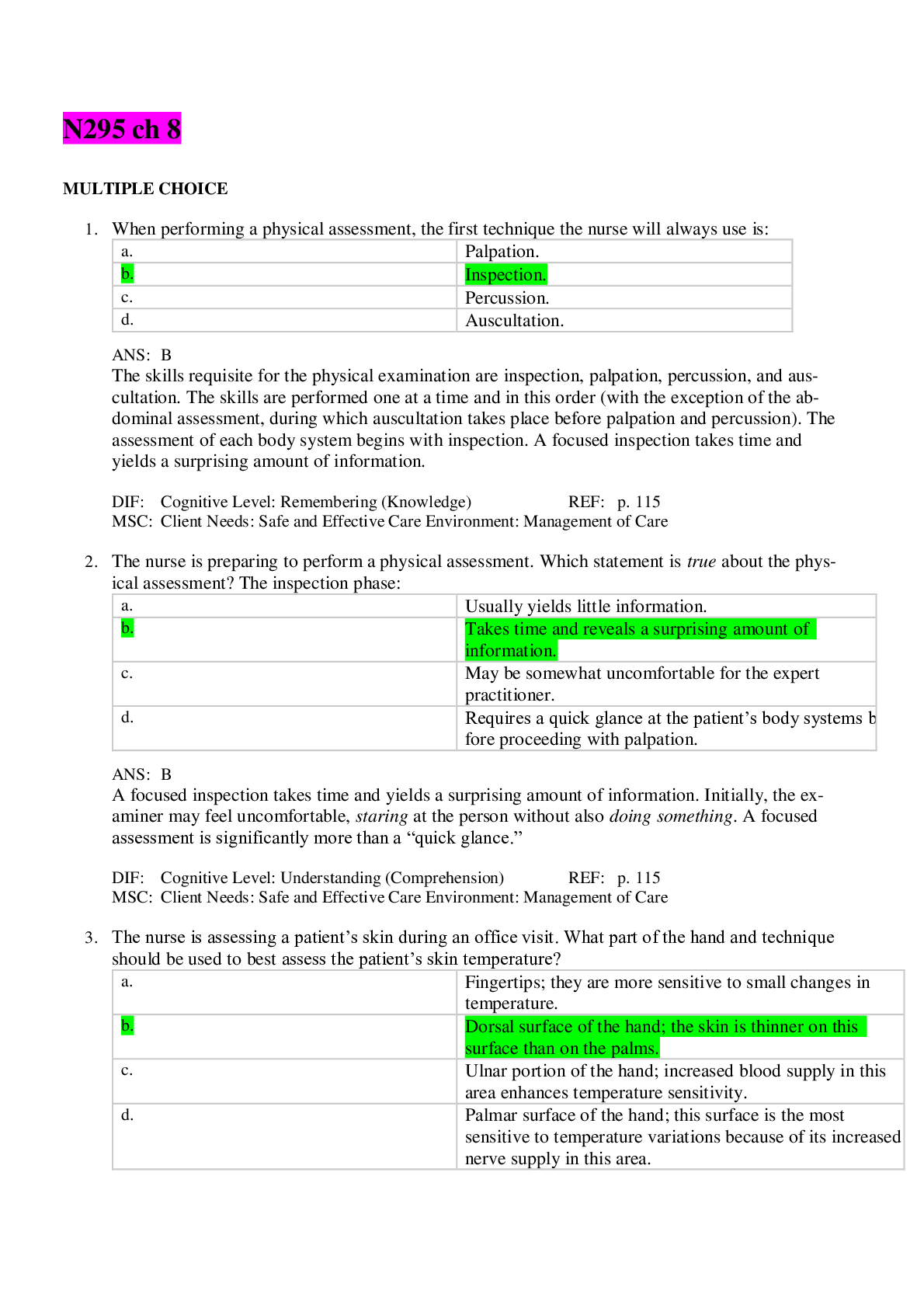

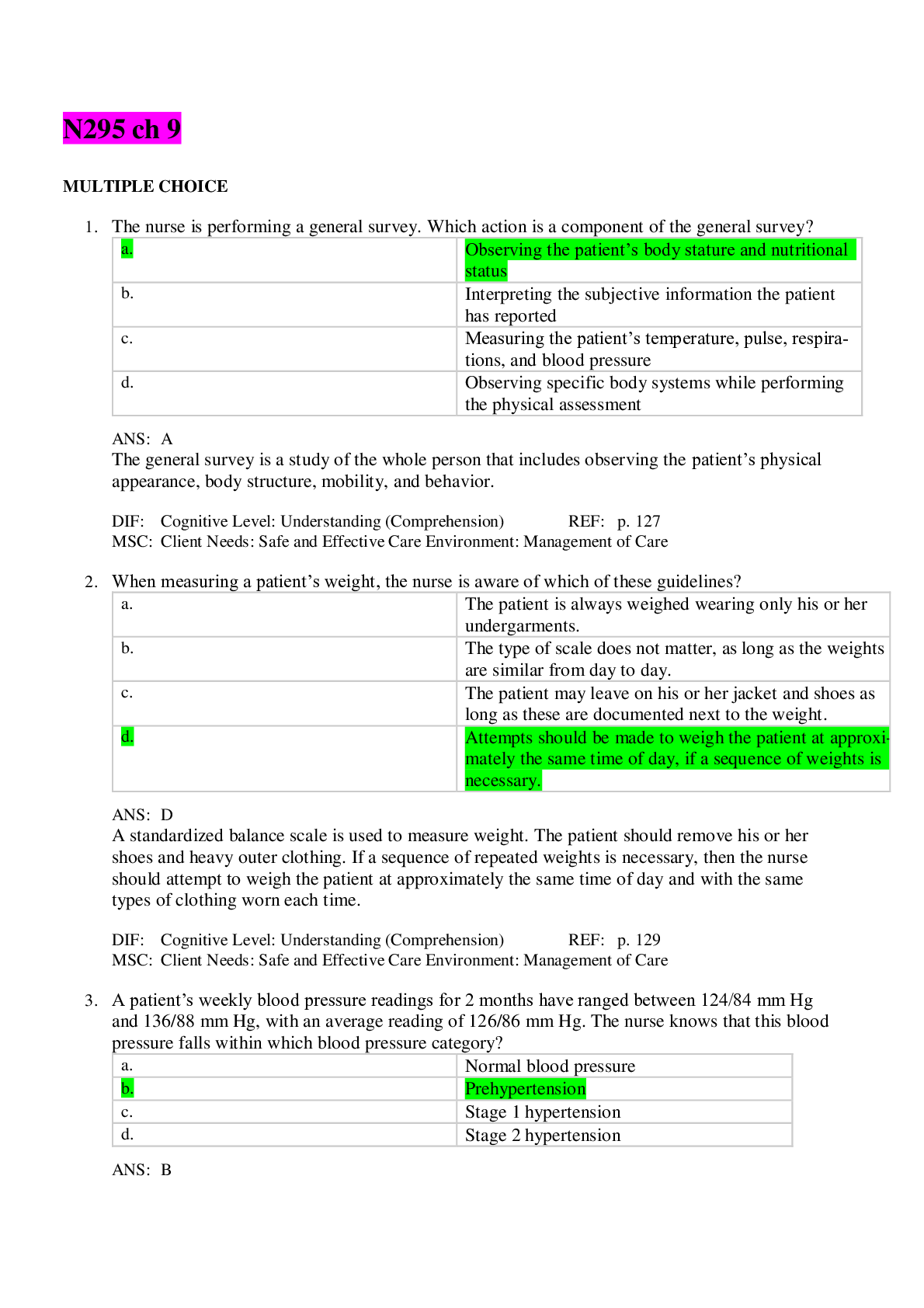

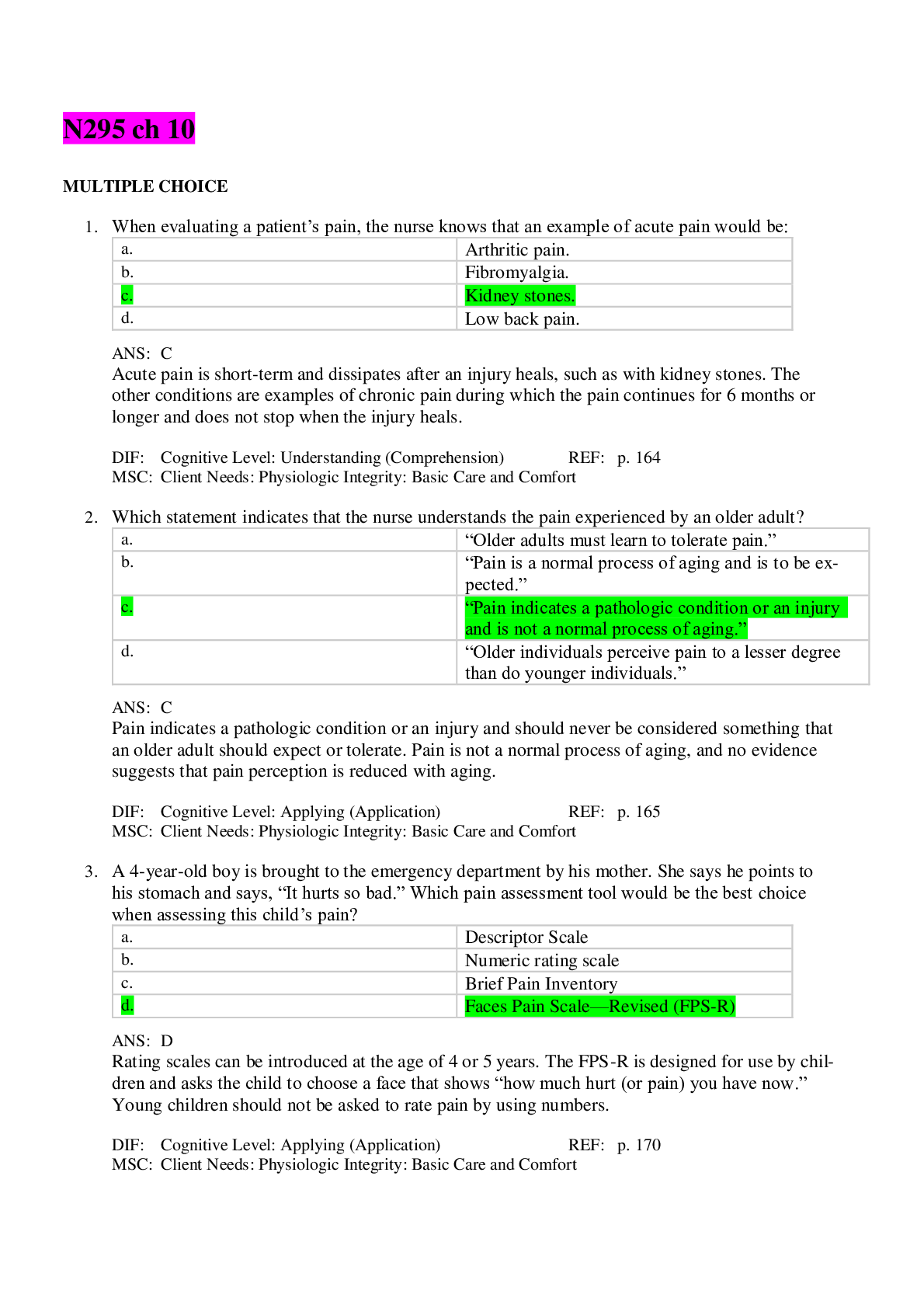

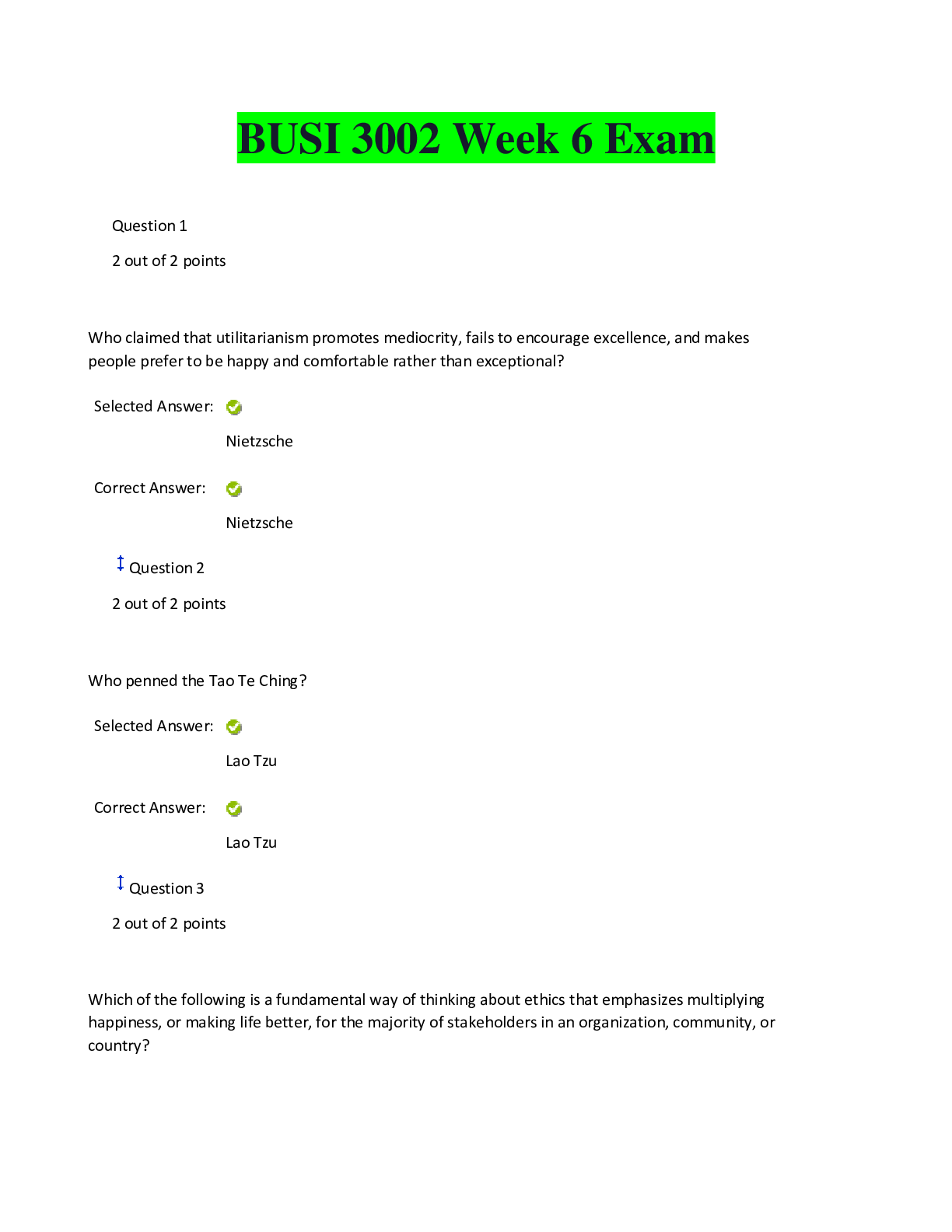

Accounting > EXAM > ACCT 212 Financial Accounting WITH CORRECT QUESTIONS AND ANSWERS ASSURED GRADE A+ SCORE (All)

ACCT 212 Financial Accounting WITH CORRECT QUESTIONS AND ANSWERS ASSURED GRADE A+ SCORE

Document Content and Description Below

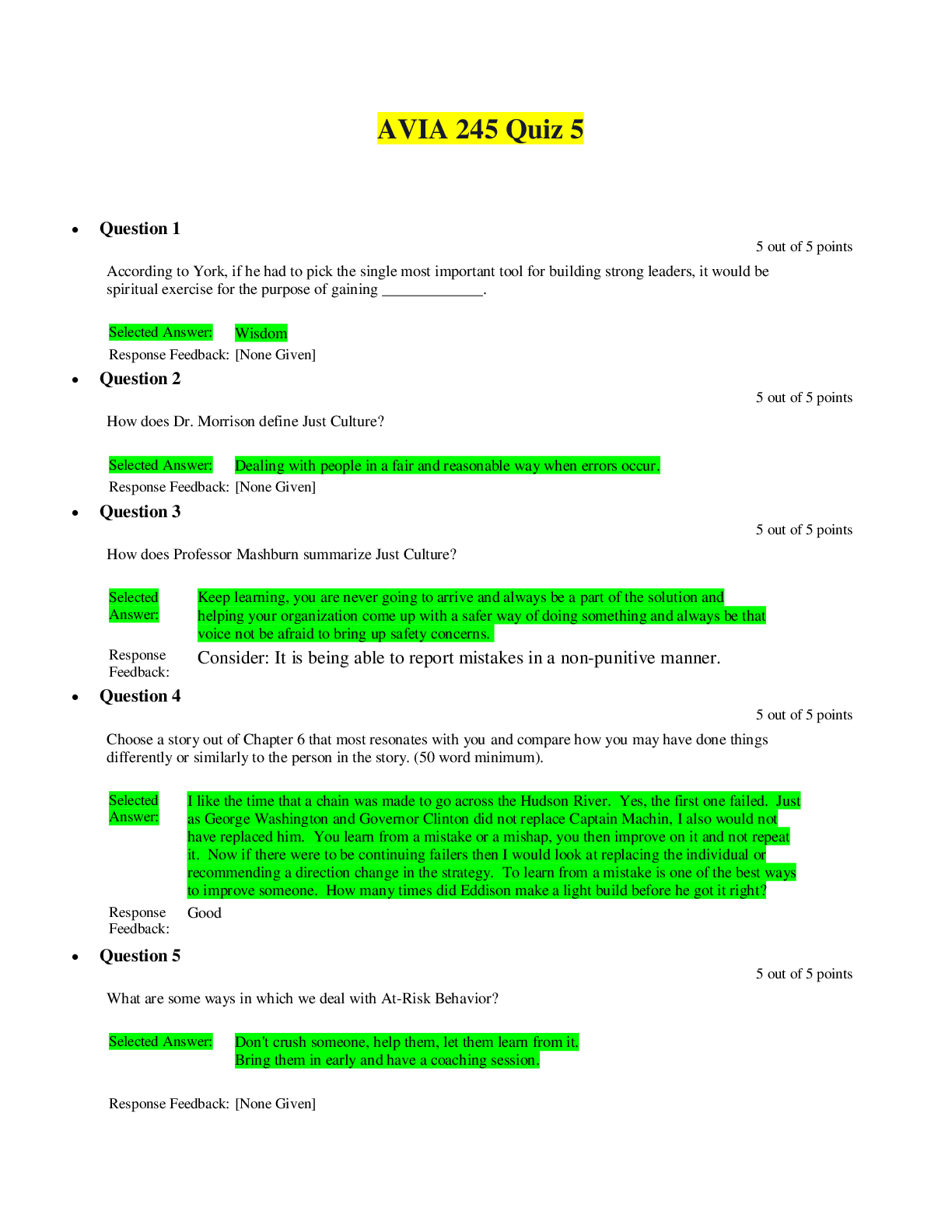

ACCT 212 Financial Accounting WITH CORRECT QUESTIONS AND ANSWERS ASSURED GRADE A+ SCORE Question/Term: Another name for short-term investments is:marketable securities. Question/Term: In... vestments in marketable securities fall into three categories, including: Question/Term: Trading security for $12,000. The entry to record this transaction will include Question/Term: An unrealized gain: Question/Term: Trading securities are: Question/Term: Unrealized gains or losses on trading securities are … on the: Question/Term: ABC Company has shipped goods to one of its customers FOB shipping point. ABC Company will recognize sales revenue when: Question/Term: When goods are … FOB destination: Question/Term: If a buyer takes advantage of a sales discount, the journal entry recorded by the seller will include a(n): Question/Term: Which of the following is a true statement about sales? Question/Term: If a buyer takes advantage of a sales discount, the journal entry recorded by the seller will include a(n): Question/Term: A ledger that contains a separate account for each customer is … a: Question/Term: The most important internal control over cash is to: Question/Term: The biggest risk of selling on credit is: Question/Term: The aging-of-receivables method is: Question/Term: Under the allowance method: Question/Term: Allowance for uncollectible accounts is classified as: Question/Term: Which account shows the amount of accounts receivable that the business does NOT expect to collect? Question/Term: The percent-of-sales method of computing uncollectible accounts is … for: Question/Term: The percent-of-sales method: Question/Term: The entry to write off an account under the allowance method for estimating uncollectible accounts: Question/Term: The aging-of-receivables method: Question/Term: Under the allowance method: Question/Term: Allowance for uncollectible accounts is classified as: Question/Term: Which account shows the amount of accounts receivable that the business does NOT expect to collect Question/Term: The percent-of-sales method of computing uncollectible accounts is … for: Question/Term: The percent-of-sales method: Question/Term: The entry to write off an account under the allowance method for estimating uncollectible accounts: Question/Term: The aging-of-receivables method: Question/Term: Under the allowance method, the entry to write off a $2,600 uncollectible account includes a: Question/Term: A company makes a journal entry to debit Uncollectible-Account Expense and credit Accounts Receivable. This entry indicates that they are using the ________ method. Question/Term: The entry to record accrued interest on a note receivable at year end includes a debit to: Question/Term: On a statement of cash flows, collections of accounts receivables are classified as: Question/Term: In 2012, Krane Company purchases $75,000 of U.S. Treasury bills. This purchase would … reported on Krane Company’s 2012 statement of cash flows as: Question/Term: A three month, 10% note for $8,000, dated April 15, is … from a customer. The principal of the note is: Question/Term: The entry to record accrued interest on a note receivable at year end includes a debit to: Question/Term: On a statement of cash flows, collections of accounts receivables are classified as: Question/Term: In 2012, Krane Company purchases $75,000 of U.S. Treasury bills. This purchase would … reported on Krane Company’s 2012 statement of cash flows as: Question/Term: A measure of the ability of an entity to pay all of its current liabilities if they come due immediately is the: Question/Term: Which of the following is … to be a more stringent measure of a company’s ability to pay its current liabilities than the current ratio? Question/Term: The quick ratio and the number of days’ sales in receivables measure: Question/Term: When computing the acid test ratio, the numerator will include all of the following EXCEPT for Question/Term: Days’ sales in receivables can … computed in two logical steps. In the second step: Question/Term: In a perpetual inventory system, Question/Term: The cost of the inventory that the business … to customers is … : Question/Term: The cost of inventory that is still on hand and has not been … to customers is … : Question/Term: Another term for gross profit is: Question/Term: Sales revenue is based on the ________ price of the inventory, while cost of goods sold is based on the ________ of the inventory. Question/Term: Which is the correct order for items to appear on the income statement? Question/Term: A periodic inventory system: Question/Term: ABC Company purchases inventory from XYZ Company with the shipping terms FOB shipping point. This means that: Question/Term: How do purchase returns and allowances and purchase discounts affect gross purchases? Question/Term: When inventory is … from the seller to the buyer with shipping terms of FOB destination: Question/Term: Under a perpetual inventory system, the journal entry to record the purchase of inventory will include a: Question/Term: All of the following costs would … included in inventory EXCEPT for: Question/Term: The cost of inventory is the: Question/Term: The specific-unit-cost method: Question/Term: ABC Auto Sales sells new Lexus vehicles. ABC will most likely use the ________ method to cost its ending inventory. Question/Term: To determine the average cost per unit: Question/Term: When inventory prices are increasing, the FIFO costing method will generally yield a cost of goods sold that is: Question/Term: Under the ________ method, ending inventory is based on the costs of the most recent purchases. Question/Term: When inventory prices are falling, the LIFO costing method will generally result in: Question/Term: When comparing the results of LIFO and FIFO when inventory costs are decreasing: Question/Term: When comparing the FIFO and LIFO inventory methods: Question/Term: A LIFO ________ occurs when inventory quantities fall below the level of the previous period. Question/Term: The ________ principle states that the financial statements of a business must report enough information for outsiders to make knowledgeable decisions about the business. Question/Term: A company uses LIFO in one year, then switches to FIFO and then to average-cost. This is a violation of the: Question/Term: The cost-of-goods sold model is: Question/Term: An error in the ending inventory for the year ended December 31, 2011: Question/Term: Ending inventory for the year ended December 31, 2011, is understated by $8,000. How will this affect net income for 2011? Question/Term: If the cost of goods sold is understated for the year, then: Question/Term: The journal entry to transfer the beginning inventory to cost of goods sold under the periodic inventory system is : Question/Term: The cost of assets purchased together in a lump sum should … allocated using the market value of each of the assets. Question/Term: TRUE OR FALSE: The cost of a building will include the costs to renovate the building for its intended use. Question/Term: TRUE OR FALSE: Any cost to get machinery up and running and ready for its intended use should … part of the cost of the asset and depreciated. Question/Term: An example of an intangible asset is: Question/Term: Long-lived tangible assets that are … in the operation of the business are … : Question/Term: The only plant asset that does not depreciate is: Question/Term: An asset with no physical form, but that has special rights to current and … future benefits is Question/Term: Which of the following should … included in the cost of land? Question/Term: ABC Company purchased land with an old building that they plan on demolishing so that they can construct a new, modern building. The cost of demolishing the building will … part of the cost of the: Question/Term: The cost of installing lights in the parking lot should … recorded as: Question/Term: Which of the following costs should NOT … added to the cost of the machine? Question/Term: Pat’s Pets recently paid to have the engine in its delivery van overhauled. The estimated useful life of the van was originally estimated to … 4 years. The overhaul is … to extend the useful life of the van to 10 years. The overhaul is regarded as a(n): Question/Term: Capital expenditures are not immediately expensed because these items: Question/Term: If a company capitalizes a cost that should have … : Question/Term: TRUE OR FALSE: Obsolescence may cause an asset’s useful life to … longer than the asset’s physical life. Question/Term: TRUE OR FALSE: Book value equals the cost of the asset less the total accumulated depreciation. Question/Term: Which of the following depreciation methods best applies to those assets that generate greater revenue earlier in their useful lives? Question/Term: All of the … to measure depreciation, EXCEPT for: Question/Term: Double-declining balance depreciation: Question/Term: When computing depreciation for a plant asset, which of the following must … estimated? Question/Term: The expected cash value of a plant asset at the end of its useful life is known as: Question/Term: When compared to the other methods of depreciation, the double-declining-balance method of depreciation gives depreciation expense that is: Question/Term: At the end of an asset’s useful life, the balance in accumulated depreciation will … the same as the: Question/Term: When an asset is fully … : Question/Term: If an asset is sold: Question/Term: Which of the following is a correct statement regarding the disposal of an asset for no proceeds? Question/Term: When plant assets are … : Question/Term: TRUE OR FALSE: Intangible assets with finite lives that can … measured are amortized. Question/Term: TRUE OR FALSE: Goodwill is … only when the purchase price exceeds the value of the net liabilities in the acquisition of another company. Question/Term: The computation of depletion expense is most … to which method for computing depreciation? Question/Term: ________ are accounted for as long-term assets when purchased or developed, and their cost is transferred to expense through a process … depletion. Question/Term: Amortization expense: Question/Term: When an intangible asset is amortized: Question/Term: Goodwill: Question/Term: If a company has goodwill on its books: Question/Term: TRUE OR FALSE: If an asset is impaired, the company is … to adjust the carrying value downward from its book value to its fair value. Question/Term: The following is the proper order for assets on a balance sheet: Question/Term: All investments not classified as available-for-sale investments or trading securities are: Question/Term: TRUE OR FALSE: Available-for-sale investments are adjusted from cost to market value. Question/Term: TRUE OR FALSE: GAAP requires companies to adjust their available-for-sale-securities to market value as of the balance sheet date. Question/Term: On purchase date, Available-for-sale investments in stock are … at: Question/Term: On the balance sheet, Available-for-sale investments in stock are … at: Question/Term: Unrealized gains and losses from available-for-sale investments arise from: Question/Term: The Unrealized Gain or the Unrealized Loss Account appears: Question/Term: Receiving a cash dividend affects what part of the balance sheet? Question/Term: Which of the following is the method … when one company owns less than 20% of the shares of another company? Question/Term: The method … to account for investments in which the investor has 35% of the investee’s voting stock and can significantly influence the decisions of the investee is the: Question/Term: Under the equity method, the Long-Term Investment account is … when the: Question/Term: A company that owns 40% of the common stock of another business recognizes revenue from the investment when: Question/Term: Under the equity method of accounting for stock investments, the Investment account is … of a dividend because: Question/Term: Acme Company owns 35% of Superior Company. Superior Company paid $35,000 cash dividends for the year. Acme Company’s journal entry to record the dividends includes a: Question/Term: Dodson Company owns 17,500 of the 50,000 shares of outstanding common stock of Ferguson Company. Dodson Company should account for this investment using the: Question/Term: Goodwill occurs when a parent company: Question/Term: A noncontrolling (minority) interest arises when: The company whose more than 50% of the stock is … by a parent company is … the: Question/Term: When a company owns more than 50% of the common stock of another company: Question/Term: A consolidated balance sheet shows: Question/Term: A consolidated income statement will show: Question/Term: On the statement of cash flows, the cash paid for 40% of a corporation to … under the equity method is … as a(n): Question/Term: TRUE OR FALSE: Present value is the value now of a … amount to … paid or received in the future, assuming compound interest. Question/Term: All of the following are necessary to compute the future value of a single amount except the: Question/Term: Which of the following discount rates will produce the smallest present value? Question/Term: The primary focus of horizontal analysis is: Question/Term: Period to period percentage change in comparative financial statements is often … : Question/Term: Horizontal analysis is performed on: Question/Term: In performing a vertical analysis, the base for sales returns and allowances is: Question/Term: Which of the following would … most helpful in the comparison of different size companies? Question/Term: Walton Company’s return on sales for the most recent year was 5%. The industry leader reports a return on sales of 7%. The comparison of each company’s return on sales is an example of: Question/Term: On a statement of cash flows, which is … an investing activity? Question/Term: On a statement of cash flows, which is … an operating activity? Question/Term: Purchases of fixed assets is a sign of: Question/Term: A measure of a company’s ability to collect cash from credit customers is the: Question/Term: The ratio that provides an estimate of the number of days, on average, that it takes for customers to pay their account is the: Question/Term: If ABC Corporation’s debt ratio is higher than its major competitors, ABC may: [Show More]

Last updated: 2 years ago

Preview 1 out of 13 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$38.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 06, 2021

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Jun 06, 2021

Downloads

0

Views

88

(1).png)

.png)