Answer all questions in the spaces provided. box

0 1 Read the information below and then answer the questions that follow.

Drake Hotels PLC owns 20 budget hotels in the UK. Each one is located in a different

city. The

...

Answer all questions in the spaces provided. box

0 1 Read the information below and then answer the questions that follow.

Drake Hotels PLC owns 20 budget hotels in the UK. Each one is located in a different

city. The industry is very competitive and Drake’s managers all have an objective to

help the business to be as efficient as possible.

Drake Hotels PLC’s operating profit for the financial year 2019–20 was £18 million.

Last month the company appointed a new Chief Executive, Mary Myers, to increase

the profitability of the business. Mary was previously the Marketing Manager of an

upmarket hotel chain.

Mary is already considering an investment proposal for a luxury hotel in Oxford. This

hotel would target overseas visitors who might want to visit the city. Drake Hotels has

found a suitable building but needs to invest to develop it.

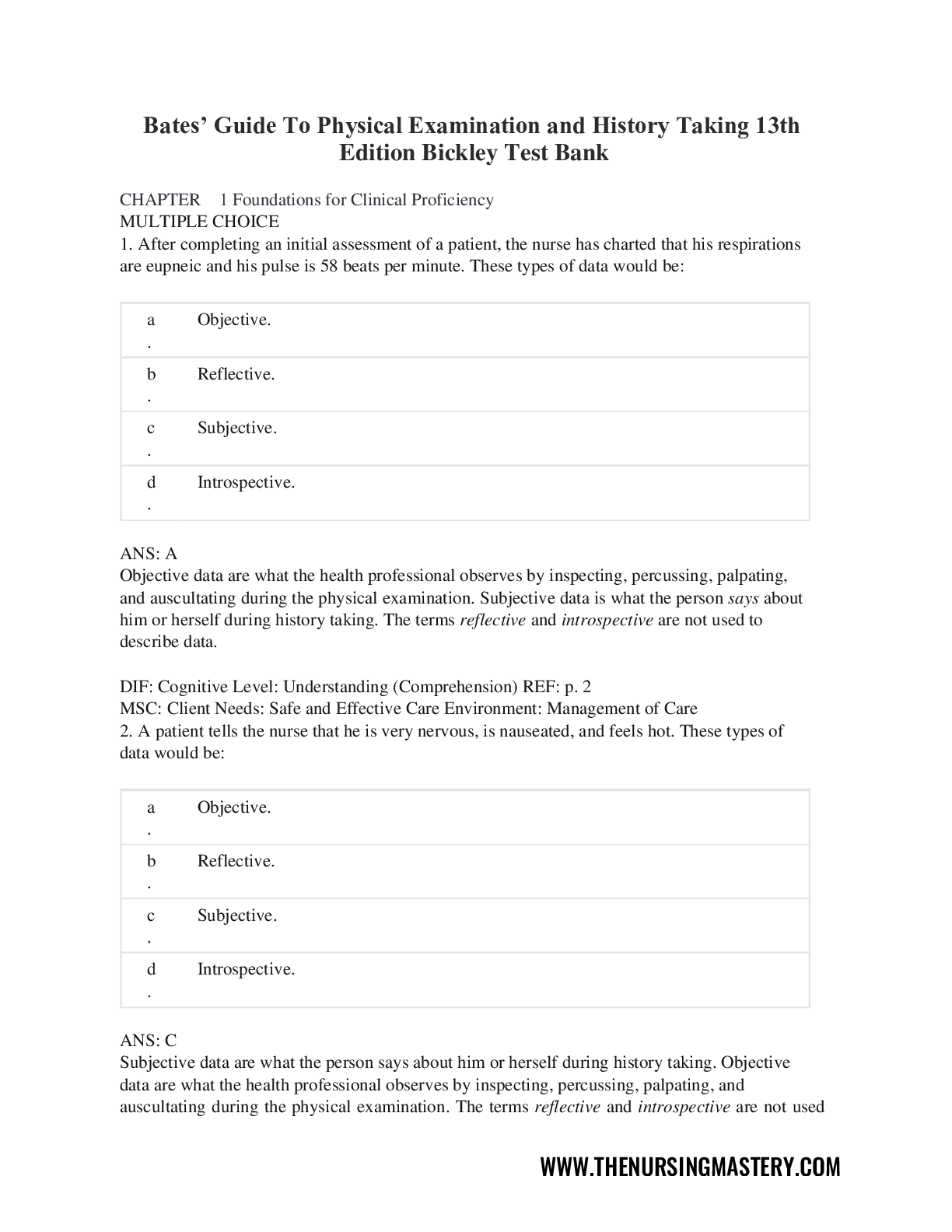

Appendix A Investment appraisal results for the proposed investment into a new

hotel in Oxford (based on net inflows for first eight years).

Average rate of return 12% per year

Net Present Value £25 million

Source: Chief Executive

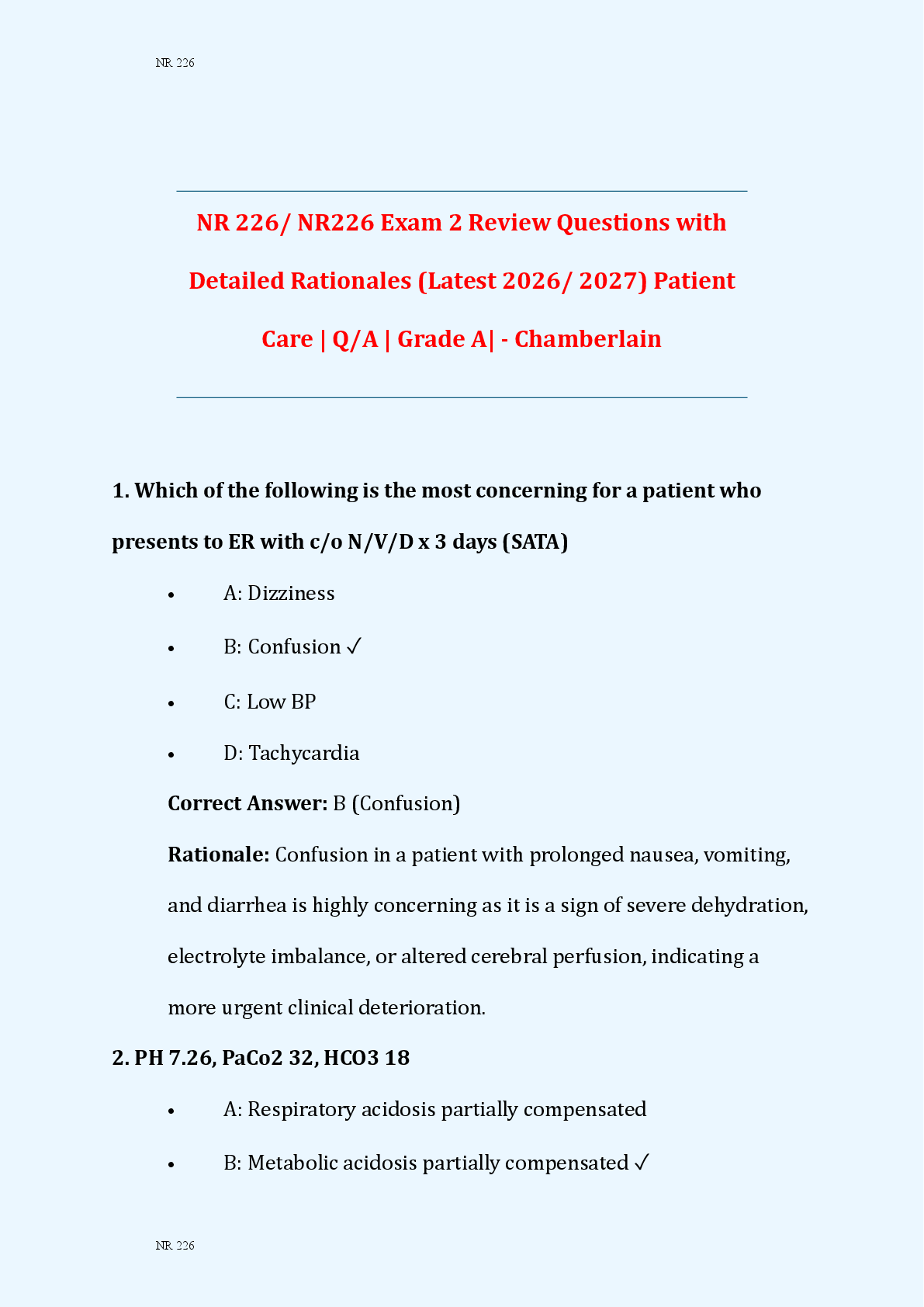

Appendix B Sensitivity analysis for the new Oxford hotel investment proposal

Two possible changes in the economy that might affect

the investment appraisal results in Appendix A

Estimated

probability of this

change happening

The value of the pound against other currencies is 10%

higher than originally forecasted. 20%

The average GDP growth in overseas countries is 1.5%

higher than originally forecasted. 30%

Source: Chief Executive

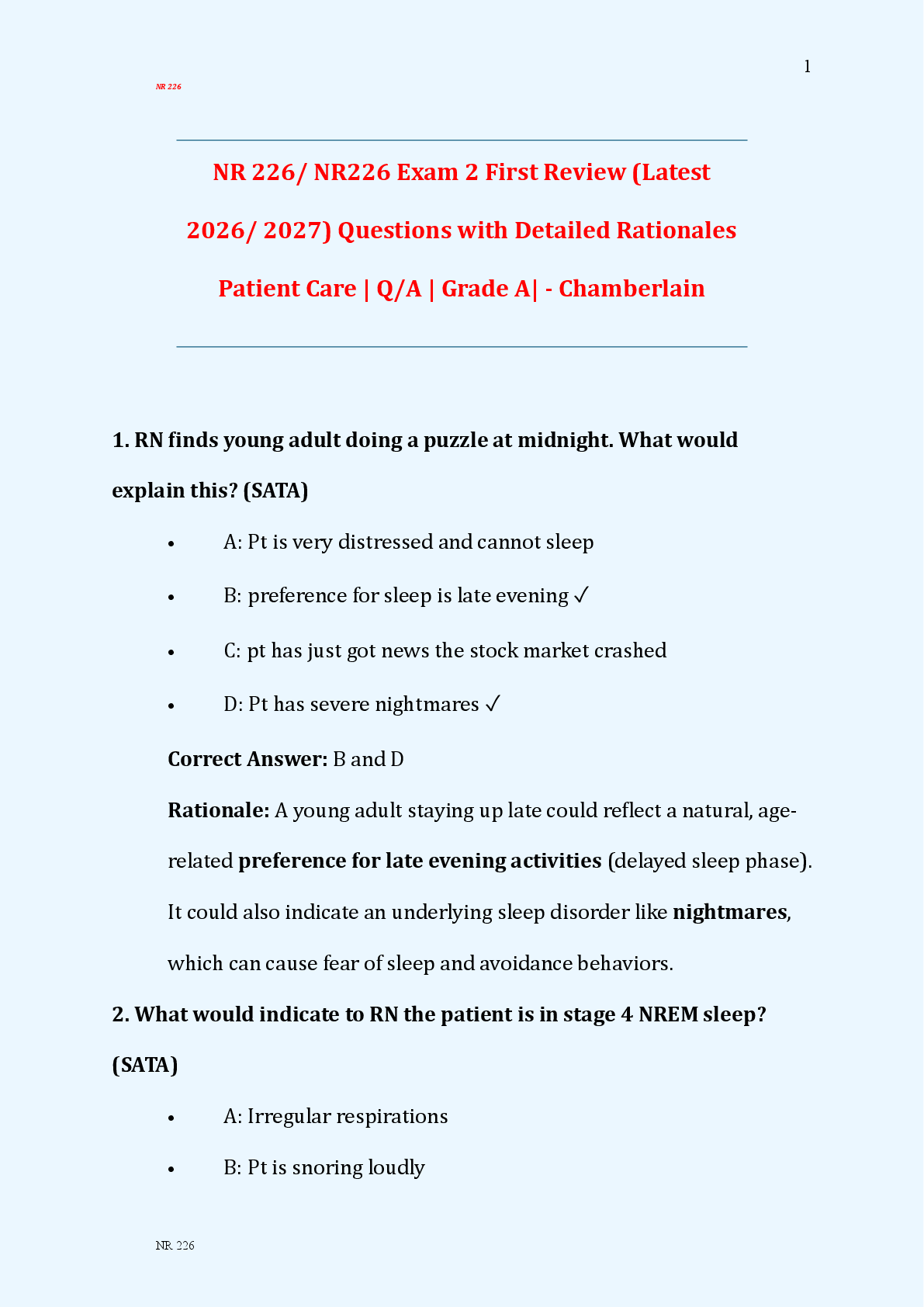

Appendix C Selected financial data for Drake Hotels PLC

£ million as at

1 May 2020

Current assets 15

Current liabilities 18

Total equity 170

Non-current liabilities 280

[Show More]

(2).png)

.png)