HMGT 3300 Exam 1 Top Questions with accurate answers, verified.

$ 5

WGU C464 Introduction to Communication Questions and Answers Already Passed

$ 14

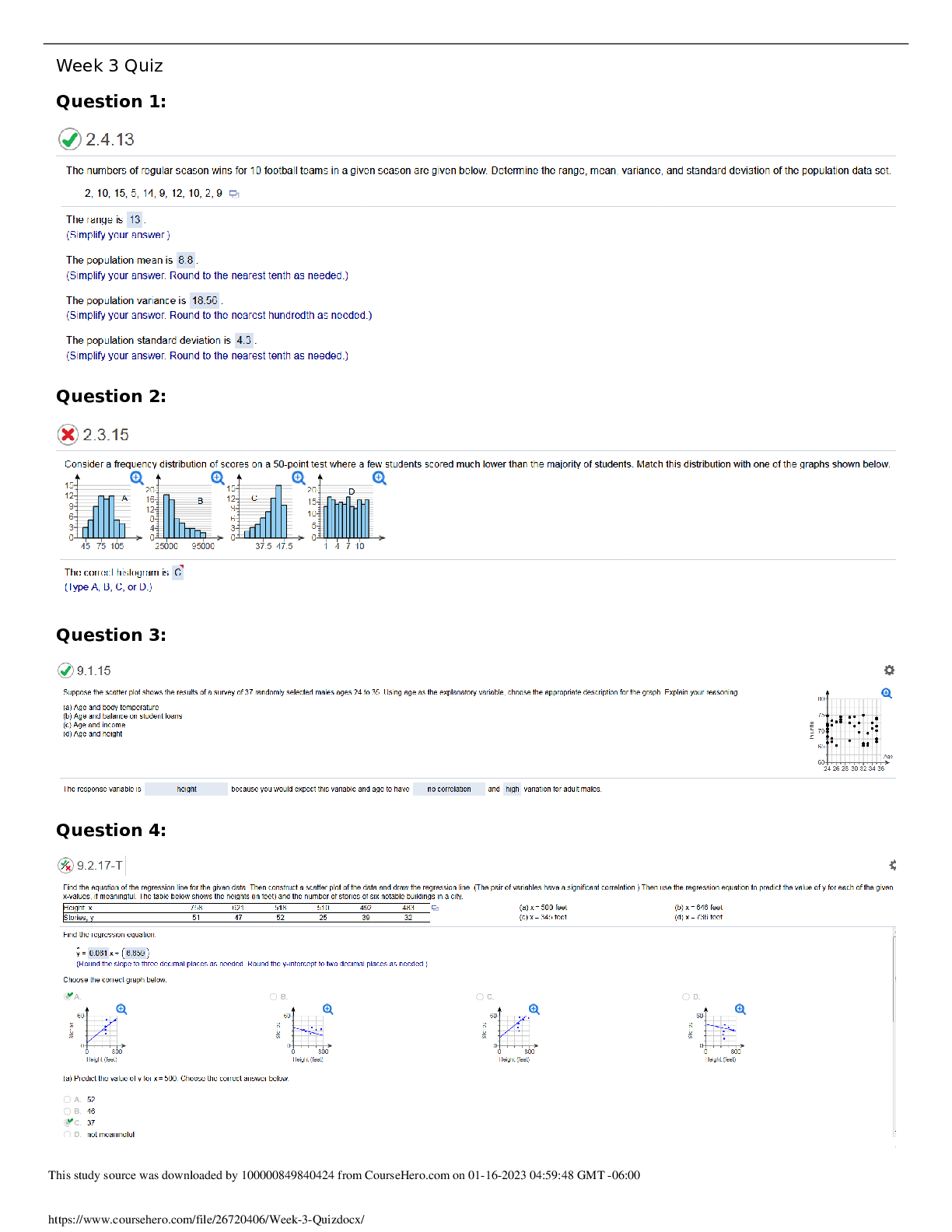

ECE 355 Week 3 Quiz solutions_ latest 2021.

$ 10

WGU C464 Introduction to Communication Questions and Answers Already Passed

$ 14

.png)

WGU Introduction to Communications C464: Competency 1

$ 6

WGU C464 Introduction to Communication Questions and Answers Already Passed