ACC 1800 1500 Final Exam | MCQ, Solutions, Journal & Inentory entries | 100% CORRECT

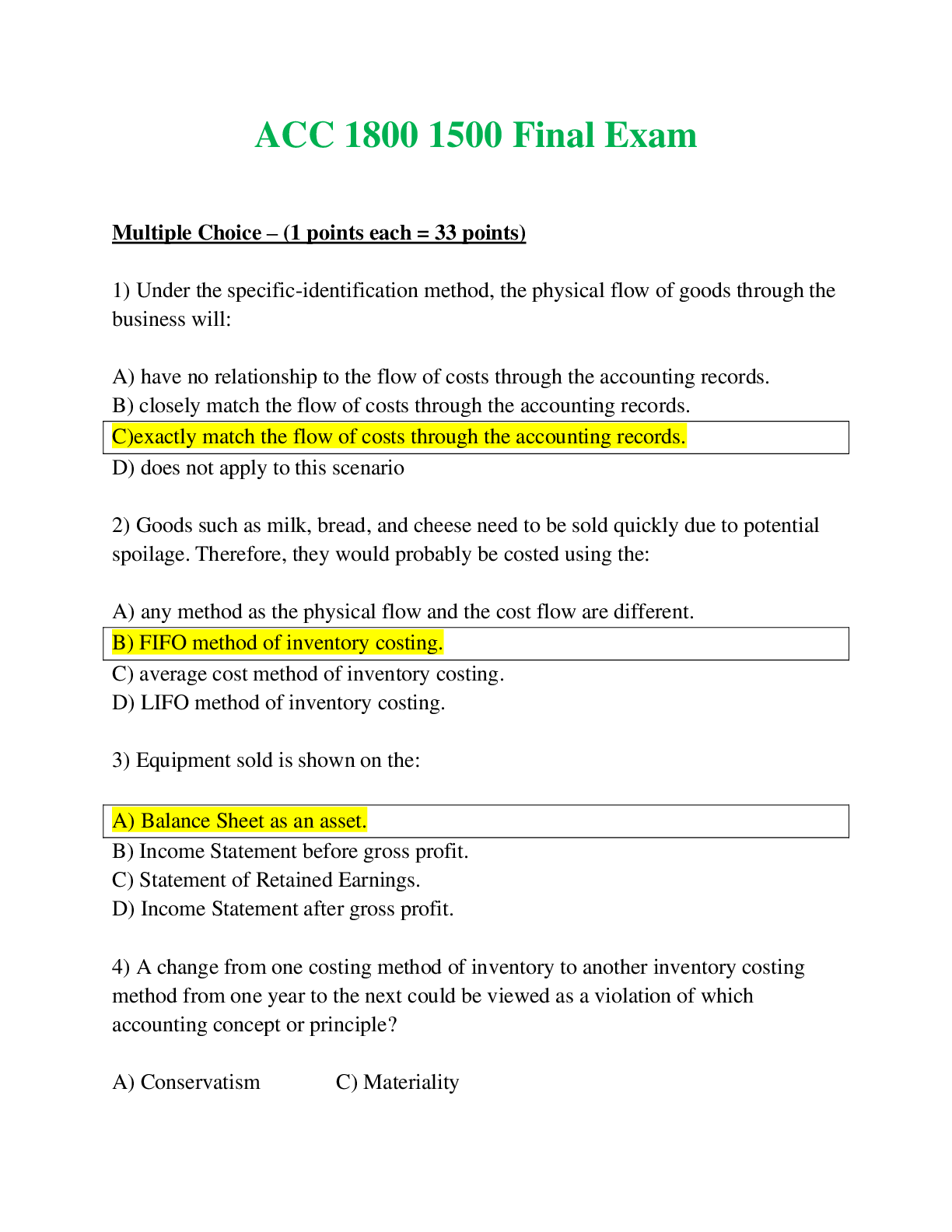

1) Under the specific-identification method, the physical flow of goods through the business will:

A) have no relationship to the f

...

ACC 1800 1500 Final Exam | MCQ, Solutions, Journal & Inentory entries | 100% CORRECT

1) Under the specific-identification method, the physical flow of goods through the business will:

A) have no relationship to the flow of costs through the accounting records.

B) closely match the flow of costs through the accounting records.

C)exactly match the flow of costs through the accounting records.

D) does not apply to this scenario

2) Goods such as milk, bread, and cheese need to be sold quickly due to potential spoilage. Therefore, they would probably be costed using the:

A) any method as the physical flow and the cost flow are different.

B) FIFO method of inventory costing.

C) average cost method of inventory costing.

D) LIFO method of inventory costing.

3) Equipment sold is shown on the:

A) Balance Sheet as an asset.

B) Income Statement before gross profit.

C) Statement of Retained Earnings.

D) Income Statement after gross profit.

4) A change from one costing method of inventory to another inventory costing method from one year to the next could be viewed as a violation of which accounting concept or principle?

A) Conservatism C) Materiality

B) Entity

D) Consistency

5) One lot of merchandise was counted at $122.87. A second count of the same merchandise showed $122.00. The difference could be ignored due to:

A) Materiality. C) Conservatism.

B) consistency. D) it should not be ignored.

6) Which concept or principle of accounting do footnotes support?

A) Entity C) materiality

B) Full disclosure D) conservatism

7) Beginning inventory + Net purchases =

A) Cost of goods sold.

B) Cost of goods available for sale.

C) Gross profit.

D) Ending inventory.

8) Cost of Goods Sold is often one of the largest:

A) expenses on the Income Statement.

B) long-term assets on the Balance Sheet.

C) current assets on the Balance Sheet.

D) part of general selling expenses.

9) For accounting information to be useful it must be all of the following EXCEPT:

A) Reliable. C) Relevant

B) understandable. D) economical

10) What agency writes U.S. GAAP?

A) IRS. C) FASB.

B) SEC. D) IASB.

11) What procedure is used to ensure financial reports abide to GAAP principles?

A) An examination. C) A review.

B) An audit. D) A confirmation.

12) Which of the following would NOT be considered part of the cost of a new long-term asset?

A) Repairs and maintenance after start-up

B) Packaging for delivery

C) Repairs and maintenance after the asset is in operation

D) Transportation and insurance costs to get the asset to the purchaser

13) What is the best method for depreciating items a vehicle?

A) Straight-line method.

B) single-declining balance method.

C) units-of-production method.

D) double-declining method.

14) Which of the following statements is correct regarding adjustments?

a) Adjustments are optional

b) All adjustments are made at the beginning of the accounting period

c) Adjustments will correctly allocate cash to revenue or expenses

d) Adjustments update assets, liabilities and owner's equity

15) Crediting income statement balances is part of the closing entry to:

a) close revenue accounts for the year

b) transfer revenue balances to cash

c) close expense accounts for the year

d) close the drawings account for the year

16) After posting the closing entries, a company must prepare a[n]:

a) posting trial balance

b) post-closing trial balance

c) unadjusted trial balance

d) adjusted trial balance

17) Which of the following is not an example of an operating expense?

a) Cost of Goods Sold

b) Insurance Expense

c) Rent Expense

d) Salaries Expense

18) The two systems of measuring inventory are:

a) periodic and episodic

b) perpetual and periodic

c) C FIFO and Weighted average

d) C control account and sub-ledger

19) Mary operates a wholesale business that distributes canned food. She receives a complaint from a customer and accepts $500 worth of product back from the customer that was billed on account. The cost of the product is $300. Which of the following entries is correct?

a) Dr. Sales Returns and Allowances $500, Cr. A/R $500

b) Dr. Sales Returns and Allowances $500, Cr. A/R $500 and Dr. Inventory $300, Cr. COGS $300

c) Dr. A/R $500, Cr. Sales Returns and Allowances $500

d) Dr. A/R $500, Cr. Sales Returns and Allowances $500 and Dr. Inventory $300, Cr. COGS $300

20) As a result of inventory shrinkage:

a) equity decreases

b) there is no change to equity

c) equity increases

d) equity may or may not decrease depending on the inventory valuation method used

21) Which of the following statements about gross and/or net income is true?

a) Net income is usually larger than gross profit

b) Net income is the difference between sales and cost of goods sold

c) Gross profit is the difference between sales and cost of goods sold

d) Gross profit and net income can be found on the balance sheet

22) Which of the following methods for valuing inventory would most likely be used for high value items such as cars and houses?

a) Specific Identification

b) FIFO

c) None of the options

d) Weighted Average

23) Unearned revenue is classified as:

a) revenue

b) a liability

c) an expense

d) an asset

23) Accrued revenues will always increase a receivable account and decrease a revenue account.

a) TRUE

b) FALSE

24) Adjusted trial balance is the next accounting process after adjustments are made

a) TRUE

b) FALSE

25) Long-term assets are those that are likely to be converted into cash or used within the next 12 months through the day-to-day operation of the business.

a) TRUE

b) FALSE

26) Current liabilities are amounts due to be paid within the next 12 months.

a) TRUE

b) FALSE

27) Senior management and accountants are responsible to ensure controls are in place to accurate track the value of inventory from the point of purchase to the point of sale.

a) TRUE

b) FALSE

28) Perpetual inventory system only updates the inventory and COGS values after physically counting the items on hand.

a) TRUE

b) FALSE

29) Sales returns occur when undesirable products are returned to the buyer.

a) TRUE

b) FALSE

30) All revenue accounts are closed to the income summary account.

a) TRUE

b) FALSE

31) The income summary account is closed to the owner's capital account.

a) TRUE

b) FALSE

32) An overstatement of ending inventory results in an understatement of COGS and an understatement of net income.

a) TRUE

b) FALSE

33) A lower inventory days on hand means that inventory is less likely to become obsolete because it is sold in fewer days.

a) TRUE

b) FALSE

PROBLEM 2 - (5 point each = 40 points)

Identify the section of the balance sheet in which the following accounts would be located:

CA - Current Assets

LTA - Long-Term Assets

CL - Current Liabilities

LTL - Long-Term Liabilities

CL Salaries Payable

CA Accounts Receivable

LTA Accumulated Depreciation

CA Cash

LTA Equipment

LTL Warranty Payable

LTL Note Payable (due in 2 years)

CL Interest Payable

Part III Journal Entries

Elisa Doon is the owner of Island Services. The following transactions need to be recorded for her business.

Island Services Elisa Doon

Aug 1 Prepaid $4,200 of insurance for one year. $4,200

Aug 2 Prepaid $2,700 of rent for three months. $2,700

Aug 3 Received a maintenance bill for $900 which will be paid next month. $900

Aug 4 Received $3,090 cash for services provided. $3,090

Aug 7 Took out a loan from the bank for $5,000. $5,000

Aug 10 Paid telephone expenses for the month with $170 cash. $170

Aug 12 Paid $860 cash to reduce the balance of accounts payable. $860

Aug 31 Paid $20 of interest on the bank loan. $20

Aug 31 Adjusted prepaid insurance for one month for $350. $350

Aug 31 Depreciated equipment for $150. $150

Aug 31 Adjusted prepaid rent for one month for $900. $900

Required

Journalize the transactions for Island Services.

Date Account Title and Explanation Debit Credit

August 01 Prepaid Insurance 4200

Cash 4200

02 Prepaid Rent 2700

Cash 2700

03 Maintenance Expense 900

Bill Payable 900

04 Cash 3090

Services revenue 3090

07 Cash 5000

Bank Loan 5000

10 Telephone Expense 170

Cash 170

Date Account Title and Explanation Debit Credit

12 Accounts payable 860

Cash 860

31 Interest Expense 20

Cash 20

31 Insurance Expense 350

Prepaid Insurance 350

31 Depreciation Expense 150

Accumulated Depreciation 150

31 Rent Expense 900

Prepaid Rent 900

Part IV Perpetual Inventory Entries

The following information was presented by the bookkeeper for NorthWave Communications for the month of December 2016.

Dec 8 Purchased $202,000 of inventory on account from Beta Wholesalers, terms 2/10, net 30 202000

Dec 10 A portion of the inventory purchased from Beta Wholesalers was defective. NorthWave returned $800 worth of inventory to the supplier. 800

Dec 12 Sold $93,900 of products to SouthShore on account, terms 2/10, net 30; cost of goods sold was $37,560 for this transaction. 93900

Dec 14 SouthShore returned $1,878 of goods purchased on account. The cost of goods sold for the returned inventory is $1,127. 1878

Dec 17 Purchased goods from EastCoast Trading Communications on account for $18,300 with terms of 3/10, net 30. 18300

Dec 18 Some of the inventory purchased from EastCoast Trading Communications was slightly damaged. NorthWave decided to keep the inventory, but will receive a $160 allowance. 160

Dec 19 Sold $48,200 of products to West Island on account, terms 2/10, net 30; cost of goods sold was $19,280 for this transaction. 48200

Dec 20 West Island discovered some scratches on some of the products they purchased on Dec 19. They will keep the product and NorthWave will offer a $240 allowance. 240

Dec 21 Paid the amount owing to Beta Wholesalers. Remember to account for the return.

Dec 23 Received payment from SouthShore. Remember to account for the return.

Dec 24 Received payment from West Island. Remember to account for the allowance and discount.

Dec 25 Paid the amount owing to EastCoast Trading Communications Remember to account for the allowance and discount.

Dec 31 A count of inventory shows that $550 is missing. Make a journal entry to record the inventory shrinkage. 550

Prepare the journal entries to record the above transactions. Assume the company uses the perpetual inventory system.

Date Account Title and Explanation Debit Credit

Dec 08 Inventory 202,000

Accounts Payables (Beta Wholesaler) 202,000

10 Accounts Payables (Beta Wholesaler) 900

Inventory 900

12 Accounts Receivables (South Shore) 93,900

Sales 93,900

Cost of Goods Sold 37,560

Inventory 37,560

14 Sales Return and Allowances 1,878

Accounts Receivables (South Shore) 1,878

Inventory 1,127

Cost of Goods Sold 1,127

17 Inventory 18,300

Accounts payable (East Coast) 18,300

18 Accounts payable (East Coast) 160

Discount and Allowances 160

19 Accounts Receivables (West Island) 48,200

Sales 48,200

20 Discount and Allowances 240

Accounts Receivables (West Island) 240

21 Accounts payable (Beta Wholesaler) (202,000-900) 201,100

Cash 201.100

23 Cash 90,181

Discount and Allowances

Accounts Receivables (South Shore) 92,021

Date Account Title and Explanation Debit Credit

24 Cash 47,001

Discount and Allowances 959

Accounts Receivables (West Island) 47,960

25 Accounts payable (East Coast) 18,140

Discount and Allowances 544

Cash 17,596

31 Shrinkage Expense Account 550

Inventory 550

[Show More]