Chapter 9 9-16 9-21 9-22

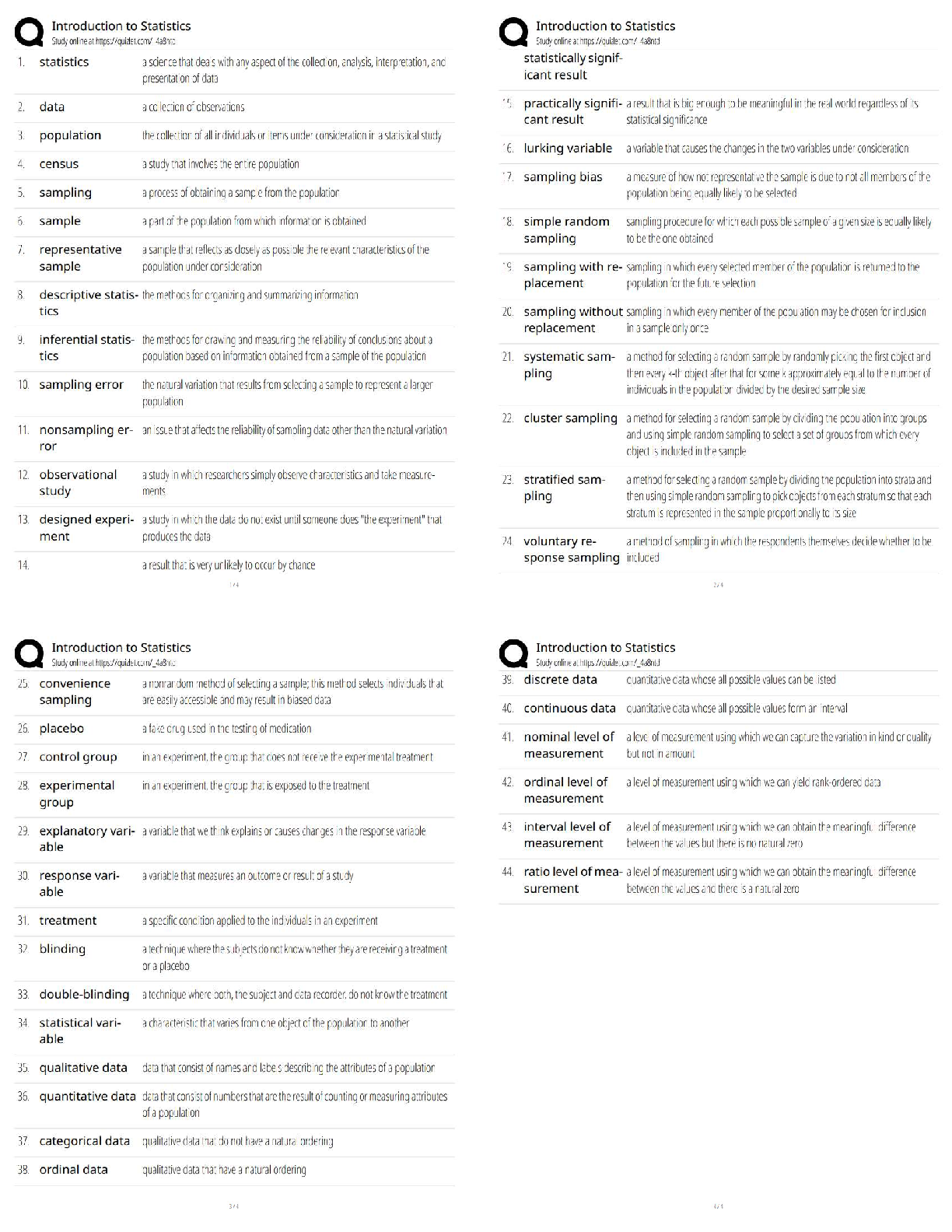

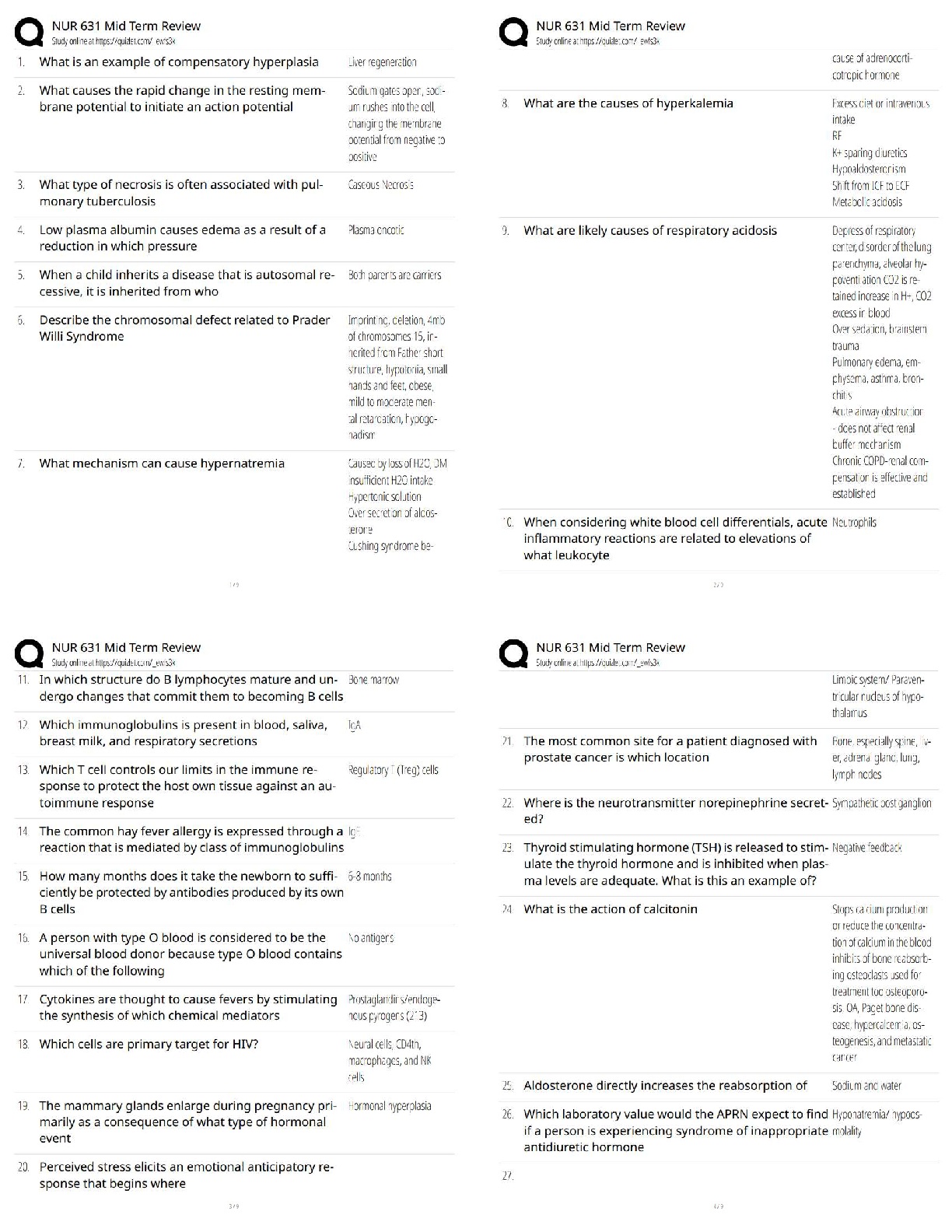

9-16 Variable and absorption costing, explaining operating-income differences. Nascar Motors assembles

and sells motor vehicles and uses standard costing. Actual data relating to April and May

...

Chapter 9 9-16 9-21 9-22

9-16 Variable and absorption costing, explaining operating-income differences. Nascar Motors assembles

and sells motor vehicles and uses standard costing. Actual data relating to April and May 2014 are as follows:

The selling price per vehicle is $24,000. The budgeted level of production used to calculate the budgeted fixed

manufacturing cost per unit is 500 units. There are no price, efficiency, or spending variances. Any productionvolume variance is written off to cost of goods sold in the month in which it occurs.

1.Prepare April and May 2014 income statements for Nascar Motors under (a) variable costing and (b)

absorption costing.

2.Prepare a numerical reconciliation and explanation of the difference between operating income for each

month under variable costing and absorption costing.

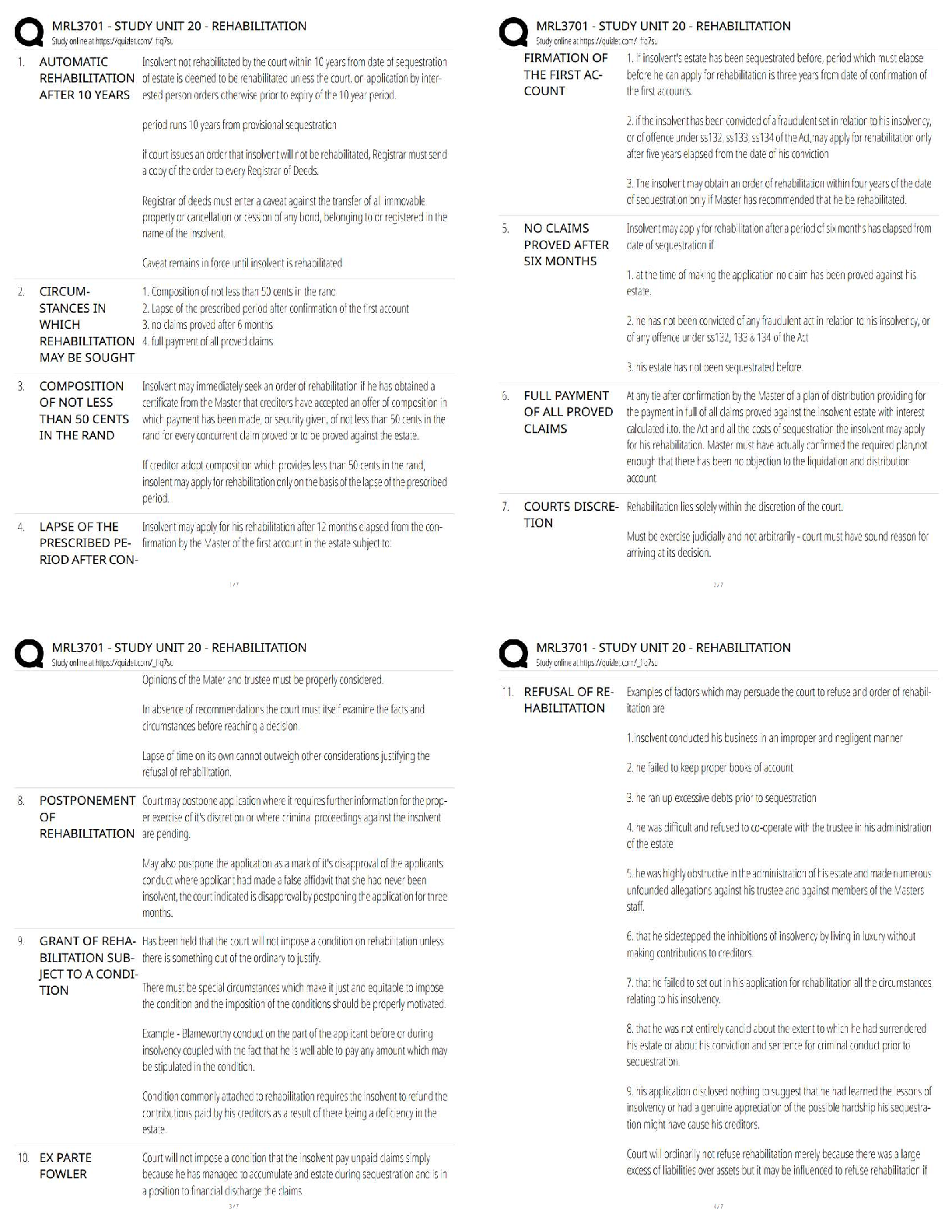

9-16 (30 min.) Variable and absorption costing, explaining operating-income differences.

1. Key inputs for income statement computations are

April May

Beginning inventory

Production

Goods available for sale

Units sold

Ending inventory

0

500

500

350

150

150

400

550

520

30

The budgeted fixed cost per unit and budgeted total manufacturing cost per unit under absorption costing are

April May

(a) Budgeted fixed manufacturing costs

(b) Budgeted production

(c) = (a) ÷ (b) Budgeted fixed manufacturing cost per unit

(d) Budgeted variable manufacturing cost per unit

(e) = (c) + (d) Budgeted total manufacturing cost per unit

$2,000,000

500

$4,000

$10,000

$14,000

$2,000,000

500

$4,000

$10,000

$14,000

9-1(a) Variable costing

April 2014 May 2014

Revenuesa $8,400,000 $12,480,000

Variable costs

Beginning inventory $ 0 $1,500,000

Variable manufacturing costsb 5,000,000 4,000,000

Cost of goods available for sale 5,000,000 5,500,000

Deduct ending inventoryc (1,500,000) (300,000)

Variable cost of goods sold 3,500,000 5,200,000

Variable operating costsd 1,050,000 1,560,000

Total variable costs 4,550,000 6,760,000

Contribution margin 3,850,000 5,720,000

Fixed costs

Fixed manufacturing costs 2,000,000 2,000,000

Fixed operating costs 600,000 600,000

Total fixed costs 2,600,000 2,600,000

Operating income $1,250,000 $3,120,000

a $24,000 × 350; $24,000 × 520 c $10,000 × 150; $10,000 × 30

b $10,000 × 500; $10,000 × 400 d $3,000 × 350; $3,000 × 520

(b) Absorption costing

April 2014 May 2014

Revenuesa $8,400,000 $12,480,000

Cost of goods sold

Beginning inventory $ 0 $2,100,000

Variable manufacturing costsb 5,000,000 4,000,000

Allocated fixed manufacturing costsc 2,000,000 1,600,000

Cost of goods available for sale 7,000,000 7,700,000

Deduct ending inventoryd (2,100,000) (420,000)

Adjustment for prod.-vol. variancee 0 400,000 U

Cost of goods sold 4,900,000 7,680,000

Gross margin 3,500,000 4,800,000

Operating costs

Variable operating costsf 1,050,000 1,560,000

Fixed operating costs 600,000 600,000

Total operating costs 1,650,000 2,160,000

Operating income $1,850,000 $ 2,640,000

a $24,000 × 350; $24,000 × 520 d $14,000 × 150; $14,000 × 30

b $10,000 × 500; $10,000 × 400 e $2,000,000 – $2,000,000; $2,000,000 – $1,600,000

c $4,000 × 500; $4,000 × 400 f $3,000 × 350; $3,000 × 520

2.

Absorption-costing

operating income

–

Variable-costing

operating income

=

Fixed manufacturing costs

in ending inventory

–

Fixed manufacturing costs

in beginning inventory

April:

$1,850,000 – $1,250,000 = ($4,000 × 150) – ($0)

$600,000 = $600,000

May:

9-2$2,640,000 – $3,120,000 = ($4,000 × 30) – ($4,000 × 150)

– $480,000 = $120,000 – $600,000

– $480,000 = – $480,000

The difference between absorption and variable costing is due solely to moving fixed manufacturing costs into

inventories as inventories increase (as in April) and out of inventories as they decrease (as in May).

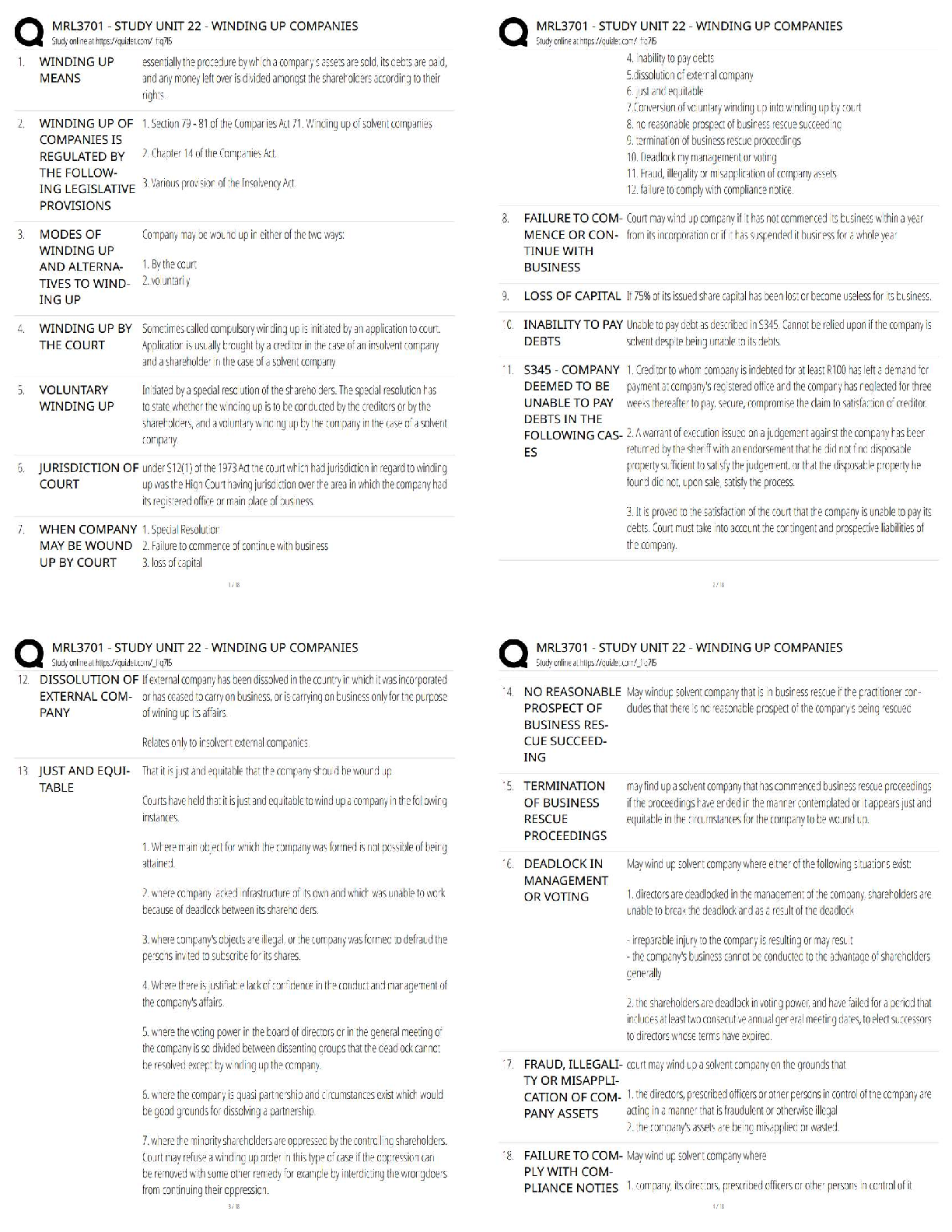

9-21 Absorption and variable costing. (CMA) Osawa, Inc., planned and actually manufactured 200,000 units of

its single product in 2014, its first year of operation. Variable manufacturing cost was $20 per unit produced.

Variable operating (nonmanufacturing) cost was $10 per unit sold. Planned and actual fixed manufacturing costs

were $600,000. Planned and actual fixed operating (nonmanufacturing) costs totaled $400,000. Osawa sold

120,000 units of product at $40 per unit.

Beginning inventory, January 1, 2014 Ending inventory, December 31, 2014 2014 salesSelling price (to distributor)

Variable manufacturing cost per unit, including direct materials Variable operating (marketing) cost per unit sold

Fixed manufacturing costsDenominator-level machine-hours

Standard production rateFixed operating (marketing) costs

85,000 units 34,500 units 345,400 units $22.00 per unit $5.10 per unit $1.10 per unit sold $1,440,000

6,00050 units per machine-hour $1,080,000

1 Osawa’s 2014 operating income using absorption costing is (a) $440,000, (b) $200,000, (c) $600,000, (d)

$840,000, or (e) none of these. Show supporting calculations.

2 Osawa’s 2014 operating income using variable costing is (a) $800,000, (b) $440,000, (c) $200,000, (d)

$600,000, or (e) none of these. Show supporting calculations.

3 9-21 (10 min.) Absorption and variable costing.

45

The answers are 1(a) and 2(c). Computations:

6

1. Absorption Costing:

Revenuesa

Cost of goods sold:

Variable manufacturing costsb

Allocated fixed manufacturing costsc

Gross margin

$2,400,000

360,000

$4,800,000

2,760,000

2,040,000

Operating costs:

Variable operatingd

Fixed operating

Operating income

1,200,000

400,000 1,600,000

$ 440,000

7 8

a $40 × 120,000

9 b $20 × 120,000

10 c Fixed manufacturing rate = $600,000 ÷ 200,000 = $3 per output unit

11 Fixed manufacturing costs = $3 × 120,000

12 d $10 × 120,000

13

14

9-32. Variable Costing:

Revenuesa

Variable costs:

Variable manufacturing cost of goods soldb

Variable operating costsc

Contribution margin

Fixed costs:

Fixed manufacturing costs

Fixed operating costs

Operating income

$2,400,000

1,200,000

600,000

400,000

$4,800,000

3,600,000

1,200,000

1,000,000

$ 200,000

15

16 a $40 × 120,000

17 b $20 × 120,000

18 c $10 × 120,000

19

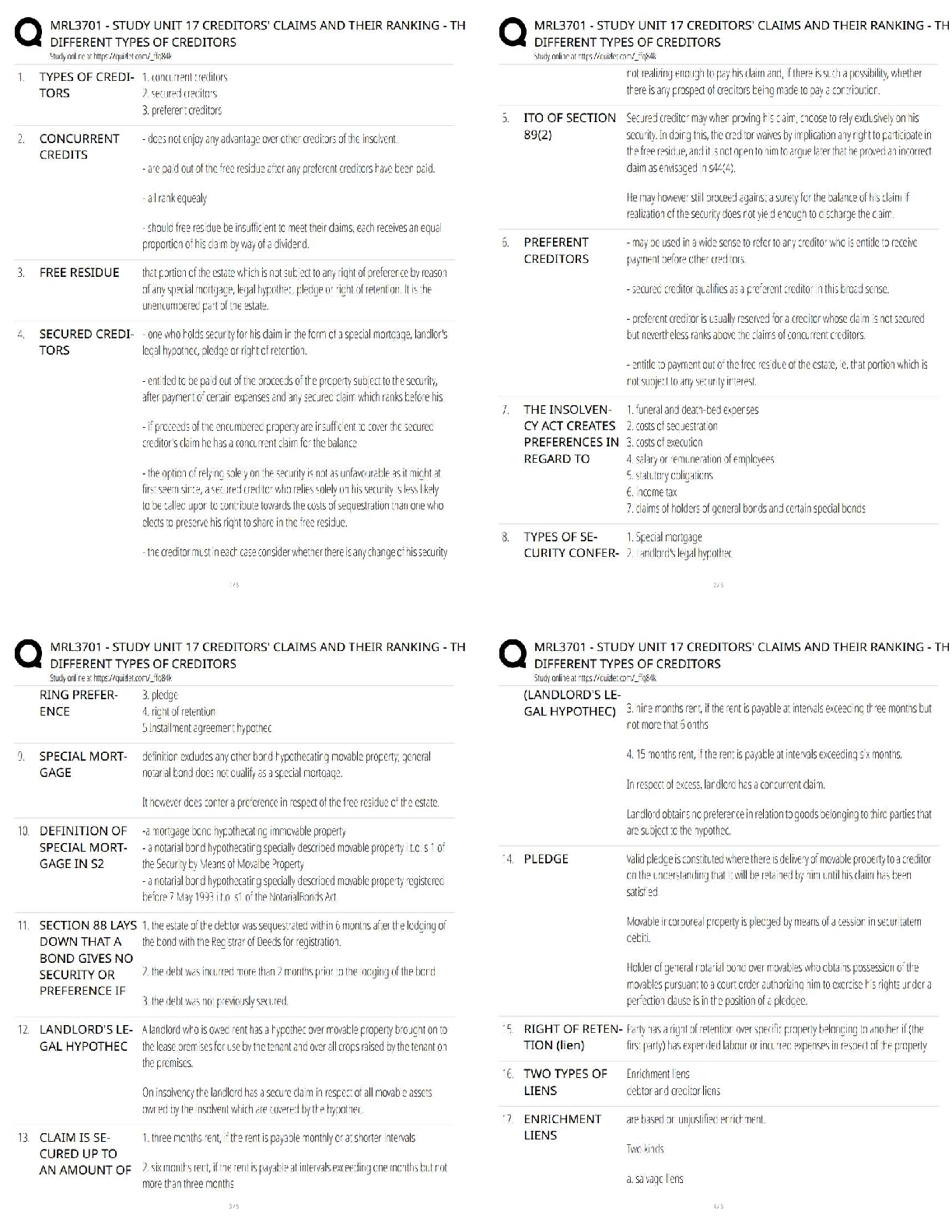

9-22 Absorption versus variable costing. Regina Company manufacturers a professional-grade vacuum cleaner

and began operations in 2014. For 2014, Regina budgeted to produce and sell 20,000 units. The company had no

price, spending, or efficiency variances and writes off production-volume variance to cost of goods sold. Ac

[Show More]

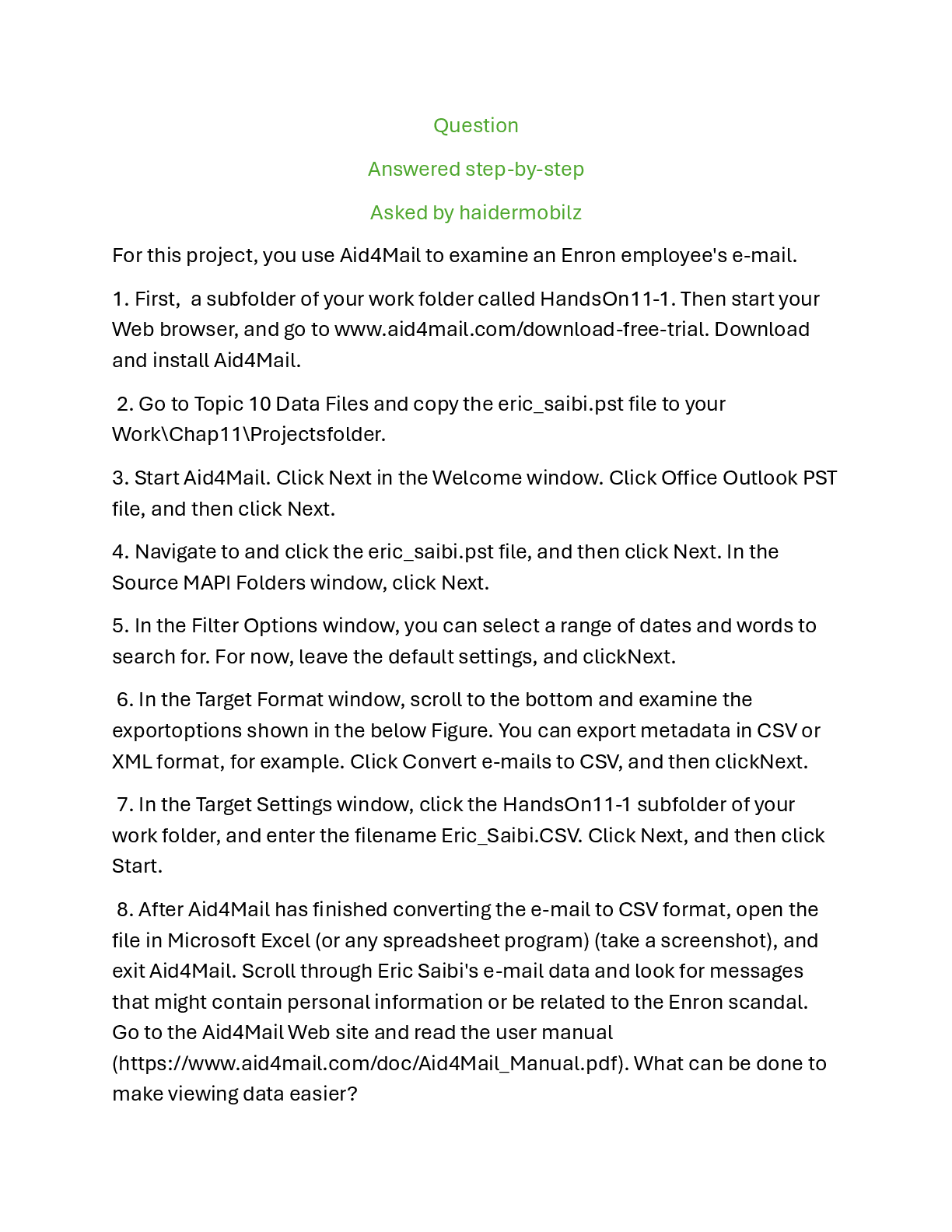

.png)

.png)