ECON 102: Homework 06. Questions and Answers

Document Content and Description Below

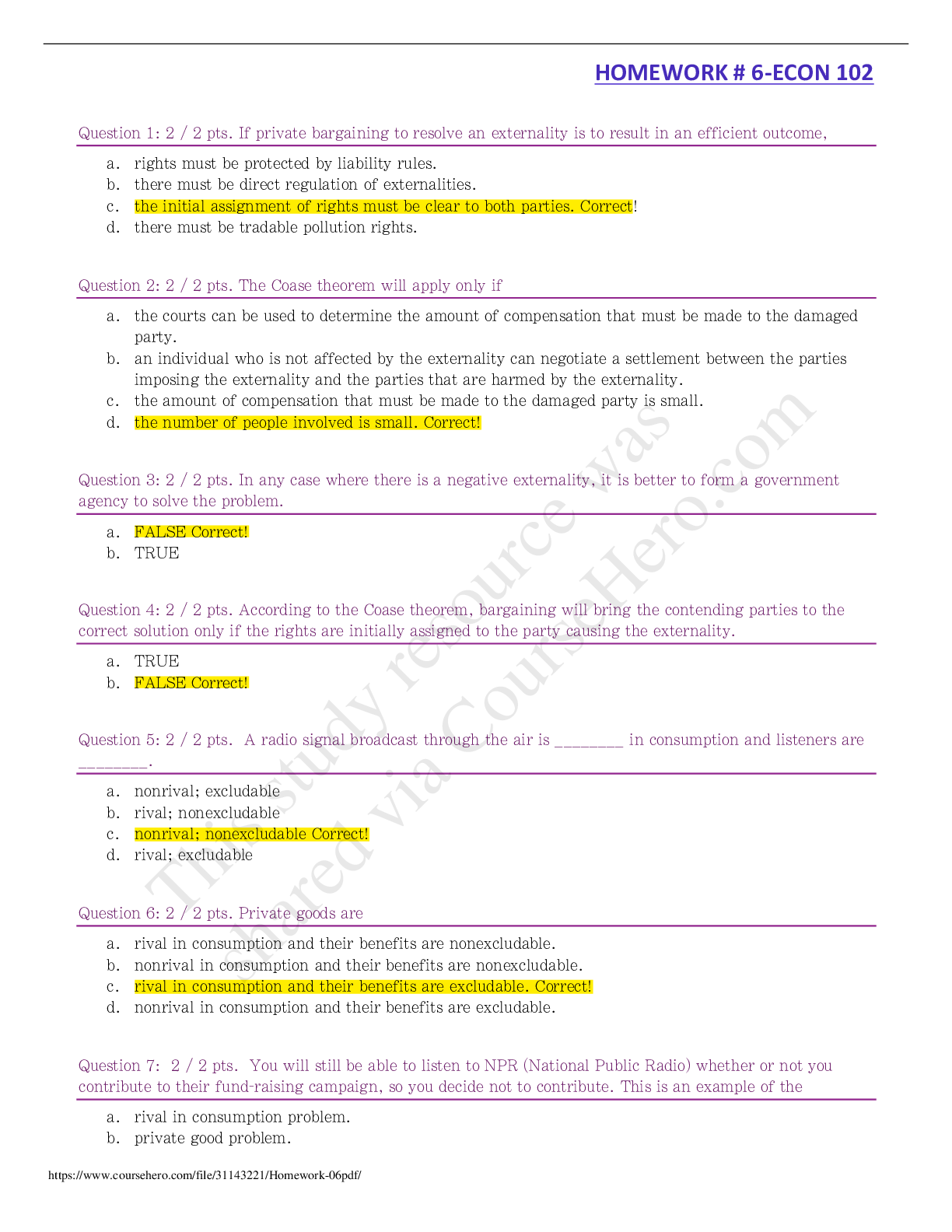

HOMEWORK # 6-ECON 102 Question 1: 2 / 2 pts. If private bargaining to resolve an externality is to result in an efficient outcome, a. rights must be protected by liability rules. b. there must be d ... irect regulation of externalities. c. the initial assignment of rights must be clear to both parties. d. there must be tradable pollution rights. Question 2: 2 / 2 pts. The Coase theorem will apply only if a. the courts can be used to determine the amount of compensation that must be made to the damaged party. b. an individual who is not affected by the externality can negotiate a settlement between the parties imposing the externality and the parties that are harmed by the externality. c. the amount of compensation that must be made to the damaged party is small. d. the number of people involved is small. Question 3: 2 / 2 pts. In any case where there is a negative externality, it is better to form a government agency to solve the problem. a. FALSE b. TRUE Question 4: 2 / 2 pts. According to the Coase theorem, bargaining will bring the contending parties to the solution only if the rights are initially assigned to the party causing the externality. a. TRUE b. FALSE Question 5: 2 / 2 pts. A radio signal broadcast through the air is ________ in consumption and listeners are ________. a. nonrival; excludable b. rival; nonexcludable c. nonrival; nonexcludable d. rival; excludable Question 6: 2 / 2 pts. Private goods are a. rival in consumption and their benefits are nonexcludable. b. nonrival in consumption and their benefits are nonexcludable. c. rival in consumption and their benefits are excludable. d. nonrival in consumption and their benefits are excludable. Question 7: 2 / 2 pts. You will still be able to listen to NPR (National Public Radio) whether or not you contribute to their fund-raising campaign, so you decide not to contribute. This is an example of the a. rival in consumption problem. b. private good problem. https://www./file/31143221/Homework-06pdf/ This study resource was shared via c. drop-in-the-bucket problem. d. free-rider problem. Question 8: 2 / 2 pts. Because people can enjoy the benefits of public goods whether they pay for them or not, they are usually unwilling to pay for them. This is known as the a. free-rider problem. b. nonrival problem. c. nonexcludable problem. d. drop-in-the-bucket problem. Question 9: 2 / 2 pts. Refer to the figure above. Suppose the government assigns property rights to the airlines. No negotiations occur between the parties. The resulting level of air travel is ________. a. Indeterminate from the given information. Question 10: 2 / 2 pts. Refer to the figure above. Suppose the government assigns property rights to the airlines. No negotiations occur between the parties. The marginal damage cost associated with the resulting level of air travel is ________. Question 11: 0 / 2 pts. Refer to the figure above. Suppose the government assigns property rights to the airlines, then the airlines and the residents engage in negotiations. The resulting efficient level of air travel is ________. a. Indeterminate from the given information. b. 0 units https://www./file/31143221/Homework-06pdf/ This study resource was shared via c. 120 units d. 100 units Question 12: 2/ 2 pts. Refer to the figure above. The marginal damage cost associated with the efficient level of air travel is ________. Question 13: 2 / 2 pts. Refer to the figure above. The marginal damage cost ________ as the quantity of air travel increases. a. decreases b. becomes negative c. remains constant d. increases Question 14: 0 / 2 pts. Refer to the figure above. Suppose the government assigns property rights to the nearby residents affected by the airlines. No negotiations occur between the parties. The resulting level of air travel is ________. a. 0 units b. 100 units You ed c. 120 units d. Indeterminate from the given information. Question 15: 33 / 33 pts. Complete the table below by filling in ALL missing numbers. If your is a decimal rather than a whole number, round your to the nearest 1 decimal place (the nearest tenth). Also, do not enter leading zeroes. For example, if the to a field is 1/8, enter .1 Do not enter .125 or 0.13 or 0. Consider the fictitious good Derp. The demand for Derp is Q = 1200 – 2P. Suppose the supply of Derp is given by Q = – 600 +2P. What is the equilibrium price of Derp? 450 What is the equilibrium quantity of Derp? 300 What is the price elasticity of demand at the equilibrium price and quantity? -3 What is the price elasticity of supply at the equilibrium price and quantity? 3 For the next seven questions, suppose a per-unit excise tax of $50 per Derp is levied on the consumers. What price will sellers receive after the tax is levied? 425 What price will consumers pay after the tax is levied? 475 What percent of the tax will be paid by the consumers of Derp? 50 (give an between 0 and 100) What percent of the tax will be paid by the suppliers of Derp? 50 (give an between 0 and 100) How many Derps will be sold after the tax is imposed? 250 https://www./file/31143221/Homework-06pdf/ This study resource was shared via How much consumer surplus do consumers get after the tax? 15625 What is the deadweight loss created by this tax? 1250 Question 16: 24 / 33 pts. Complete the table below by filling in ALL missing numbers. If your is a decimal rather than a whole number, round your to the nearest 1 decimal place (the nearest tenth). Also, do not enter leading zeroes. For example, if the to a field is 1/8, enter .1 Do not enter .125 or 0.13 or 0.1 Consider the market for laptop computers. The demand for laptops is Q = 1800 – 3P. Suppose the supply of laptops is given by Q = – 200 +2P. 1. What is the equilibrium price of laptops? 400 2. What is the equilibrium quantity of laptops? 600 3. What is the price elasticity of demand at the equilibrium price and quantity? 2 4. What is the price elasticity of supply at the equilibrium price and quantity? 1.3 For the next seven questions, suppose a per-unit excise tax of $80 per laptops is levied on the consumers. 1. What price will sellers receive after the tax is levied? 352 2. What price will consumers pay after the tax is levied? 432 3. What percent of the tax will be paid by the consumers of laptops? 40 (give an between 0 and 100) 4. What percent of the tax will be paid by the suppliers of laptops? 30 (give an between 0 and 100) 5. How many laptops will be sold after the tax is imposed? 504 6. How much consumer surplus do consumers get after the tax? 42236 7. What is the deadweight loss created by this tax? 3840 Question 17: 2 / 2 pts. An externality is a. a cost or benefit resulting from some activity or transaction that is imposed or bestowed on parties outside the activity or transaction. b. a problem intrinsic to public goods: The good or service is so costly that its provision generally does not depend on whether or not any single person pays. c. the amount a consumer pays to consume an additional amount of a particular good. This study resource was shared via. the total cost to society of producing an additional unit of a good or service. Question 18: 2 / 2 pts. Assuming no externalities exist, if a good’ s price is less than its marginal cost, then the benefits consumers derive are a. less than the cost of resources needed to produce it and more should be produced. b. greater than the cost of resources needed to produce it and more should be produced. c. greater than the cost of resources needed to produce it and less should be produced. d. less than the cost of resources needed to produce it and less should be produced. Question 19: 2 / 2 pts. Vaccinations convey ________ to third parties. a. positive externalities b. negative externalities c. economies of scale d. public goods [Show More]

Last updated: 3 years ago

Preview 1 out of 5 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 02, 2020

Number of pages

5

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 02, 2020

Downloads

0

Views

100