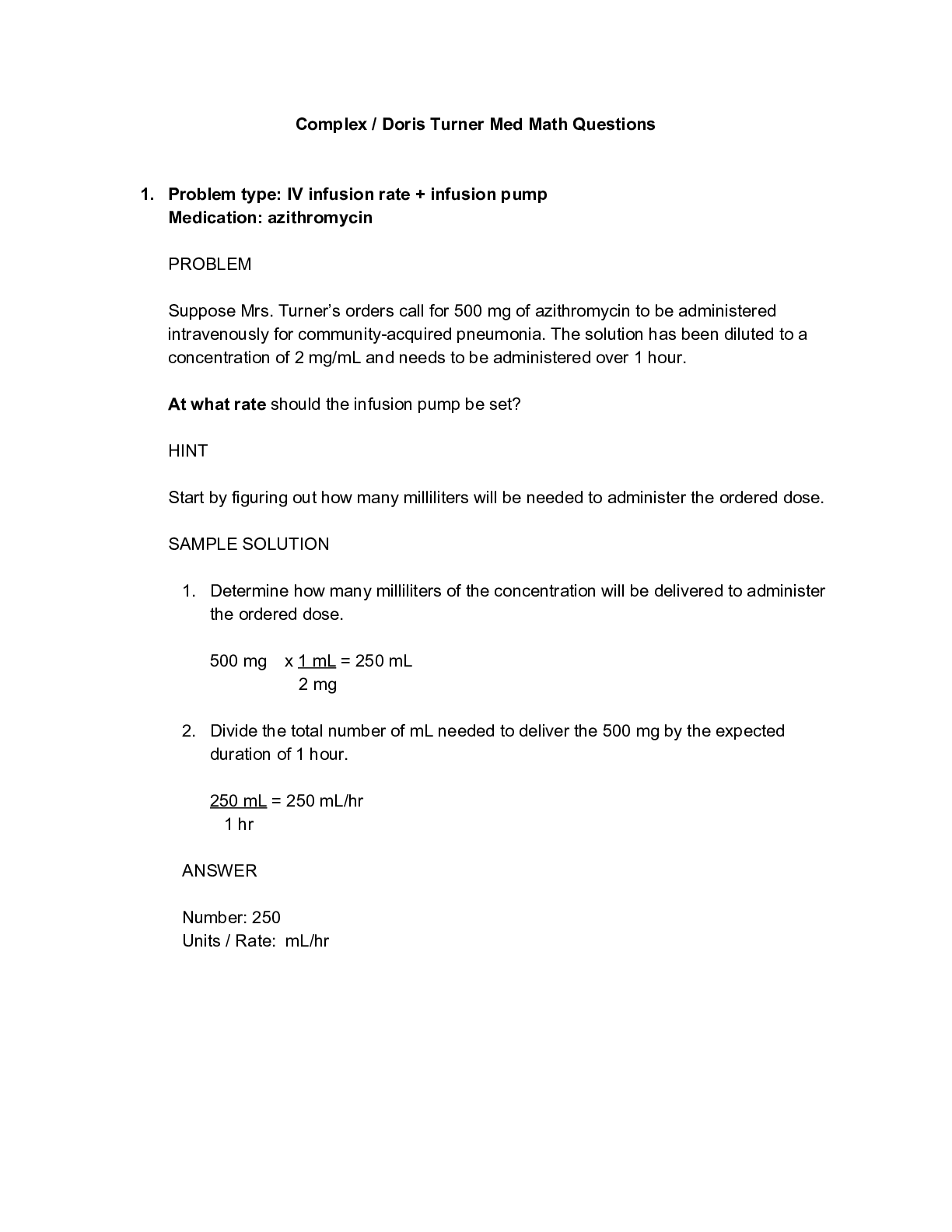

Finance > QUESTIONS & ANSWERS > University of North Texas>FINA 4310 Exam> Financial Valuation Chapter 6>Risk and Return>Stocks. (all (All)

University of North Texas>FINA 4310 Exam> Financial Valuation Chapter 6>Risk and Return>Stocks. (all correct answers)

Document Content and Description Below

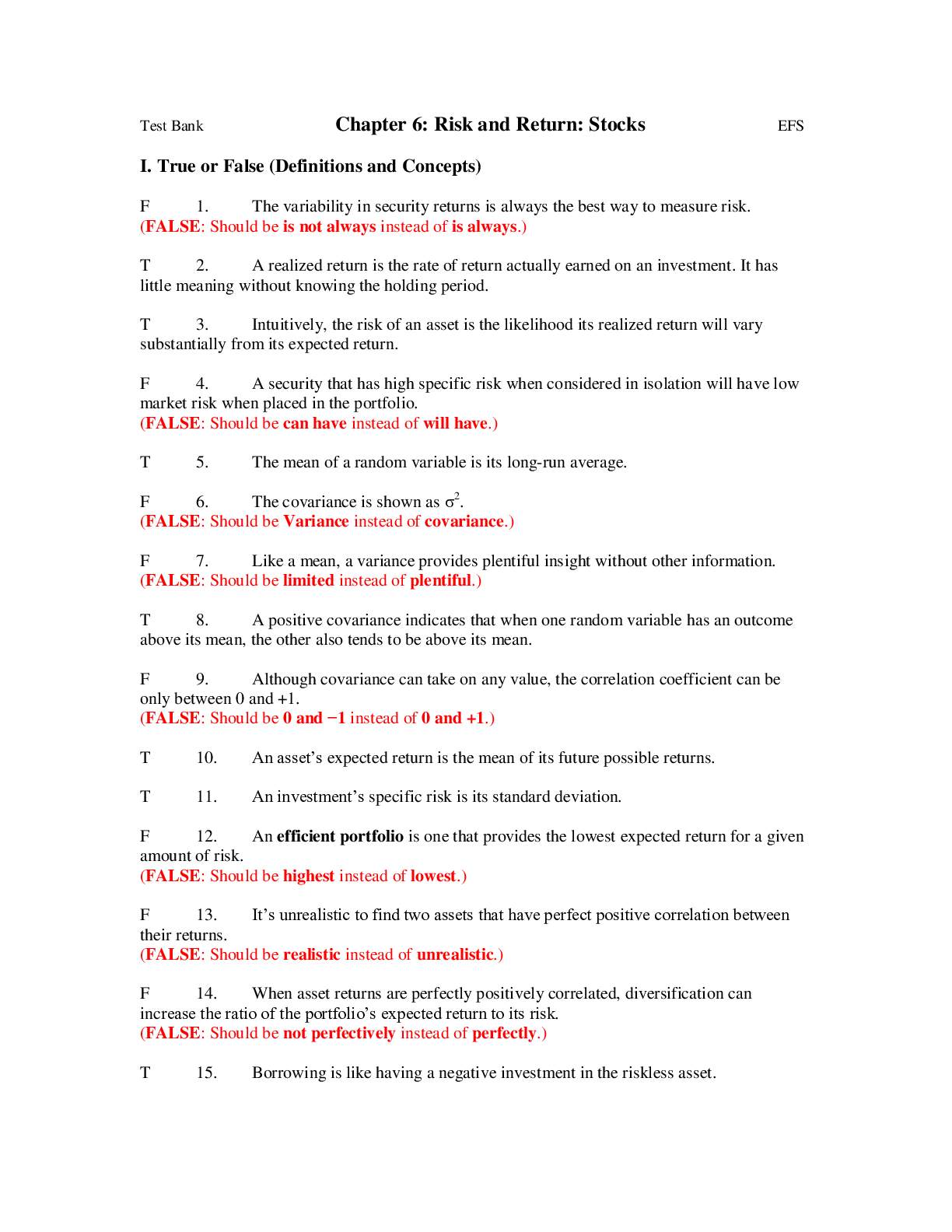

I. True or False (Definitions and Concepts) F 1. The variability in security returns is always the best way to measure risk. (FALSE: Should be is not always instead of is always.) T 2. A realized r... eturn is the rate of return actually earned on an investment. It has little meaning without knowing the holding period. T 3. Intuitively, the risk of an asset is the likelihood its realized return will vary substantially from its expected return. F 4. A security that has high specific risk when considered in isolation will have low market risk when placed in the portfolio. (FALSE: Should be can have instead of will have.) T 5. The mean of a random variable is its long-run average. F 6. The covariance is shown as σ 2 . (FALSE: Should be Variance instead of covariance.) F 7. Like a mean, a variance provides plentiful insight without other information. (FALSE: Should be limited instead of plentiful.) T 8. A positive covariance indicates that when one random variable has an outcome above its mean, the other also tends to be above its mean. F 9. Although covariance can take on any value, the correlation coefficient can be only between 0 and +1. (FALSE: Should be 0 and −1 instead of 0 and +1.) T 10. An asset’s expected return is the mean of its future possible returns. T 11. An investment’s specific risk is its standard deviation. F 12. An efficient portfolio is one that provides the lowest expected return for a given amount of risk. (FALSE: Should be highest instead of lowest.) F 13. It’s unrealistic to find two assets that have perfect positive correlation between their returns. (FALSE: Should be realistic instead of unrealistic.) F 14. When asset returns are perfectly positively correlated, diversification can increase the ratio of the portfolio’s expected return to its risk. (FALSE: Should be not perfectively instead of perfectly.) T 15. Borrowing is like having a negative investment in the riskless asset. II. Multiple Choice (Definitions and Concepts) c 16. One problem with using negative values for w1 (the proportion invested in the riskless asset) to represent a borrowed amount is that the implied borrowing rate of interest is the same as . a. the prime rate of interest b. the current rate of interest c. the lending rate of interest d. the nominal rate of interest a 17. Investing in the riskless asset is really simply lending the money. The opposite, borrowing, is like having a negative investment in the asset. a. riskless b. risky c. underlying d. fixed b 18. Using a single rate for borrowing and lending is essentially equivalent to assuming transactions. a. imperfect b. costless c. costly d. both a & c are correct d 19. The line that links possible investment combinations when you can borrow at the riskless return is called the . a. capital market line b. security market line c. CML d. both a & c are correct a 20. A slope is the “rise” over the “run.” For the CML, the rise is ¯rM − rf, and the run is where σf is zero. a. σM − σf b. σM − rf c. ¯rM − rf d. σM − ¯rM [Show More]

Last updated: 2 years ago

Preview 1 out of 22 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 10, 2020

Number of pages

22

Written in

Additional information

This document has been written for:

Uploaded

Oct 10, 2020

Downloads

0

Views

85