Accounting > STUDY GUIDE > Liberty UniversityACCT 301ACCT 301 Homework Chapter 3. (All)

Liberty UniversityACCT 301ACCT 301 Homework Chapter 3.

Document Content and Description Below

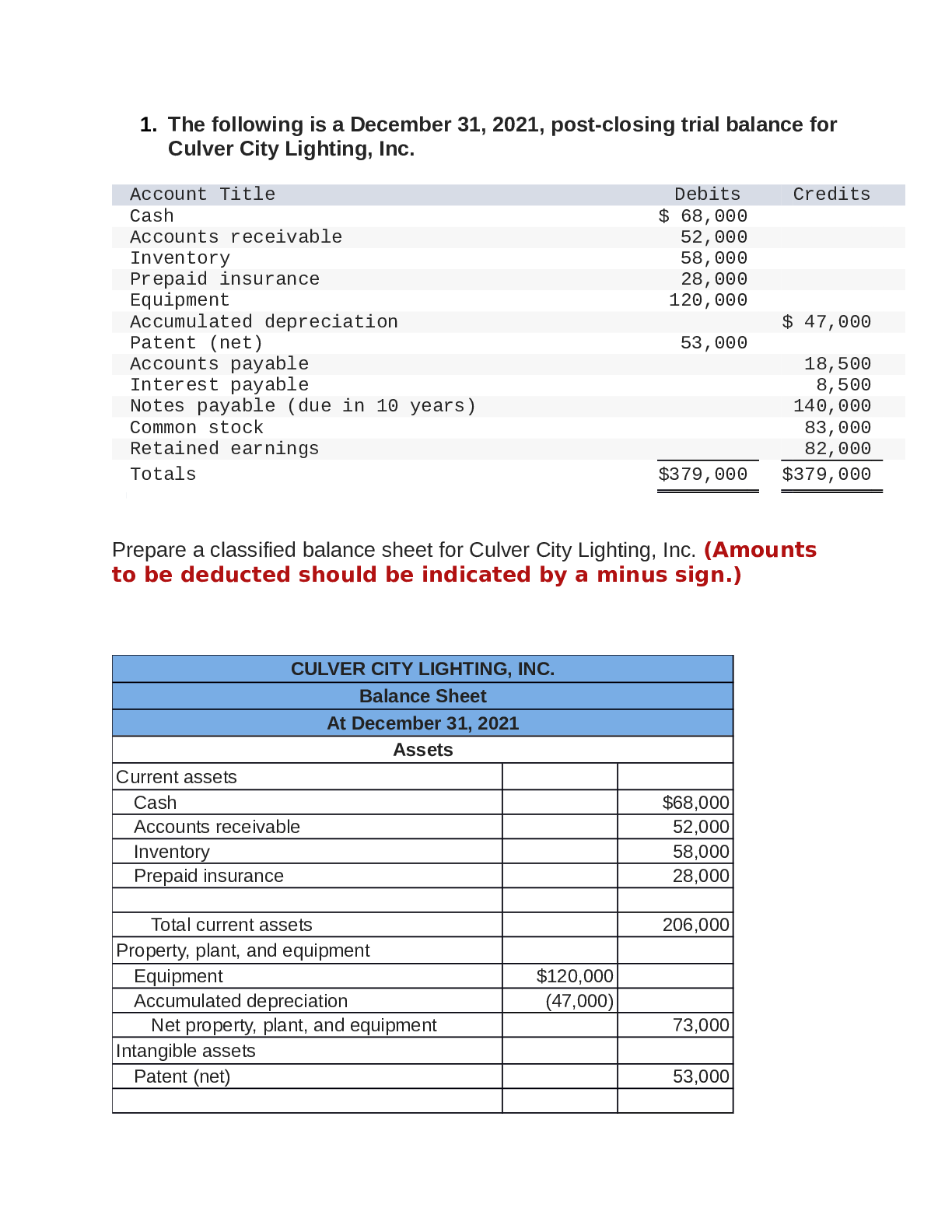

1. The following is a December 31, 2021, post-closing trial balance for Culver City Lighting, Inc. Account Title Debits Credits Cash $ 68,000 Accounts receivable 52,000 Inventory 58,000 Prepaid ... insurance 28,000 Equipment 120,000 Accumulated depreciation $ 47,000 Patent (net) 53,000 Accounts payable 18,500 Interest payable 8,500 Notes payable (due in 10 years) 140,000 Common stock 83,000 Retained earnings 82,000 Totals $379,000 $379,000 Prepare a classified balance sheet for Culver City Lighting, Inc. (Amounts to be deducted should be indicated by a minus sign.) CULVER CITY LIGHTING, INC. Balance Sheet At December 31, 2021 Assets Current assets Cash $68,000 Accounts receivable 52,000 Inventory 58,000 Prepaid insurance 28,000 Total current assets 206,000 Property, plant, and equipment Equipment $120,000 Accumulated depreciation (47,000) Net property, plant, and equipment 73,000 Intangible assets Patent (net) 53,000 Total assets $332,000 Liabilities and Shareholders' Equity Current liabilities Accounts payable $18,500 Interest payable 8,500 Total current liabilities 27,000 Long-term liabilities Notes payable 140,000 Total liabilities 167,000 Shareholders' equity Common stock $83,000 Retained earnings 82,000 Total shareholders' equity 165,000 Total liabilities and shareholders' equity $332,000 2. You have been asked to review the December 31, 2021, balance sheet for Champion Cleaning. After completing your review, you list the following three items for discussion with your superior: 1. An investment of $49,000 is included in current assets. Management has indicated that it has no intention of liquidating the investment in 2022. 2. A $290,000 note payable is listed as a long-term liability, but you have determined that the note is due in 10, equal annual installments with the first installment due on March 31, 2022. 3. Deferred revenue of $117,000 is included as a current liability even though only two-thirds will be recognized as revenue in 2022, and the other one-third in 2023. Determine the appropriate classification of each of these items. (If no entry is required for classification, choose "No entry".) Current Long-term Items Amount Classification Amount 1. Investment No entry $49,000 Investments 2. Installment note $29,000 Current liabilities $261,000 Long-term liabilities 3. Deferred revenue $78,000 Current liabilities $39,000 Long-term liabilities Explanation 1. The $49,000 should be classified as a long-term asset, under the investments classification. 2. $29,000, next year’s installment, should be classified as a current liability, current maturities of long-term debt. The remaining $261,000 is included in long-term liabilities. 3. Two-thirds of the deferred revenue, $78,000, should be classified as a current liability, the remaining $39,000 as a long-term liability. 3 For each of the following note disclosures, indicate whether the disclosure would likely appear in (A) the summary of significant accounts policies or (B) a separate note. Note disclosures A/B (1) Depreciation method A (2) Contingency information B (3) Significant issuance of common stock after the fiscal year-end B (4) Cash equivalent designation A (5) Long-term debt information B (6) Inventory costing method A 4 The following are the typical classifications used in a balance sheet [Show More]

Last updated: 3 years ago

Preview 1 out of 16 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 21, 2021

Number of pages

16

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 21, 2021

Downloads

0

Views

78

.png)

.png)