Statistics > QUESTIONS & ANSWERS > University of New BrunswickCE 3963Final_2011 (All)

University of New BrunswickCE 3963Final_2011

Document Content and Description Below

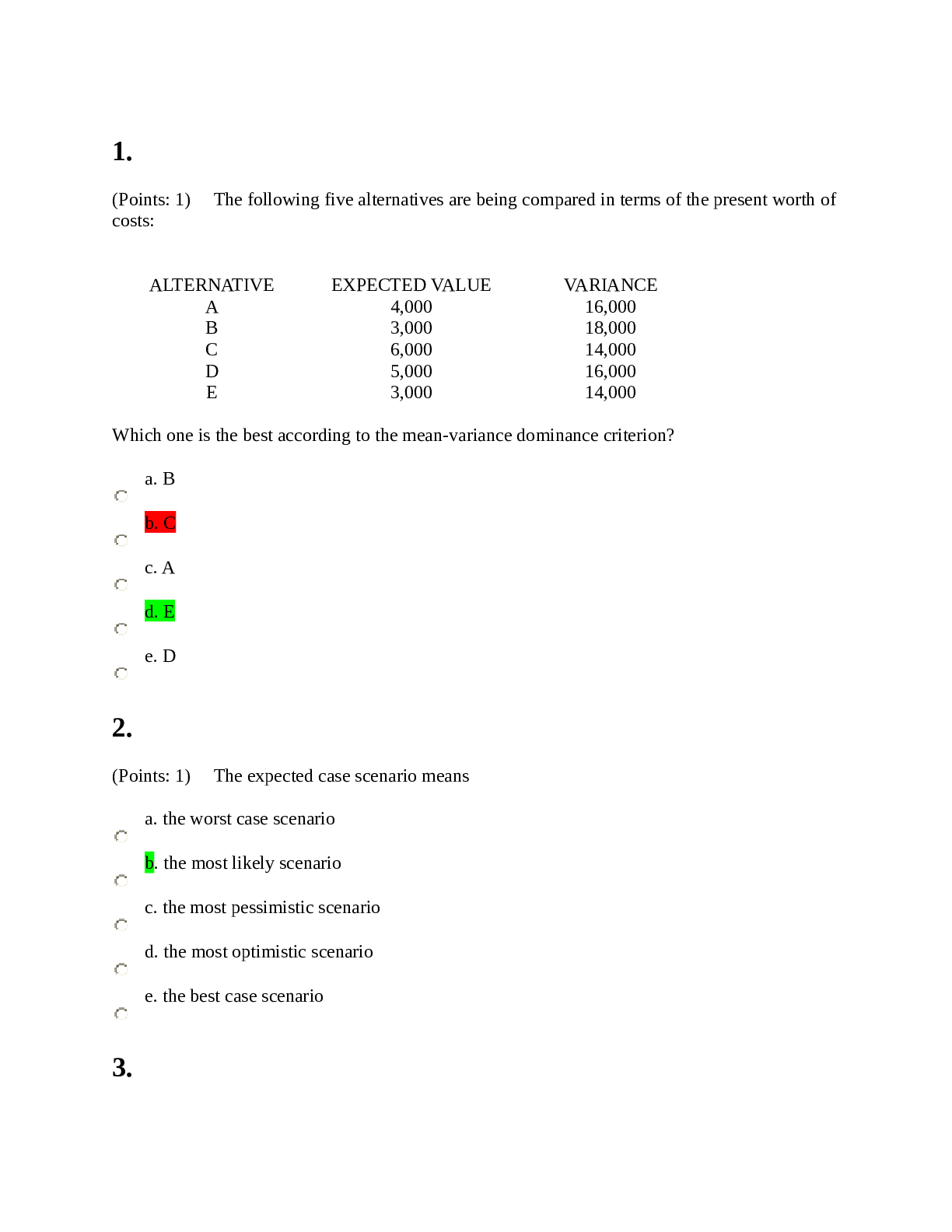

1. (Points: 1) The following five alternatives are being compared in terms of the present worth of costs: ALTERNATIVE EXPECTED VALUE VARIANCE A 4,000 16,000 B 3,000 18,000 C 6,000 14,000 D 5,00 ... 0 16,000 E 3,000 14,000 Which one is the best according to the mean-variance dominance criterion? a. B b. C c. A d. E e. D 2. (Points: 1) The expected case scenario means a. the worst case scenario b. the most likely scenario c. the most pessimistic scenario d. the most optimistic scenario e. the best case scenario 3.(Points: 1) If interest rate is 10%, the depreciation rate is 10%, service life is 10 years and first cost is $10 million then EAC(Capital) is a. $1.409 million b. $1.060 million ? c. $1.000 million d. $1.977 million e. $1.349 million 4. (Points: 1) It is known that the inflation rate over next three years is expected to be 5% in the first year, 10% in the second and 15% in the third. In such a case, average expected annual inflation rate is a. 10.00% b. 15.00% c. 10.08% d. 5.00% e. 9.92% 5. (Points: 1) Suppose that first cost of an asset is $1 million, the depreciation rate is 10%, service life is 10 years, the tax rate is 35% , the CCA rate is 30% and the after-tax interest rate is 15%. In this case, the present worth of the salvage value with tax effects incorporated is a. $0.268 million b. $0.066 million c. $0.005 milliond. $0.020 million e. $0.153 million 6. (Points: 1) Which of the following statements is correct? a. To account for tax effects it is necessary to multiply first cost by the tax benefit factor b. To account for tax effects it is necessary to multiply salvage value by the tax benefit factor c. To account for tax effects it is necessary to multiply annual savings by the tax benefit factor d. To account for tax effects it is necessary to multiply first cost by one munis the tax benefit factor e. To account for tax effects it is necessary to multiply anuual savings by one munis the tax benefit factor 7. (Points: 1) Capital costs are a. always sunk costs b. equally spread over the service life of an asset c. fixed costs that do not directly depend on the level of production d. costs of administrative overhead e. variable costs that directly depend on the level of production 8. (Points: 1) Sunk costs are a. non-recoverable portion of capital costsb. costs at the end of an asset's service life c. operating and maintenance costs d. opportunity costs e. external costs 9. (Points: 1) It is known that demand for a public park is given by the following expression: MWTP = 2 - 0.5N where MWTP is marginal willingness to pay in dollars per visit and N is visitation rate in millions of visits. If admission to the park is free, what is the park's value? a. $2 million b. $1 million c. $5 million d. $3 million e. $4 million 10. (Points: 1) As a result of sensitivity analysis, you ended up with the slope of the sensitivity graph with respect to first cost equal to -50. It means that a. An increase in first cost by $1 decreases the present worth of a project by 50% b. An increase in first cost by 1% decreases the present worth of a project by $50 c. An increase in first cost by $1 decreases the present worth of a project by $50 d. An increase in first cost by 1% decreases the present worth of the first costs by $50e. An increase in first cost by 1% decreases the present worth of a project by 50% 11. (Points: 1) In general, Monte Carlo Method is a. simulation of a project's dynamics on the basis of a generator of random numbers b. simulation of all project's cash flows in a prespecified interval c. simulation of the PW of a project given the PDFs of the project's inputs d. simulation of the PDF of a project's economic performance measure given the PDFs of the project's inputs e. simulations of a project's risk on the basis of constrained optimization 12. (Points: 1) Suppose that your income in 2005 was $35,000. If annual inflation rate has been 2% since 2005, what was your income in 2005 in terms of 2010 dollars? a. $31,700 b. $31,500 c. $32,334 d. $37,885 e. $38,643 13. (Points: 1) It is known that in 2010 the price of oil was $60 per barrel and it was $9 per barrel in 1998. In order for these two values to be equivalent, what annual rate of inflation should we assume? a. 13%b. 7% c. 17% d. 10% e. 20% 14. (Points: 1) Future annual revenue generated by a project is a random variable. Probability distribution function is given as follows Values, $$/year Probability 10,000 0.1 20,000 0.4 30,000 0.1 40,000 0.3 50,000 0.1 What is the probability of annual revenue being higher than $30,000/year? a. 0.4 b. 0.3 c. 0.1 d. 0.5 e. 0.6 15. (Points: 1) Suppose that you need to accumulate $10,000 in three years in todays dollars. What monthly amount in nominal (actual) dollars should your save if your real rate of return is 5% and expected annual inflation rate is 3%?a. $268.96 b. $281.96 c. $258.04 d. $275.14 e. $246.14 16. (Points: 1) Which of the following is not an example of a sensitivity analysis? a. Sensitivity graphs b. Scenario analysis c. Internal Rate of Return calculations d. Monte Carlo Method e. Break-even analysis 17. (Points: 1) In order to define equivalent annual cost operating the following information is needed a. interest rate, service life and salvage value b. salvage value, service life and first cost c. interest rate, first cost and salvage value d. interest rate, service life and maintenance costs e. interest rate, salvage value and annual revenue18. (Points: 1) To incorporate tax effects into annual savings it is necessary to a. multiply annual savings by one minus the tax rate b. multiply by the tax benefit factor c. divide annual savins by one minus the tax rate d. multiply annual savings by the tax rate e. divide annual savings by the tax rate 19. (Points: 1) It was calculated that a bridge will require $10 million in first costs and $0.5 milllion every year in maintenance and operating costs. CVM revealed that 2 million people identified themselves as potential bridge users. Average willingness to pay for crossing the bridge was defined as $5 with 1 million potential crossings per year. If we assume infinite time horizon for the bridge, what is the benefit-cost ratio of this project under 5% annual interest rate? a. 1.00 b. 5.00 c. 10.00 d. 0.10 e. 0.20 20. (Points: 1) Average corporate tax rate in Canada is a. 30% b. 36%c. 40% d. 46% e. 26% 21. (Points: 1) In order to define equivalent annual cost capital the following information is needed a. interest rate, service life, first cost and salvage value b. salvage value, service life, first cost and annual revenue c. interest rate, service life, first cost and maintenance costs d. interest rate, salvage value, first cost and annual revenue e. interest rate, service life, salvage value and annual revenue 22. (Points: 1) Suppose that as a result of a public project evaluation the following information was obtained: - PW of the project's capital costs = $9 million - PW of the project's operating costs = $5 million - PW of the project's benefits = $20 million What is the BCRM for this project? a. 1.07 b. 0.42 c. 2.20 d. 0.67 e. 1.6723. (Points: 1) Which of the following statements is correct? a. CPI is the average price of a fixed basket of consumer goods and services relative to base year b. Inflation increases the purchasing power of money c. Inflation rate is given by the CPI d. Inflation rate is the opportunity cost of money e. Inflation is a measure of changes in relative prices 24. (Points: 1) One of the following is not a remedy for market failures. Which one? a. Monetary policy b. Regulation by the government c. Litigation d. Government provision of a public service e. Taxation of negative externalities 25. (Points: 1) Break-even analysis implies that a. a project's benefits are lower or equal to the project's costs in terms of present worth b. the present worth of a project is positive c. a project's benefits are higher than the project's costs in terms of present worth d. a project's costs are exactly equal to the project's benefitse. the present worth of a project is equal to zero 26. (Points: 1) Which of the following is an example of market failure? a. Long distance telephone service b. Fire protection c. CNN broadcasting d. Extraction of natural gas e. Cellular telephone services 27. (Points: 1) Which of the following is the best technique to measure a project's risk? a. Sensitivity graph b. Decision tree analysis c. Scenario analysis d. Monte Carlo simulation e. Break-even analysis 28. (Points: 1) In general, an increase in salvage value __________ and an increase in the interest rate ________ the present worth of a project a. decreases, decreasesb. does not affect, decreases c. decreases, increases d. increases, decreases e. increases, increases 29. (Points: 1) The after tax IRR is a. always smaller that the before tax IRR b. always greater than the before tax IRR c. equal to the before tax IRR minus the inflation rate d. equal to the before-tax IRR e. equal to the before tax IRR plus the inflation rate 30. (Points: 1) When transportation experts say there is a 0.5% chance of an accident this is an example of a. relative (frequency) probability b. axiomatic probability c. classical probability d. subjective probabilitye. conditional probability 31. (Points: 5) An automobile-manufacturing company is considering purchasing an industrial robot to do spot welding, which is currently done by skilled labour. The initial cost of the robot is $218,780, and the annual labour savings are projected to be $90,827. The robot is a Class 43 property with a CCA rate of 30%. The robot will be used for seven years, at the end of which the firm expects to sell it for $28,144. The company's marginal tax rate is 35% and the after-tax MARR is 10%. Calculate the annual worth of this investment. (Don't use the $ sign in your answer and round it to 2 decimal points) Answer 32. (Points: 5) The purchase of a car requires a $20,245 loan to be repaid in monthly installments for four years at 12% annual real interest rate. If annual inflation rate is 2%, find the exra amount to be paid in 20th month due to inflation. (Don't use the $ sign in your answer and round it to 2 decimal points) Answer 33. (Points: 5) The University has just invested $9,443 in a new desktop publishing system. From past experience, annual cash returns are estimated as A(t) = $8000 - $4000(1+0.15)t-1 S(t) = $6000(1 - 0.5)t where A(t) stands for the net cash flow in period t and S(t) stands for the salvage value at the end of year t, and t 1 If the MARR is 12%, compute the annual equivalent cost in year 2. 20 2 19(Don't use the $ sign in your answer and round it to 2 decimal points) Answer 34. (Points: 5) The city of Fredericton operates automobile parking facilities and is evaluating a proposal to erect and operate a structure for parking in the city's downtown area. Two designs for a facility to be built have been identified (all values are in thousands of dollars): Design A Design B Cost of site $283 $119 Cost of building $2,392 $656 Annual fee collection $830 $750 Annual maintenance cost $410 $360 Service life 30 years 30 years Calculate the incremental (A-B) benefit-cost ratio if annual interest rate is 10% (Round your answer to 2 decimal points) Answer 35. (Points: 5) A small manufacturing firm is considering purchasing a new boring machine to modernize one of its production lines. Two types of boring machine are available on the market. The machines are described by the following characteristics: Item Machine A Machine B First cost $7,234 $8,805 Service life 8 years 10 years Salvage value $569 $1,026 Annual O&M costs $729 $606 CCA rate 30% 30% Determine the break-even annual O&M costs for machine A so that the present worth of machine A is the same as that of machine B. Use a MARR (after tax) of 10% and a marginal tax rate of 30%. 24 45(Don't use the $ sign in your answer and round it to 2 decimal points) Answer 36. (Points: 5) The present worth of an investment project is described by the following equation: PW = 20X + 8XY where X and Y are statistically independent discrete random variables with the following PDFs: PDF of X Value Probability $21 0.6 $82 0.4 PDF of Y Value Probability $32 0.4 $72 0.6 Calculate the mean of the project's PW (Don't use the $ in your answer and round it to 2 decimal point) Answer 11 [Show More]

Last updated: 3 years ago

Preview 1 out of 15 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 29, 2021

Number of pages

15

Written in

All

Additional information

This document has been written for:

Uploaded

Jul 29, 2021

Downloads

0

Views

56

.png)

.png)

.png)

.png)

.png)