Finance > EXAM > Ross, Westerfield, and Jordan Fundamentals of Corporate Finance, 9e Practice Questions for the CFA E (All)

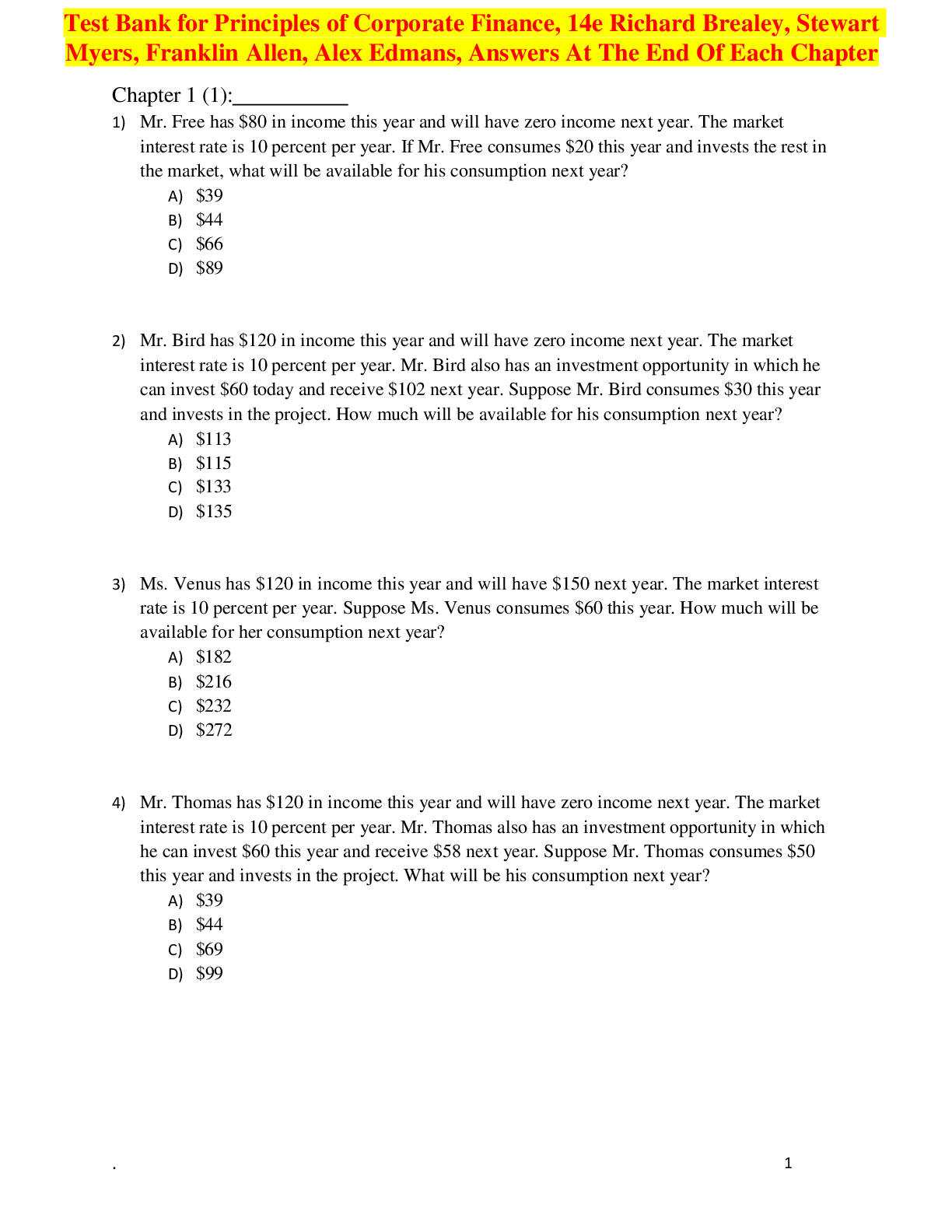

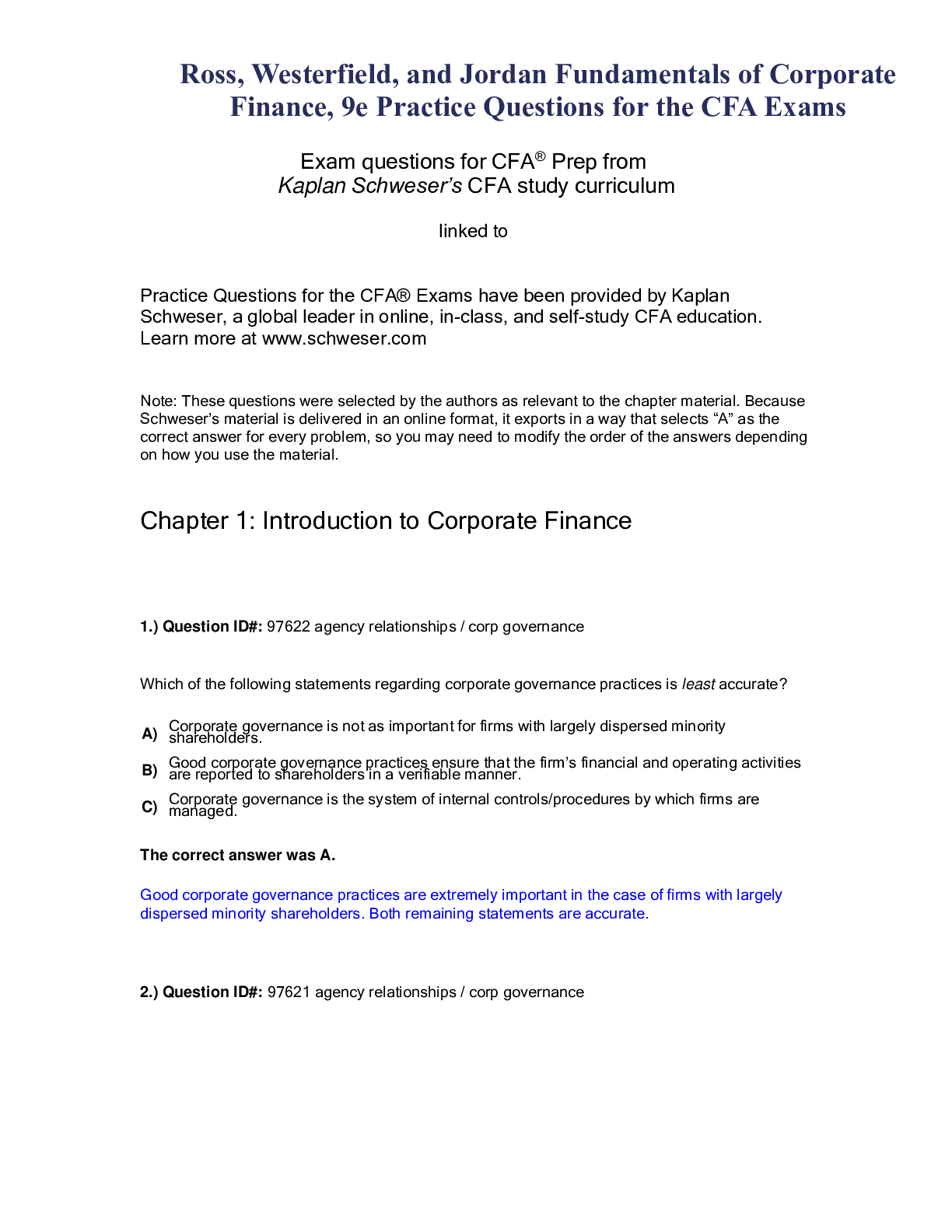

Ross, Westerfield, and Jordan Fundamentals of Corporate Finance, 9e Practice Questions for the CFA Exams

Document Content and Description Below

Ross, Westerfield, and Jordan Fundamentals of Corporate Finance, 9e Practice Questions for the CFA Exams Chapter 1: Introduction to Corporate Finance 1.) Question ID#: 97622 agency relationships / cor... p governance Which of the following statements regarding corporate governance practices is least accurate? A) Corporate governance is not as important for firms with largely dispersed minority shareholders. B) Good corporate governance practices ensure that the firm’s financial and operating activities are reported to shareholders in a verifiable manner. C) Corporate governance is the system of internal controls/procedures by which firms are managed. The correct answer was A. Good corporate governance practices are extremely important in the case of firms with largely dispersed minority shareholders. Both remaining statements are accurate. 2.) Question ID#: 97621 agency relationships / corp governance Corporate governance is the set of internal controls, processes and procedures defining how a firm is managed. Which of the following statements concerning corporate governance is least accurate? A) Good corporate governance means that the board can work effectively with management. B) Good corporate governance dictates that the firm’s financial, operating and governance activities are reported to stakeholders in a fair, accurate and timely manner. C) Corporate governance defines the appropriate rights, roles and responsibilities of management, the board, and stakeholders within a firm. The correct answer was A. The board of directors must be able to act independently from management. Both remaining statements concerning corporate governance are accurate. 3.) Question ID#: 97513 agency problem / takeover defense A special-purpose board committee with which of the following responsibilities would be least likely to act in the best interests of the shareholders? A) Takeover defense. B) Corporate governance. C) Mergers and acquisitions. The correct answer was A. A committee responsible for takeover defense would most likely be acting in the interests of the company's current management rather than in the interests of shareholders. 4.) Question ID#: 97565 agency problem / takeover defense Which of the following statements regarding company takeover defenses is CORRECT? A) Newly created anti-takeover provisions may or may not require stakeholder authorization/approval. B) The firm’s annual report contains pertinent details concerning takeover defenses. C) A firm’s proxy is the most likely place to find information about present takeover defenses. The correct answer was A. These provisions may or may not require such approval. In either case, the firm may have to, at a minimum, provide information to its shareholders about any amendments to existing takeover defenses. A firm’s articles of organization are the most likely places to locate information about present takeover defenses. 5.) Question ID#: 98225 importance of secondary market Which of the following statements regarding secondary markets is least accurate? Secondary markets are important because they provide: A) regulators with information about market participants. B) investors with liquidity. C) firms with greater access to external capital. The correct answer was A. Secondary markets are important because they provide liquidity and continuous information to investors. The liquidity of the secondary markets adds value to both the investor and firm because more investors are willing to buy issues in the primary market, when they know these issues will later become liquid in the secondary market. Therefore, the secondary market makes it easier for firms to raise external capital. 6.) Question ID#: 97471 primary/secondary market Which of the following statements about primary and secondary markets is least accurate? A) The proceeds from a sale in the secondary market go to the issuer. B) A primary market is a market in which new securities are sold. C) The primary market benefits from the liquidity provided by the secondary market. The correct answer was A. Proceeds in a primary market go to the issuing firm. Proceeds from a sale in the secondary market go to the current owner who is selling the securities. 7.) Question ID#: 97369 primary/secondary market Which of the following statements regarding primary and secondary markets is least accurate? A) Prevailing market prices are determined by primary market transactions and are used in pricing new issues. B) Secondary market transactions occur between two investors and do not involve the firm that originally issued the security. C) New issues of government securities can be sold on the primary market. The correct answer was A. Prevailing market prices are determined by the transactions that take place on the secondary market. This information is used to determine the price of new issues sold on primary markets. 8.) Question ID#: 97223 primary market A primary market transaction involves: A) the sale of new securities to investors. B) the direct trading of securities between institutional investors. C) primarily preferred stocks. The correct answer was A. A primary market is a market for new issues of securities. 9.) Question ID#: 97612 agency relationships / corp governance Rochelle Dixon is delivering a presentation on best practices for corporate governance. Two of her recommendations are as follows: Statement 1: To avoid the potential for harming shareholders’ interests by wasting company resources, the Board of Directors should get management’s approval before it hires outside consultants. Statement 2: The more members a Board of Directors has, the more likely it is to represent shareholders’ interests fairly. Are Dixon’s statements CORRECT? Statement 1 Statement 2 A) Incorrect Incorrect B) Incorrect Correct C) Correct Correct The correct answer was A. Both statements are incorrect. An independent board should have the ability to seek specialized advice by hiring outside consultants without management approval. The size of the board should be appropriate for the facts and circumstances of the firm; having more members does not imply that the board will be more independent if the additional members are aligned closely with management or are less well qualified. Chapter 2: Financial Statements, Taxes, and Cash Flow 1. Question ID#: 98190 diff betw bs,is,cfs Which of the following statements represents information at a specific point in time? A) The balance sheet. B) The income statement and the balance sheet. C) The income statement. The correct answer was A. The balance sheet represents information at a specific point in time. The income statement represents information over a period of time. 2. Question ID#: 98195 purpose of fin stmt anal. [Show More]

Last updated: 2 years ago

Preview 1 out of 98 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$23.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 07, 2021

Number of pages

98

Written in

Additional information

This document has been written for:

Uploaded

Jul 07, 2021

Downloads

0

Views

82

.png)