Strayer University - FIN 534 FINAL EXAM QUESTIONS AND ANSWERS. LATEST 2021

Document Content and Description Below

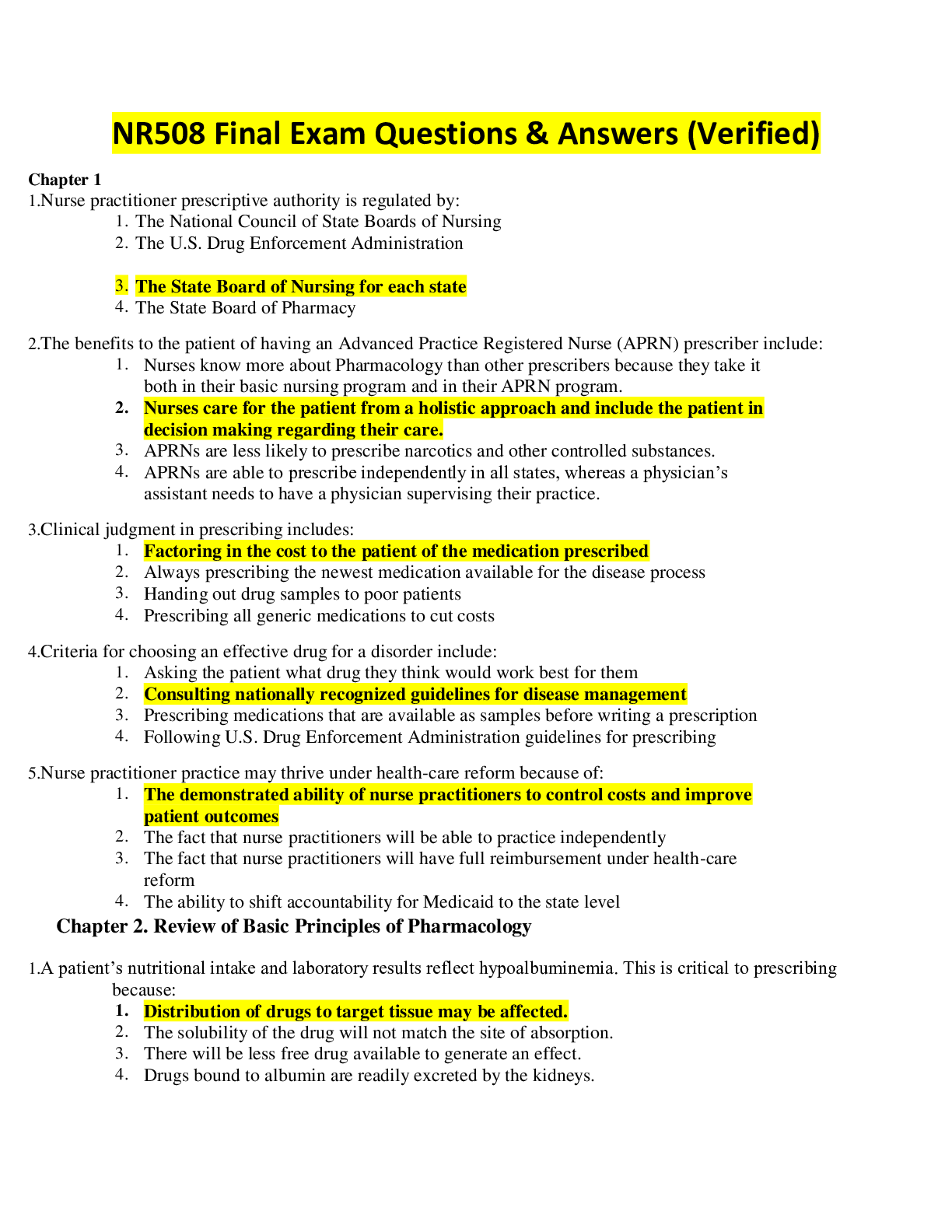

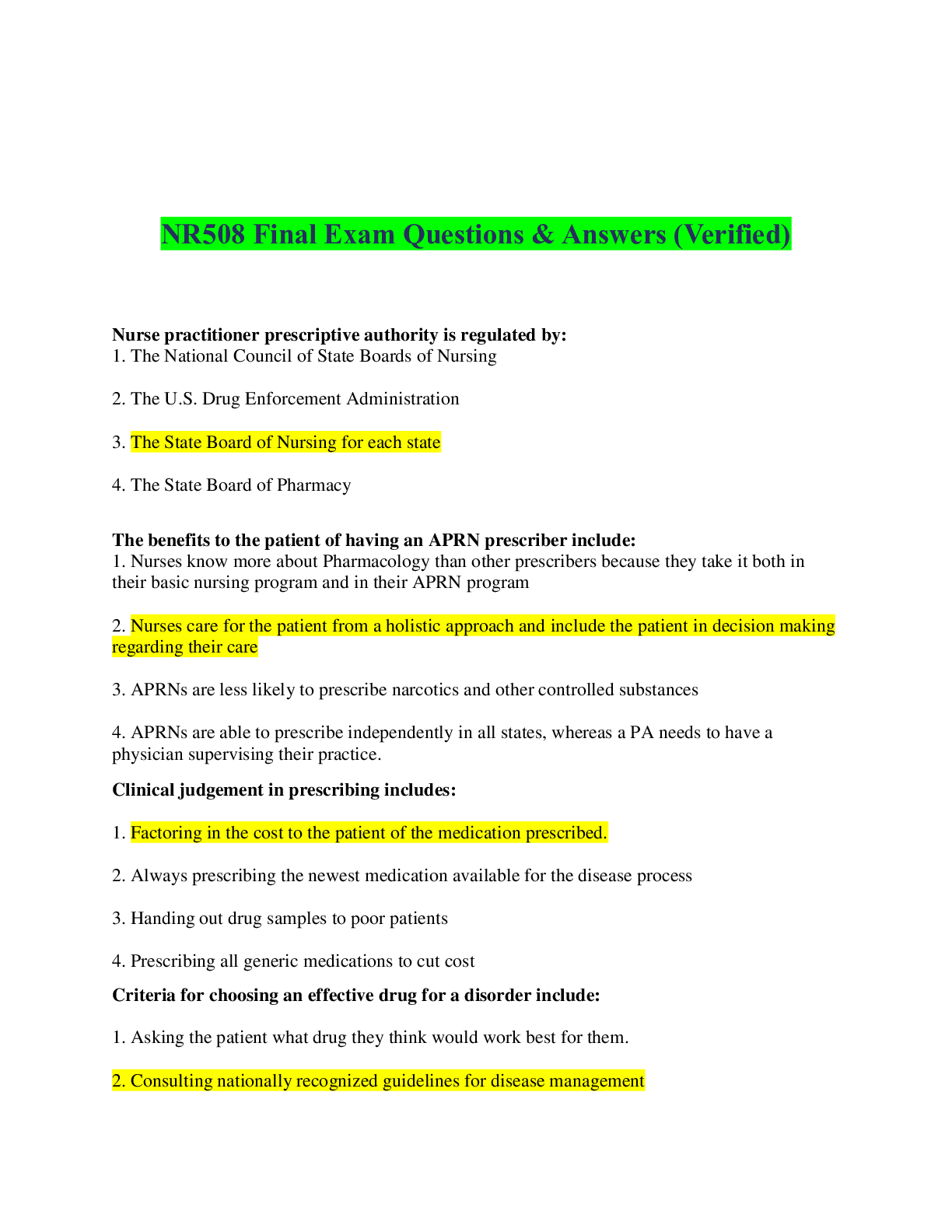

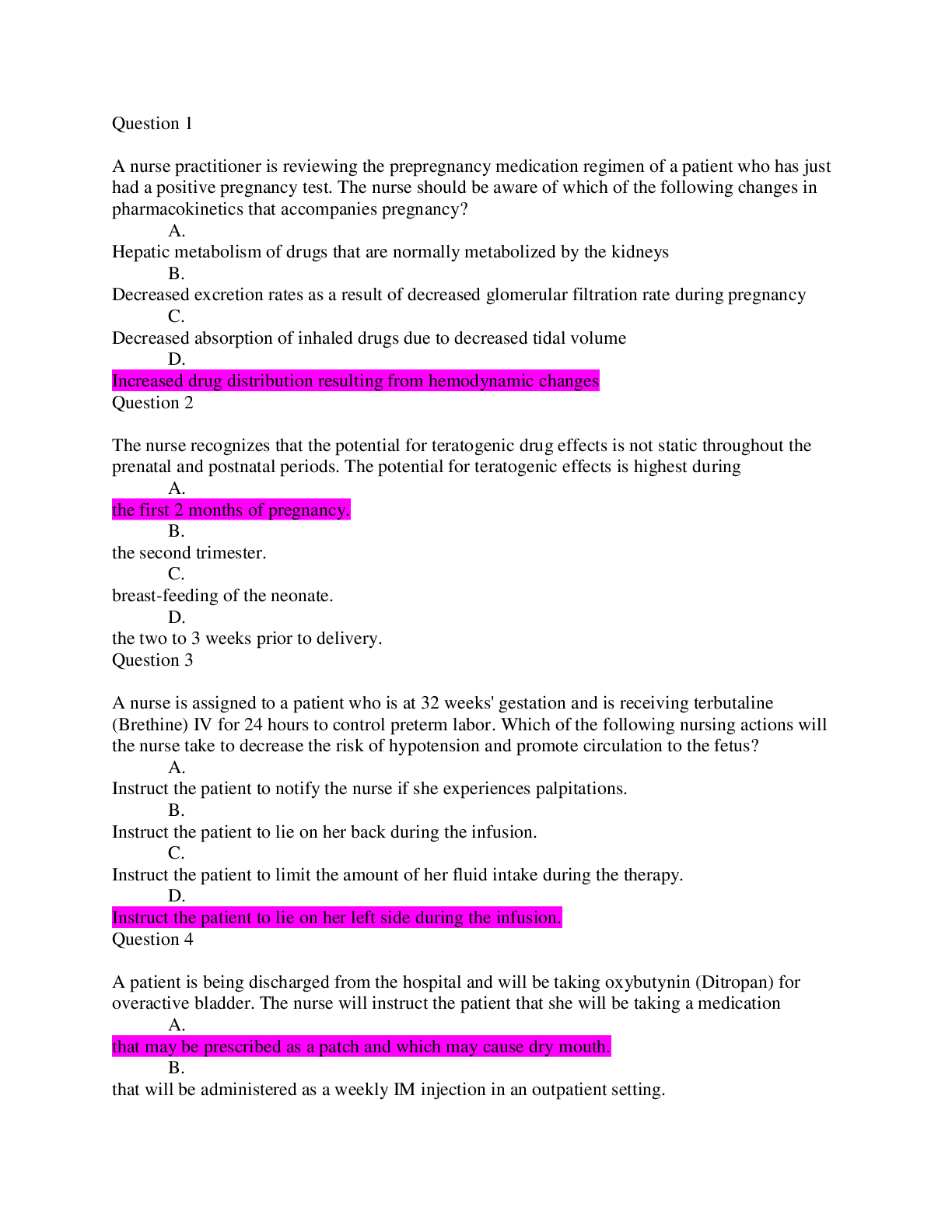

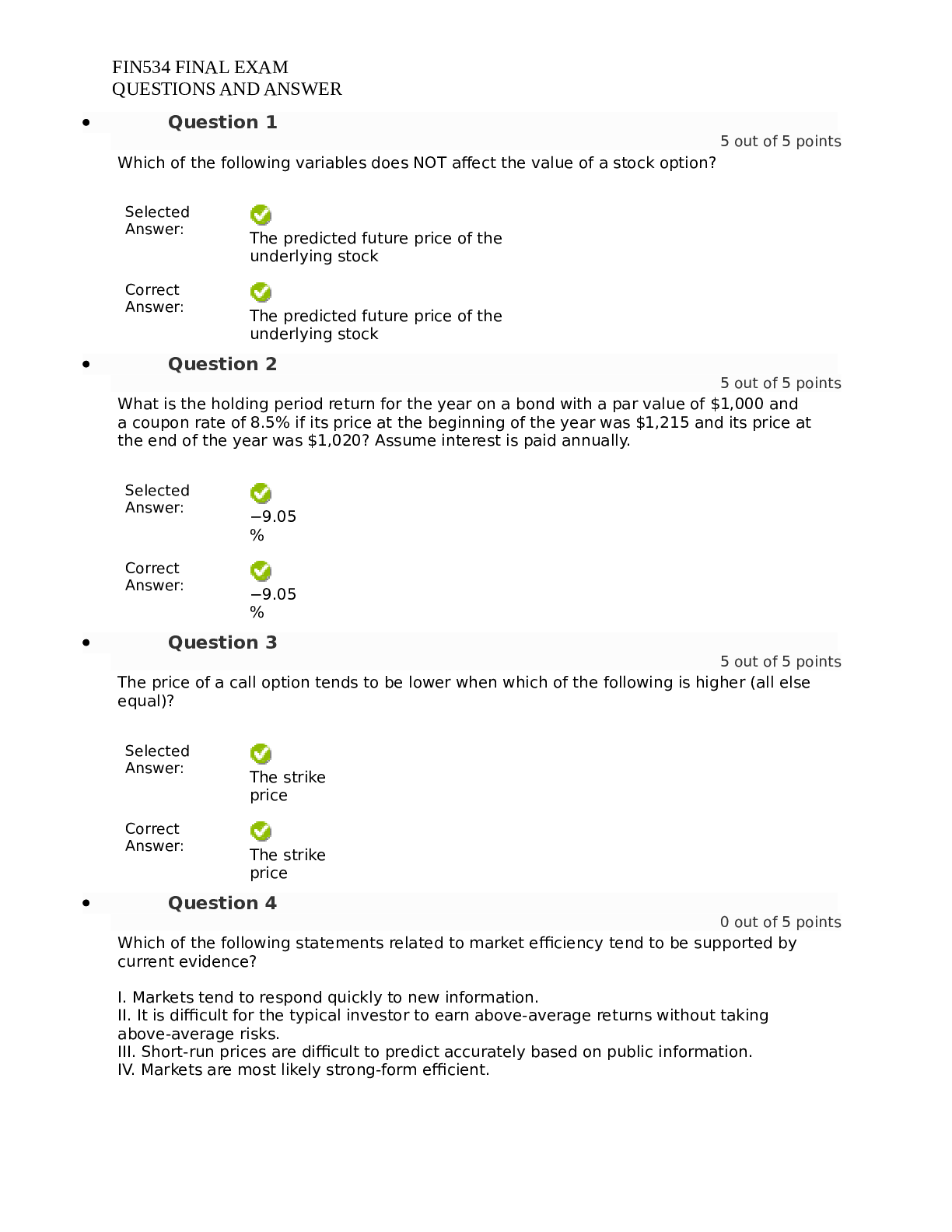

Strayer University - FIN 534 FINAL EXAM QUESTIONS AND ANSWERS. LATEST 2021.Question 1 5 out of 5 points Which of the following variables does NOT affect the value of a stock option? Selected Answe... r: The predicted future price of the underlying stock Correct Answer: The predicted future price of the underlying stock Question 2 5 out of 5 points What is the holding period return for the year on a bond with a par value of $1,000 and a coupon rate of 8.5% if its price at the beginning of the year was $1,215 and its price at the end of the year was $1,020? Assume interest is paid annually. Selected Answer: −9.05 % Correct Answer: −9.05 % Question 3 5 out of 5 points The price of a call option tends to be lower when which of the following is higher (all else equal)? Selected Answer: The strike price Correct Answer: The strike price Question 4 0 out of 5 points Which of the following statements related to market efficiency tend to be supported by current evidence? I. Markets tend to respond quickly to new information. II. It is difficult for the typical investor to earn above-average returns without taking above-average risks. III. Short-run prices are difficult to predict accurately based on public information. IV. Markets are most likely strong-form efficient. FIN534 FINAL EXAM QUESTIONS AND ANSWER Selected Answer: I and IV only Correct Answer: I, II, and III only Question 5 0 out of 5 points Which of the following securities has a purely fixed claim against a firm’s cash flows? Selected Answer: None of the options are correct. Correct Answer: bonds Question 6 0 out of 4 points JKL Corporation has a projected times-interest-earned ratio of 4.0 for next year. What percentage could EBIT decline next year before JKL’s times-interest-earned ratio would fall below 1.0? Selected Answer: Insufficient information is provided. Correct Answer: 75% Question 7 4 out of 4 points According to the pecking order theory of capital structure, why do firms avoid issuing equity? Selected Answer: Because equity issuance signals that managers believe their stock is overvalued, which causes the price of the stock to fall Correct Answer: Because equity issuance signals that managers believe their stock is overvalued, which causes the price of the stock to fall Question 8 4 out of 4 points Which of the following factors favor the issuance of equity in the financing decision? I. Market signaling II. Distress costs III. Management incentives IV. Financial flexibility [Show More]

Last updated: 2 years ago

Preview 1 out of 10 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$13.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 13, 2021

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Jul 13, 2021

Downloads

0

Views

54

.png)

.png)

.png)