Financial Accounting > QUESTIONS & ANSWERS > Week 2 ACC 206 Homework and Quiz REVISED EDITION 2020/2021 (All)

Week 2 ACC 206 Homework and Quiz REVISED EDITION 2020/2021

Document Content and Description Below

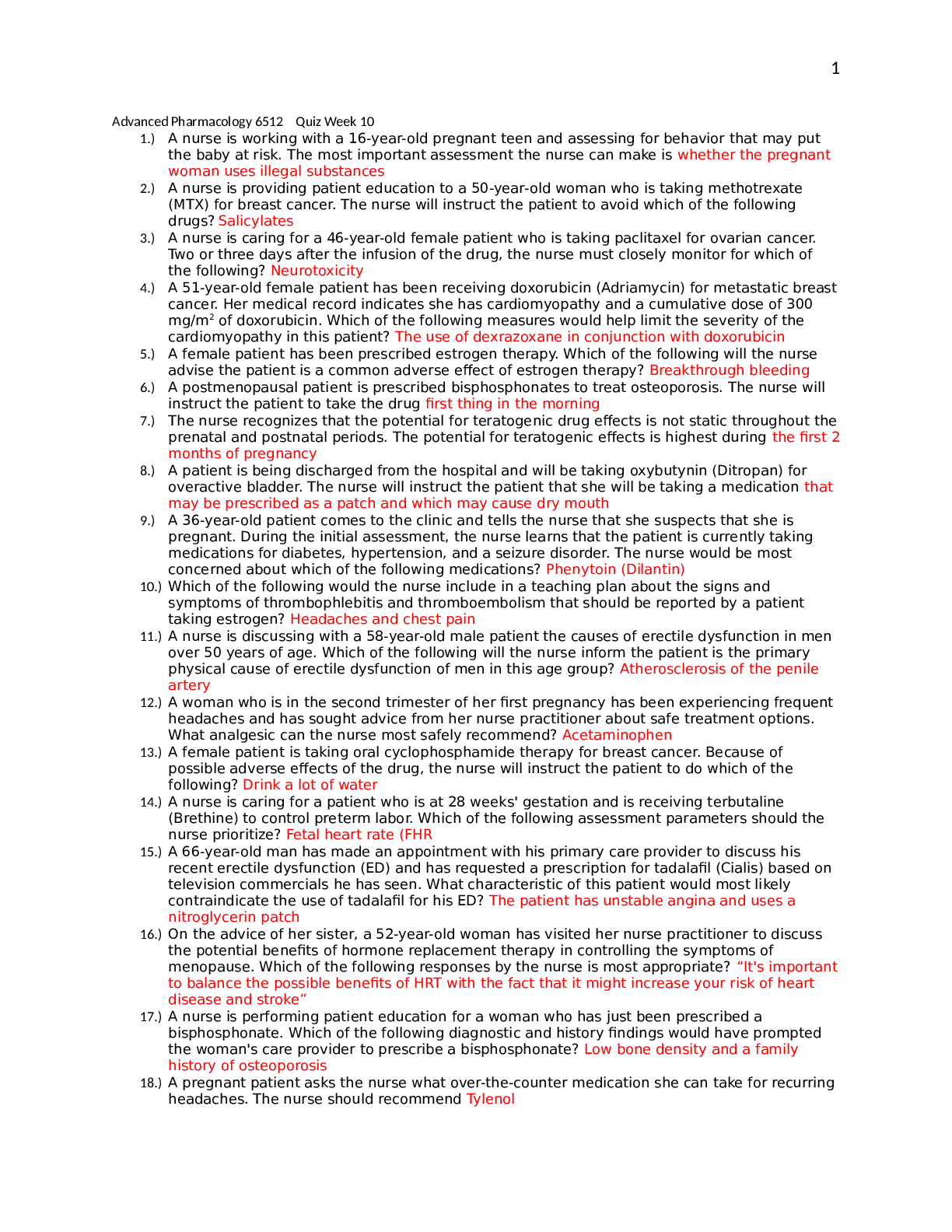

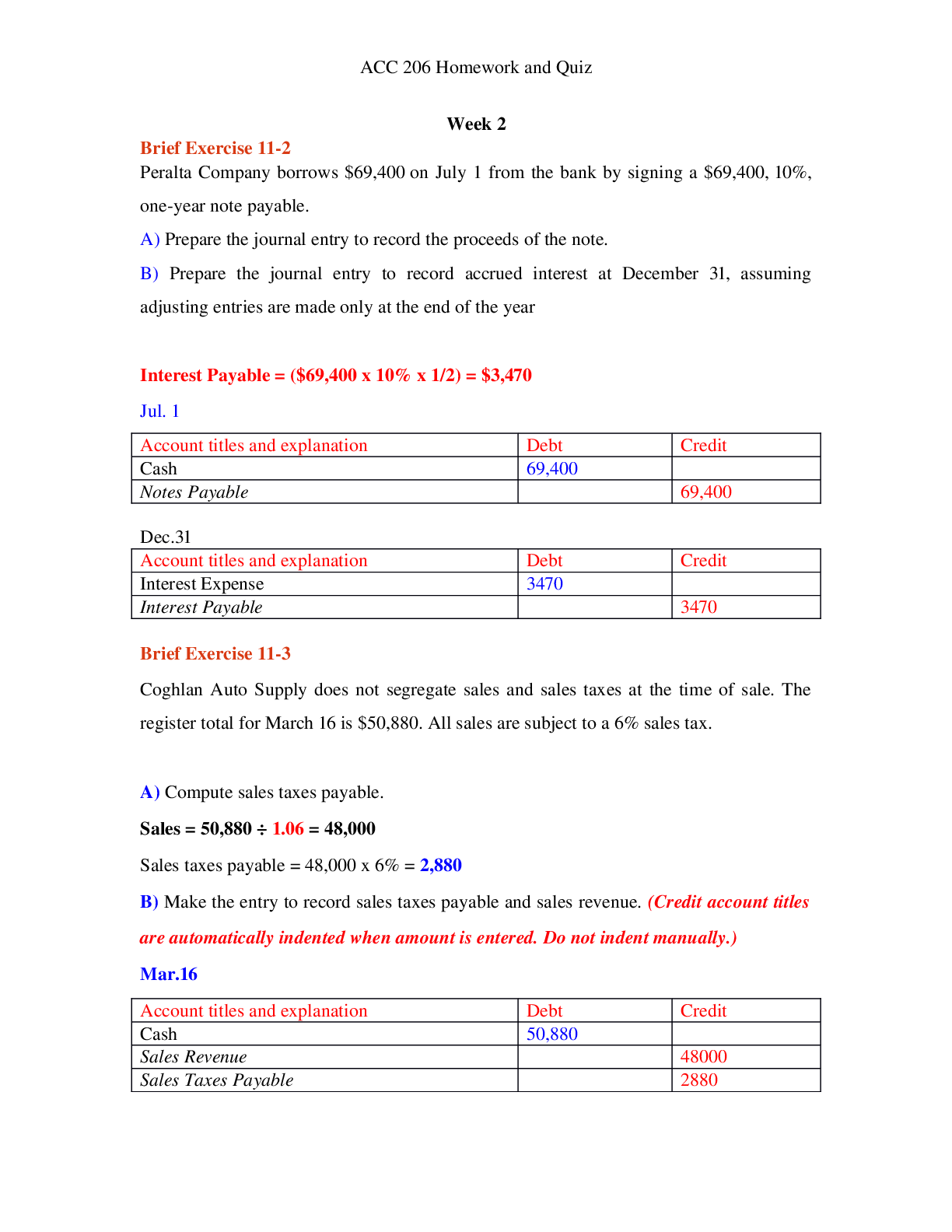

Peralta Company borrows $69,400 on July 1 from the bank by signing a $69,400, 10%, oneyear note payable. A) Prepare the journal entry to record the proceeds of the note. B) Prepare the journal ent ... ry to record accrued interest at December 31, assuming adjusting entries are made only at the end of the year Interest Payable = ($69,400 x 10% x 1/2) = $3,470 Jul. 1 Account titles and explanation Debt Credit Cash 69,400 Notes Payable 69,400 Dec.31 Account titles and explanation Debt Credit Interest Expense 3470 Interest Payable 3470 Brief Exercise 113 Coghlan Auto Supply does not segregate sales and sales taxes at the time of sale. The register total for March 16 is $50,880. All sales are subject to a 6% sales tax. A) Compute [Show More]

Last updated: 3 years ago

Preview 1 out of 10 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 12, 2021

Number of pages

10

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 12, 2021

Downloads

0

Views

87

.png)