Take Test_ Final Exam 2021 May Fin 9873 - 2021 Spring

Document Content and Description Below

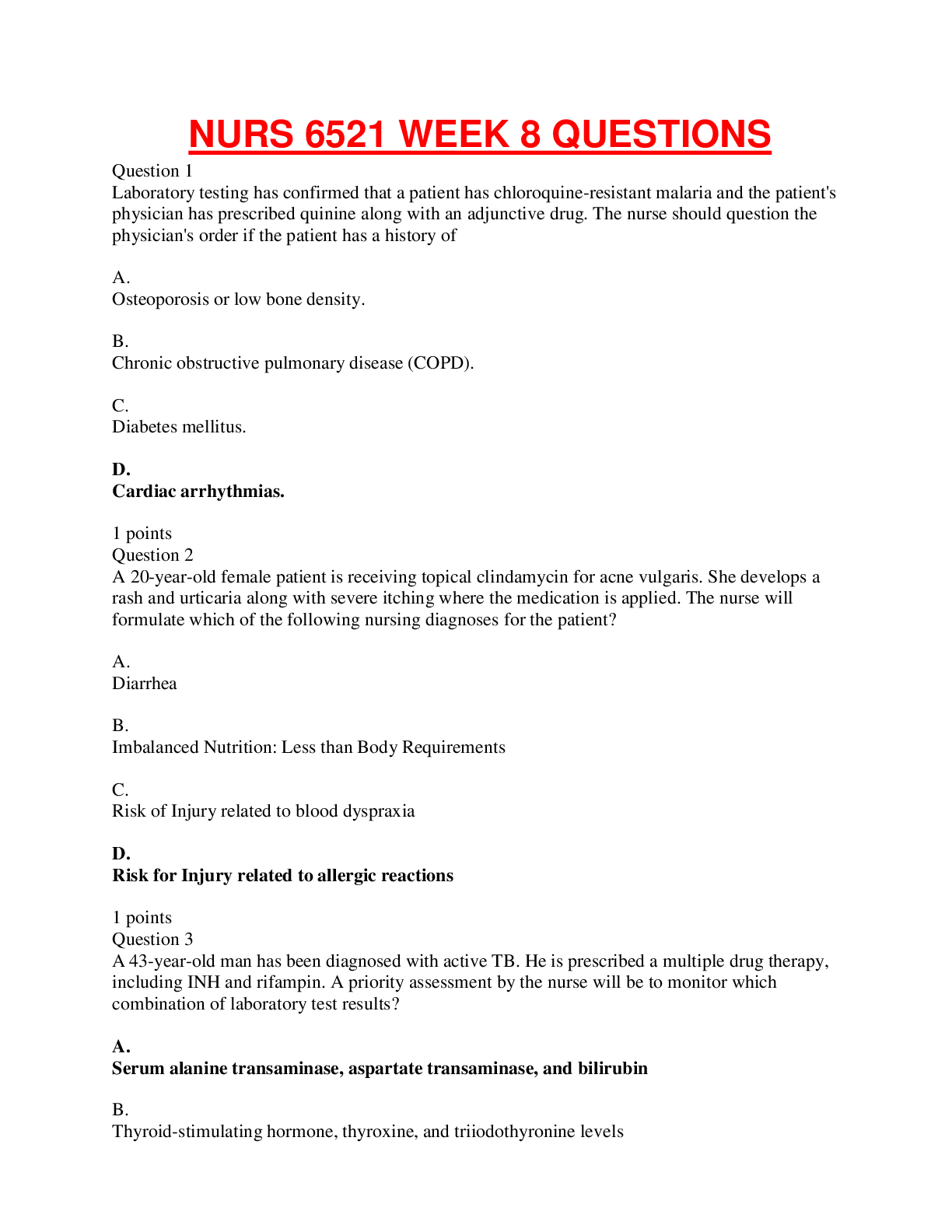

QUESTION 2 Which one of the following accurately describe all the steps for LTCM to earn very high returns from trading against small bond mispricing without being aected by market-wide interest ra... te changes over time? First, buy illiquid assets; Second, short liquid assets at the same time. Third, use leverage. First, buy illiquid assets; Second, short liquid assets at the same time. Third, use leverage. Fourth, dynamic hedging. First, buy illiquid assets; Second, hold those assets for the long term without trading. First, short liquid assets; Second, borrow money from investment banks to return cash to investors when investors have redemption demands. 2 points Save Answer QUESTION 3 You have $500,000 available to invest. The risk-free rate, as well as your borrowing rate, is 8%. The return on the risky portfolio is 16%. If you wish to earn a 22% return, you should _________. borrow $125,000 invest $375,000 in the risk-free asset [Show More]

Last updated: 2 years ago

Preview 1 out of 23 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 23, 2021

Number of pages

23

Written in

Additional information

This document has been written for:

Uploaded

Jun 23, 2021

Downloads

0

Views

171

(2).png)

.png)

(1).png)