Accounting > QUESTIONS & ANSWERS > ACC707 - AUDITING - Final Exam-ALL ANSWERS CORRECT (All)

ACC707 - AUDITING - Final Exam-ALL ANSWERS CORRECT

Document Content and Description Below

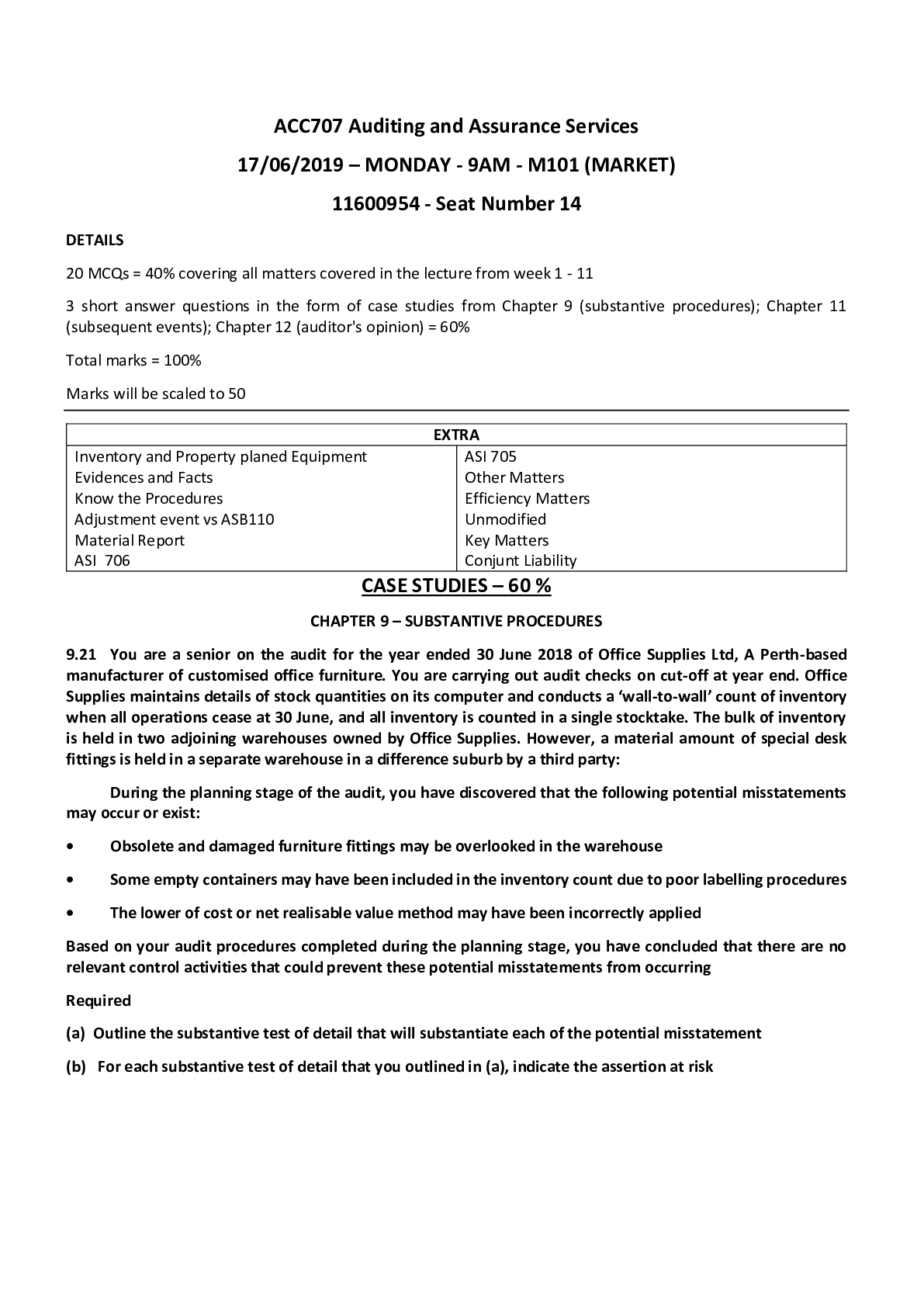

ACC707 Auditing and Assurance Services 17/06/2019 – MONDAY - 9AM - M101 (MARKET) 11600954 - Seat Number 14 DETAILS 20 MCQs = 40% covering all matters covered in the lecture from week 1 - 11 3 s ... hort answer questions in the form of case studies from Chapter 9 (substantive procedures); Chapter 11 (subsequent events); Chapter 12 (auditor's opinion) = 60% Total marks = 100% Marks will be scaled to 50 EXTRA Inventory and Property planed Equipment Evidences and Facts Know the Procedures Adjustment event vs ASB110 Material Report ASI 706 ASI 705 Other Matters Efficiency Matters Unmodified Key Matters Conjunt Liability CASE STUDIES – 60 % CHAPTER 9 – SUBSTANTIVE PROCEDURES 9.21 You are a senior on the audit for the year ended 30 June 2018 of Office Supplies Ltd, A Perth-based manufacturer of customised office furniture. You are carrying out audit checks on cut-off at year end. Office Supplies maintains details of stock quantities on its computer and conducts a ‘wall-to-wall’ count of inventory when all operations cease at 30 June, and all inventory is counted in a single stocktake. The bulk of inventory is held in two adjoining warehouses owned by Office Supplies. However, a material amount of special desk fittings is held in a separate warehouse in a difference suburb by a third party: During the planning stage of the audit, you have discovered that the following potential misstatements may occur or exist: • Obsolete and damaged furniture fittings may be overlooked in the warehouse • Some empty containers may have been included in the inventory count due to poor labelling procedures • The lower of cost or net realisable value method may have been incorrectly applied Based on your audit procedures completed during the planning stage, you have concluded that there are no relevant control activities that could prevent these potential misstatements from occurring Required (a) Outline the substantive test of detail that will substantiate each of the potential misstatement (b) For each substantive test of detail that you outlined in (a), indicate the assertion at riskPotential misstatement (a) Substantive test of detail (b) Assertion at risk Obsolete and damaged furniture fittings may be overlooked in the warehouse Select a sample from inventory records and match to physical inventory, looking for obsolete or damaged furniture components Accuracy, valuation and allocation Some empty containers may have been included in the inventory count, due to poor labelling procedures Select a sample from the inventory records and match to physical inventory, looking for empty containers in the sample count Existence The lower of cost or net realisable value may have been incorrectly applied Check subsequent sales prices and compare with cost to ascertain whether the correct valuation method has been applied Accuracy, valuation and allocation CHAPTER 11 – SUBSEQUENT EVENTS 11.15 You are the audit senior on the audit for the year ended 30 June 2018 of Ultimate Sound Ltd, an Australian Company that retails audio and other electronic equipment. During the year, Ultimate Sound has expanded rapidly both locally and overseas, particularly in the UK and Asia. Due to this rapid expansion, its accounts receivable and inventories have both increased considerably. Required Explain the audit procedure you would undertake to obtain the necessary assurance that all subsequent events have been identified and considered before finalisation and signing of the auditor’s report The audit procedures used to identify subsequent events would include: • reading board minutes and enquiring about matters discussed at meetings • reading the entity’s latest available interim financial report, budgets, cash-flow forecasts and other related management reports • enquiring of the entity’s solicitor concerning legal matters • due to the build-up of receivables, reviewing the level of cash received subsequent to balance date • due to the build-up of inventory, looking at the sales volume and sales prices of the merchandise subsequent to balance date • reviewing technical journals for any recent developments in the high technology equipment they produce • due to the expansion of the overseas operations, reviewing economic forecasts and articles on the overseas economies concerned • reviewing the procedures that management has established to ensure that material after-balance-date events are identified, and enquiring of management as to whether any such events have occurred that might affect the financial report being reported on.11.16 George Blewett is the engagement partner for the financial report audit of Play Equipment Ltd for the year ended 30 June 2018. The following material events or transactions have come to George’s attention before he is schedulred to issue his report on 31 August 2018. (a) On 14 July 2018, Play Equipment settled and paid a personal injury claim of a former employee as a result of an accident that occurred in March 2017. The company has not previously recorded a liability for the claim (b) On 17 July 2018, Play Equipment agreed to purchase for cash the outstanding shares of Recreation al Equipment Ltd. This acquisition is likely to double the sales volume of Play Equipment (c) On 20 July 2018, the directors become aware of broken glass found in their pre-packaged sandpits. This product had only been on sale for two weeks and had been purchased directly from the manufacturer, Sandpit Ltd, an unrelated company in Thailand, one week prior to being introduced to the public (d) On 3 August 2018, a plant owned by Play Equipment was damaged in a flood, resulting in an uninsured loss of inventory Required For each of the above events or transactions, identify audit procedures that should have brought the item to the auditor’s attention, and determine the treatment required in the financial report for the year ended 30 June 2018 (a) The audit procedures that would have identified this are a solicitor’s letter or a review of payment details. The event that gives rise to the liability (that is, the accident) occurred before balance date and so the payout relates to this financial year. Therefore, the financial report should be adjusted. (b) The audit procedures that would have identified this are a review of the minutes, enquiries of the client or a solicitor’s letter. The agreement to purchase the shares occurred after balance date, but will have a significant effect on the coming year and affect users’ decisions. Therefore, the event is a non-adjusting event and should be disclosed in the notes to the financial report. (c) The audit procedures that would have identified this are a review of the director’s minutes and enquiries of management. The event has taken place in the next financial year; that is, the purchase of the product from overseas, its subsequent sale and fault all occurred after 30 June 2018, so this is a non-adjusting event after the reporting date. Therefore, the event should be disclosed in the notes to the financial report. (d) The audit procedures that would have identified this are enquiries of the client, client correspondence, newspaper reports or a visit to the client. The flood occurred after balance date, but because the inventory was uninsured it will have a significant effect in the coming year and affect users’ decisions. Therefore, the event is a non-adjusting event and should be disclosed in the notes to the financial report. CHAPTER 12 – AUDITOR’S OPINION 12.19 You are the auditor of Bricks & Mortar Ltd (BML)for the year ended 30 June 2018. You have identified a material misstatement of the property, plant and equipment account. BML has not changed its depreciation rates for the past four years. However, recent technological changes in the industry have convinced you that the useful lives of BML’s assets need to be adjusted downwards, resulting in an increased depreciation charge. BML’s directors have refused to make any change to the depreciation rates, despite you explaining that this will put them in breach of the requirements regarding impairment tests contained in Australian accounting standards RequiredExplain the auditor’s opinion you would issue for BML for the year ended 30 June 2018 The impact of the situation on the auditor’s opinion is as follows: • There is a disagreement with management regarding the application of an accounting standard. • A qualified opinion should be issued as the disagreement is material, but not pervasive, as it affects only property, plant and equipment. The auditor’s opinion should cite the accounting standard and quantify the financial effects of the disagreement. 12.20 You are the auditor of Northern Forest Ltd for the year ended 30 June 2018. The audit of Northern Forest was extremely difficult this year, as the company did not keep appropriate books and records. As the accounting department was chronically understaffed, transactions were not entered promptly and reconciliations not performed. In an attempt to sort out the mess, a temporary accountant was employed; however, she was unable to even reconcile the bank account at the year end. You are not satisfied all transactions that occurred during the year are reflected in the financial report Required Assuming the mater remains unresolved, explain the auditor’s opinion that should be issued for Northern Forest for the year ended 30 June 2018 The impact of the situation on the auditor’s opinion is as follows: • There is an inability to obtain sufficient appropriate audit evidence (scope limitation) on which to base the auditor’s opinion. No year-end balances can be verified (not even the bank account could be reconciled), so it is reasonable to assume that the possible effects of the adjustments are so pervasive that the financial report as a whole is potentially misleading. • Therefore, a disclaimer of opinion should be issued. 12.21 You are undertaking the audit for the year ended 30 June 2018 of Durable Drums Ltd, a manufacturer and retailer of steel drums. As in previous years, Durable Drums has accounted for inventory on a last in, first out (LIFO) basis. Durable Drums also uses a ‘just-in-time’ inventory management system and therefore the effect of this departure from Australian accounting standards was previously not material. In the current year, however, the company has a large stockpile of inventory at year end, due to an unexpected cancellation of a major order en route to its destination. In order to cut freight costs, Durable Drums stored the foods temporarily in Thailand, hoping for an order from another South-east Asian customer. Unfortunately, you were not told of this problem until after balance date and did not conduct a stocktake of the inventory. You have also been told that some of the inventory has since been shipped to a number of different customers to fill outstanding orders. The available audit procedures have been unable to validate the existence of this inventory at balance date. The relevant inventory is currently recorded at $2,500,000. Audit procedures have indicated that, had inventory been accounted for on a first in, first out (FIFO) basis, it would have been record at $3,500,000. Materiality for the audit has been set at $1,000,000 Required What is the most appropriate auditor’s opinion for Durable Drums for the year ended 30 June 2018? In this case there is both a disagreement with management over non-application of an accounting standard (the accuracy, valuation and allocation assertion), as LIFO is not an acceptable accounting method in Australia under the accounting standards, and an inability to obtain sufficient appropriate audit evidence (scope limitation) regarding the existence of inventory.The outcome in either case is a qualified opinion, given the situation is material, but does not appear to be pervasive, as it affects only inventory. 12.22 You are auditing Indian Imports Ltd for the year ended 30 June 2018. The company is incorporated in Australia and imports a variety of products from India. A significant proportion (15 per cent) of Indian Imports’ assets, including warehouses and inventory, are located in New Delhi. In previous years, an accountant in New Delhi has inspected these warehouses and inventory on your behalf. Unfortunately, this year, due to recent economic and social turmoil, you have been unable to obtain assistance from the New Delhi accountant. The chief executive officer (CEO) of Indian Imports has assured you that the company will be able to continue as a going concern, as it is currently obtaining new suppliers and its existing customers and suppliers have expressed a desire to continue trading with the company. However, your audit procedures have not revealed any firm commitments from suppliers, customers or financiers, and you have doubts about the ability of the entity to continue as a going concern. The directors of Indian imports have agreed to make disclosures indicating the extent of the problems they are facing. After reviewing the information, you are satisfied that the disclosures are adequate. Required Explain the most appropriate auditor’s opinion for Indian Imports for the year ended 30 June 2018 There are two issues here. The first issue is an inability to obtain sufficient appropriate audit evidence (scope limitation) as the auditor is unable to verify the existence of 15% of the company’s assets. This will result in a qualified opinion as the amount is material, but does not seem to be pervasive. The second issue is the existence of an inherent uncertainty concerning the ability of the entity to continue as a going concern. On the basis of the information contained in the question, especially the conclusion of the auditor that the disclosures made with regards going concern are adequate (implying that the auditor has been satisfied that it is not improbable that Indian Imports would continue as a going concern, even though there is significant uncertainty), the auditor’s report should also include a paragraph under the heading ‘Material Uncertainty Related to Going Concern’, drawing attention to the disclosures related to the ability of the entity to continue as a going concern. 12.23 You are the audit partner of Preston & Associates, a mid-tier audit firm. You are responsible for the audit of the following three independent entities for the year ended 30 June 2018. (a) Helping Hand Ltd is a non-profit entity. You have discovered that it has not kept substantiating vouchers or receipts for more than 65 per cent of tis expenses, excluding salaries and allowances (b) Skyscraper Ltd is a building contractor with a varying workload. In order to compensate for the irregularity of tis contracted building projects, Skyscraper also purchases large vacant blocks of land that it later subdivides for the construction of houses and units. Skyscraper then sells these on its own account. Your analysis strongly suggests that the apportionment of costs to houses and units sold has been kept low in order to boosts profits. In your opinion, this has resulted in the overvaluation of the unsold properties. The directors of the company do not afree, and hold to their view that the stocks of properties is correctly valued (c) Big Event Ltd arranges for popular overseas entertainment artists to perform in Australia. The band Eclipse was booked by Big Event to play in major cities across the country. Big Event’s written contract required the company to pay the band in US dollars but, in order to reduce costs, it did not hedge the amounts. Subsequent to year end, the Australian dollar fell against the US dollar and a substantial loss relating to the band’s tour was predicted. The management of Big Event tried unsuccessfully to renegotiate the band’s contract and has be unable to obtain finance to cover the expected shortfall. Big Event has now cancelled the tour and expects a substantial claim from Eclipse. It is clear to you, as the auditor that Big Event does not have the income, cash or other assets to sustain such a loss. RequiredAssuming that all amounts involved are material, identify and discuss the most likely auditor’s opinion that you would issue on each financial report for the year ending 30 June 2018. Situation Auditor’s opinion Justification (a) Disclaimer Helping Hand has placed a scope limitation on the audit by not having a majority of non-salary/allowance vouchers available as evidence of expenses. Therefore, there is an inability to obtain sufficient appropriate audit evidence. The most likely auditor’s opinion is a disclaimer, as the impact of not being able to verify 65% of nonsalary/allowance expenses is likely to affect the usefulness of the financial report as a whole and so be considered pervasive. (b) Qualified The situation has led to a disagreement with management, resulting in the financial report being materially misstated. The most likely auditor’s opinion is a qualified auditor’s opinion, as the extent of the disagreement is not so pervasive as to render the financial report as a whole misleading, as it relates only to the valuation of the properties. (c) Adverse Big Event does not have the income, cash or other assets to sustain such a loss. Therefore, it is unable to continue as a going concern. As Big Event has prepared its financial report on a going concern basis when, in fact, it should be prepared on a liquidation basis, the auditor is likely to render an adverse opinion, as the financial report as a whole is likely to be misleading. PAQ 16.27 Property, plant and equipment — substantive procedures Your firm is the auditor of GreenBrown Ltd, a manufacturer. You have obtained a summary of the property, plant and equipment for the year ended 30 June 2015, which identifies cost and accumulated depreciation brought forward, additions and disposals in the year and depreciation charges. A review of the management letter from the previous year’s audit shows that there were some problems in relation to making a distinction between capital and revenue expenditure; some items were capitalised when they should have been expensed and other capital items were included in repairs and maintenance in the income statement. Another risk identified from prior years relates to depreciation calculations; there is a range of depreciation rates within categories and there has been concern that the rates applied to some assets have been too low. The depreciation policy disclosed in the financial report shows: • buildings: 2–4% straight line • plant and machinery: 5–10% straight line • fixtures fittings and equipment: 5–20% straight line. Required Describe audit procedures to ensure: (a) the accuracy of the summary of property plant and equipment (b) all items of a capital expenditure are included in additions for the year and that no revenue expenditure has been capitalised (c) the depreciation rates are calculated appropriately. (a) The following procedures should be carried out on the client's schedule of non-current assets: · Check the additions on the summary · Agree the summary to the draft accounts · Agree the additions, disposals and depreciation amounts on the summary to the trial balance, nominal ledger and to the non-current assets register · Agree the opening balances on the summary to last year's accounts. (b) Procedures to ensure items are correctly capitalised and expensed as appropriate: · Obtain details of the company’s capitalisation policy and review it for reasonableness to ensure it includes expenditure which: enhances the economic benefits of existing assets, replaces a component of an asset that hasbeen treated separately for depreciation purposes, or relates to a major overhaul that restores economic benefits of an asset that have been consumed by the entity · Select a sample of additions in the year and assess whether the item has been correctly treated or should have been expensed · Review the asset additions account in the general ledger and the noncurrent assets register for items which appear to have been incorrectly capitalised · Review expenses accounts in the nominal ledger for repair and maintenance and sight invoices for unusual items · Perform analytical review work on expense accounts and investigate any unusual or unexpected increases. (c) Procedures to ensure that depreciation rates are appropriately calculated: · Select a sample of assets assess the appropriateness of the depreciation rate, by reference to information about the asset’s estimated life · Review asset disposals for significant losses or gains on disposal that might indicate incorrect depreciation rates · Review the condition of assets for any assets that appear obsolete but are still being depreciated · Review the non-current asset register to ensure all assets that have not been fully written down have been depreciated. Perform analytical procedures on depreciation amounts and follow up on any unusual differences · Check a sample of depreciation calculations on the asset register. 16.22 Physical inventory — substantive procedures Stenton Toys Pty Ltd is a toy retailer with shops in each of the Australian state capitals. Stenton has a head office and a central warehouse in Brisbane. All stock purchases are made centrally and are held in the Brisbane warehouse; they are then despatched around the country as needed by each of the shops. Details of stock movements are recorded on a perpetual inventory system and Stenton carries out year-end stocktakes at all locations. You are the auditor of Stenton and are planning the audit of the stocktake that is about to take place; you have established the following from your planning procedures. 1. An inventory report will be produced from the inventory system for each shop and the warehouse. The report gives details of inventory code, stock description, units held and unit selling price. The report also gives a breakdown of where inventory items are held and the total value of items held at each location. 2. A sales movement report is also produced which gives details of: inventory code, unit descriptions, units purchased for the period and their cost price, units sold in the period. 3. The largest shop is in Melbourne and 35% of all stock is held there 4. The Perth shop has suffered significant levels of stock shrinkage recently [Show More]

Last updated: 3 years ago

Preview 1 out of 112 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$19.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 04, 2021

Number of pages

112

Written in

All

Additional information

This document has been written for:

Uploaded

Jul 04, 2021

Downloads

0

Views

87

.png)

.png)