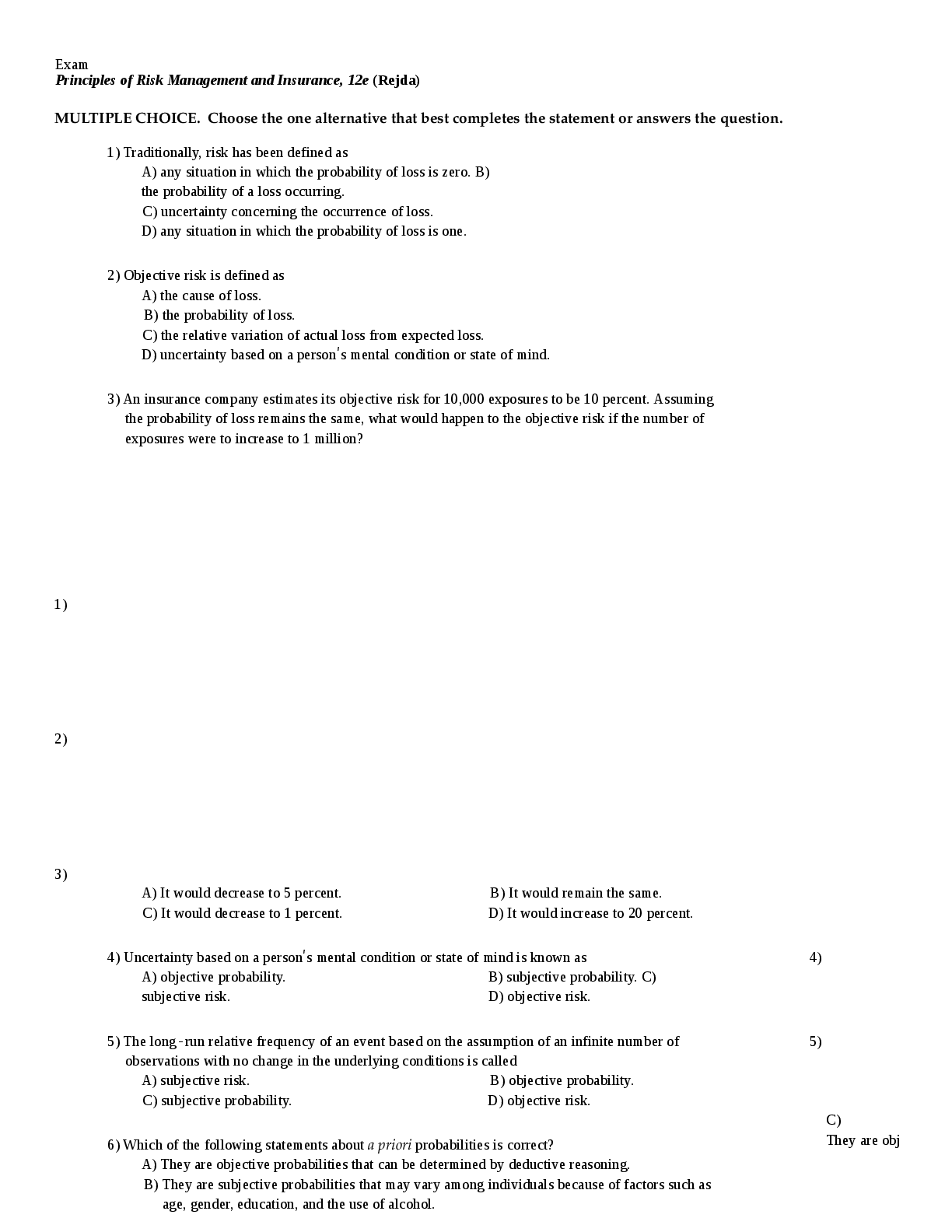

• 1. Points:2

Which statement best represents the relationship between date of declaration, date of record and ex-dividend date, and date of payment, for a cash dividend.

a.The date of payment results in the biggest de

...

• 1. Points:2

Which statement best represents the relationship between date of declaration, date of record and ex-dividend date, and date of payment, for a cash dividend.

a.The date of payment results in the biggest decrease in the current ratio. b.The date of record establishes the amount to be received.

c.The ex-dividend date establishes the decrease to cash.

d.The date of declaration establishes the increase to liabilities.

•

2. Points:2

When a company is determining its dividend policy, the company must adhere to legal requirements.

The legal requirements are determined by

a.the Financial Accounting Standards Board (FASB). b.the state in which the company was incorporated.

c.the Securities and Exchange Commission (SEC). d.the Federal Trade Commission (FTC).

•

3. Points:2

The denominator in the calculation for the price/earnings ratio is basic earnings per share.

True False

•

4. Points:2

How will a company's total current liabilities and total stockholders' equity be affected by the declaration of a stock dividend? (Assume the stock dividend is distributed at a later date.)

Total Total

Current Liabilities Stockholders' Equity

I. increase decrease

II. increase no effect

III. no effect decrease

IV. no effect no effect

a.I b.II c.III

d.IV

•

5. Points:2

Common shares outstanding are increased as a result of a stock dividend or stock split. For purposes of calculating the earnings per share, when is the stock dividend or stock split considered to have occurred?

a.at the beginning of the earliest comparative period for which earnings per share information is presented b.at the end of the earliest comparative period for which earnings per share information is presented

c.at the beginning of the year declared d.as of the date of declaration

•

6. Points:2

A corporation's legal capital

a. is established to protect the corporation’s creditors.

b. is a requirement established by the SEC to aid in enforcement of regulations.

c. is the amount of cash received by the corporation from its shareholders when it originally issues stock. d.allows a corporation to declare dividends of any amount.

•

7. Points:2

When common stock is issued at an amount greater than par value, the difference between the par value and the proceeds from the sale is recorded by

a.crediting the common stock account b.debiting an additional paid-in capital account c.crediting the retained earnings account

d.crediting an additional paid-in capital account

•

8. Points:2

Which of the following statements is true regarding dividends on preferred stock? a.Preferred shareholders are guaranteed an annual dividend.

b.Preferred shareholders will receive a dividend if common shareholders are paid. c.Preferred dividends in arrears are a current liability.

d.Preferred dividends in arrears are either a current or long-term liability, depending upon when the corporation last declared a dividend.

•

9. Points:2

State laws established the concept of legal capital which is designed to protect the corporation’s creditors by | restricting the distribution of shareholder’s equity to shareholders.

True False

•

11. Points:4

On January 1, Buchanan Corporation had 50,000 shares of common stock outstanding. On April 1, the company declared a 15% stock dividend, and on August 1, the company had a 3-for-1 stock split. On December 1, the company issued an additional 6,000 shares. What is the denominator in the earnings per share calculation?

a.186,000 b.180,500 c.180,000

d.173,000

•

12. Points:4

On January 1, 2016, Samuel Company had 31,000 shares of common stock outstanding and issued an additional 2,600 shares on May 1. The company declared and paid a cash dividend of $45,000 and earned $450,000 net income. What was the basic earnings per share for the year?

a.$15.63

b.$13.75 c$17.86 d.$12.50

•

13. Points:4

Norwalk Corporation issued 10,000 shares of $50 par preferred stock at $74 a share. A stock warrant attached to each preferred share allows the holder to buy one share of $10 par common stock for $20. Right after issuance, the preferred stock sells ex-rights for $63 per share. The warrants began selling at $7 per warrant.

The amount credited to Common Stock Warrants at issuance of the preferred stock is

a.$0 b.$70,000

c.$74,000 d.$160,000

•

14. Points:4

Exhibit 15-9

Groundcover, Inc. had never had a treasury stock transaction prior to 2016. It experienced the following treasury stock transactions during 2016:

4/1/2016: Reacquired 1,000 shares of its own $5 par common stock, originally

•

Common stock, $20 par (25,000 shares issued of which

2,000 are being held as treasury stock)

$ 500,000

Additional paid-in capital 750,000

Retained earnings 2,250,000

$3,500,000

Less: Treasury stock (2,000 shares at cost) (120,000)

Total stockholders' equity $3,380,000

•

•

•

19. Points:4

On January 1, a corporation had 15,380 shares of common stock outstanding. On August 1, it sold an additional 5,000 shares. During the year, dividends of $4,800 and $56,000 were declared and paid on the common and preferred stock, respectively. Net income for the year was $250,000. What was the basic earnings per share for the year (rounded to the nearest cent)?

a.$16.26 b.$14.32

c.$11.11 d.$10.83

•

20. Points:4

On January 1, a corporation had 25,000 shares of common stock outstanding. An additional 10,000 shares were issued on July 1, and on November 1, the company declared a 2-for-1 stock split.

What is the denominator in the earnings per share calculation?

a.35,000 b.56,000

c.60,000 d.50,000

•

21. Points:5

Exhibit 16-1

The Zeller Corporation's stockholders' equity accounts have the following balances as of December 31, 2016:

Common stock, $10 par (30,000 shares issued and outstanding)

$ 300,000

Additional paid-in capital 2,000,000

Retained earnings 5,700,000

Total stockholders' equity $8,000,000

Refer to Exhibit 16-1. On January 2, 2017, the board of directors of Zeller declared a 30% stock dividend to be distributed on January 31, 2017. The market price per share of Zeller's common stock was $30 on January 2 and $32 on January 31. As a result of this stock dividend, the retained earnings account should be decreased by

a.$ 90,000. b.$270,000. c.$288,000.

d.zero; only a memorandum entry is required.

•

22. Points:25

The following information is provided from the Forza Corporation’s accounting records.

1) Issued 2,500 shares of $1 par common stock at $23 a share.

2) Issued 7,500 shares of $1 par common stock in exchange for land valued at $65,000.

3) In order to prevent a hostile takeover the company reacquired the 7,500 shares for $20 per share as treasury stock.

4) The hostile takeover did not succeed, and the company reissued 5,500 of the treasury shares of $21 per share.

5) The remaining treasury shares were reissued for $22 per share and an additional 2,000 shares were issued at the same price.

Required:

Prepare the journal entries for the stock transactions, using the cost method assumption to account for the treasury stock.

1)

Cash 57,500

Common Stock 2,500

Additional paid-in capital on common stock 55,000

2)

Land 65,000

Common Stock 7,500

Additional paid-in capital on common stock 57,500

3)

Treasury Stock 150,000

Cash 150,000

4)

Cash (2,500 * $22)

Treasury Stock (2,500 x $20) 55,000

50,000

Additional paid-in capital from Treasury Stock 5,000

Cash (2,000 x $22) Common Stock

44,000

2,000

Additional paid-in capital on common stock 42,000

•

a. Security A Impact

$2.00

$22,000/11,000 shares

B $1.27 ($19,000 × .60)/9,000 shares

C $1.50 ($8,000 × .60)/3,200 shares

D $2.20 $16,500/67,500 shares

b. Security A

Rank 3

B 1

C 2

D 4

[Show More]