Reproductive Technologies and Biobanking for the Conservation of Amphibians Hardcover by Aimee J. Silla , Andy J. Kouba , Harold Heatwole

$ 30

CRJ 512 Week One Assignment Final 2020

$ 4

Solutions Manual For Cost Management Accounting and Control 5th Edition By Hanson and Mowen

$ 29

ATI Primary Care Art and Science of Advanced Practice Nursing - Test Bank, Chapter 61. Hematologic Disorders

$ 6.5

D208 DTAN 5203 Predictive Modelling FA (Qns & Ans) 2025 WGU

$ 12

NR 508 Final Exam Study Guide UPDATED LATEST SOLUTION

$ 18

NR 565 - Week 7 Gastrointestinal (GI). Case Study (Actual Post).

$ 8

ATI MATERNAL NEWBORN PROCTORED EXAM 2025-26

$ 8

ARS 100 Exam 4 Study Guide updated study guide 2020

$ 7.5

Introduction to Business Milestone 1 Test

$ 10

NINA ADAMS IHUMAN CASE STUDY. CC- FATIGUE AND ARM WEAKNESS

$ 17

eBook [PDF] Women and Borders in the Mediterranean The Wretched of the Sea 1st Edition By Camille Schmoll

$ 29

ATI Mental Health Proctored

$ 7

SS ATI Practice Assessment.Answer Key for Stroke and Intracranial Problems

$ 10

Advanced Nutrition and Human Metabolism, 7e Sareen Gropper, Jack Smith, Timothy Carr (Instructor Manual All Chapters, 100% Original Verified, A+ Grade {Updated 2025}

$ 20

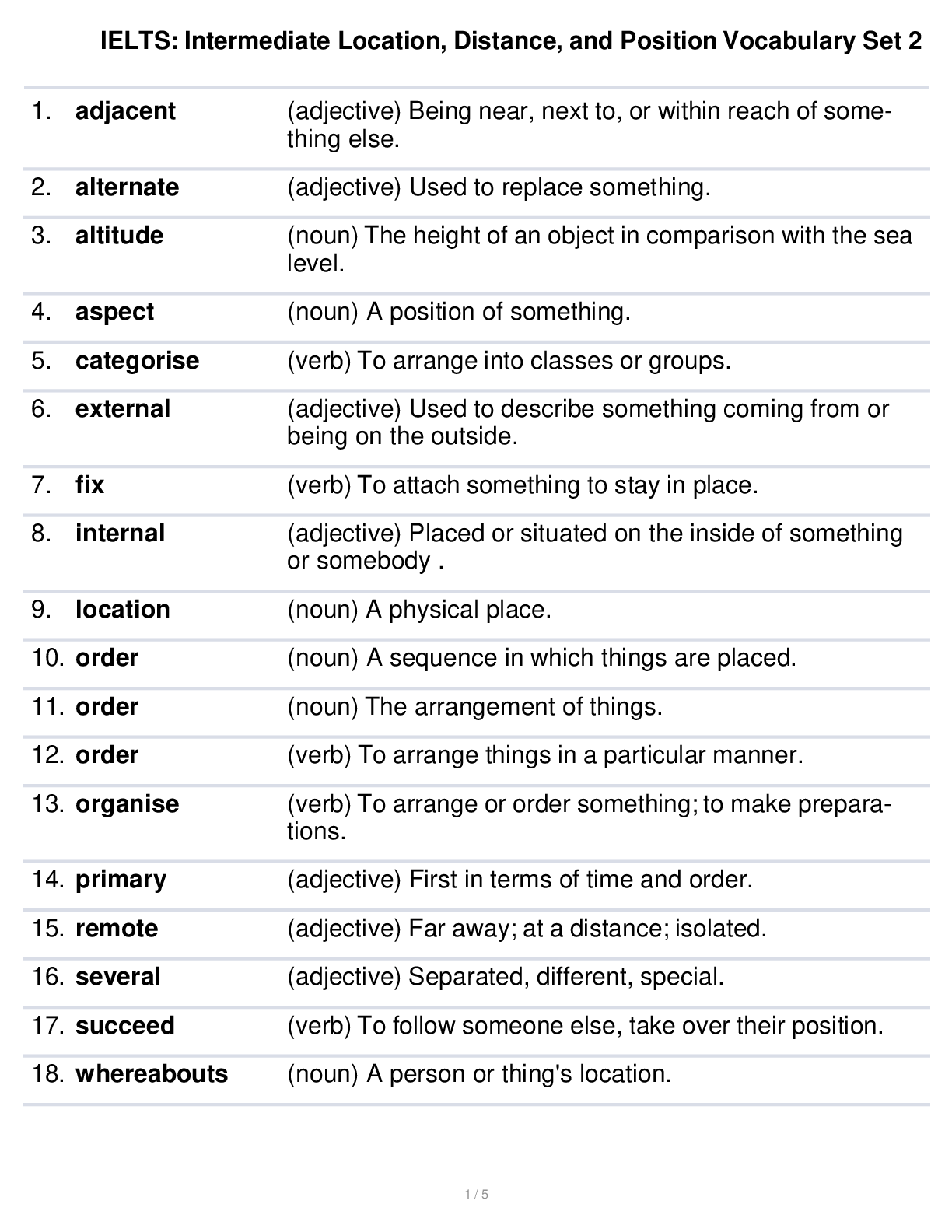

IELTS: Intermediate Location, Distance, and Position Vocabulary Set 2

$ 5.5

Pearson Edexcel Level 3 GCE Physics Advanced Subsidiary PAPER 2: Core Physics II. question booklet and mark scheme results 2022

$ 10

Liberty University ACCT 212 connect homework 3 Complete solution.

$ 7

HIM 1101 ACLS Post Test Questions and Answers LATEST,2022/2023

$ 10

.png)

NETWORK+ G itnw 1325chapter-4-programming-challengesnotassigned

$ 9

.png)

GCSS Army - Property Book's Tests 1 Graded A+

$ 7

ECON MICROECONO Foundations of Microeconomics

$ 8

PN Hesi Exit V1 PRACTICE EXAM QUESTIONS AND ANSWERS

$ 12

Instructor's Solutions Manual For Personal Finance 7th Edition By Jeff Madura

$ 22

Oxford Cambridge and RSA Thursday 9 June 2022 — Morning GCSE(9L4) History A (Explaining the Modern World) J410/01 China 1950-1981: The People and the state

$ 5

(Capella) HIM-FPX4640 Electronic Health Records & HIS Comprehensive Final Exam Guide 2024

$ 14

HESI MED SURG EXAM WITH QUESTIONS AND ANSWERS /HESI MED SURG EXAM 100% LATEST SOLUTIONS

$ 18

ATI RN Inclusion, Equity, and Diversity Assessment

$ 18

GFEBS Spending Chain Manage Purchase Requisitions Course Brand NEW | Latest 2023-2024 | Complete Questions & Answers (Solved)

$ 10

Pearson Edexcel Level 3 GCE_Physics_9PH0/03 Question Paper 2021 | General and Practical Principles in Physics

$ 6.5

(HU) NU 480 Dimensions of ANP - Midterm Readiness Exam Guide - 2024

$ 13

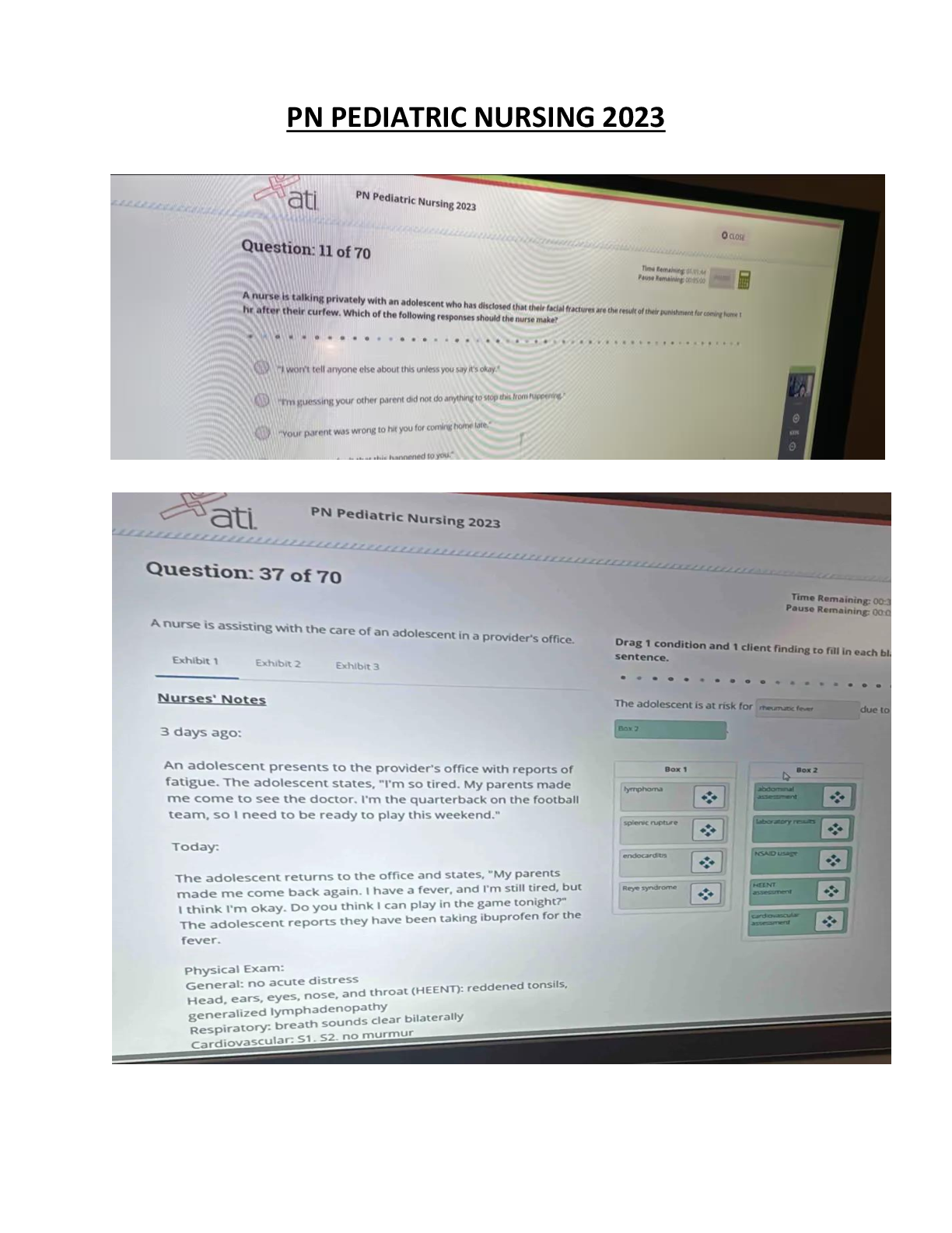

PN PEDIATRIC NURSING 2025-2026 EDITION

.png)