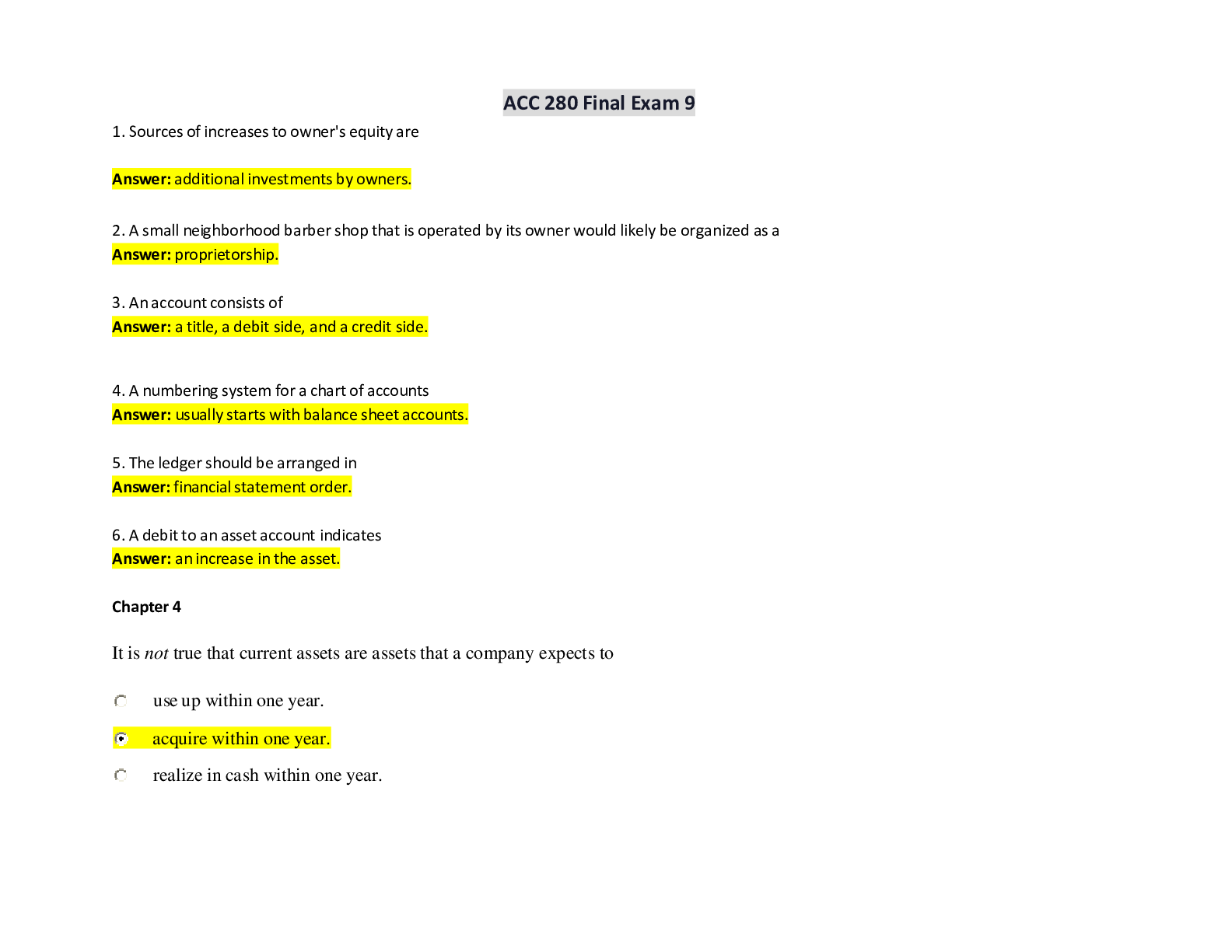

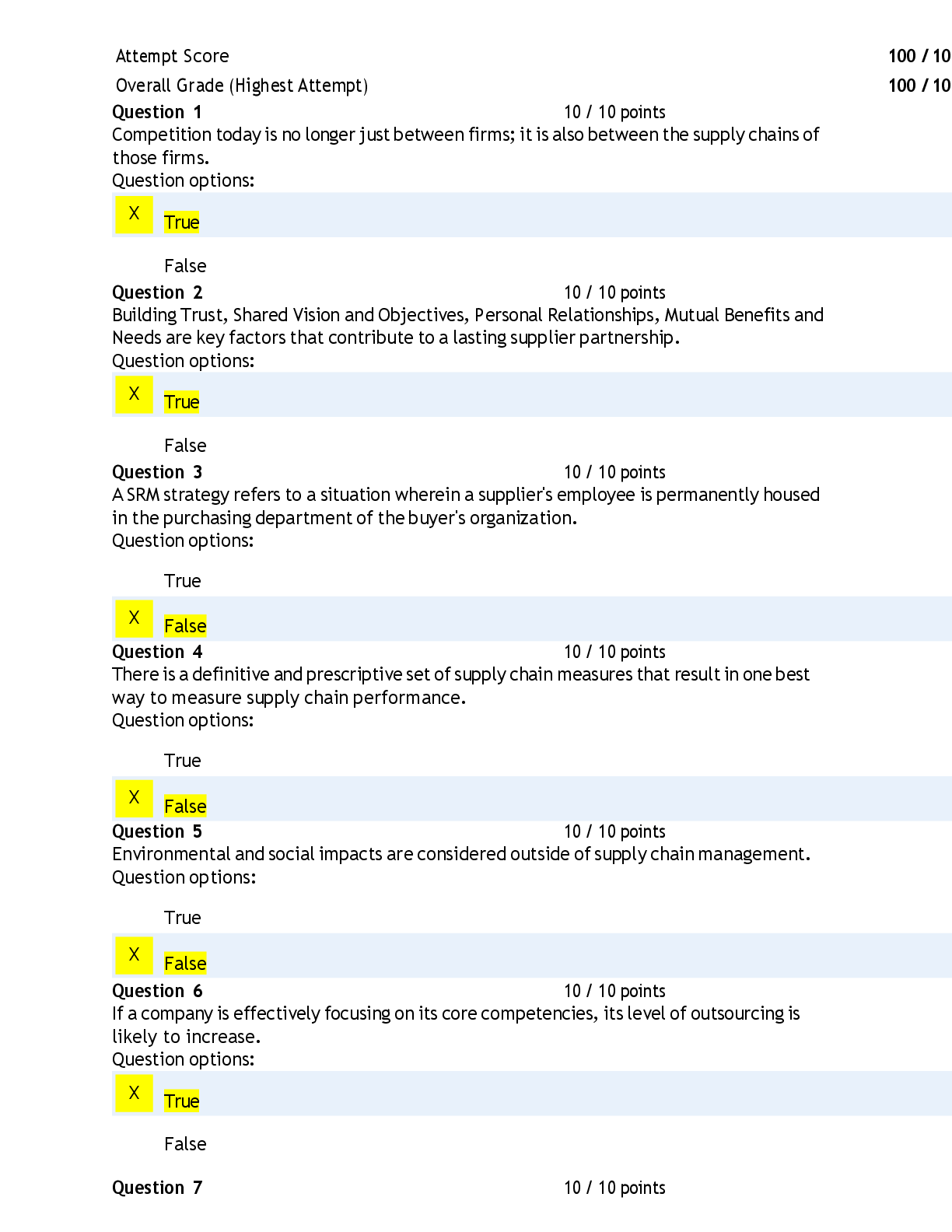

ACC 280 Final Exam 4

1. Because accounting often requires estimates to be made to assess the effect of a transaction, the shorter the time period, the easier it becomes to determine the proper adjustments.

4. A co

...

ACC 280 Final Exam 4

1. Because accounting often requires estimates to be made to assess the effect of a transaction, the shorter the time period, the easier it becomes to determine the proper adjustments.

4. A company's calendar year and fiscal year are always the same.

5. Accounting time periods that are one year in length are referred to as interim periods.

6. Income will always be greater under the cash basis of accounting than under the accrual basis of accounting.

7. The cash basis of accounting is not in accordance with generally accepted accounting principles. T

8. The matching principle requires that assets be matched with liabilities.

9. Accrual basis accounting requires that expenses be recognized when incurred regardless of when paid.

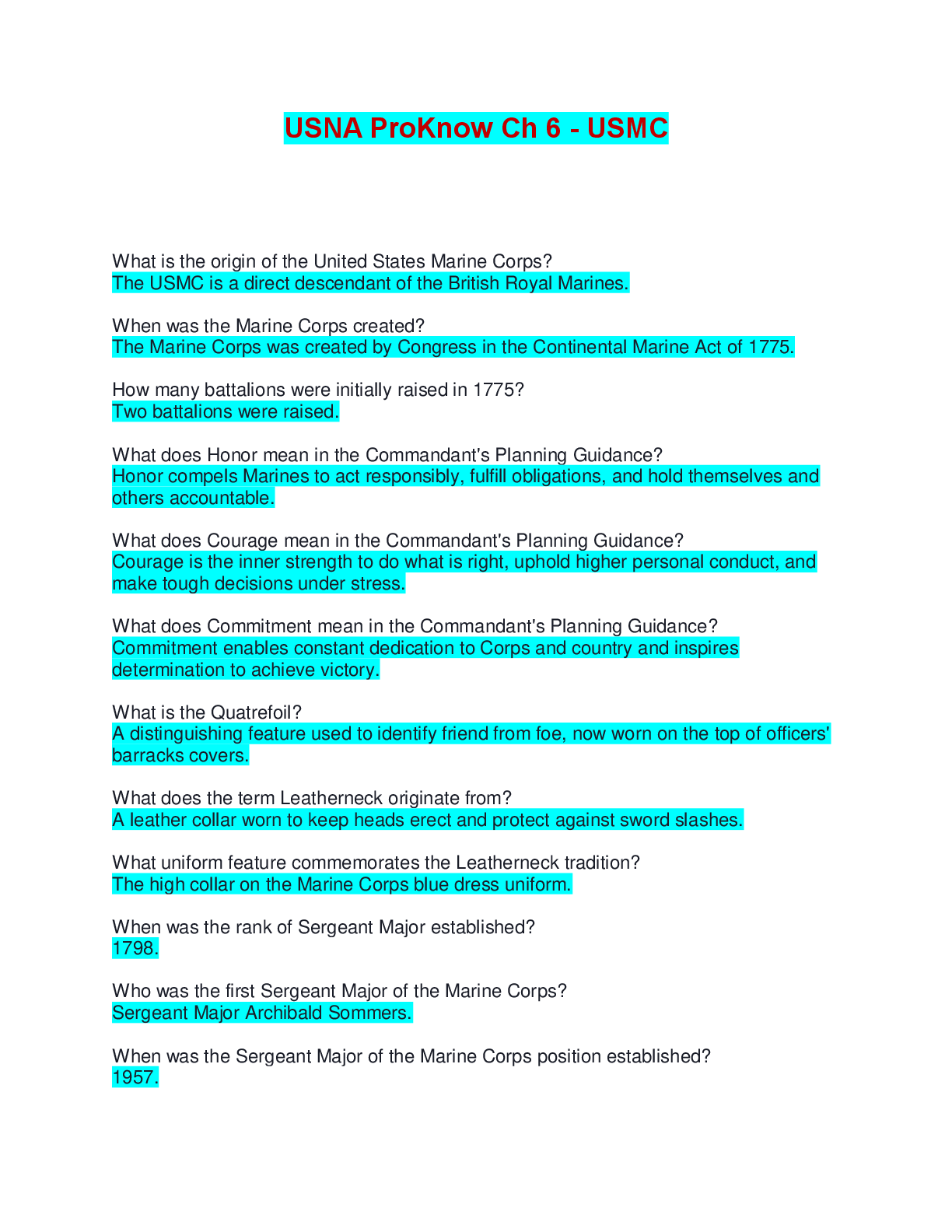

Multiple Choice Questions

11. Monthly and quarterly time periods are called

12. The time period assumption states that

13. Adjustments would not be necessary if financial statements were prepared to reflect net income

from

14. Management usually desires financial statements and the IRS requires all businesses to file tax returns.

15. Which of the following are in accordance with generally accepted accounting principles?

16. Joe's Tune-up Shop follows the revenue recognition principle. Jim services a car on July 31. The customer picks up the vehicle on August 1 and mails the payment to Jim on August 5. Jim receives the check in the mail on August 6. When should Jim show that the revenue was earned?

17. Adjusting entries are

18. Faraway Beltway Company pays weekly salaries for a 5-day week of $2,000 every Friday,

January 31 falls on a Thursday. The monthly adjusting entry at January 31

19. On January 1, the Seigel-Jones Law Firm received a $12,000 cash retainer for legal services to

be rendered ratably over the next 6 months. The full amount was credited to the liability account Unearned Legal Fees. Which of the following statements is true regarding adjusting

entries for this liability account?

20. Adjusting entries can be classified as

21. Pleymeyer Realty generates revenue through its many rental properties. As of August 31, the company has not collected $6,000 of August rental payments because of delinquencies. The monthly adjusting journal entry at August 31

22. At March 1, 2006, Striped Candy Delights Inc. had supplies on hand of $500.

During the

month, Candy purchased supplies of $1,200 and used supplies of $1,500. The March 31 adjusting journal entry should include:

23. Quirk-Wit Company purchased office supplies costing $4,000 and debited Office Supplies for

the full amount. At the end of the accounting period, a physical count of office supplies revealed

$1,600 still on hand. The appropriate adjusting journal entry to be made at the end of the period

would be

24. Silver Fleet Services Company purchased equipment for $5,000 on January 1, 2006. The

company expects to use the equipment for 5 years. It has no salvage value. What balance

would be reported on the December 21, 2006 balance sheet for Accumulated Depreciation?

25. Hardy Parties Company purchased a computer for $2,400 on December 1. It is estimated that

annual depreciation on the computer will be $480. If financial statements are to be prepared on

December 31, the company should make the following adjusting entry:

[Show More]

.png)

.png)