Law > QUESTIONS & ANSWERS > CSCE 465432 Series63 Actual Exam, answered. (All)

CSCE 465432 Series63 Actual Exam, answered.

Document Content and Description Below

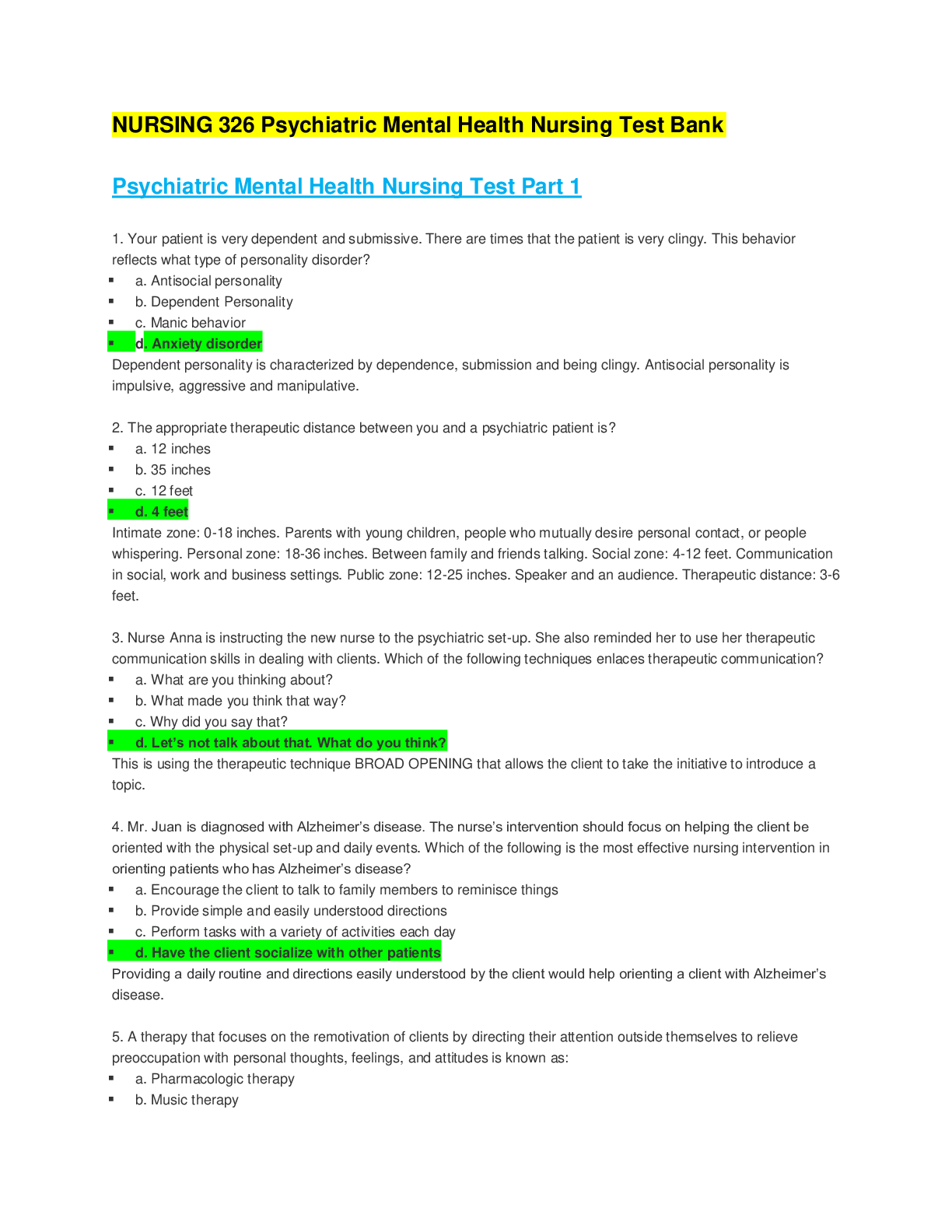

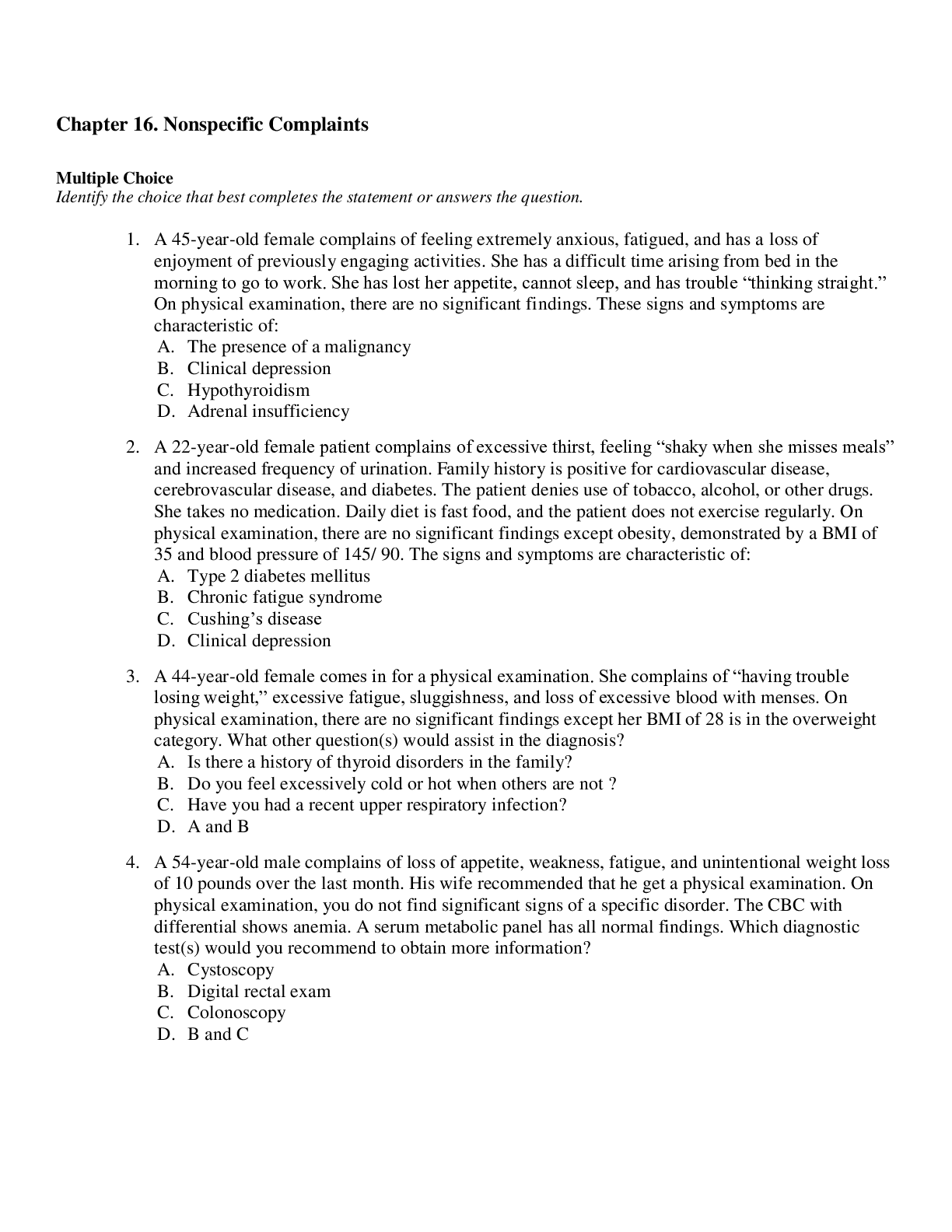

FINRA Series63 Uniform Securities Agent State Law Examination The Uniform Securities Act (USA) is A. a body of laws governing the purchase and sale of secur... ities within a single state. B. a set of guidelines for individual states to follow when formulating their own securities’ laws. C. a group of laws requiring state-issued securities, such as municipal bonds, to be registered with. D. federal legislation that requires all states to adopt the same registration requirements for all. Once you have passed the Series 63 examination, which entity must then approve your application to sell securities? A. FINRA B. NASAA C. SEC D. the state administrator Which of the following securities would not necessarily be exempt from state registration? A. a stock listed on the Tokyo Stock Exchange B. a bond guaranteed by the Canadian government C. a bond issued by another state’s employees’ credit union D. a stock listed as a NASDAQ National Market Issue. Moe is a registered investment adviser doing business under the name of MoeMoney Investment Advisers, LLC. Larry, Curly, and Mary all hold positions with the firm. Larry is on the board of directors; Mary is a sales representative for the firm; and Curly is an administrative assistant, who performs clerical duties. Given that Moe is already a registered investment adviser, which of the other three are automatically registered as investment adviser representatives? A. Larry only B. Larry and Mary only C. Larry, Mary and Curly D. Mary and Curly only Jack is employed by NewCorp, which is engaging in an initial public offering (IPO). Jack will need to register as a sales representative if he: A. engages in transactions with the underwriters of the IPO for the purpose of taking the firm public. B. represents NewCorp in any transactions with financial institutions. C. participates in the selling of the new stock to individual investors. D. Jack will need to register as a sales representative if he performs any one of the above activities. Blue Sky Laws are designed to: A. protect investors from fraud in their securities market transactions. B. protect agents, broker-dealers, and investment advisers and their representatives from spurious allegations of fraudulent activity. C. enhance the tourism industry within a state. D. favor investment in companies that engage in environmentally friendly practices. An individual who represents a broker-dealer in the buying and selling of securities is called a(n): A. underwriter B. issuer C. agent D. administrator Which of the following statements best explains the difference between an agent and a broker-dealer? A. An agent is an individual who represents a broker-dealer or an issuer and buys and sells securities he does not own in return for a commission on the transactions he executes. A broker-dealer may also buy and sell securities for his own portfolio, in which case the broker-dealer enjoys any price appreciation on those securities. B. A broker-dealer must be licensed in the state in which he conducts business, but there are no separate licensing requirements for agents. C. Agents are engaged exclusively in the purchase and sale of stocks whereas broker-dealers also buy and sell bonds and option contracts. D. Agents conduct their business exclusively in the secondary market, while broker-dealers also operate in the primary market. on No: 9 Rich Writewell wants to begin publishing an independent weekly financial newsletter that will provide investment recommendations as well as other financial news items to the general public. Rich hopes that his newsletter will achieve nationwide circulation within a few months. Which of the following statements is true? A. Rich will have to register as an investment adviser since his publication will include investment recommendations. B. Rich will have to register as an investment adviser only if he sells this newsletter to the public. If the publication is to be distributed free of charge, he will not have to register. C. Rich may be exempt from registering as an investment adviser if he is a lawyer, accountant, engineer, or teacher. Otherwise, he will have to register. D. Rich will not have to register as an investment adviser since he is publishing a legitimate financial newsletter for distribution to the general public. Erin is a registered agent who works for SecureMoney Brokers-dealers. One of her clients, Mrs. McTurk, is a recently-widowed woman who relies on Erin for advice about her investment portfolio. Mrs. McTurk reminds Erin of her own grandmother, and she is happy to provide guidance within the sphere of her own knowledge. Based on these facts, which of the following statements is true? A. SecureMoney Broker-dealers must register as an investment adviser since one of its employees is providing investment advice. B. Erin must register as an investment adviser since she is providing investment advice. C. SecureMoney Broker-dealers must register as an investment adviser since one of its employees is providing investment advice, and Erin must register as an investment adviser representative as the firm’s employee. D. Neither SecureMoney Broker-dealers nor Erin must register as an investment adviser based on the facts provided. Which of the following would not fall under the classification of “institutional investor”? A. Prudential Insurance B. Chase Bank C. Neuring Investment Advisers D. Franklin Templeton Mutual Funds Which of the following is an example of a non-issuer transaction? A. IBM sells a new issue of bonds to an insurance company. B. Jose purchases a 10-year bond issued by Progress Energy when it has 6 years remaining to maturity. C. Google offers more shares of its stock for sale to the public. D. NewCorp, which has been a privately held company, is engaging in an initial public offering (IPO) of its stock. Which of the following is not considered to be a security, as defined by the Uniform Securities Act (USA)? A. a debenture B. a certificate of deposit (CD) C. a put option D. an annuity contract wherein an insurance company promises to pay a fixed sum, either in a lump amount or through periodic payments. The Uniform Securities Act excludes annuity contracts wherein an insurance company promises either to pay a fixed sum, either in a lump amount or through periodic payments, from its definition of a security. Debentures, CDs, and option contracts are all classified as securities under the USA. Which of the following scenarios would not be considered a “sale,” as defined by the Uniform Securities Act (USA)? I. Yoshito owned shares of Minnow Corporation and received shares of Whale Corporation from Whale when it merged with Minnow. II. Olivia’s uncle, an agent with SecureMoney Brokers, sold Olivia ten call options on the stock of Microsoft. III. Hans purchased a bond of Indebted Corporation that had detachable warrants and subsequently sold the warrants. IV. Tom pledged some shares of stock he owned personally to secure a business loan for his company. A. Neither I nor II would be considered sales. B. Neither II nor III would be considered sales. C. Neither I nor IV would be considered sales. D. Neither III nor IV would be considered sales. Jeremy Sly considered himself somewhat of an inventor. The only problem was that his day job interfered with his opportunity to exercise his creativity. He came up with a plan to get outside investors to support his inventive activities. To this end, he produced and distributed a brochure advertising partnership interests with a guaranteed return on investment of at least 15% after the first 12 months, based on what he had allegedly generated from his other (non-existent) inventions. Given these facts, is Jeremy guilty of any security violations under the Uniform Securities Act (USA)? A. No. The facts don’t indicate whether any partnership interests were actually sold, and there can be no violation unless there is a sale. B. No. An interest in a partnership is not considered a security. C. No. It is not against the law to believe in oneself and promote one’s ideas. D. Yes. Even an “offer” to sell securities must not contain any untruths. Although an Administrator has broad powers, he or she cannot: A. issue subpoenas involving compulsory attendance. B. gather evidence. C. deliver a judicial injunction. D. formulate rules and orders. “Federal covered securities” were defined and exempted from state registration requirements by the: A. National Securities Markets Improvement Act of 1996 (NSMIA.) B. Gramm-Leach-Bliley Act of 1999 (GLBA.) C. Uniform Securities Act (USA.) D. National Conference of Commissioners on Uniform State Laws (NCCUSL.) Rich Quick is a broker-dealer licensed in the state of Massachusetts and has offices only within the state. Two of Rich Quick’s clients regularly vacation in Florida during the winter months, and Rich Quick executes trades for them when they call him from out-of-state. Based on these facts, I. Rich Quick needs to register as a broker-dealer in the state of Florida as well. II. Rich Quick needs to register only as an agent in the state of Florida. III. Rich Quick needs to establish an office in the state of Florida in order to transact business. IV. Rich Quick need not register in Florida. A. Statements I and III are true. B. Statements II and III are true. C. Only Statement I is true. D. Only Statement IV is true. Most individual state securities laws today are based on: A. the Uniform Securities Act of 1956. B. the Uniform Securities Act of 2002. C. the National Securities Markets Improvement Act of 1996. D. the Gramm-Leach-Bliley Act of 1999. BigCash Broker-Dealers is registered in the state and is in the process of purchasing a smaller broker- dealer, Target Investments, as a subsidiary. Target Investments is also registered in the state. After completing the purchase, what actions must BigCash take regarding registration of its new subsidiary? A. BigCash need do nothing since Target Investments was already duly registered with the state as a broker-dealer. B. BigCash must file a new application with the state to register its new subsidiary, but will be able to utilize the remainder of any annual filing fees that Target Investments had paid for the year. C. BigCash must file a new application with the state to register its new subsidiary and must also pay the annual filing fees required by the Administrator. D. BigCash will need to pay the annual filing fees required by the Administrator, but will not need to file a new registration application. [Show More]

Last updated: 2 years ago

Preview 1 out of 12 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 26, 2021

Number of pages

12

Written in

Additional information

This document has been written for:

Uploaded

Aug 26, 2021

Downloads

0

Views

73