Accounting > EXAM > Questions and Answers >Financial Accounting Multiple Choice Questions and Answers. (Answers highligh (All)

Questions and Answers >Financial Accounting Multiple Choice Questions and Answers. (Answers highlighted in yellow)

Document Content and Description Below

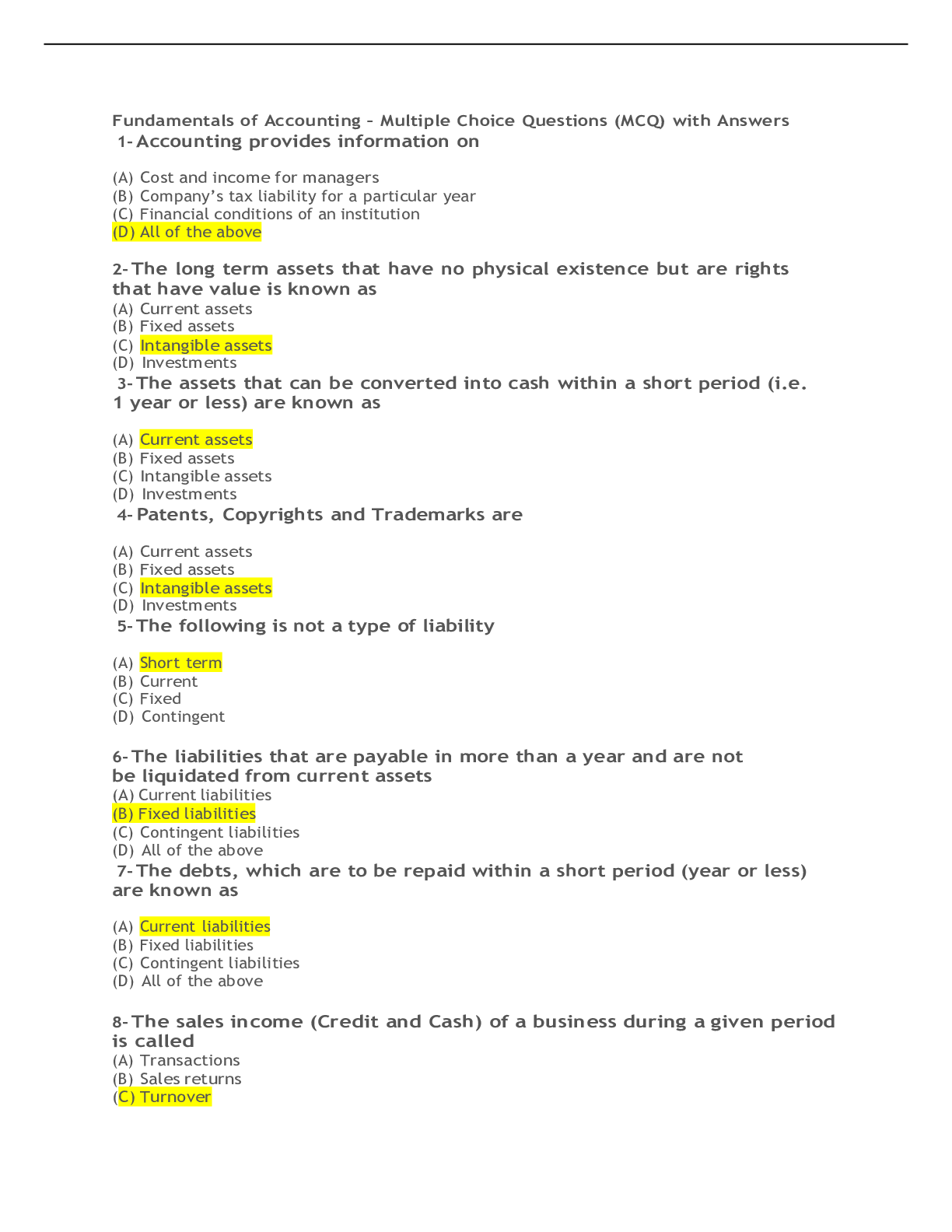

Fundamentals of Accounting – Multiple Choice Questions (MCQ) with Answers 1-Accounting provides information on (A) Cost and income for managers (B) Company’s tax liability for a particular year ... (C) Financial conditions of an institution (D) All of the above 2-The long term assets that have no physical existence but are rights that have value is known as (A) Current assets (B) Fixed assets (C) Intangible assets (D) Investments 3-The assets that can be converted into cash within a short period (i.e. 1 year or less) are known as (A) Current assets (B) Fixed assets (C) Intangible assets (D) Investments 4-Patents, Copyrights and Trademarks are (A) Current assets (B) Fixed assets (C) Intangible assets (D) Investments 5-The following is not a type of liability (A) Short term (B) Current (C) Fixed (D) Contingent 6-The liabilities that are payable in more than a year and are not be liquidated from current assets (A) Current liabilities (B) Fixed liabilities (C) Contingent liabilities (D) All of the above 7-The debts, which are to be repaid within a short period (year or less) are known as (A) Current liabilities (B) Fixed liabilities (C) Contingent liabilities (D) All of the above 8-The sales income (Credit and Cash) of a business during a given period is called (A) Transactions (B) Sales returns (C) Turnover (D) Purchase returns 9-Any written evidence in support of a business transaction is called (A) Journal (B) Ledger (C) Ledger posting (D) Voucher 10-The accounts that records expenses, gains and losses are (A) Personal accounts (B) Real accounts (C) Nominal accounts (D) None of the above 11-Real accounts records (A) Dealings with creditors or debtors (B) Dealings in commodities (C) Gains and losses (D) All of the above MULTIPLE CHOICE QUESTIONS ON BASIC ACCOUNTING Q1] Which accounting concept satisfy the valuation criteria: a) Going concern, Realisation, Cost b) Going concern, Cost, Dual aspect c) Cost, Dual aspect, Conservatism d) Realisation, Conservatism, Going concern. Q2] A trader has made a sale of Rs.75, 500 out of which cash sales amounted to Rs.25, 500. He showed trade receivables on 31-3-2014 at Rs.25,500. Which concept is followed by him? a) Going concern b) Cost c) Accrual d) Money measurement Q3] In which of the following cases, accounting estimates are needed? a) Employs benefit schemes b) Impairment of losses c) Inventory obsolescence d) All of the above Q4] Deewali advance given to an employee is a) Revenue Expenditure b) Capital Expenditure c) Deferred Revenue Expenditure d) Not an Expenditure Q5] A firm has reported a profit of Rs.1,47,000 for the year ended 31-3-2014 after taking into consideration the following items. (i) The cost of an asset Rs.23,000 has been taken as an expense (ii) The firm anticipated a profit of Rs.12,000 on the sale of an old furniture (iii) Salary of Rs.7,000 outstanding for the year has not been taken into account. (iv) An asset of [Show More]

Last updated: 3 years ago

Preview 1 out of 8 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 07, 2021

Number of pages

8

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 07, 2021

Downloads

0

Views

97