According to Sam Shaw, the fixed asset coordinator, Apollo Shoes moved into new quarters and acquired new equipment in February 2010. Up to that time, Apollo purchased only a fleet of vehicles for key executives and ren

...

According to Sam Shaw, the fixed asset coordinator, Apollo Shoes moved into new quarters and acquired new equipment in February 2010. Up to that time, Apollo purchased only a fleet of vehicles for key executives and rented everything else. (All of their salesmen rent cars on an as needed basis for visiting clients.) Since the move, there have been only three major capital additions:

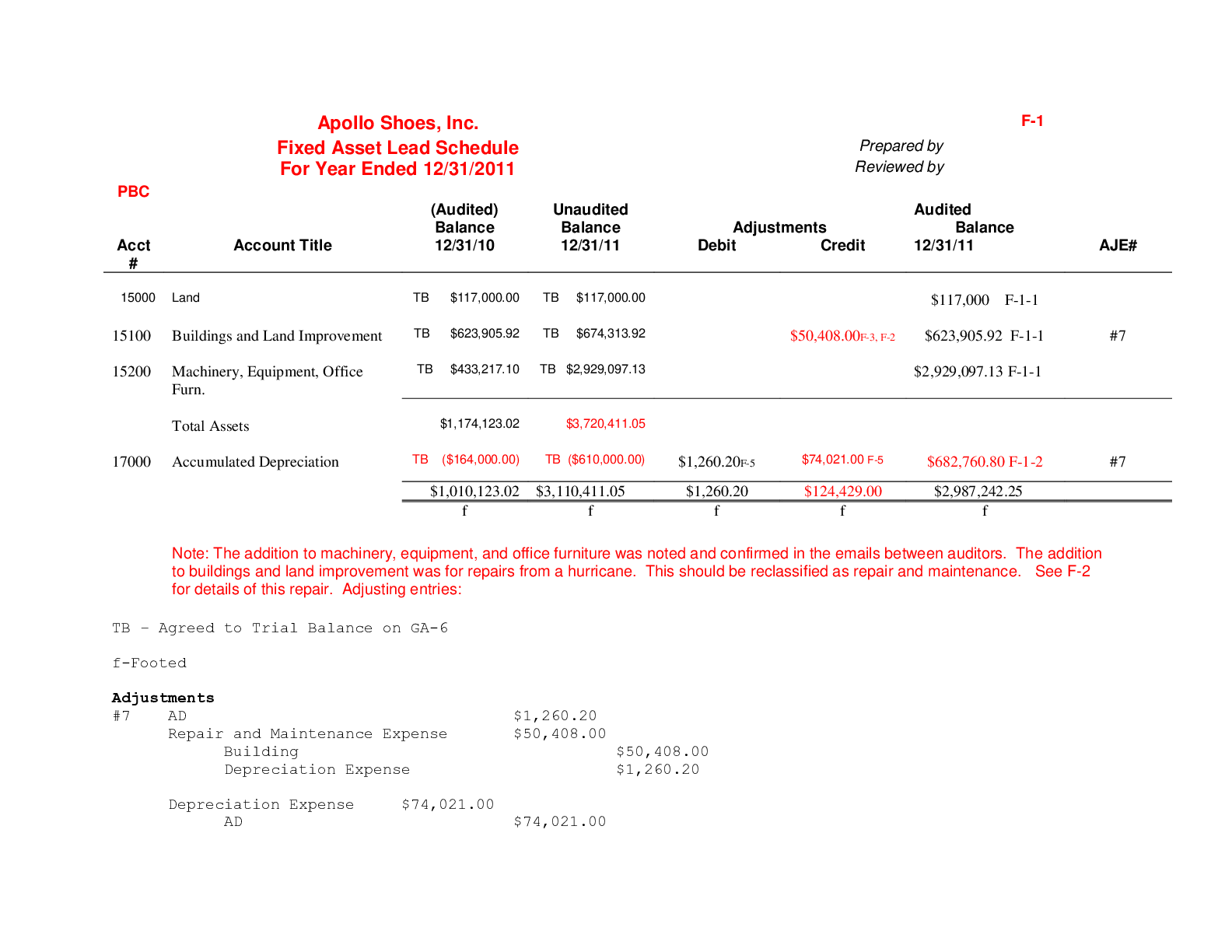

• Apollo repaired damage to the new building from a hurricane in April. Also, the building was repainted at the same time. I examined an invoice from ZZZ Best Building Repair Company for $50,408.00 as well as the cancelled check. This amount should be expensed and not depreciated. The following adjusting entry is proposed to expense the repairs and reverse the recorded depreciation:

• The company purchased and installed new machinery to make shoes themselves. Apparently, they have been buying all the shoes pre-made from an overseas company. The machinery was installed in January, but hasn’t yet been operated. They hope to start production in January 2012. I examined an invoice for $1,295,359.98 (F-1.1)as well as the cancelled check. This amount should be depreciated over a 5 year period and depreciation should begin this year. However, this machinery was calculated over 7 years. The amount is calculated on F-2. Needs adjusting entry.

• Apollo purchased and installed a new computer system in July. I examined three invoices and related cancelled checks for $1,200,519.90. One was to Smart Chip for $1,000,000. One was to FastMove for moving services for 519.90. The third was to Professor Josephine Mandeville for $200,000 for “system analysis consulting.” All of these expenses should be added to cost of the equipment and be depreciated over 5 years.

• I scanned the invoices in the Repairs and Maintenance account. Repairs and small capital additions (<$5,000) were expensed according to company policy.

• I examined the titles of the land, building, and vehicles. All listed “Apollo Shoes, Inc.” as titleholder. No new land was purchased or disposed of during the year (F-1.1)

[Show More]