Management > EXAM > SOLVED- ELABORATED-CMCA Terms for Budgets, Reserves, Investments, and Assessments-Financial Controls (All)

SOLVED- ELABORATED-CMCA Terms for Budgets, Reserves, Investments, and Assessments-Financial Controls for 2023

Document Content and Description Below

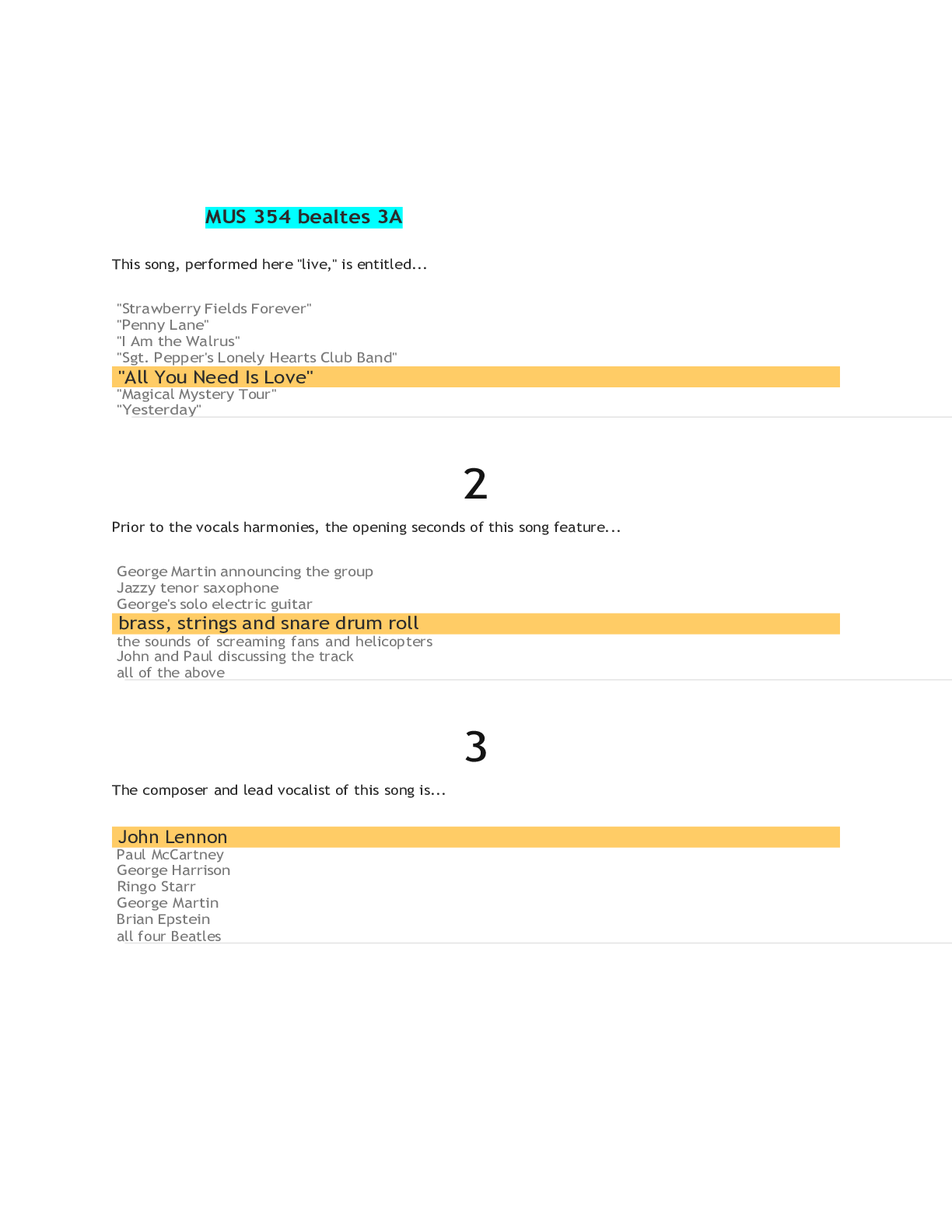

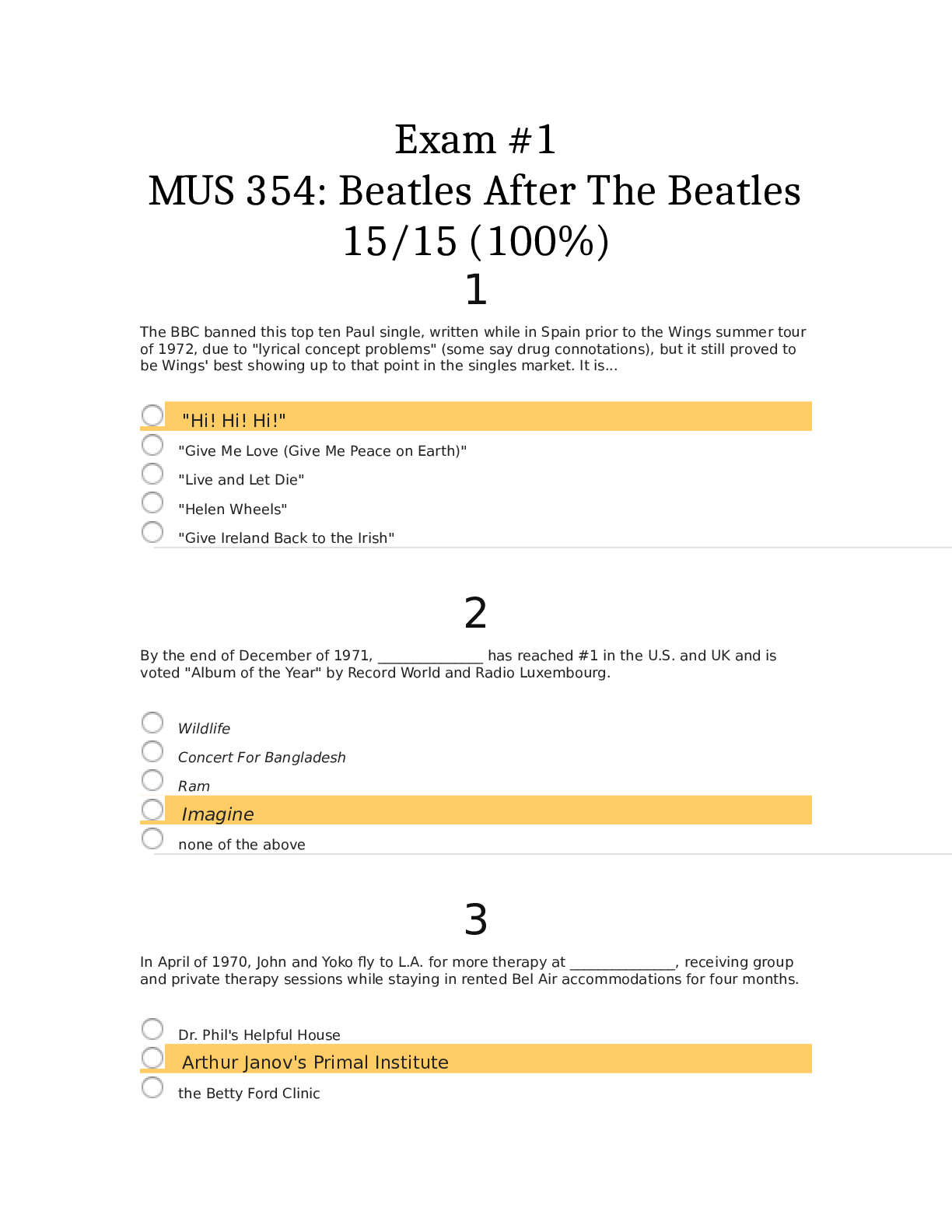

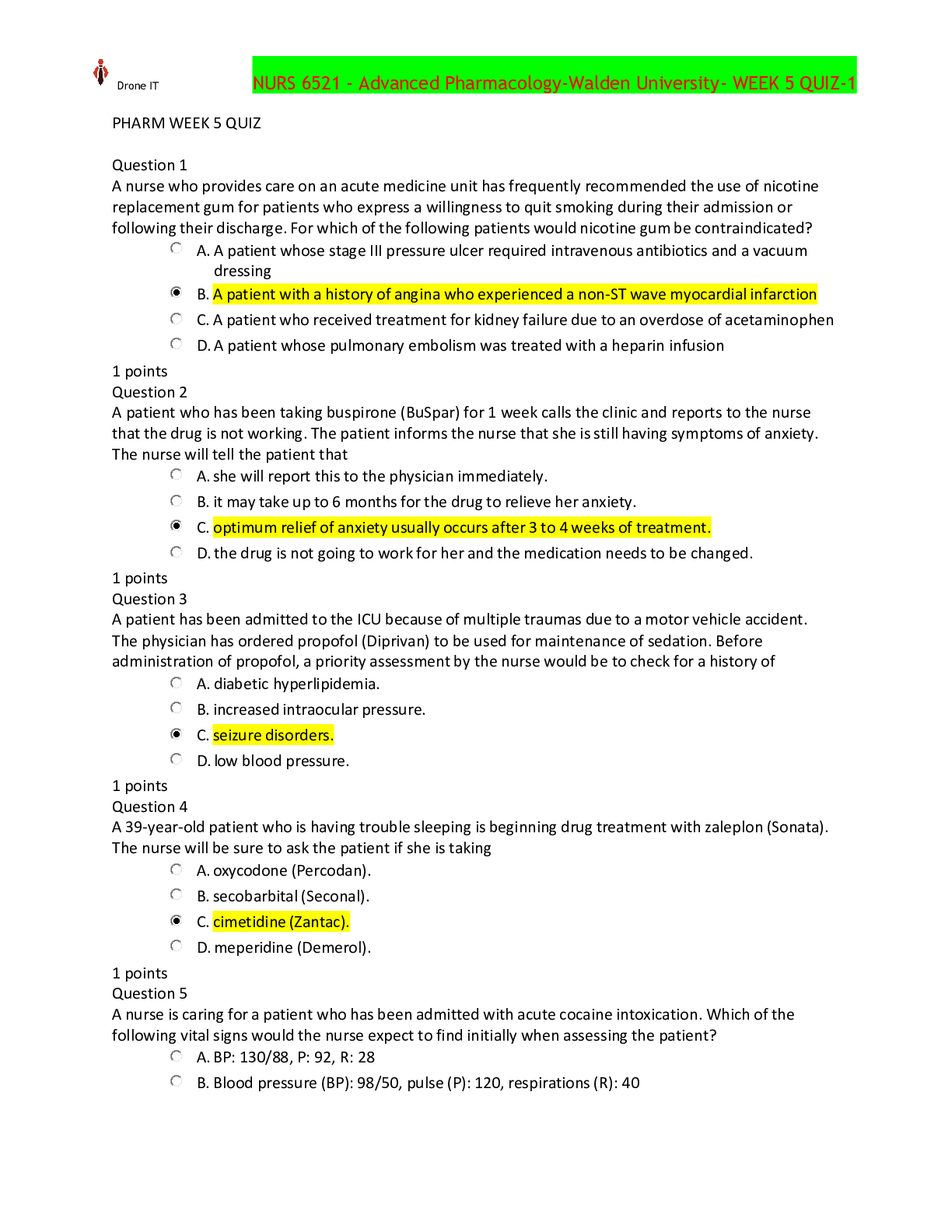

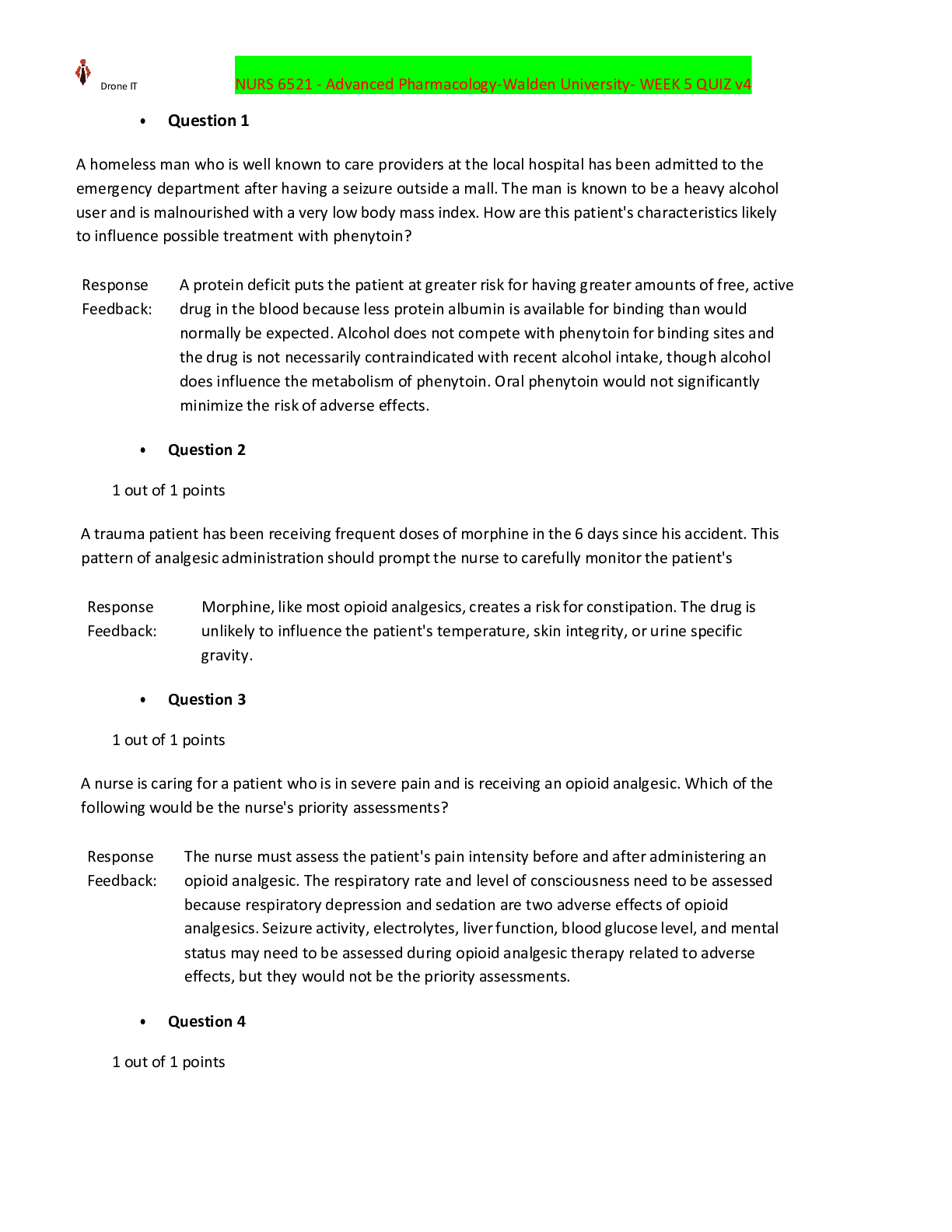

SOLVED- ELABORATED-CMCA Terms for Budgets, Reserves, Investments, and Assessments-Financial Controls for 2022Financial Statements, Audits, Income Taxes & Investments for 2022 Liabilities - |Ans| &... gt;> Liabilities consist of what is owed to others or collected in advance (e.g. owner assessments received prior to the billed month). Members' equity - |Ans| >> Members' equity is called the fund balance under the fund method of reporting. It equals the difference between the community association's assets and liabilities. Modified cash basis of accounting - |Ans| >> This method records income and expenses on a cash basis with selected items recorded on an accrual basis. Modified cash varies in format depending on the number of items accrued. Net income - |Ans| >> Net income is the amount left after deducting expenses from income. Net loss - |Ans| >> A net loss occurs when expenses are greater than income. Notes to financial statements - |Ans| >> The notes accompany the CPA-prepared financial statements. These footnotes provide additional information to help the reader understand the community association's financial situation. Representation letter - |Ans| >> A letter from the CPA that states that the information the community association provides is true to the best of its knowledge. Statement of cash flows - |Ans| >> This is a summary of the flow of funds into and out of the community association. Summaries are prepared for normal operations, investment activities, and any borrowing activities. Statement of income and expense - |Ans| >> This report records the community association's financial transactions during a given period of time—generally for a given month plus the fiscal year to date. It is a way to keep track of the community's financial activity. Treasury bills - |Ans| >> Treasury bills are short-term instruments that mature in 13, 26, or 52 week periods. They are issued in minimum denominations of $10,000. Anything larger must be in $5,000 increments. As soon as one is purchased, the buyer receives the promised earnings. Then, when the bill matures, the buyer receives the face value (value indicated in the wording of the T-bill). Treasury bonds - |Ans| >> Treasury notes mature in one to 10 years. Treasury bonds mature in more than 10 years. Both notes and bonds are issued in denominations from $1,000 to $100,000. They are also interest-bearing with interest paid every six months. When the note or bond matures, the buyer receives the full face value.#Applications and Forms #CMCA #Exam #Prep #CMCA #Examination #You #Passed. #Standards of #Professional #Conduct #MaintainingtheCMCA #CMCA #Retired #State #Specific #Requirements #CommunitySOLVED- ELABORATED-CMCA Terms for Budgets, Reserves, Investments, and Assessments-Financial Controls for 2022 [Show More]

Last updated: 2 years ago

Preview 1 out of 3 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$6.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 02, 2023

Number of pages

3

Written in

Additional information

This document has been written for:

Uploaded

Mar 02, 2023

Downloads

0

Views

74