Financial Accounting > EXAM > DEVRY UNIVERSITY. ACCT 304 WEEK 8 FINAL EXAM (VERSION 2). QUESTIONS AND ANSWERS. LATEST SOLUTION. (All)

DEVRY UNIVERSITY. ACCT 304 WEEK 8 FINAL EXAM (VERSION 2). QUESTIONS AND ANSWERS. LATEST SOLUTION.

Document Content and Description Below

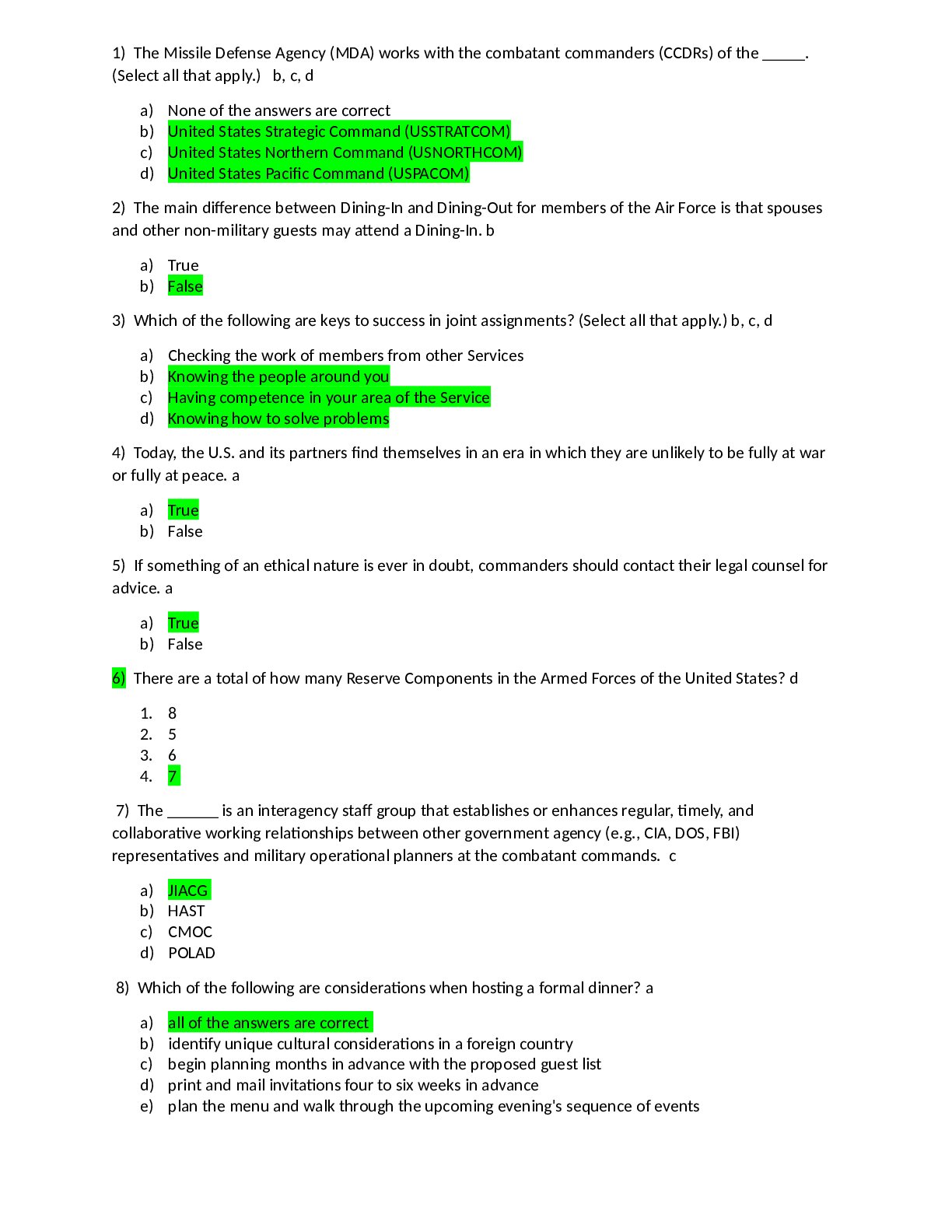

DEVRY UNIVERSITY. ACCT 304 WEEK 8 FINAL EXAM (VERSION 2). QUESTIONS AND ANSWERS. LATEST SOLUTION.1. (TCO 1) The SEC issues accounting standards in the form of (Points : 6) accounting research bull ... etins. financial reporting releases. financial accounting standards. financial technical bulletins. Question 2. 2. (TCO 1) When a registrant company submits its annual filing to the SEC, it uses (Points : 6) Form 10A. Form 10K. Form 10Q. Form S1. Question 3. 3. (TCO 2) SFAC No. 5 focuses on (Points : 6) objectives of financial reporting. qualitative characteristics of accounting information. recognition and measurement concepts in accounting. elements of financial statements. Question 4. 4. (TCO 2) Enhancing qualitative characteristics of accounting information include (Points : 6) relevance and comparability. comparability and timeliness. understandability and relevance. neutrality and consistency. Question 5. 5. (TCO 3) Incurring an expense for advertising on an account would be recorded by (Points : 6) debiting liabilities. crediting assets. debiting an expense. debiting assets. Question 6. 6. (TCO 3) Prepayments occur when (Points : 6) cash flow precedes expense recognition. sales are delayed pending credit approval. customers are unable to pay the full amount due when goods are delivered. manufactured goods await quality control inspections. Question 7. 7. (TCO 4) Current assets include cash and all other assets expected to become cash or be consumed (Points : 6) within 1 year. within 1 operating cycle. within 1 year or 1 operating cycle, whichever is shorter. within 1 year or 1 operating cycle, whichever is longer. Question 8. 8. (TCO 4) Rent collected in advance is (Points : 6) an asset account in the balance sheet. a liability account in the balance sheet. a shareholders' equity account in the balance sheet. a temporary account that is not in the balance sheet at all. Question 9. 9. (TCO 5) The Claxton Company manufactures children's toys and also has a division that makes automobile parts. Due to a change in its strategic focus, the company sold the automobile parts division. The division qualifies as a component of the entity according to GAAP regarding disposal of longlived assets. How should Claxton report the sale in its 2011 income statement? (Points : 6) Report it as an extraordinary item. Report it as a discontinued operation, reported below income from continuing operations. Report the income or loss from operations of the division in discontinued operations below continuing operations and the gain or loss from disposal in continuing operations. None of the above Question 10. 10. (TCO 5) On May 1, Foxtrot Co. agreed to sell the assets of its Footwear Division to Albanese Inc. for $80 million. The sale was completed on December 31, 2012. The following additional facts pertain to the transaction: The Footwear Division qualifies as a component of the entity according to GAAP regarding discontinued operations. The book value of Footwear's assets totaled $48 million on the date of the sale. Footwear's operating income was a pretax loss of $10 million in 2012. Foxtrot's income tax rate is 40%. [Show More]

Last updated: 3 years ago

Preview 1 out of 14 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

DEVRY UNIVERSITY. ACCT 304 WEEK 8 FINAL EXAMS(3 VERSIONS). QUESTIONS AND ANSWERS. LATEST SOLUTIONS.

DEVRY UNIVERSITY. ACCT 304 WEEK 8 FINAL EXAMS(3 VERSIONS). QUESTIONS AND ANSWERS. LATEST SOLUTIONS.

By Quality Suppliers 4 years ago

$20

3

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 12, 2021

Number of pages

14

Written in

All

Additional information

This document has been written for:

Uploaded

Jul 12, 2021

Downloads

0

Views

87

.png)

.png)