Financial Accounting > QUESTIONS & ANSWERS > ACCT 212 Week 6 Quiz (Summer 2020)(With all the correct answers highlighted). (All)

ACCT 212 Week 6 Quiz (Summer 2020)(With all the correct answers highlighted).

Document Content and Description Below

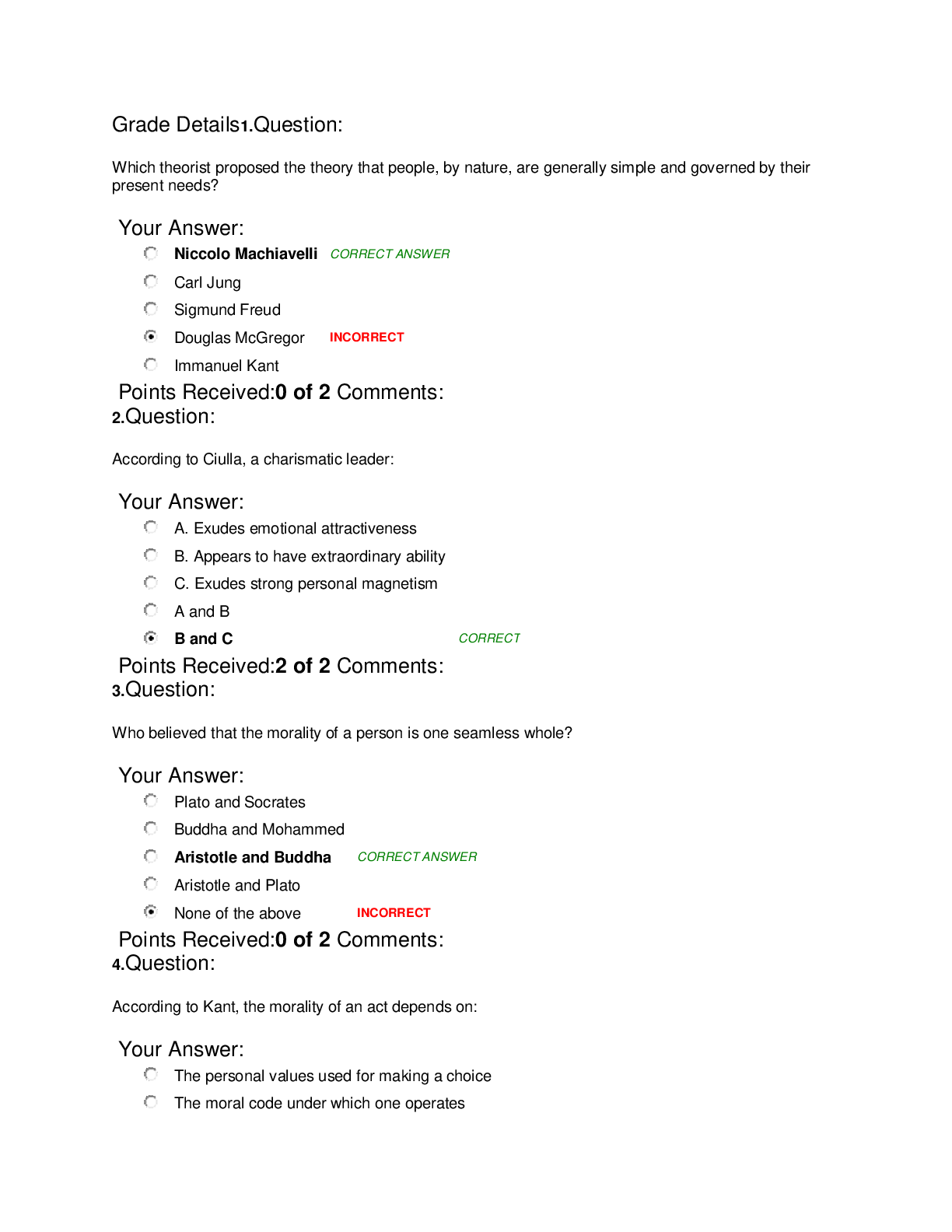

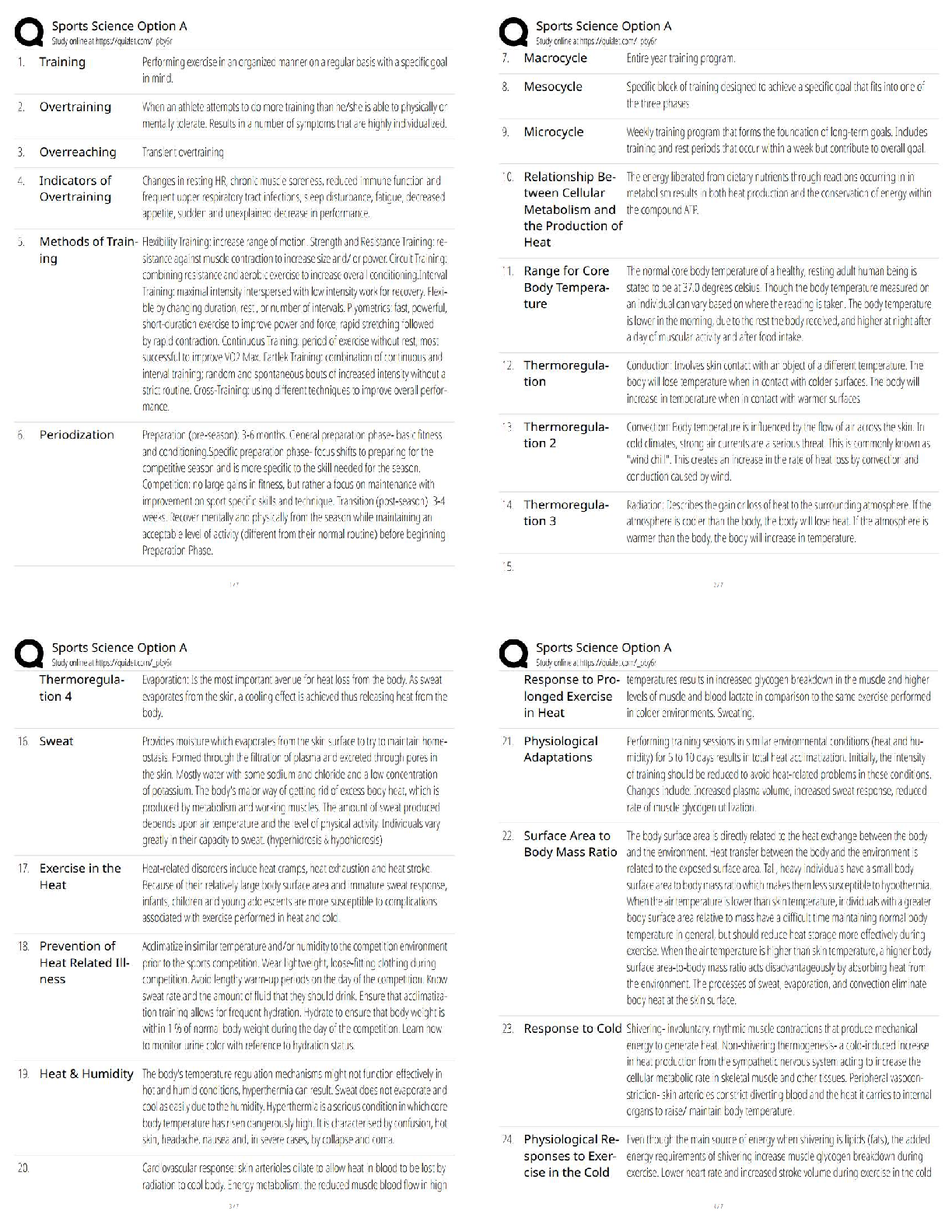

Question: A company incurred the following costs: Purchase price of land $230,000 Survey fees ... 6,000 Payment for demolition of old building on land 40,000 Bank property taxes on land 5,000 Paving costs for parking lot 50,000 Fence around perimeter of land 15,000 Lights in parking lot 90,000 Signs for new business 5,000 What is the … of land? 2. Question: A company incurred the following costs for a new delivery truck………….. What is the … of the delivery truck? 3. Question: On January 2, 2019, Konard Corporation acquired equipment for $800,000. The estimated life of the equipment is 5 years or 31,000 hours. The estimated residunal value is $25,000, if Konard Corporation uses the units of production method of depreciation, what will be the debit to Depreciation Expense for the year ended December 31, 2020, assuming that during this period, the asset was used 10.000 hours? 4. Question: On January 2, 2019, Kaiman Corporation acquired equipment for $800,000. The estimated life of the equipment is 5 years or 70,000 hours. The estimated residual value is $20,000. What is the balance in Accumulated Depreciation on December 31, 2020, if Kaiman Corporation uses the straight – line method of depreciation? 5. Question: On January 2, 2019, Kornis Corporation acquired equipment for $1,200,000. The estimated life of the equipment is 5 years or 80,000 hours. The estimated residual value is $40,000. What is the balance in Accumulated Depreciation on December 31, 2019, if Kornis Corporation uses the double – declining – balance method of depreciation. 6. Question: Wisconsin Bank lends Local Furniture Company $140,000 on November 1. Local Furniture Company signs a $140,000, 6%, 4 – month note. The fiscal year end of Local Furniture Company is December 31. The journal entry made by Local Furniture Company on December 31 is: 7. Question: Kathy’s Corner Store has total cash sales for the month of $32,000 excluding sales taxes. If the sales tax rate is 8%, which journal entry is … ? (Ignore Cost of Goods Sold). 8. Question: Montana Company sold merchandise with a retail price of $34,000 for cash. Montana Company is … to collect 6% state sales tax. The total cash received from customers was: [Show More]

Last updated: 3 years ago

Preview 1 out of 3 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 21, 2020

Number of pages

3

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 21, 2020

Downloads

0

Views

162

.png)

.png)

.png)