Business > QUESTIONS & ANSWERS > Loan Officer – NMLS Questions and Answers Graded A+ (All)

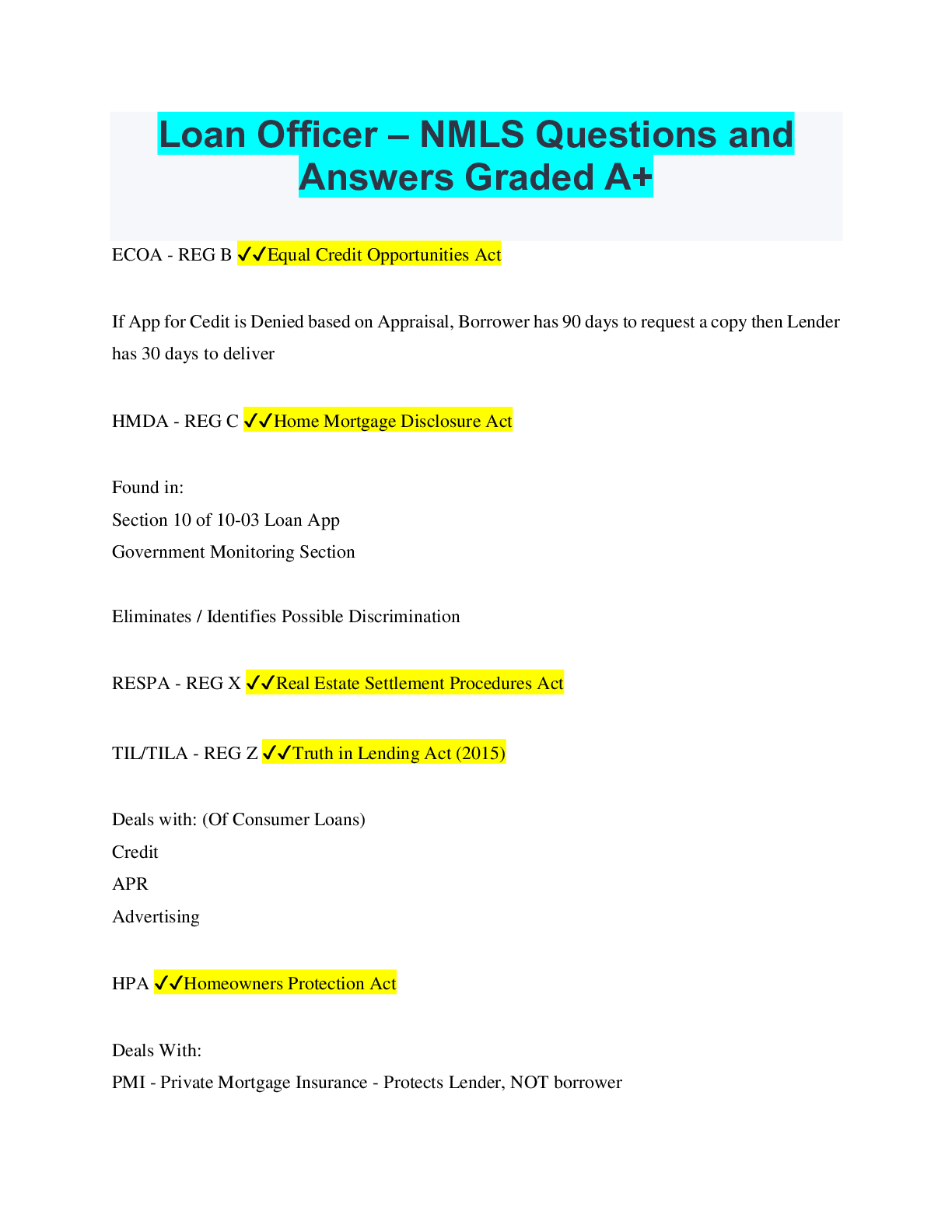

Loan Officer – NMLS Questions and Answers Graded A+

Document Content and Description Below

Loan Officer – NMLS Questions and Answers Graded A+ ECOA - REG B ✔✔Equal Credit Opportunities Act If App for Cedit is Denied based on Appraisal, Borrower has 90 days to request a copy then Le... nder has 30 days to deliver HMDA - REG C ✔✔Home Mortgage Disclosure Act Found in: Section 10 of 10-03 Loan App Government Monitoring Section Eliminates / Identifies Possible Discrimination RESPA - REG X ✔✔Real Estate Settlement Procedures Act TIL/TILA - REG Z ✔✔Truth in Lending Act (2015) Deals with: (Of Consumer Loans) Credit APR Advertising HPA ✔✔Homeowners Protection Act Deals With: PMI - Private Mortgage Insurance - Protects Lender, NOT borrowerConventional Loans NOT MIP NOT Government Loans 20% Down SAFE ✔✔SECURE and Fair Enforcement Act Created by HERA* HERA ✔✔Housing and Economic Recovery Act Law that created the SAFE Act* TILA - REG Z requires lenders... ✔✔To disclose the COMPLETE COST OF CREDIT to consumer loan applicants. Tell the WHOLE STORY of the loan. 3-Day Right of Recission ✔✔ESTABLISHED BY TILA - REG Z - Creditor must return any money collected related to the loan within 20 CALENDAY DAYS - Consumers may rescind the credit transaction UNTIL MIDNIGHT OF THE THIRD BUSINESS DAY. - Borrowers must receive TWO COPIES of a Notice of Right to Rescind. Cooling Off Period ✔✔3 Days to change your mind (TILA) TILA Disclosures must be Kept for... ✔✔2 YearsEXCEPTIONS: Loan Estimate - 3 YRS Closing Discolures - 5 YRS TILA Disclosures ✔✔Loan Estimate Disclosure Closing Disclosure CHARM Booklet (Consumer Handbook on Adjustable Rate Mortgages) APR ✔✔Annual Percentage Rate Another Phrase for APR... ✔✔Effective Rate Another Term for Interest Rate... ✔✔Note Rate or Nominal Rate Penalties for violating TILA ✔✔$5,000 per day for SINGLE Violation $25,000 per day for reckless violation $1,000,000 per day for KNOWINGLY violating TRID RESPA ✔✔Real Estate Settlement Procedures Act RESPA Definition ✔✔Passed in 1974 to provide consumer protection for loans on RESIDENTIAL PROPERTIES (1-4 Units) Enacted so consumers can obtain info on costs of closing so that they can shop for settlement services. Limits Escrow depositsRESPA Allows Borrowers... ✔✔... to receive pertinent and timely DISCLOSURES regarding the nature and cost of SETTLEMENT SERVICE cost. RESPA Purpose ✔✔To help consumers become better shoppers for settlement services and to eliminate unnecessary increases in the costs of due to KICKBACKS and places limitation on the use of RESERVE accounts. 4 Important Sections of RESPA ✔✔Section 6 - 8 - 9 - 10. RESPA Section 6 ✔✔Protects homeowners against Mortgage Servicing Abuse. RESPA Section 8 ✔✔Prohibits Kickbacks, Fee-Splitting, and unearned fees. RESPA Section 9 ✔✔States a seller cannot require the use of particular title company. RESPA Section 10 ✔✔Identifies amounts that can be charged to maintain escrow accounts Settlement Services Include ✔✔- Origination of a Federally related Mortgage Loan - Mortgage Broker Services - Services related to the origination , processing, or federal mortgage loan funding - Title services Settlement Services NOT Included ✔✔- Building / Remodeling Contractors - Service and Repair Contractors - Moving Companies - Landscaper - Home Improvement or Design Companies Department of Hosing and Urban Development Acronym ✔✔HUDRESPA applicable Loans ✔✔Made with funds insured by the federal government (e.g., FHA loans) Made with collateral insured by the federal government (e.g., flood insurance) Made with funds from a lender regulated by the federal government or that has deposits insured by the federal government (e.g., depository institutions regulated by the FDIC or NCUA) Intended for sale to Fannie Mae or Freddie Mac Made by a creditor regulated under the Truth-in-Lending Act, or Made by a mortgage broker and assigned to a creditor Loans RESPA does NOT apply to ✔✔- Business - Commercial - Agricultural - Construction - Vacant Land - Secondary Market - Loan Conversions [Show More]

Last updated: 2 years ago

Preview 1 out of 45 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 16, 2022

Number of pages

45

Written in

Additional information

This document has been written for:

Uploaded

Nov 16, 2022

Downloads

0

Views

136

with Complete Solution.png)

Career Information with Complete Solution.png)

for E-6 Career Information_watermark.png)

.png)

.png)

.png)