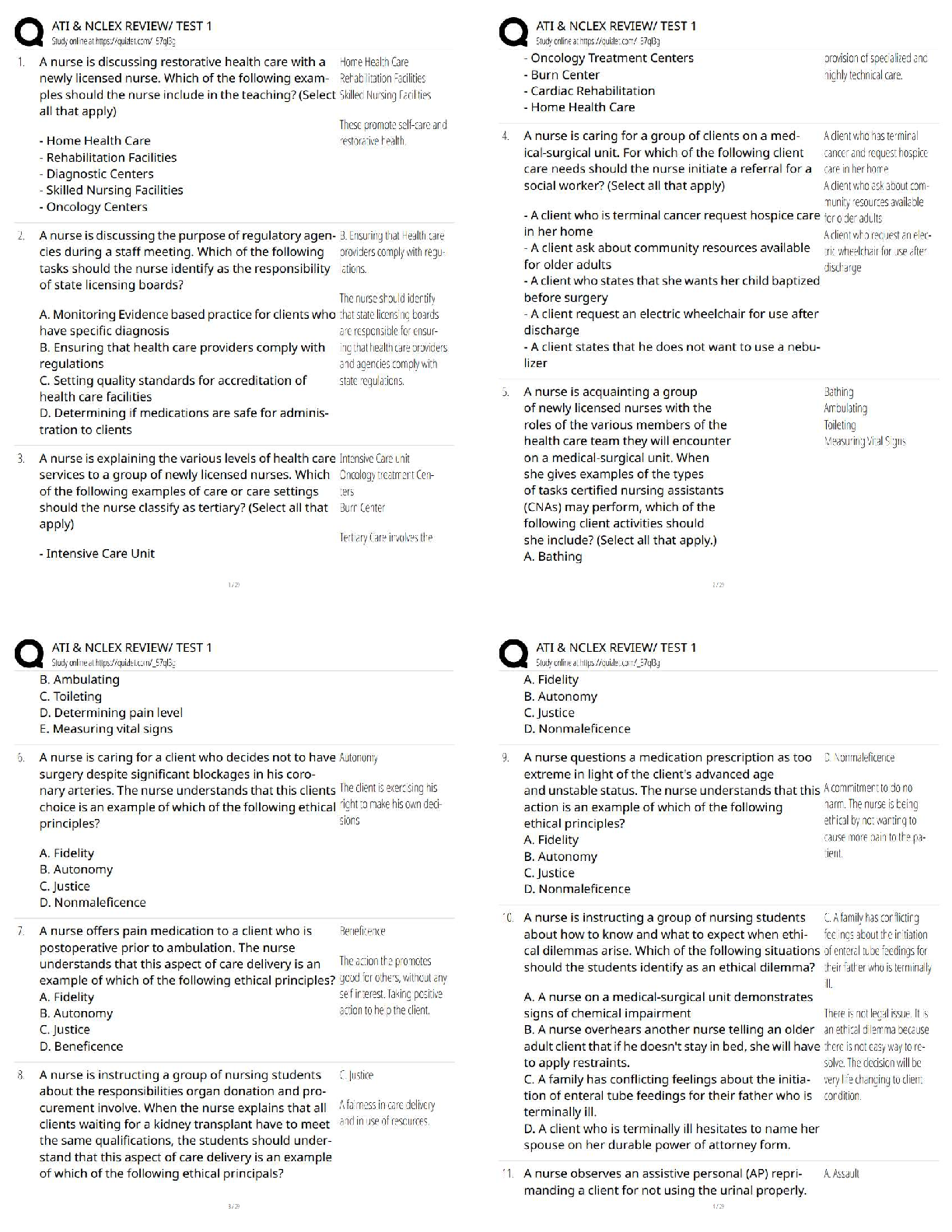

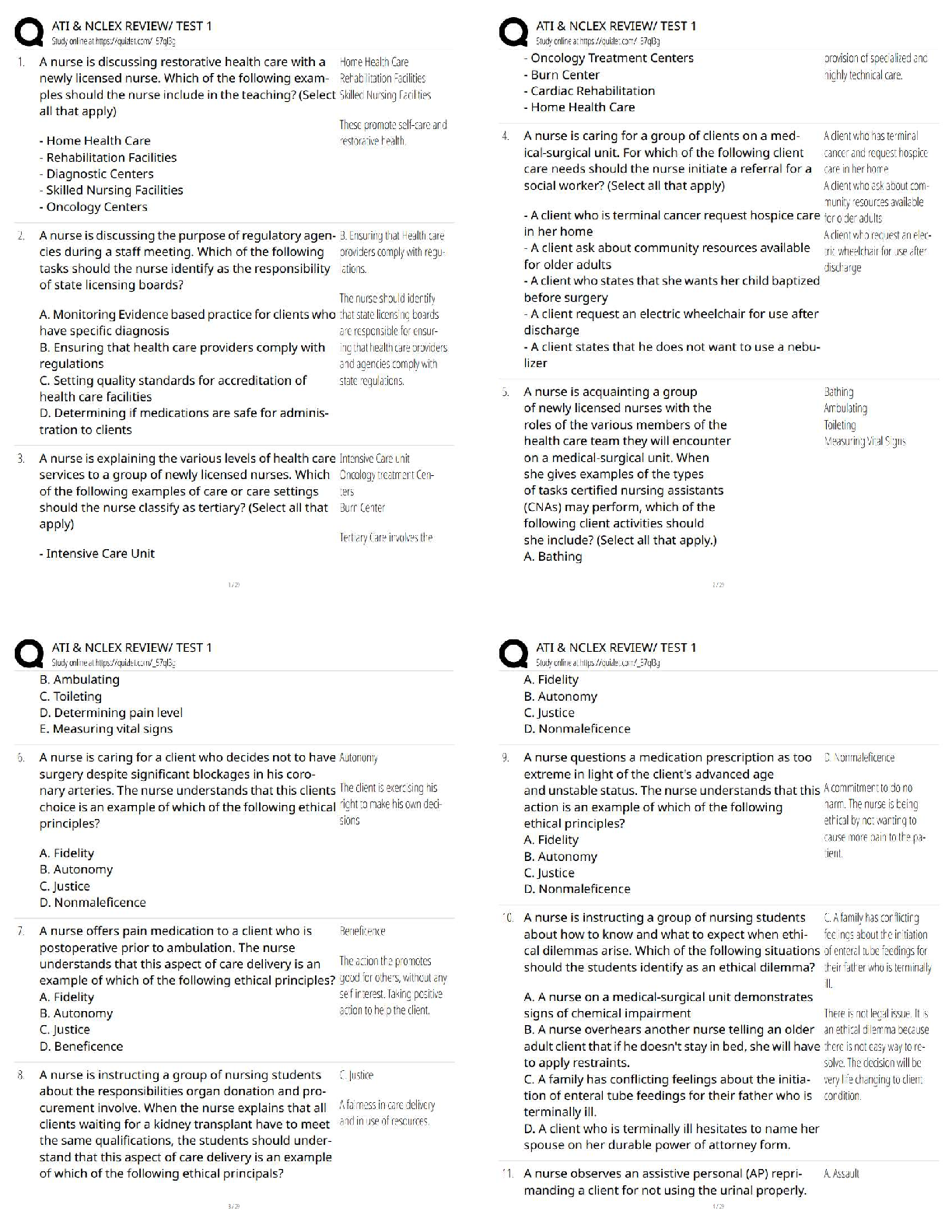

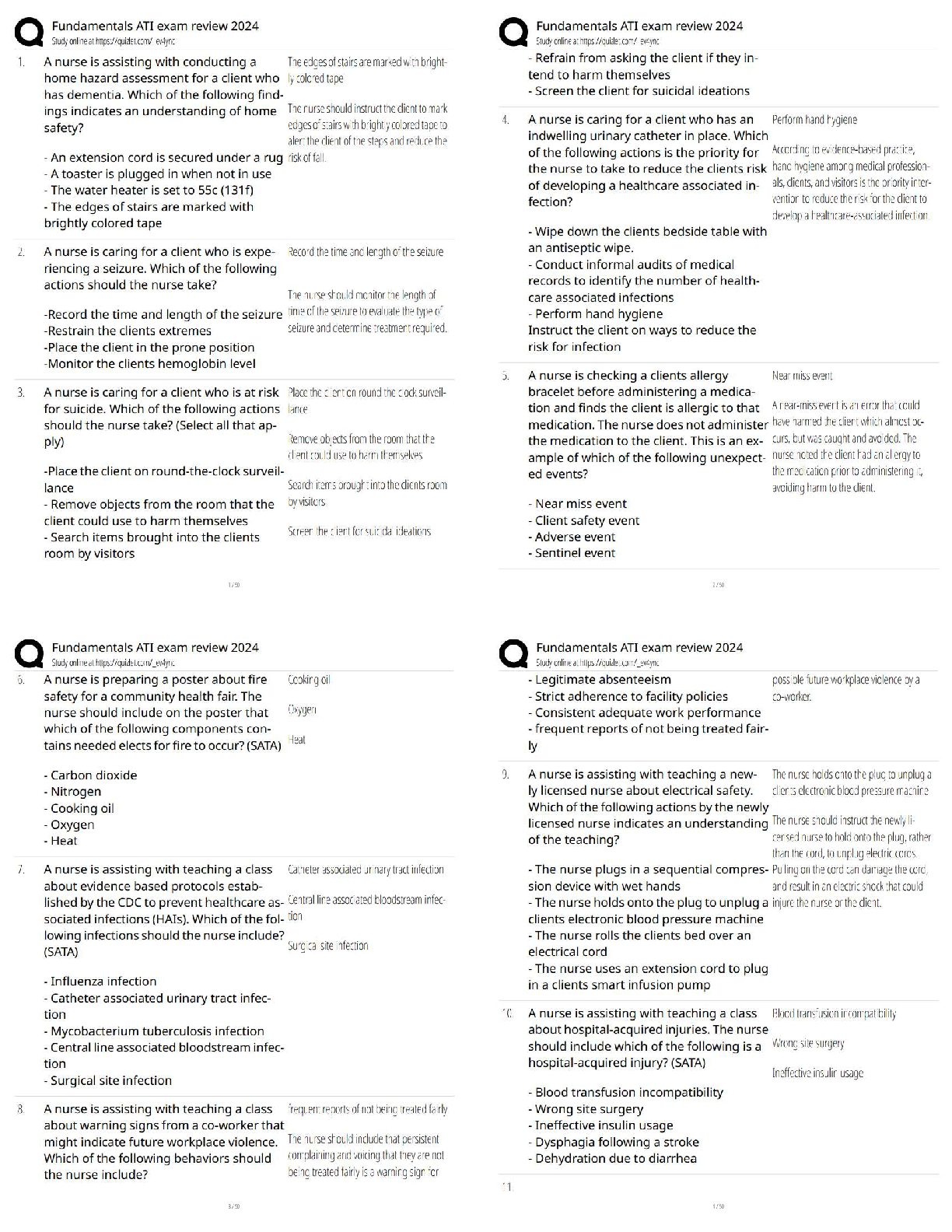

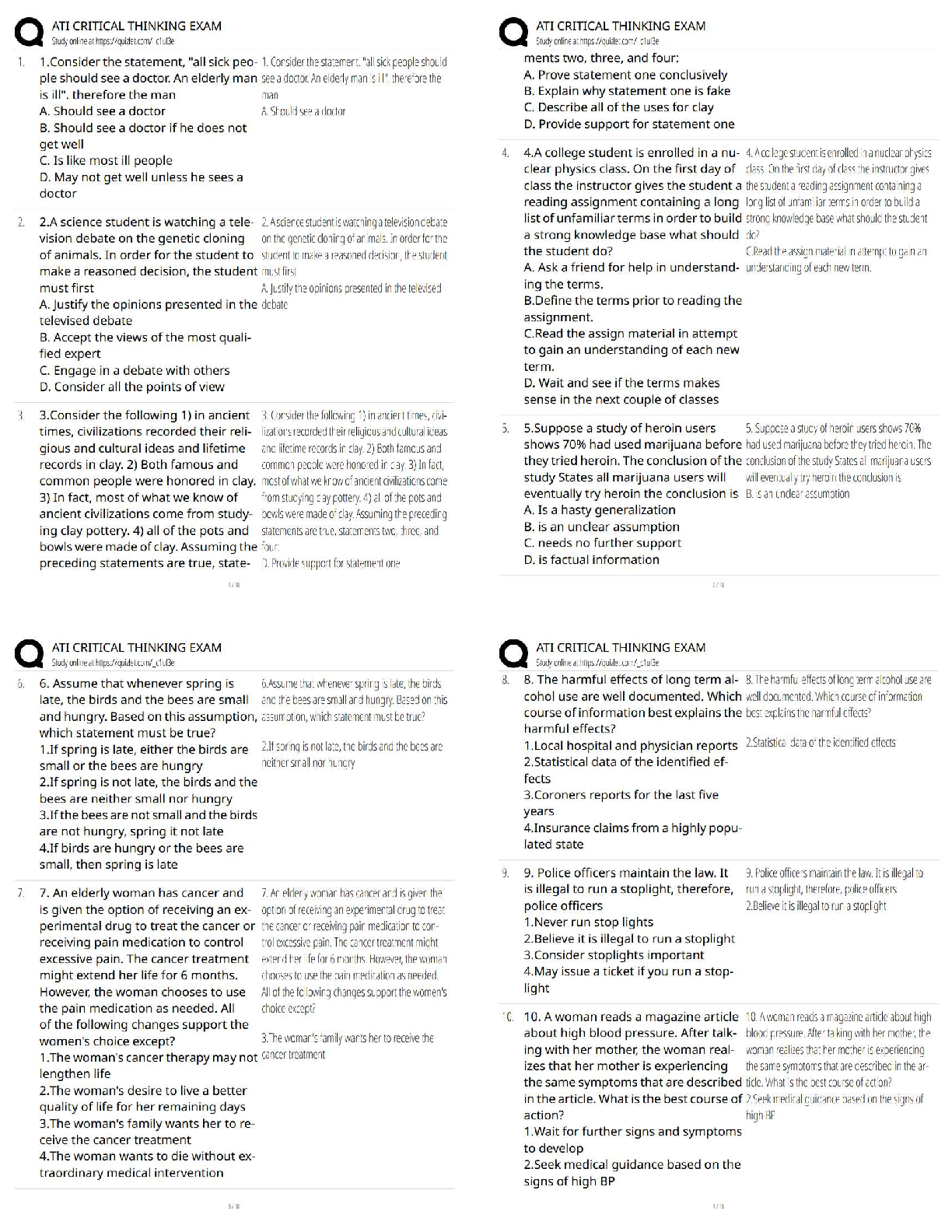

Management > QUESTIONS & ANSWERS > Alliance UniversityCF 406CF MCQ for exam (All)

Alliance UniversityCF 406CF MCQ for exam

Document Content and Description Below