Economics > QUESTIONS & ANSWERS > ECON 102HL12 Quiz. 100% Correct Answers. (All)

ECON 102HL12 Quiz. 100% Correct Answers.

Document Content and Description Below

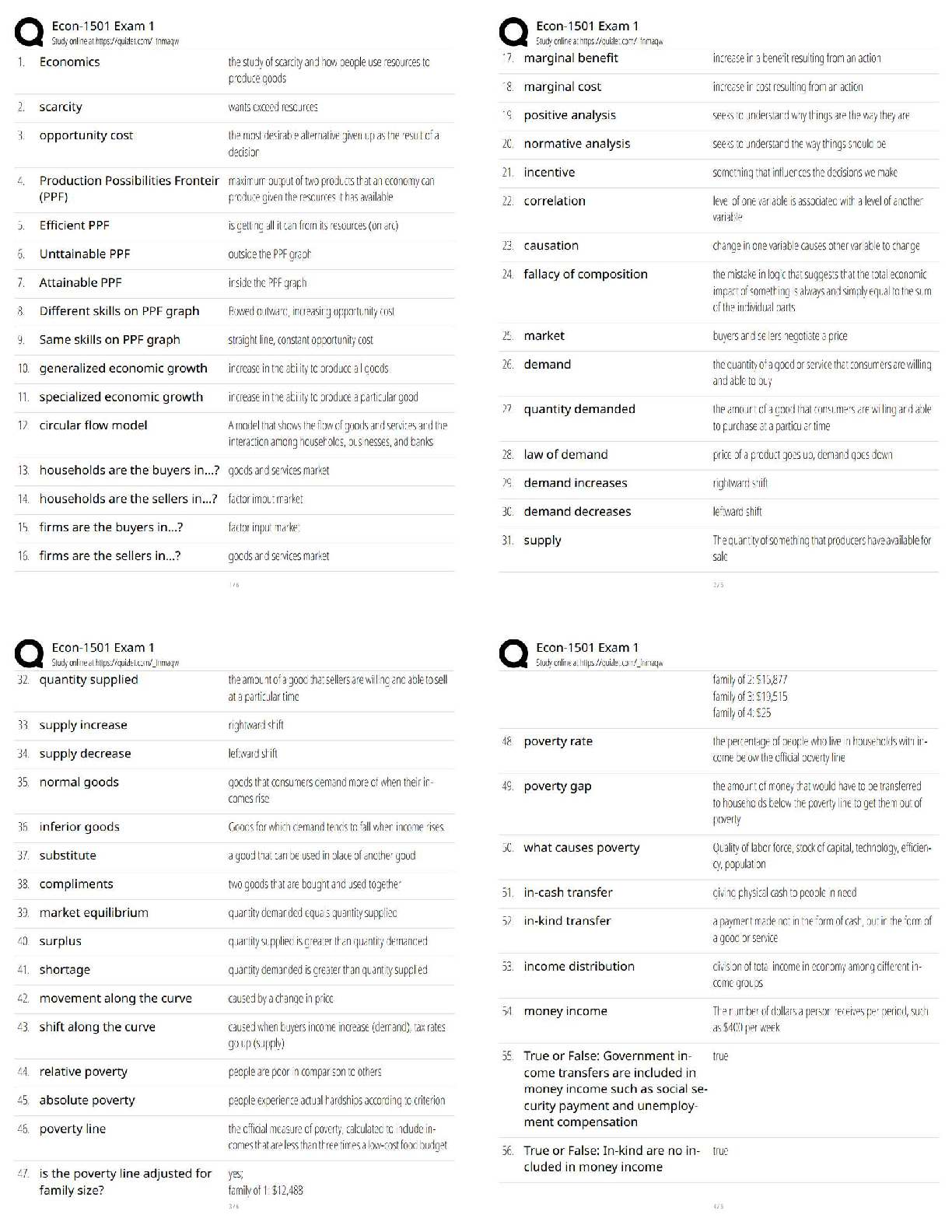

Question 1: 0 / 1 pts. Suppose the demand for a product is given by P = 100 – 2Q. Also, the supply is given by P = 20 + 6Q. If an $8 per-unit excise tax is levied on the buyers of a good, then afte ... r the tax buyers will pay _________ for each unit of the good. a. $82: c. $9 d. $80 e. None of these The demand curve will shift down by an amount exactly equal to the tax. This allows you to find the equation for the new demand curve. The buyers will pay a price equal to the new equilibrium price plus the tax. Question 2: 0 / 1 pts. Suppose the demand for a product is given by P = 100 – 2Q. Also, the supply is given by P = 20 + 6Q. If an $8 per-unit excise tax is levied on the buyers of a good, then after the tax the sellers will receive _________ for each unit of the good. a. None of these b. $80 c. $9 d. $74 e. $82 The demand curve will shift down by an amount exactly equal to the tax. This allows you to find the equation for the new demand curve. The sellers will receive a price equal to the new equilibrium price. Question 3: 1 / 1 pts. Suppose the demand for a product is given by P = 60 – 2Q. Also, the supply is given by P = 10 + 3Q. If a $10 per-unit excise tax is levied on the buyers of a good, what proportion of the tax will be paid by the buyers? a. 60% b. 75% c. None of these d. 40% e. 0% The proportion of the tax paid by buyers depends on the relative price elasticities of supply and demand. Question 4: 1 / 1 pts. Suppose the demand for a product is given by P = 30 – 2Q. Also, the supply is given by P = 5 + 3Q. If a $5 per-unit excise tax is levied on the buyers of a good, the deadweight loss created by this tax will be a. $16 b. None of these c. $2.50 d. $4 e. $5 The deadweight loss is the difference between total surplus without the tax and total surplus with the tax. Question 5: 1 / 1 pts. Suppose the demand for a product is given by P = 50 – Q. Also, the supply is given by P = 10 + 3Q. If a $12 per-unit excise tax is levied on the buyers of a good, consumer surplus is equal to a. $36 b. $49 c. $73.5 d. $84 e. None of these Consumer surplus is the area under the demand curve and above the price that the consumer pays. This study resource was shared via Question 6: 0 / 1 pts. Suppose the demand for a product is given by P = 60 – 2Q. Also, the supply is given by P = 10 + 3Q. If a $10 per-unit excise tax is levied on the buyers of a good, producer surplus is equal to a. $20 You Answered b. $64 c. $10 d. None of these Correct Answer e. $128 Producer surplus is the area under the price that producers receive, and above the supply curve. Question 7: 0 / 1 pts. Suppose the demand for a product is given by P = 40 – 4Q. Also, the supply is given by P = 10 + Q. If a $10 per-unit excise tax is levied on the buyers of a good, government revenue is equal to a. $10 You Answered b. $32 c. None of these Correct Answer d. $64 e. $8 Government revenue equals the amount of the tax times the number of units sold after the tax. Question 8: 1 / 1 pts. Suppose the demand for a product is given by P = 100 – 2Q. Also, the supply is given by P = 20 + 6Q. If an $8 per-unit excise tax is levied on the buyers of a good, after the tax, the total amount of tax paid by the consumers is a. $54 b. $81 c. None of these d. $72 e. $4 The total tax paid by the consumer is equal to (Pt + t – P*. times Qt. Question 9: 1 / 1 pts. Suppose the demand for a product is given by P = 30 – 3Q. Also, the supply is given by P = 10 + Q. If a $4 per-unit excise tax is levied on the buyers of a good, after the tax, the total amount of tax paid by the producers is a. $16 Correct Answer b. $4 c. $8 d. None of these e. $12 The total tax paid by the producer is equal to (P* - Pt. times Qt. Question 10: 1 / 1 pts. Suppose the demand for a product is given by P = 100 – 2Q. Also, the supply is given by P = 20 + 6Q. If an $8 per-unit excise tax is levied on the buyers of a good, after the tax, the total quantity of the good sold is a. 9 b. 80 c. 10 d. 74 e. None of these Qt. can be found by the intersection of the new demand curve and the original supply curve. This study resource was shared via Question 1: 1 / 1 pts. Suppose the demand for a product is given by P = 50 – Q. Also, the supply is given by P = 10 + 3Q. If a $12 per-unit excise tax is levied on the buyers of a good, then after the tax buyers will pay _________ for each unit of the good. a. $43 b. $10 c. $31 d. $40 e. None of these The demand curve will shift down by an amount exactly equal to the tax. This allows you to find the equation for the new demand curve. The buyers will pay a price equal to the new equilibrium price plus the tax. Question 2: 1 / 1 pts. Suppose the demand for a product is given by P = 40 – 4Q. Also, the supply is given by P = 10 + Q. If a $10 per-unit excise tax is levied on the buyers of a good, then after the tax sellers will receive _________ for each unit of the good. a. $6 b. $16 c. $4 d. None of these e. $24 The demand curve will shift down by an amount exactly equal to the tax. This allows you to find the equation for the new demand curve. The sellers will receive a price equal to the new equilibrium price. Question 3: 1 / 1 pts. Suppose the demand for a product is given by P = 100 – 2Q. Also, the supply is given by P = 20 + 6Q. If an $8 per-unit excise tax is levied on the buyers of a good, what proportion of the tax will be paid by the buyers? a. 75% b. None of these c. 60% d. 40% e. 25% The proportion of the tax paid by buyers depends on the relative price elasticities of supply and demand. Question 4: 1 / 1 pts. Suppose the demand for a product is given by P = 100 – 2Q. Also, the supply is given by P = 20 + 6Q. If an $8 per-unit excise tax is levied on the buyers of a good, the deadweight loss created by this tax will be a. $72 b. $81 c. None of these d. $243 e. $4 The deadweight loss is the difference between total surplus without the tax and total surplus with the tax. Question 5: 1 / 1 pts. Suppose the demand for a product is given by P = 30 – 3Q. Also, the supply is given by P = 10 + Q. If a $4 per-unit excise tax is levied on the buyers of a good, consumer surplus is equal to a. $16 b. $24 Correct Answer c. None of these d. $8 e. $4 This study resource was shared via Consumer surplus is the area under the demand curve and above the price that the consumer pays. Question 6: 1 / 1 pts. Suppose the demand for a product is given by P = 60 – 2Q. Also, the supply is given by P = 10 + 3Q. If a $10 per-unit excise tax is levied on the buyers of a good, producer surplus is equal to a. None of these b. $10 c. $20 d. $128 e. $64 Producer surplus is the area under the price that producers receive, and above the supply curve. Question 7: 0 / 1 pts. Suppose the demand for a product is given by P = 100 – 2Q. Also, the supply is given by P = 20 + 6Q. If an $8 per-unit excise tax is levied on the buyers of a good, government revenue is equal to a. $81 b. $243 c. None of these d. $72 Correct Answer e. $4 Government revenue equals the amount of the tax times the number of units sold after the tax. Question 8: 1 / 1 pts. Suppose the demand for a product is given by P = 30 – 3Q. Also, the supply is given by P = 10 + Q. If a $4 per-unit excise tax is levied on the buyers of a good, after the tax, the total amount of tax paid by the consumers is a. $16 b. None of these c. $8 d. $12 e. $4 The total tax paid by the consumer is equal to (Pt + t – P*. times Qt. Question 9: 1 / 1 pts. Suppose the demand for a product is given by P = 50 – Q. Also, the supply is given by P = 10 + 3Q. If a $12 per-unit excise tax is levied on the buyers of a good, after the tax, the total amount of tax paid by the producers is a. $84 b. None of these c. $21 d. $18 e. $63 The total tax paid by the producer is equal to (P* - Pt. times Qt. Question 10: 1 / 1 pts. Suppose the demand for a product is given by P = 100 – 2Q. Also, the supply is given by P = 20 + 6Q. If an $8 per-unit excise tax is levied on the buyers of a good, after the tax, the total quantity of the good sold is a. 9 b. 80 c. 74 d. 10 e. None of these Qt. can be found by the intersection of the new demand curve and the original supply curve. [Show More]

Last updated: 3 years ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 02, 2020

Number of pages

4

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 02, 2020

Downloads

0

Views

107