Finance > QUESTIONS & ANSWERS > Questions and Answers > FIN 1234 Chapter 1, 2 & 3 (All)

Questions and Answers > FIN 1234 Chapter 1, 2 & 3

Document Content and Description Below

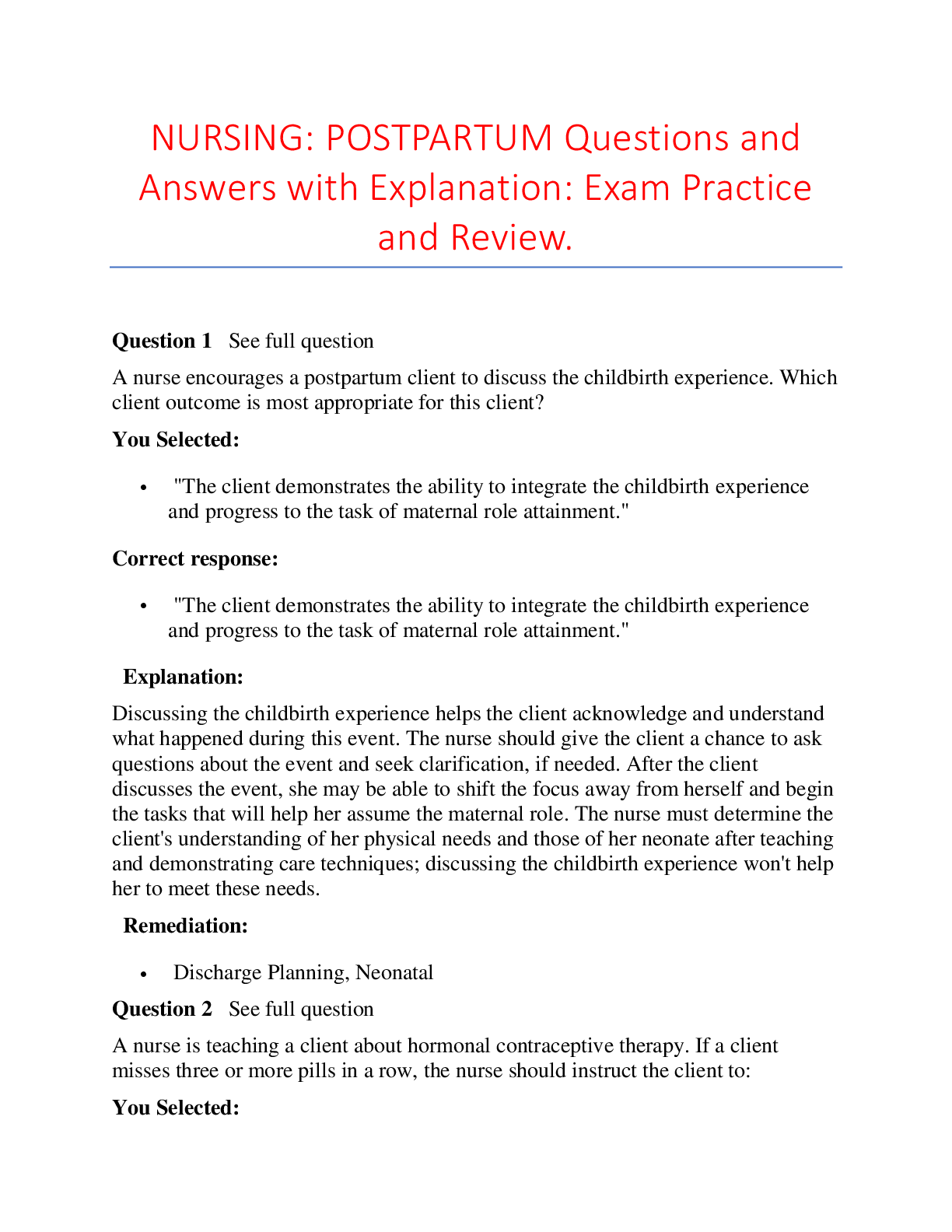

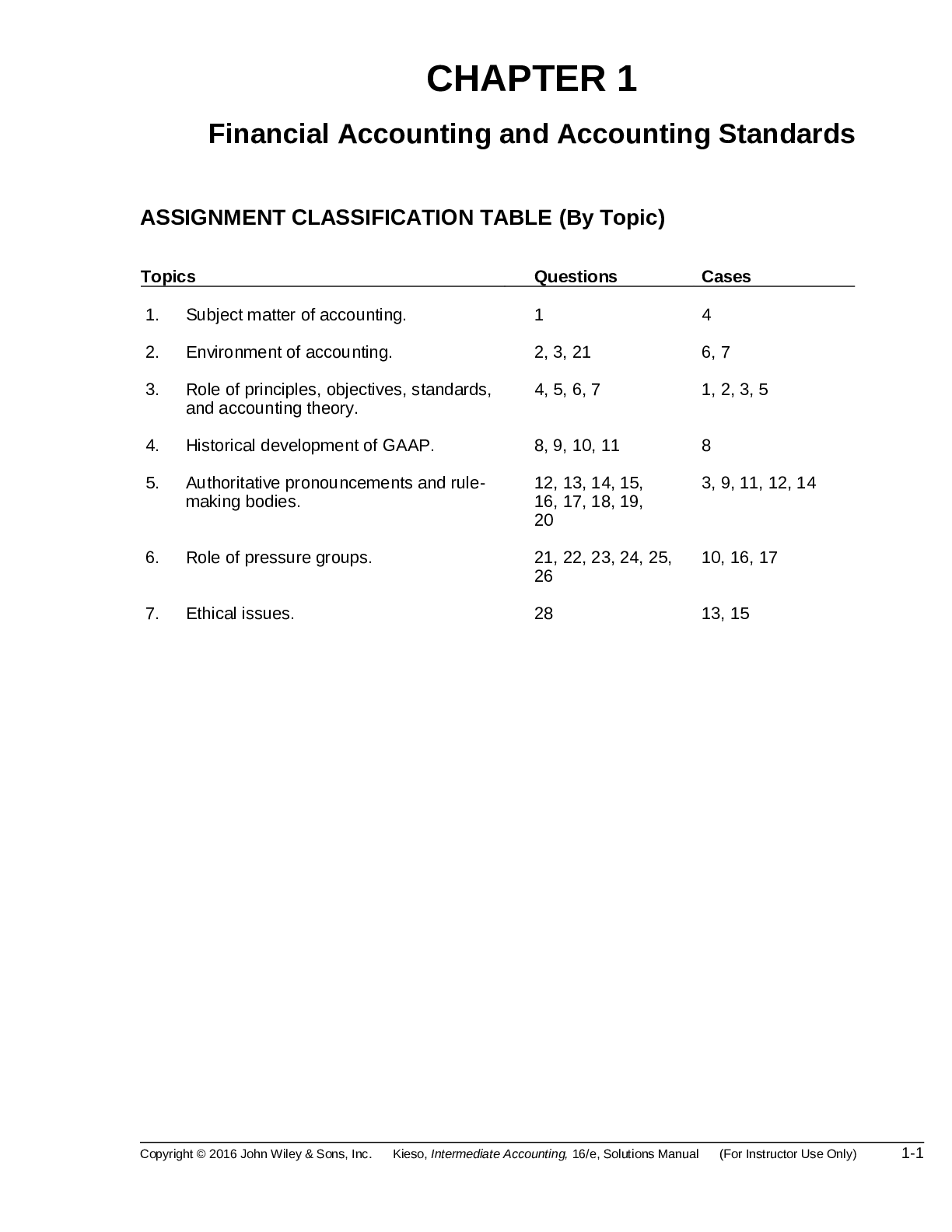

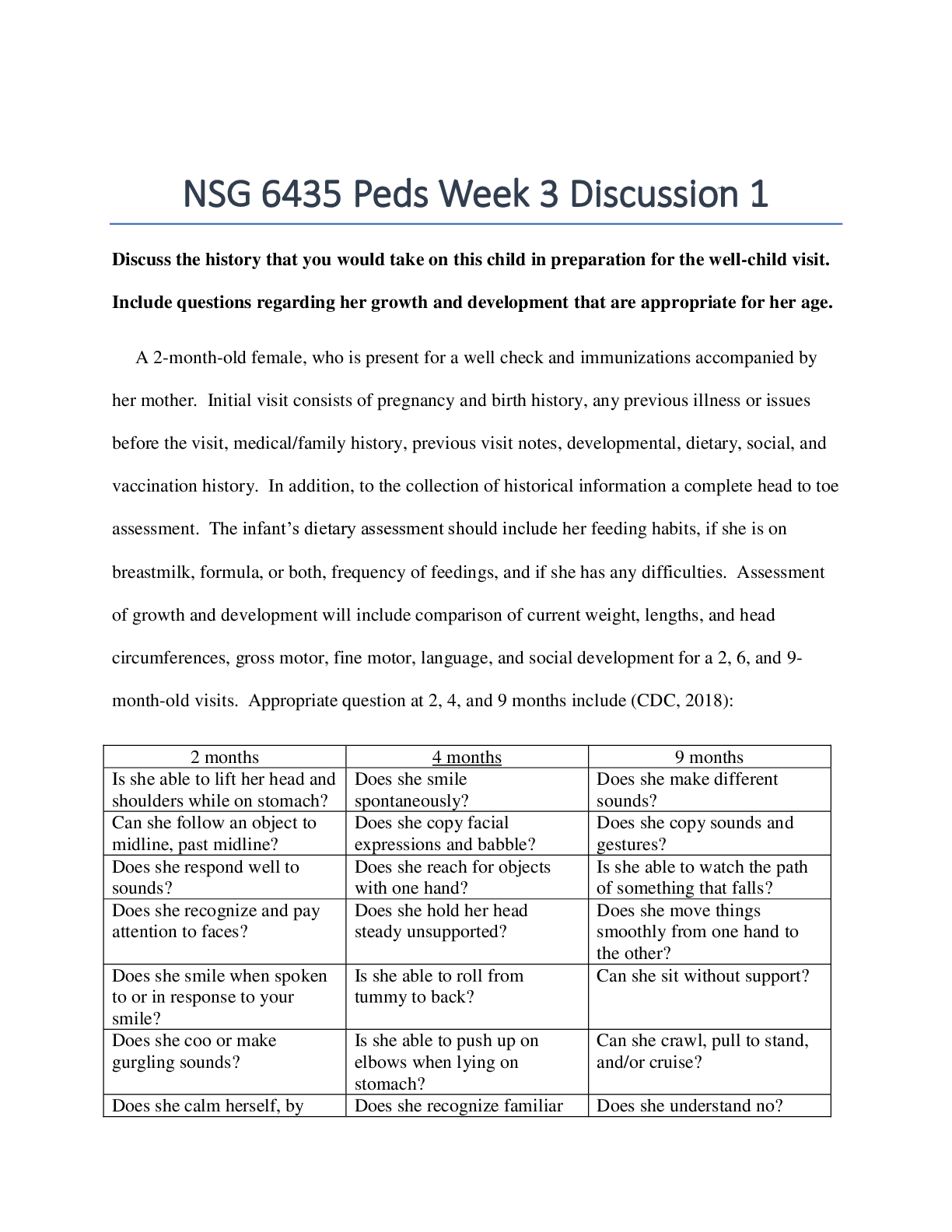

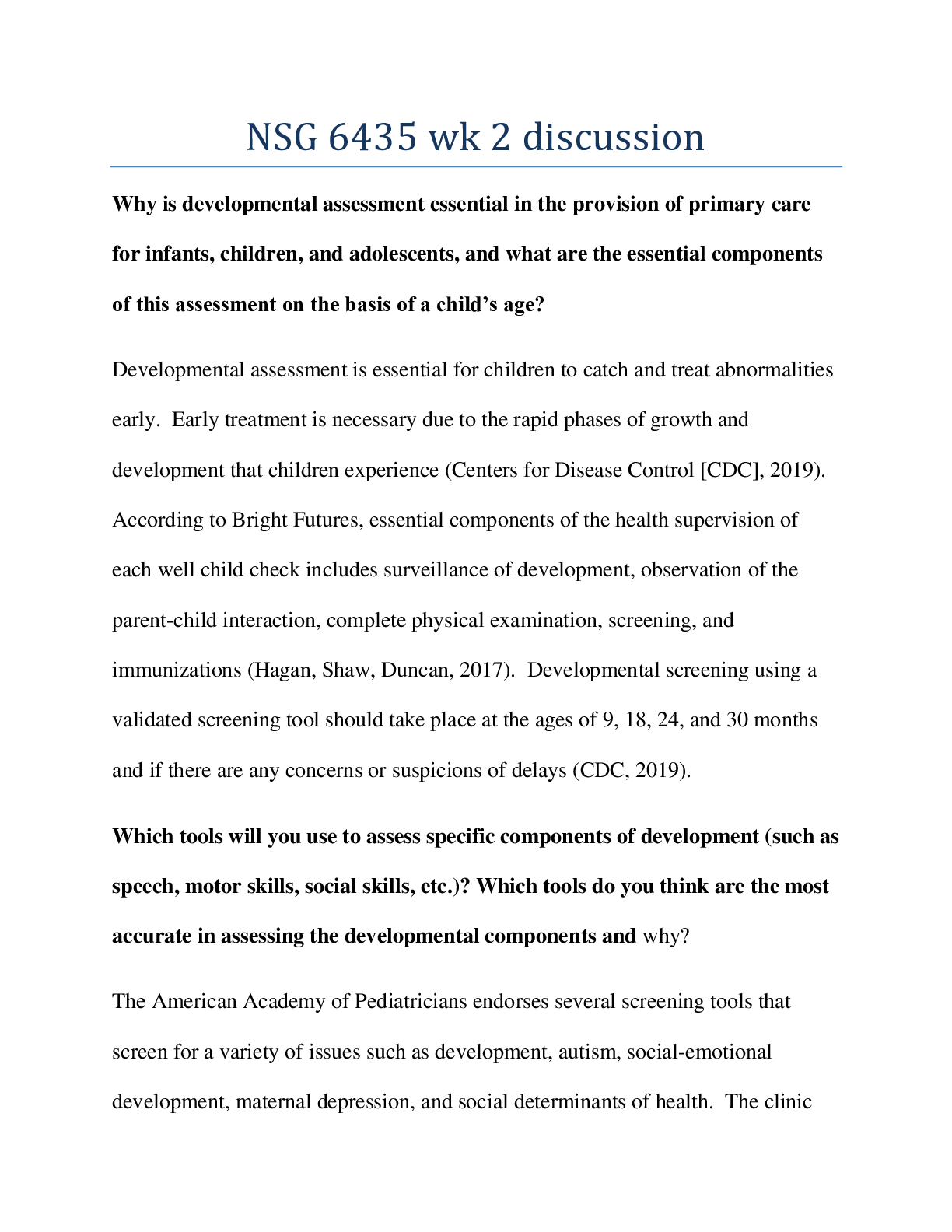

FIN 1234 Chapter 1, 2 & 3 Questions and Answers Accounting is ingrained in our society and it is vital to our economic system.” Do you agree? Explain. Identify and describe the steps in th... e accounting process. (a) Who are internal users of accounting data? (b) How does accounting provide relevant data to these users? What uses of financial accounting information are made by (a) investors and (b) creditors? “Bookkeeping and accounting are the same.” Do you agree? Explain. Jackie Remmers Travel Agency purchased land for $85,000 cash on December 10, 2014. At December 31, 2014, the land’s value has increased to $93,000. What amount should be reported for land on Jackie Remmers’ statement of financial position at December 31, 2014? Explain. What is the monetary unit assumption? What is the economic entity assumption? What are the three basic forms of profit-oriented business organizations? Teresa Alvarez is the owner of a successful printing shop. Recently, her business has been increasing, and Teresa has been thinking about changing the organization of her business from a proprietorship to a corporation. Discuss some of the advantages Teresa would enjoy if she were to incorporate her business. What is the basic accounting equation? (a) Define the terms assets, liabilities, and equity. (b) What items affect equity? Which of the following items are liabilities of Designer Jewelry Stores? (a) Cash. (f) Equipment. (b) Accounts payable. (g) Salaries and wages (c) Dividends. payable. (d) Accounts receivable. (h) Service revenue. (e) Supplies. (i) Rent expense. Can a business enter into a transaction in which only the left side of the basic accounting equation is affected? If so, give an example. Are the following events recorded in the accounting records? Explain your answer in each case. (a) The president of the company dies. (b) Supplies are purchased on account. (c) An employee is fired. Indicate how the following business transactions affect the basic accounting equation. (a) Paid cash for janitorial services. (b) Purchased equipment for cash. (c) Received cash in exchange for ordinary shares. (d) Paid accounts payable in full. (a) Decrease assets and decrease equity.(b) Increase assets and decrease assets.(c) Increase assets and increase equity.(d) Decrease assets and decrease liabilities. Listed below are some items found in the financial statements of Alex Greenway Co. Indicate in which financial statement(s) the following items would appear. (a) Service revenue. (e) Retained earnings. (b) Equipment. (f) Salaries and wages (c) Advertising expense. payable. (d) Accounts receivable. In February 2014, Paula Klink invested an additional $10,000 in Midtown Company. Midtown’s accountant, Jon Shin, recorded this receipt as an increase in cash and revenues. Is this treatment appropriate? Why or why not? “A company’s net income appears directly on the income statement and the retained earnings statement, and it is included indirectly in the company’s statement of financial position.” Do you agree? Explain. Jardine Enterprises had an equity balance of $158,000 at the beginning of the period. At the end of the accounting period, the equity balance was $198,000. (a) Assuming no additional investment or distributions during the period, what is the net income for the period? (b) Assuming an additional investment of $13,000 but no distributions during the period, what is the net income for the period? 21. Summarized operations for H. J. Oslo Co. for the month of July are as follows. Revenues earned: for cash £20,000; on account £70,000. Expenses incurred: for cash £26,000; on account £40,000. Indicate for H. J. Oslo Co. (a) the total revenues, (b) the total expenses, and (c) net income for the month of July. 23. The basic accounting equation is: Assets 5 Liabilities 1 Equity. Replacing the words in that equation with numeric amounts, what is Nestlé’s accounting equation at December 31, 2010? CHAPTER 2 1. Describe the parts of a T-account. 2. “The terms debit and credit mean increase and decrease, respectively.” Do you agree? Explain. 3. Jason Hilbert, a fellow student, contends that the double-entry system means each transaction must be recorded twice. Is Jason correct? Explain. 4. Sandra Browne, a beginning accounting student, believes debit balances are favorable and credit balances are unfavorable. Is Sandra correct? Discuss. 5. State the rules of debit and credit as applied to (a) asset accounts, (b) liability accounts, and (c) equity accounts (revenue, expenses, dividends, share capital— ordinary, and retained earnings). 6. What is the normal balance for each of the following accounts? (a) Accounts Receivable. (b) Cash. (c) Dividends. (d) Accounts Payable. (e) Service Revenue. (f) Salaries and Wages Expense. (g) Share Capital—Ordinary. 7. Indicate whether each of the following accounts is an asset, a liability, or an equity account and whether it has a normal debit or credit balance: (a) Accounts Receivable, (b) Accounts Payable, (c) Equipment, (d) Dividends, (e) Supplies. 8. For the following transactions, indicate the account debited and the account credited. (a) Supplies are purchased on account. (b) Cash is received on signing a note payable. (c) Employees are paid salaries in cash. (a) Debit Supplies and credit Accounts Payable. (b) Debit Cash and credit Notes Payable. (c) Debit Salaries and Wages Expense and credit Cash. 9. Indicate whether the following accounts generally will have (a) debit entries only, (b) credit entries only, or (c) both debit and credit entries. (1) Cash. (2) Accounts Receivable. (3) Dividends. (4) Accounts Payable. (5) Salaries and Wages Expense. (6) Service Revenue. 10. What are the basic steps in the recording process? 11. What are the advantages of using a journal in the recording process? 12. (a) When entering a transaction in the journal, should the debit or credit be written first? (b) Which should be indented, the debit or credit? 13. Describe a compound entry, and provide an example. 14. (a) Should business transaction debits and credits be recorded directly in the ledger accounts? (b) What are the advantages of first recording transactions in the journal and then posting to the ledger? 15. The account number is entered as the last step in posting the amounts from the journal to the ledger. What is the advantage of this step? 16. Journalize the following business transactions. (a) Alberto Rivera invests $9,000 cash in the business in exchange for ordinary shares. (b) Insurance of $800 is paid for the year. (c) Supplies of $2,000 are purchased on account. (d) Cash of $7,500 is received for services rendered. 17. (a) What is a ledger? (b) What is a chart of accounts and why is it important? 18. What is a trial balance and what are its purposes? 19. Joe Kirby is confused about how accounting information flows through the accounting system. He believes the flow of information is as follows. (a) Debits and credits posted to the ledger. (b) Business transaction occurs. (c) Information entered in the journal. (d) Financial statements are prepared. (e) Trial balance is prepared. Is Joe correct? If not, indicate to Joe the proper flow of the information. 20. Two students are discussing the use of a trial balance. They wonder whether the following errors, each considered separately, would prevent the trial balance from balancing. What would you tell them? (a) The bookkeeper debited Cash for €600 and credited Salaries and Wages Expense for €600 for payment of wages. (b) Cash collected on account was debited to Cash for €900 and Service Revenue was credited for €90. 21. What are the normal balances for Samsung’s Cash, Accounts Payable, and Interest Expense accounts? CHAPTER 3 (a) How does the time period assumption affect an accountant’s analysis of business transactions? (b) Explain the terms fiscal year, calendar year, and interim periods. Define two IFRS principles that relate to adjusting the accounts. Gabe Corts, a lawyer, accepts a legal engagement in March, performs the work in April, and is paid in May. If Corts’ law firm prepares monthly financial statements, when should it recognize revenue from this engagement? Why? Why do accrual-basis financial statements provide more useful information than cash-basis statements? 5. In completing the engagement in Question 3, Corts pays no costs in March, $2,200 in April, and $2,500 in May (incurred in April). How much expense should the firm deduct from revenues in the month when it recognizes the revenue? Why? 6. “Adjusting entries are required by the historical cost principle of accounting.” Do you agree? Explain. 7. Why may a trial balance not contain up-to-date and complete financial information? 8. Distinguish between the two categories of adjusting entries, and identify the types of adjustments applicable to each category. 9. What is the debit/credit effect of a prepaid expense adjusting entry? 10. “Depreciation is a valuation process that results in the reporting of the fair value of the asset.” Do you agree? Explain. 11. Explain the differences between depreciation expense and accumulated depreciation. 12. Jain Company purchased equipment for Rs18,000,000. By the current statement of fi nancial position date, Rs7,000,000 had been depreciated. Indicate the statement of financial position presentation of the data. 13. What is the debit/credit effect of an unearned revenue adjusting entry? 14. A company fails to recognize revenue for services performed but not yet received in cash or recorded. Which of the following accounts are involved in the adjusting entry: (a) asset, (b) liability, (c) revenue, or (d) expense? For the accounts selected, indicate whether they would be debited or credited in the entry. 15. A company fails to recognize an expense incurred but not paid. Indicate which of the following accounts is debited and which is credited in the adjusting entry: (a) asset, (b) liability, (c) revenue, or (d) expense. 16. A company makes an accrued revenue adjusting entry for $900 and an accrued expense adjusting entry for $700. How much was net income understated prior to these entries? Explain. 17. On January 9, a company pays $6,000 for salaries and wages, of which $2,000 was reported as Salaries and Wages Payable on December 31. Give the entry to record the payment. 18. For each of the following items before adjustment, indicate the type of adjusting entry (prepaid expense, unearned revenue, accrued revenue, or accrued expense) that is needed to correct the misstatement. If an item could result in more than one type of adjusting entry, indicate each of the types. 19. One-half of the adjusting entry is given below. Indicate the account title for the other half of the entry. (a)Salaries and Wages Expense is debited. (b) Depreciation Expense is debited (c) Interest Payable is credited. (d) Supplies is credited. (e) Accounts Receivable is debited. (f) Unearned Service Revenue is debited. (a) Accrued revenues. (d) Accrued expenses or prepaid expenses.(b) Unearned revenues. (e) Prepaid expenses.(c) Accrued expenses. (f) Accrued revenues or unearned revenues. 20. “An adjusting entry may affect more than one statement of financial position or income statement account.” Do you agree? Why or why not? 21. Why is it possible to prepare financial statements directly from an adjusted trial balance? 22. L. Thomas Company debits Supplies Expense for all purchases of supplies and credits Rent Revenue for all advanced rentals. For each type of adjustment, give the adjusting entry. 23. (a) What is the primary objective of financial reporting? (b) Identify the characteristics of useful accounting Information. 24. D an Fineman, the president of King Company, is pleased. King substantially increased its net income. in 2014 while keeping its unit inventory relatively the same. Howard Gross, chief accountant, cautions Dan, however. Gross says that since King changed its method of inventory valuation, there is a consistency problem and it is difficult to determine whether King is better off. Is Gross correct? Why or why not? 25. What is the distinction between comparability and consistency? 26. D escribe the constraint inherent in the presentation of accounting information. 27. Laurie Belk is president of Better Books. She has no accounting background. Belk cannot understand why fair value is not used as the basis for all accounting measurement and reporting. Discuss. 28. What is the economic entity assumption? Give an example of its violation. [Show More]

Last updated: 2 years ago

Preview 1 out of 18 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$14.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 11, 2020

Number of pages

18

Written in

Additional information

This document has been written for:

Uploaded

Dec 11, 2020

Downloads

0

Views

155

Download to Score A.png)

Download to Score A.png)

, All Correct, Download to Score A.png)

.png)

.png)