Economics > QUESTIONS & ANSWERS > Pennsylvania State University - ECON 102 QUIZ 12. The original score for this attempt: was 6 out of (All)

Pennsylvania State University - ECON 102 QUIZ 12. The original score for this attempt: was 6 out of 10. After the review, the correct answers were indicated as seen in the attachment. All 100% Correct.

Document Content and Description Below

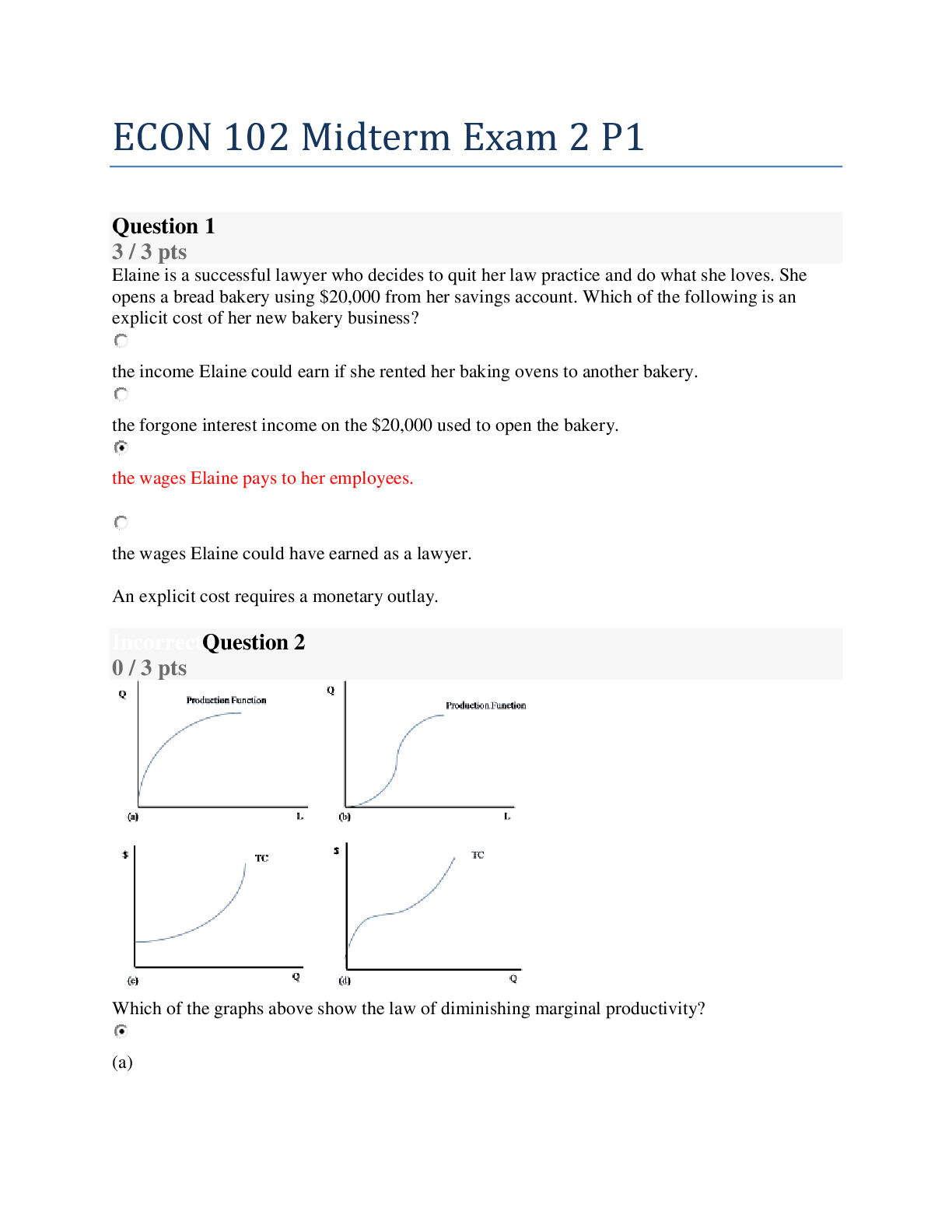

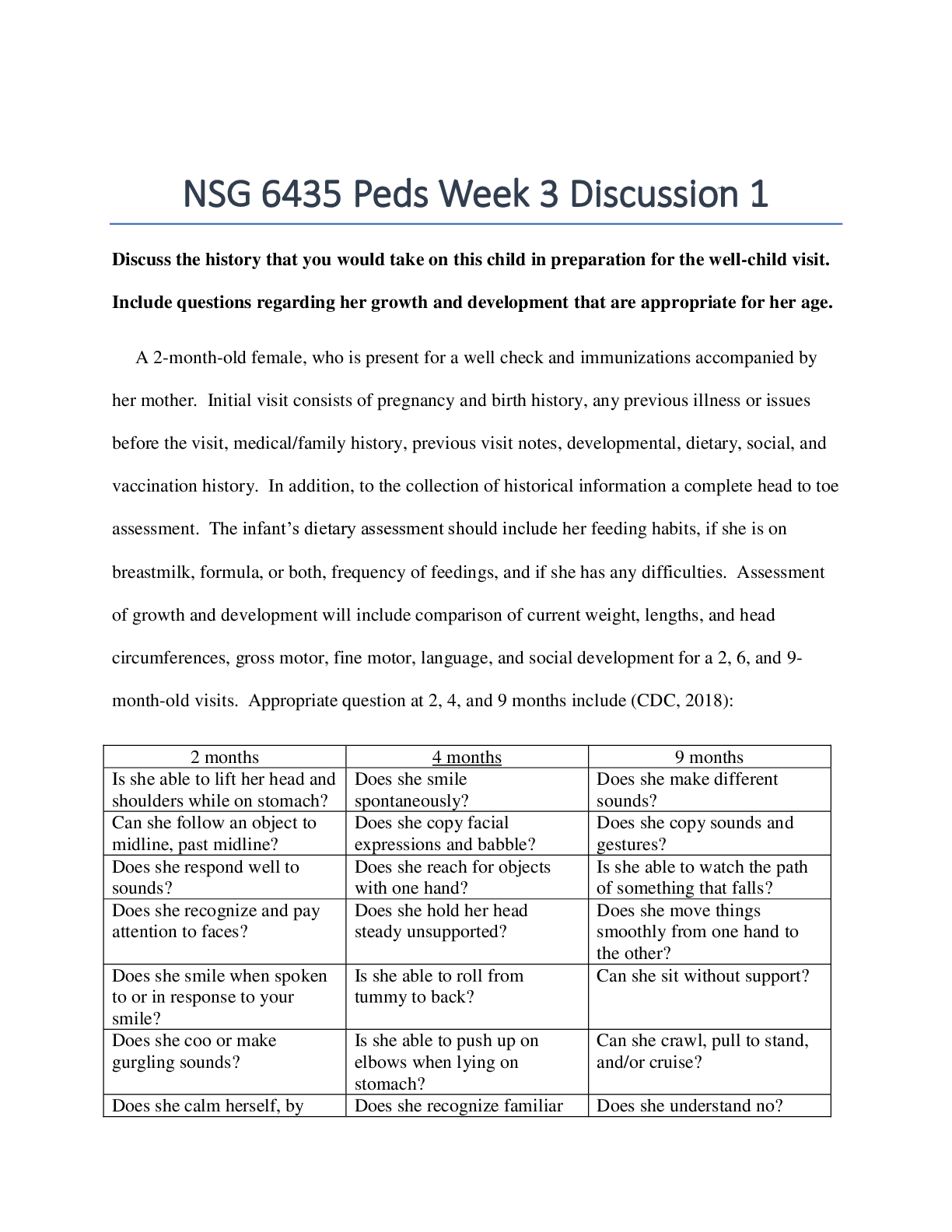

ECON 102 QUIZ 12: Score for this attempt: 6 out of 10 Question 1 1 / 1 pts Suppose the demand for a product is given by P = 100 – 2Q. Also, the supply is given by P = 20 + 6Q. If an $8 per-uni... t excise tax is levied on the buyers of a good, then after the tax buyers will pay _________ for each unit of the good. Correct! $82 $80 $74 None of these $9 The demand curve will shift down by an amount exactly equal to the tax. This allows you to find the equation for the new demand curve. The buyers will pay a price equal to the new equilibrium price plus the tax. Question 2 0 / 1 pts Suppose the demand for a product is given by P = 40 – 4Q. Also, the supply is given by P = 10 + Q. If a $10 per-unit excise tax is levied on the buyers of a good, then after the tax sellers will receive _________ for each unit of the good. Correct Answer None of these $16 $4 You Answered $24 $6 The demand curve will shift down by an amount exactly equal to the tax. This allows you to find the equation for the new demand curve. The sellers will receive a price equal to the new equilibrium price. Question 3 0 / 1 pts Suppose the demand for a product is given by P = 30 – 3Q. Also, the supply is given by P = 10 + Q. If a $4 per-unit excise tax is levied on the buyers of a good, what proportion of the tax will be paid by the buyers? 40% You Answered 20% 0% 25% Correct Answer None of these The proportion of the tax paid by buyers depends on the relative price elasticities of supply and demand. Question 4 1 / 1 pts Suppose the demand for a product is given by P = 60 –2Q. Also, the supply is given by P = 10 + 3Q. If a $10 per-unit excise tax is levied on the buyers of a good, the deadweight loss created by this tax will be $64 $5 None of these Correct! $10 $20 The deadweight loss is the difference between total surplus without the tax and total surplus with the tax. Question 5 1 / 1 pts Suppose the demand for a product is given by P = 30 – 2Q. Also, the supply is given by P = 5 + 3Q. If a $5 per-unit excise tax is levied on the buyers of a good, after the tax, consumer surplus is equal to Correct! $16 None of these $24 $2.50 $25 Consumer surplus is the area under the demand curve and above the price that the consumer pays. Question 6 1 / 1 pts Suppose the demand for a product is given by P = 40 – 4Q. Also, the supply is given by P = 10 + Q. If a $10 per-unit excise tax is levied on the buyers of a good, producer surplus is equal to None of these $32 $10 $64 Correct! $8 Producer surplus is the area under the price that producers receive, and above the supply curve. Question 7 1 / 1 pts Suppose the demand for a product is given by P = 40 – 4Q. Also, the supply is given by P = 10 + Q. If a $10 per-unit excise tax is levied on the buyers of a good, government revenue is equal to $8 Correct! None of these $64 $32 $10 Government revenue equals the amount of the tax times the number of units sold after the tax. Question 8 0 / 1 pts Suppose the demand for a product is given by P = 60 –2Q. Also, the supply is given by P = 10 + 3Q. If a $10 per-unit excise tax is levied on the buyers of a good, after the tax, the total amount of tax paid by the consumers is $80 Correct Answer $32 You Answered $48 $10 None of these The total tax paid by the consumer is equal to (Pt + t –P*. times Qt. Question 9 1 / 1 pts Suppose the demand for a product is given by P = 50 –Q. Also, the supply is given by P = 10 + 3Q. If a $12 per-unit excise tax is levied on the buyers of a good, after the tax, the total amount of tax paid by the producers is Correct! $63 $84 None of these $18 $21 The total tax paid by the producer is equal to (P* - Pt. times Qt. Question 10 0 / 1 pts Suppose the demand for a product is given by P = 100 – 2Q. Also, the supply is given by P = 20 + 6Q. If an $8 per-unit excise tax is levied on the buyers of a good, after the tax, the total quantity of the good sold is Correct Answer 9 80 10 None of these You Answered 74 Qt can be found by the intersection of the new demand curve and the original supply curve. [Show More]

Last updated: 2 years ago

Preview 1 out of 6 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 02, 2020

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Oct 02, 2020

Downloads

0

Views

153

.png)