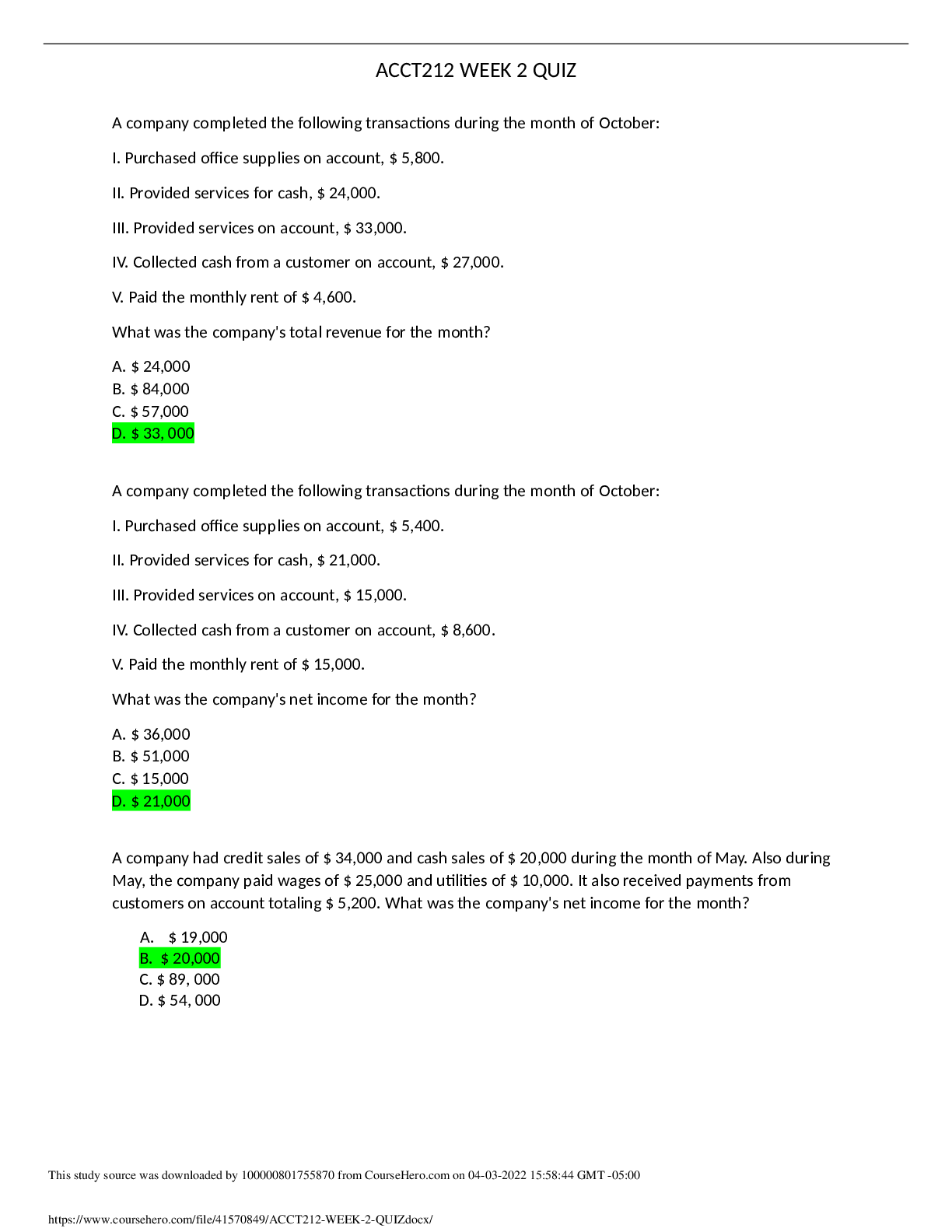

A company completed the following transactions during the month of October:

I. Purchased office supplies on account, $ 5,800.

II. Provided services for cash, $ 24,000.

III. Provided services on account, $ 33,000.

IV.

...

A company completed the following transactions during the month of October:

I. Purchased office supplies on account, $ 5,800.

II. Provided services for cash, $ 24,000.

III. Provided services on account, $ 33,000.

IV. Collected cash from a customer on account, $ 27,000.

V. Paid the monthly rent of $ 4,600.

What was the company's total revenue for the month?

A.$ 24,000

B.$ 84,000

C.$ 57,000

D. $ 33, 000

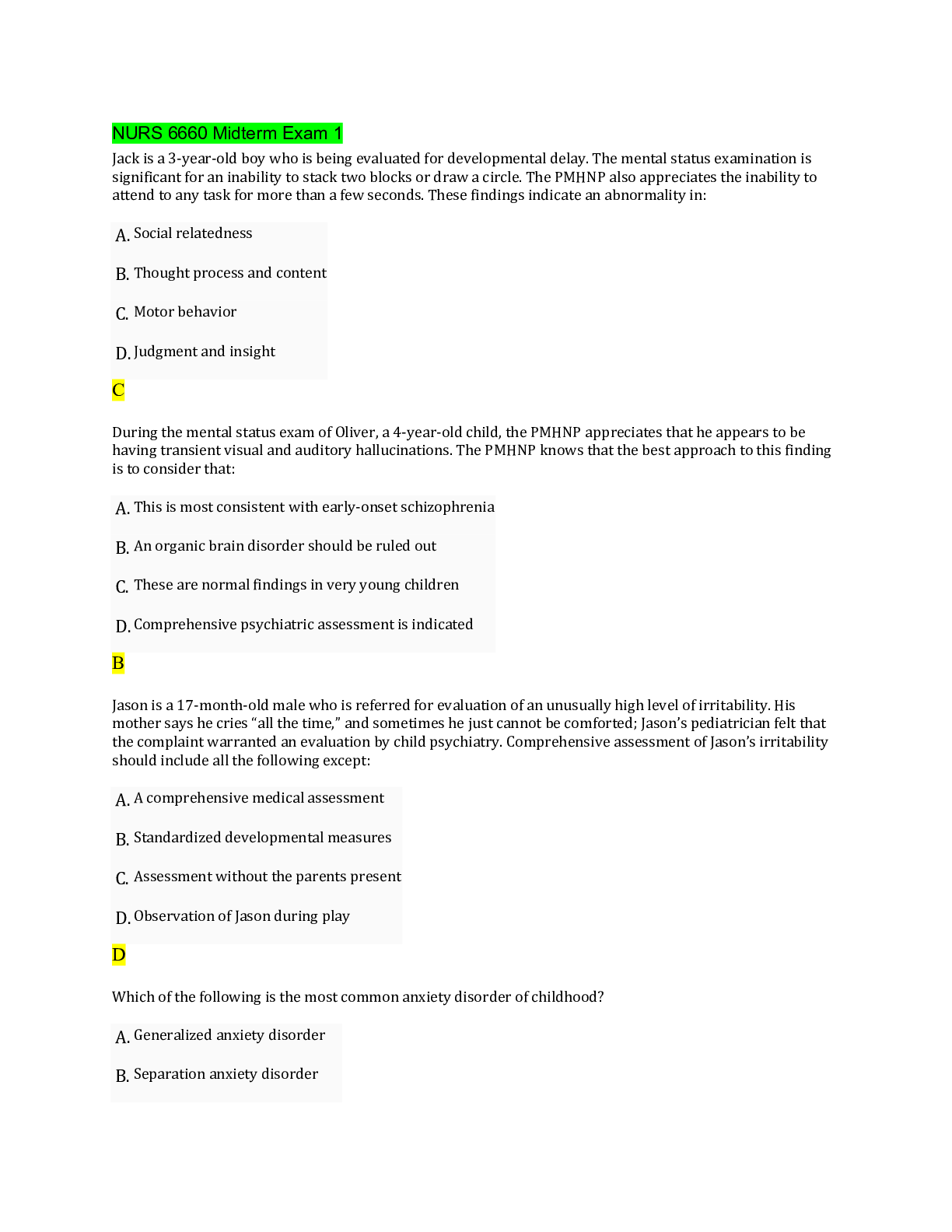

A company completed the following transactions during the month of October:

I. Purchased office supplies on account, $ 5,400.

II. Provided services for cash, $ 21,000.

III. Provided services on account, $ 15,000.

IV. Collected cash from a customer on account, $ 8,600.

V. Paid the monthly rent of $ 15,000.

What was the company's net income for the month?

A.$ 36,000

B.$ 51,000

C.$ 15,000

D.$ 21,000

A company had credit sales of $ 34,000 and cash sales of $ 20,000 during the month of May. Also during May, the company paid wages of $ 25,000 and utilities of $ 10,000. It also received payments from customers on account totaling $ 5,200. What was the company's net income for the month?

A. $ 19,000

B. $ 20,000

C.$ 89, 000

D.$ 54, 000

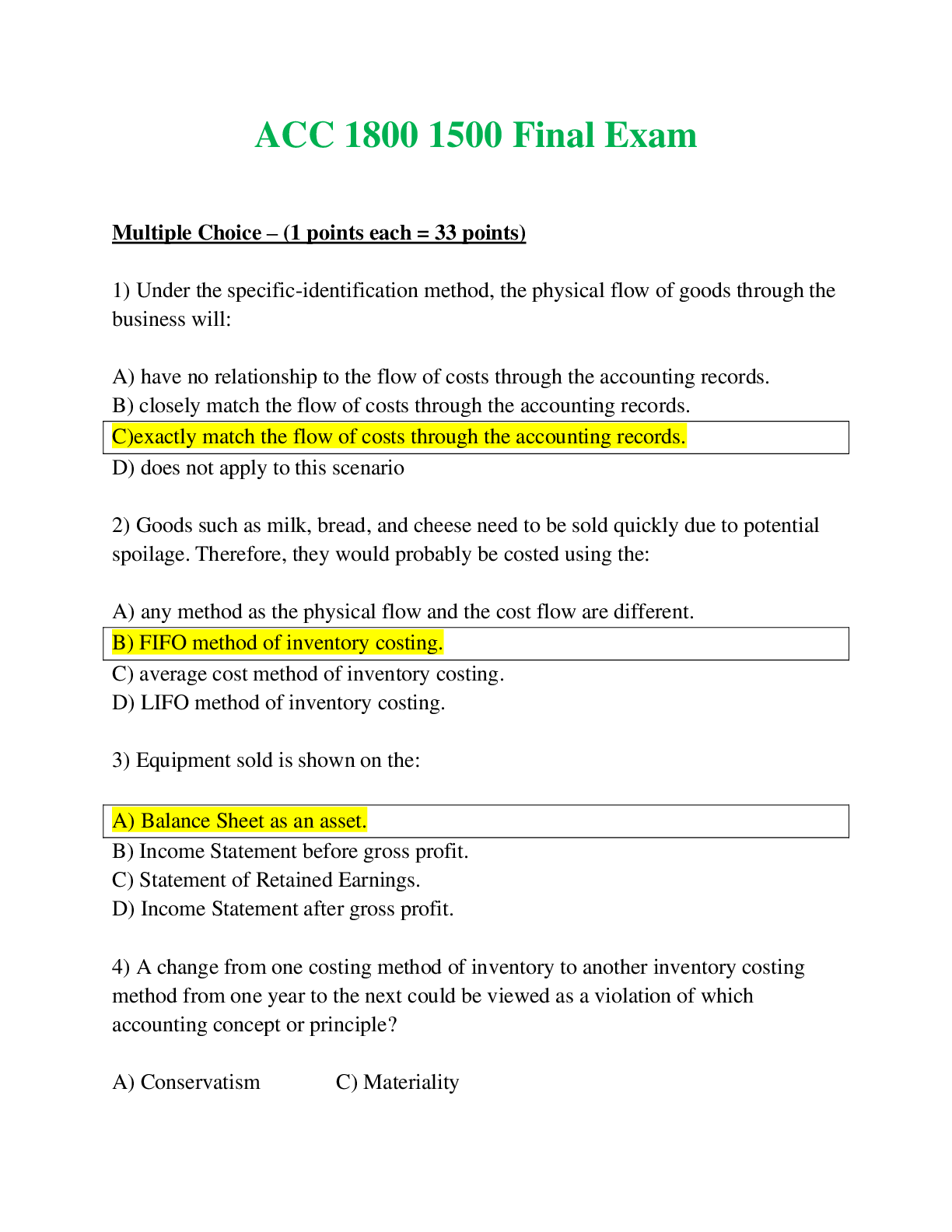

A company received $ 34,000 cash and issued common stock in exchange. How does this transaction affect the accounting equation?

A.Add $ 34,000 to Cash and add $ 34,000 to Retained Earnings.

B.Add $ 34,000 to Cash and add $ 34,000 to Common Stock.

C.Add $ 34,000 to Dividends and subtract $ 34,000 from Retained Earnings.

D.Add $ 34,000 to Cash and add $ 34, 000 to Revenue.

Which accounts are increased by debits?

A.Salaries Expense and Common Stock.

B.Accounts Payable and Service Revenue.

C.Cash and Accounts Payable.

D.Accounts Receivable and Utilities Expense

Posting is:

A. copying the information from the journal to the ledger.

B.copying the information from the journal to the trial balance.

C.copying the information from the ledger to the financial statements.

D.entering the data into the journal.

A business paid $ 3,100 on account. The journal entry would:

A. debit Accounts Payable for $ 3,100 and credit Cash for $ 3,100.

B.debit Cash for $ 3,100 and credit Retained Earnings for $ 3,100.

C.debit Cash for $ 3,100 and credit Accounts Payable for $ 3,100.

D.debit Accounts Receivable for $ 3,100 and credit Revenue for $ 3,100.

On May 1, a business provided legal services to a client and billed the client $ 2,400. The client promised to pay the business in one month. Which journal entry should the business record on May 1?

A. Debit Accounts Receivable for $ 2,400 and credit Service Revenue for $ 2,400.

B.Debit Cash for $ 2,400and credit Retained Earnings for $ 2,400.

C.Debit Cash for $ 2,400and credit Service Revenue for $ 2,400.

D.Debit Accounts Payable for $ 2,400 and credit Service Revenue for $ 2,400

The Accounts Receivable account for Johnny's Mechanic Shop had a beginning balance of $ 36,000. During the month, Johnny made sales on account of $ 42,000. The ending balance in the Accounts Receivable account is $ 32,000. What are cash collections for the month?

A.$ 42,000

B.$ 46, 000

C.$ 36,000

D.$ 78,000

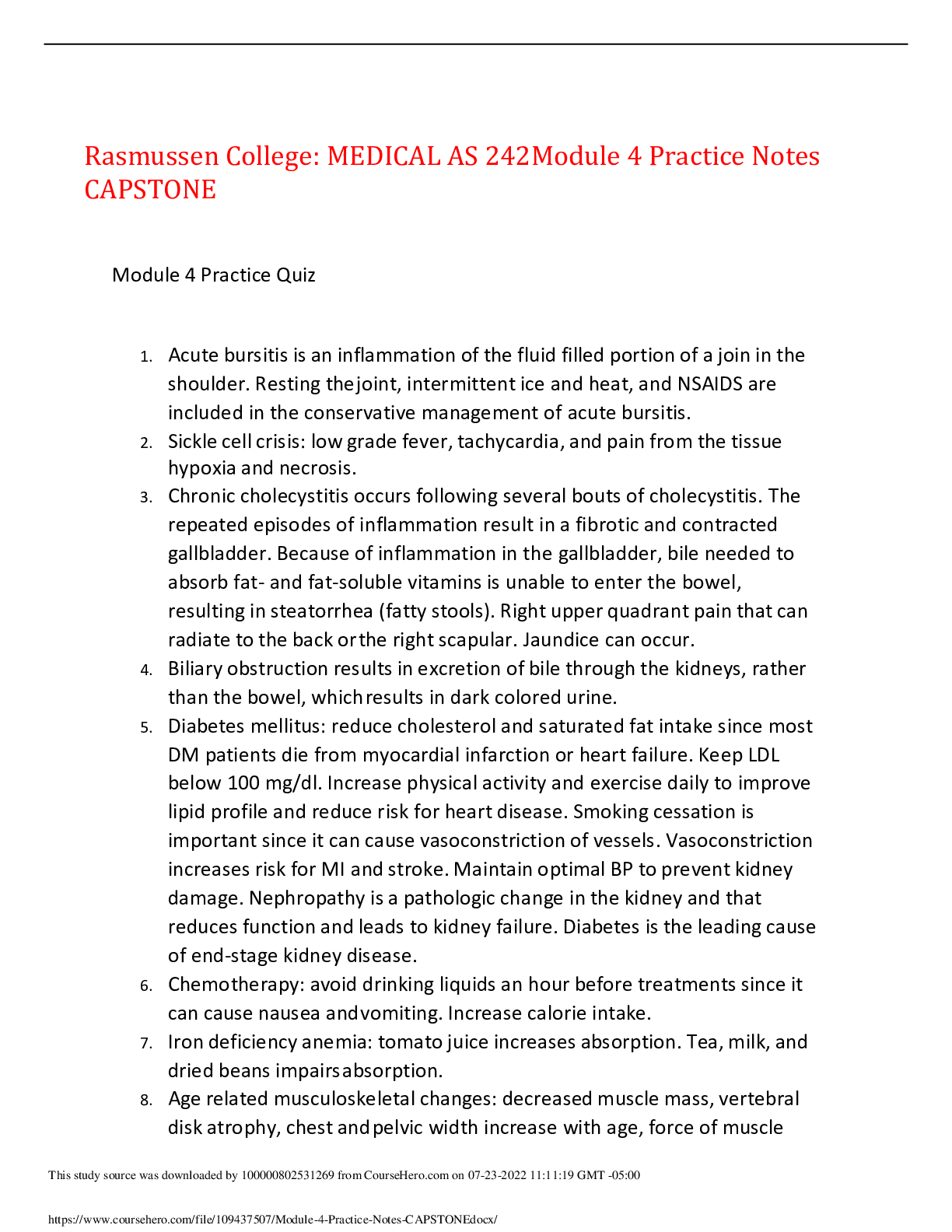

A company completed the following transactions during the month of October:

I. Purchased office supplies on account, $ 5,800.

II. Provided services for cash, $ 21,000.

III. Provided services on account, $ 16,000.

IV. Collected cash from a customer on account, $ 7,200.

V. Paid the monthly rent of $ 14,000.

What was the company's net income for the month?

A.$ 37,000

B.$ 23,000

C.$ 16,000

D.$ 51,000

[Show More]