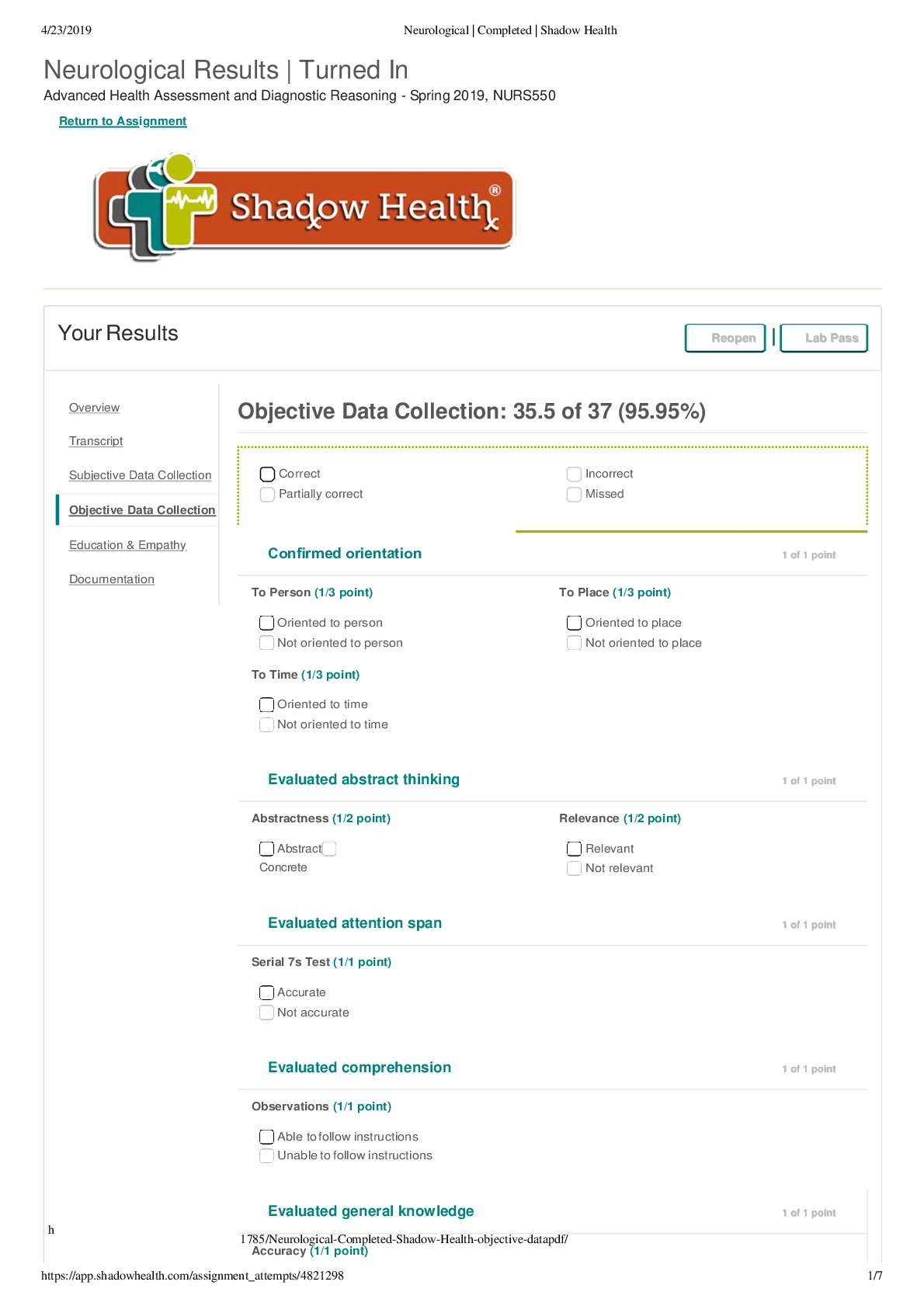

Neurological _ Completed _ Shadow Health_objective data. Neurological Results | Turned In Advanced Health Assessment and Diagnostic Reasoning_NURS550. Objective Data Collection: 35.5 of 37 (95.95%).

$ 8.5

AQA AS PSYCHOLOGY 7181/1 Paper 1 Introductory topics in Psychology Mark scheme June 2022 Version: 1.0 Final Mark Scheme

$ 7

World Civilizations The Global Experience, Volume 2, 8th edition By Peter Stearns, Michael Adas, Stuart Schwartz, Marc Jason Gilbert [SOLUTIONS MANUAL]

$ 25

AQA A-level HISTORY 7042 Component 2G The Birth of the USA, 1760–1801 June 2021 QP.

.png)

.png)

.png)

.png)