Managerial Economics > EXAM > MBA 601 Exam 2 Questions and Answers | 50 Most Frequently tested questions. Includes Solutions, Rati (All)

MBA 601 Exam 2 Questions and Answers | 50 Most Frequently tested questions. Includes Solutions, Rationale and Explanations

Document Content and Description Below

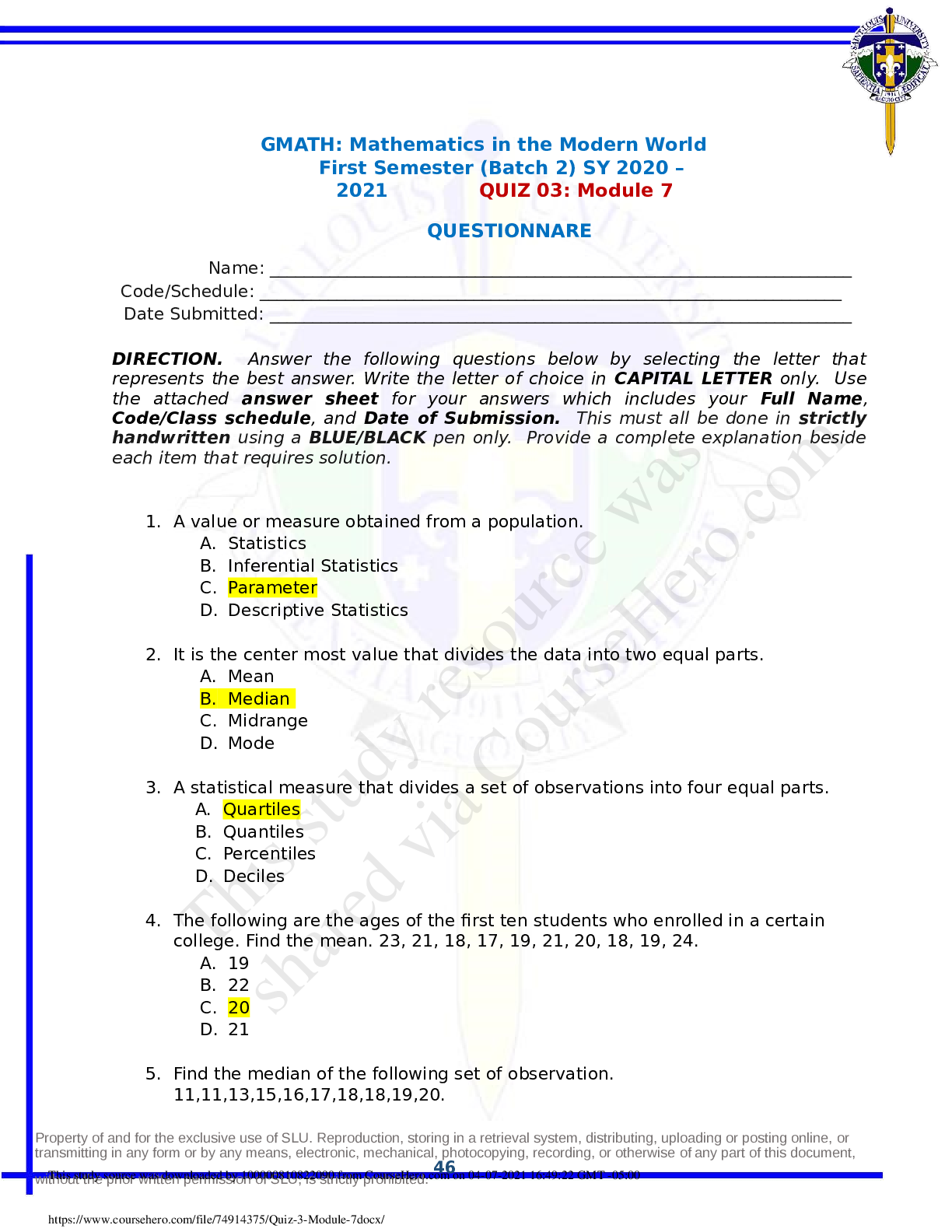

MBA 601 Exam 2 Questions and Answers | 50 Most Frequently tested questions. Includes Solutions, Rationale and Explanations 1. ROE is computed as: A) Net income attributable to controlling interest / ... Average equity attributable to controlling interest B) Net income attributable to controlling interest / Net sales C) [RNOA + (FLEV × Spread)] x NCI ratio D) A and B E) A and C 2. The 2013 balance sheet of E.I. du Pont de Nemours and Company shows average DuPont shareholders’ equity attributable to controlling interest of $13,219 million, net operating profit after tax of $3,145 million, net income attributable to DuPont of $4,848 million, and common shares issued of 1,014 million. Assume the company has no preferred shares issued. DuPont’s return on equity (ROE) for the year is: A) 20.9% B) 36.7% C) 23.8% D) 36.4% E) There is not enough information to calculate the ratio. 3. The 2014 balance sheet of Staples, Inc. shows total assets of $11,174,876 thousand, operating assets of $10,682,344 thousand, operating liabilities of $3,929,854 thousand, and shareholders’ equity of $6,132,263 thousand. Staples’ 2014 net operating assets are: A) $ 7,245,022 thousand B) $ 10,682,344 thousand C) $ 6,752,490 thousand D) $ 6,132,263 thousand E) None of the above 4. Mattel Inc.’s 2013 financial statements show operating profit before tax of $1,168,103 thousand, net income of $903,944 thousand, provision for income taxes of $195,184 thousand and net nonoperating expense before tax of $68,975 thousand. Assume Mattel’s statutory tax rate for 2013 is 37%. Mattel’s 2013 effective tax rate is: A) 17.8% B) 37.0% C) 19.4% D) 16.7% E) None of the above 5. The fiscal 2013 financial statements for Walgreen, Inc., report net sales of $72,217 million, net operating profit after tax of $2,478 million, net operating assets of $21,556 million. The 2012 balance sheet reports net operating assets of $21,465 million. Walgreen’s 2013 net operating asset turnover is: A) 11.5% B) 3.24 C) 3.43% D) 3.36 E) There is not enough information to calculate the ratio. 6. The 2013 balance sheet of Microsoft Corp. reports total assets of $142,431 million, operating liabilities of $47,242 million, and total shareholders’ equity of $78,944 million. Microsoft 2013 nonoperating liabilities are: A) $63,487 million B) $16,245 million C) $95,189 million D) $31,702 million E) There is not enough information to calculate the amount. 7. Liquidity refers to: A) The life cycle of the company B) The amount of receivables the company has in the balance sheet C) The amount of financial leverage D) None of the above 8. Which of the following is a measure of liquidity? A) Liabilities-to-Equity Ratio = Total Liabilities / Stockholder’s Equity B) Times Interest Earned = Earnings before interest and taxes / Interest Expense C) Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities D) Return on net operating assets (RNOA) E) All of the above 9. The fiscal 2013 balance sheet for Whole Foods Market reports the following data (in millions). What is the company’s quick ratio? Cash and cash equivalents Accounts receivable Merchandise inventories Current assets Current liabilities $290 $188 $414 $1,980 $1,088 A) 0.82 B) 1.55 C) 0.44 D) 1.82 E) None of the above 10. Selected income statement data follow for Harley Davidson, Inc., for the year ended December 31, 2013 (in thousands). What is the company’s times interest earned ratio? Income before provision for income taxes Interest expense Statutory tax rate Provision for income taxes Net income $1,114,305 $45,256 37% $380,312 $733,993 A) 16.2 B) 1.6 C) 17.2 D) 25.6 E) None of the above 11. Selected ratios follow for Baker Hughes Inc. for the year ended December 31, 2013 (in millions). What is the company’s return on equity (ROE) for the year? Return on net operating assets (RNOA) Profit margin (PM) Net operating profit margin (NOPM) Asset turnover (AT) Financial leverage (FL) 5.94% 4.90% 5.59% 0.82 1.57 A) 7.20% B) 7.65% C) 6.31% D) 3.83% E) None of the above 12. Boston Consulting Group (BCG) is a management consulting, technology services and outsourcing organization. Which of the following actions should managers take when there is evidence that a fixed-rate contract is over budget and will generate a loss for the firm? A) Use the percentage of completion method to recognize the loss over the remaining term of the engagement. B) Recognize the loss in the current period rather than over the remaining term of the engagement. C) Restate the financial statements and recognize the loss in the earliest period of the engagement. D) Use the percentage of completion method and pro rate the loss over the entire term of the engagement. E) None of the above is an appropriate action. 13. On December 31, 2014, State Construction Inc. signs a contract with the state of West Virginia Department of Transportation to manufacture a bridge over the New River. State Construction anticipates the construction will take three years. The company’s accountants provide the following contract details relating to the project: Contract price $520 million Estimated construction costs $400 million Estimated total profit $220 million During the three-year construction period, State Construction incurred costs as follows: 2015 $ 40 million 2016 $240 million 2017 $120 million State Construction uses the percentage of completion method to recognize revenue. Which of the following represent the revenue recognized in 2015, 2016, and 2017? A) $150 million, $200 million, $170 million B) $40 million, $240 million, $120 million C) $22 million, $132 million, $66 million D) $52 million, $312 million, $156 million E) None of the above 14. Sam’s Club (part of the WalMart consolidated operations) collects annual non-refundable membership fees from customers. When should Sam’s Club recognize revenue for these membership fees? A) Immediately when cash is received because the fees are nonrefundable B) Evenly over the membership year C) Evenly over the current fiscal year D) At the end of the membership year when Sam’s has discharged its obligation to the customer E) Pro rata over the customer’s actual purchasing pattern 15. Tickets Today contracts with the producer of Riverdance to sell tickets online. Tickets Today charges each customer a fee of $6 per ticket and receives $15 per ticket from the producer. Tickets Today does not take control of the ticket inventory. Average ticket price for the event is $150. How much revenue should Tickets Today recognize for each Riverdance ticket sold? A) $6 because the $15 from the producer is similar to a negative cost of goods sold B) $150 because the $135 is cost of goods sold paid to the Riverdance producer C) $21 because both the fee from the customer and the producer are earned D) $156 because the $135 is cost of goods sold paid to the Riverdance producer E) None of the above 16. On its 2013 income statement, Yahoo! reported product development expense of $919,368,000. Which of the following statements must be true? A) Yahoo spent $919,368,000 in cash to develop new products and improve old products. B) Product development expense reduced Yahoo’s 2013 net income by $919,368,000. C) Yahoo capitalized at least $919,368,000 of product development costs in 2013. D) The $919,368,000 included amortized product development costs from prior years that were not previously expensed, because Yahoo incurs such expenses each year. E) None of the above 17. Life Technologies Corporation and Affymetrix Inc. are competitors in the life sciences and clinical healthcare industry. Following is a table of Total revenue and R&D expenses for both companies. (in thousands) Life Technologies Corporation Affymetrix Inc 2012 2011 2010 2012 2011 2010 Total revenue $3,798,510 $3,775,672 $3,588,094 $295,623 $267,474 $310,746 R&D expenses $341,892 $377,924 $375,465 $57,881 $63,591 $67,934 Which of the following is true? A) Life Technologies Corporation is the more R&D intensive company of the two. B) Life Technologies Corporation has become more R&D intensive over the three years. C) Affymetrix is more R&D intensive in 2012 than in 2011. D) Affymetrix is less R&D intensive in 2012 than in 2011. E) None of the above 18. Yahoo! reported the following in its 2013 financial statements (in millions): (in millions) December 31, 2013 December 31, 2012 Total assets $17,103.3 $16,805.0 Revenues $4,984.2 $4,986.6 Product development expense $919.4 $885.8 Net income $1,048.8 $3,945.5 What is Yahoo’s common-sized product development expense for 2013? A) 5.4% B) 20.2% C) 18.4% D) 87.7% E) None of the above 19. Nickolas Imports recorded a restructuring charge of $21.6 million during fiscal 2014 related entirely to the closing of its California based operations in San Diego and in Tijuana, Mexico. The company’s financial statement footnotes indicated that expected employee separation payments amounted to $16.8 million and that fixed asset write-downs accounted for the remainder. Nickolas had never before incurred restructuring charges. At the end of the year, the company’s balance sheet included a restructuring accrual of $3,600,000. The cash flow effect of Nickolas’s restructuring during fiscal 2014 is: A) $0 (there was no cash flow effect in 2014) B) $13,200,000 C) $16,800,000 D) $ 3,600,000 E) $21,600,000 20. Cranberry Chemical recorded pretax restructuring charges of $1,378 million in 2014. The charges consisted of asset write-downs of $908 million, costs associated with exit or disposal activities of $132 million, and employee severance costs of $338 million. The company paid $144 million cash to settle these restructuring charges during the year (2014). At year end, the restructuring accrual associated with these charges was: A) $ 1,378 million B) $ 326 million C) $ 1,234 million D) $ 194 million E) There is not enough information to determine the amount. 21. In fiscal 2013, Microsoft Corp. reported a statutory tax rate of 35.00% and an effective tax rate of approximately 19.18 %. The tax rate on operating profit was 19.39%. The 2013 income statement reported income tax expense of $5,189 million. What did Microsoft report as income before income tax expense that year? A) $14,826 million B) $28,071 million C) $27,054 million D) $ 7,571 million E) None of the above 22. The 2013 annual report of Computer Corporation included the following disclosure: During fiscal 2013, the U.S. dollar strengthened relative to the other principal currencies in which we transact business with the exception of the Japanese Yen. What effect did these currency fluctuations have on Computer Corporation’s 2013 consolidated income statement? A) Net profit of the Japanese subsidiary will be higher B) Net profit of the Japanese subsidiary will be lower C) Net assets of the subsidiaries that report in the other principal currencies will be higher D) Net assets of the subsidiaries that report in the other principal currencies will be lower E) Both A and D 23. Oracle Corporation reported the following earnings per share information in its 2013 annual report. The company has only one class of stock outstanding. ($ in millions) Net income $10,925 Dividends to common shareholders $1,433 Weighted average common shares outstanding 4,769 Weighted average dilutive shares from employee stock plans 75 Basic and diluted earnings per share were, respectively: A) $0.30 and $0.30 B) $0.77 and $0.74 C) $1.08 and $1.06 D) $2.29 and $2.26 E) None of the above 24. The ability to generate future revenues and meet long-term obligations is referred to as: a. Liquidity and efficiency. b. Solvency. c. Profitability. d. Creditworthiness. 25. The ability to meet short-term obligations and to generate revenues using the least amount of resources is called: a. Liquidity and efficiency. b. Solvency. c. Profitability. d. Creditworthiness. 26. Net sales divided by average accounts receivable is equal to the: a. Days' sales uncollected b. Average accounts receivable ratio c. Profit margin d. Accounts receivable turnover ratio 27. The ability to provide financial rewards sufficient to attract and retain financing is called: a. Liquidity and efficiency. b. Solvency. c. Profitability. d. Creditworthiness. 28. Dividing accounts receivable by (net sales divided by 365) is equal to the: a. Profit margin b. Days' sales in accounts receivable c. Accounts receivable turnover ratio d. Average accounts receivable ratio 29. Net income divided by average total equity is equal to the: a. Profit margin b. Return on average assets c. Return on total assets d. Return on total equity 30. A company had a market price of $37.50 per share, earnings per share of $1.25, and dividends per share of $0.40. Its price-earnings ratio is equal to: a. 3.1 b. 30.0 c. 93.8 d. 32.0 31. Par value of a stock refers to the: a. Issue price of the stock. b. Value assigned to a share of stock by the corporate charter. c. Market value of the stock on the date of the financial statements. d. Maximum selling price of the stock. Use the financial statements for Ascension provided with the exam to answer the following: 32. Current assets minus current liabilities is equal to: A. Profit margin B. Financial leverage C. Current ratio D. Working capital E. Quick assets 33. Current assets divided by current liabilities is equal to the: A. Current ratio B. Quick ratio C. Debt ratio D. Liquidity ratio E. Solvency ratio 34. Net sales divided by average accounts receivable is equal to the: A. Days' sales uncollected B. Average accounts receivable ratio C. Current ratio D. Profit margin E. Accounts receivable turnover ratio 35. Dividing accounts receivable by net sales and multiplying the result by 365 is equal to the: A. Profit margin B. Days' sales uncollected C. Accounts receivable turnover ratio D. Average accounts receivable ratio E. Current ratio 36. Net sales divided by average total assets is equal to the: A. Profit margin B. Total asset turnover C. Current ratio D. Sales return ratio E. Return on total assets 37. Net income divided by average total assets is equal to the: A. Profit margin B. Total asset turnover C. Return on total assets D. Days' income in assets E. Current ratio 38. Corona Company's balance sheet accounts follow: At December 31 2014 2013 2012 Assets Cash $25,868 $31,163 $31,182 Accounts receivable, net 78,034 53,995 41,152 Merchandise inventory 95,120 73,491 46,095 Prepaid expenses 8,330 8,099 3,429 Plant assets, net 241,854 218,932 199,542 Total assets $449,206 $385,680 $321,400 Liabilities and Equity Accounts payable $108,058 $67,135 $42,849 Long-term notes payable secured by mortgages on plant assets 85,791 87,819 71,029 Common stock, $10 par value 162,500 162,500 162,500 Retained earnings 92,857 68,226 45,022 Total liabilities and equity $449,206 $385,680 $321,400 ________________________________________ What is Corona Company’s debt to equity ratio for 2013? A. 1.49 B. .71 C. .40 D. 4.39 E. .67 39. Corona Company's balance sheet accounts follow: At December 31 2014 2013 2012 Assets Cash $25,868 $31,163 $31,182 Accounts receivable, net 78,034 53,995 41,152 Merchandise inventory 95,120 73,491 46,095 Prepaid expenses 8,330 8,099 3,429 Plant assets, net 241,854 218,932 199,542 Total assets $449,206 $385,680 $321,400 Liabilities and Equity Accounts payable $108,058 $67,135 $42,849 Long-term notes payable secured by mortgages on plant assets 85,791 87,819 71,029 Common stock, $10 par value 162,500 162,500 162,500 Retained earnings 92,857 68,226 45,022 Total liabilities and equity $449,206 $385,680 $321,400 ________________________________________ What is Corona Company’s days’ sales uncollected ratio for 2014 assuming net sales and gross profit for the period were $1,236,783, $927,587 respectively? A. 25.20 B. 23.03 C. 20.99 D. 24.58 E. 22.17 40. Corona Company's balance sheet accounts follow: At December 31 2014 2013 2012 Assets Cash $25,868 $31,163 $31,182 Accounts receivable, net 78,034 53,995 41,152 Merchandise inventory 95,120 73,491 46,095 Prepaid expenses 8,330 8,099 3,429 Plant assets, net 241,854 218,932 199,542 Total assets $449,206 $385,680 $321,400 Liabilities and Equity Accounts payable $108,058 $67,135 $42,849 Long-term notes payable secured by mortgages on plant assets 85,791 87,819 71,029 Common stock, $10 par value 162,500 162,500 162,500 Retained earnings 92,857 68,226 45,022 Total liabilities and equity $449,206 $385,680 $321,400 ________________________________________ What is Corona Company’s current ratio for 2014? A. 1.96 B. 2.32 C. 1.07 D. 1.92 E. 2.17 Feedback: Current assets: $25,868 + $78,034 + $95,120 + $8,330 = $207,352 $207,352/$108,058 = 1.92 41. A company’s balance sheet and income statement accounts follow: At December 31 2014 2013 2012 Assets Cash $30,872 $36,086 $37,974 Accounts receivable, net 89,476 63,151 50,632 Merchandise inventory 112,499 83,450 54,467 Prepaid expenses 9,942 9,473 4,219 Plant assets, net 291,143 268,126 244,108 Total assets $533,932 $460,286 $391,400 Liabilities and Equity Accounts payable $130,290 $76,233 $50,632 Long-term notes payable secured by mortgages on plant assets 98,372 103,748 107,769 Common stock, $10 par value 142,500 132,500 102,500 Retained earnings 182,770 147,805 130,499 Total liabilities and equity $533,932 $460,286 $391,400 ________________________________________ For Year Ended December 31 2014 2013 Sales $694,112 $547,740 Cost of goods sold $423,408 $356,031 Other operating expenses 215,175 138,578 Interest expense 11,800 12,598 Income taxes 9,023 8,216 Total costs and expenses 659,406 515,423 Net income $34,706 $32,317 Earnings per share $2.14 $1.99 ________________________________________ What is the company’s profit margin ratio for 2014? A. 65% B. 12% C. 3.7% D. 5.9% E. 5.0% 42. The 2013 financial statements of Leggett & Platt, Inc. include the following information in a footnote. What are the company’s gross accounts and other receivables at the end of 2013? (in millions) 2013 2012 Allowance for doubtful accounts $15.2 $19.2 Total accounts and other receivables, net $467.4 $446.2 A) $467.4 million B) $471.4 million C) $452 million D) $482.6 million E) None of the above 43. The 2013 financial statements of Leggett & Platt include the accounts receivable footnote: Total accounts and other receivables at December 31 consisted of the following: (in millions) 2013 2012 Total accounts and other receivables $482.6 $465.4 Allowance for doubtful accounts (15.2) (19.2) Total accounts and other receivables, net $467.4 $446.2 The 2013 balance sheet reports total assets of $3,108.1 million. Common-sized gross accounts and other receivables are: A) $467.4 million B) $482.6 million C) 15.5% D) 5.0% E) None of the above 44. At what amount will accounts receivable be reported on the balance sheet if the gross receivable balance is $35,000 and the allowance for uncollectible accounts is estimated at 18% of gross receivables? A) $6,300 B) $41,300 C) $35,000 D) $28,700 45. Fey Corporation has aged its accounts receivable and estimated uncollectible accounts as follows (in thousands). What bad debt expense should the company report for the current period? Age of Receivables AR Balance Estimated % uncollectible Allowance Current $5,500 × 1% $55 30-60 days past due 1,200 × 3% 36 61-90 days past due 850 × 6% 51 Over 90 days past due 420 × 10% 42 A) $55 thousand B) $184 thousand C) $3,030 thousand D) $129 thousand E) There is not enough information to determine the amount. 46. The 2013 financial statements of BNSF Railway Company report total revenues of $22,014 million, accounts receivable of $1,298 million for 2013 and $1,168 million for 2012. The company’s accounts receivable turnover for the year is: A) 17.0 days B) 8.9 times C) 18.8 days D) 17.9 times E) None of the above 47. The 2013 financial statements of CVS Caremark reported the following information (in millions): CVS Caremark 2013 2012 Net sales $126,761 $123,120 Cost of sales 102,978 100,632 Inventories, net 11,045 11,032 The inventory turnover ratio for 2013 is: A) 9.22 B) 11.48 C) 9.33 D) 8.32 E) None of the above 48. CarMax Inc. reports sales of $10,962,818 thousand and cost of sales of $9,498,456 thousand for the year ended February 28, 2013. The gross profit for the year is: A) $20,461,274 thousand B) $ 1,464,362 thousand C) 86.6% D) 13.4% E) There is not enough information to determine gross profit. 49. Fischer, Inc. had the following inventory in fiscal 2013. The company uses the FIFO method of accounting for inventory. Beginning Inventory, January 1, 2013: 130 units @ $10.00 Purchase 200 units @ $12.00 Purchase 50 units @ $9.00 Purchase 110 units @ $10.50 Ending Inventory, December 31, 2013: 120 units The company’s cost of goods sold for fiscal 2013 is: A) $4,060 B) $4,045 C) $4,105 D) $5,305 E) None of the above 50. An asset is impaired when the asset’s carrying value is: A) Greater than the sum of discounted expected cash flows. B) Less than the sum of discounted expected cash flows. C) Less than the sum of undiscounted expected cash flows. D) Greater than the sum of undiscounted expected cash flows. E) None of the above 51. The 2013 financial statements for BNSF Railway report the following information: Year ended December 31, 2013 2012 (In millions) Revenues $22,014 $20,835 Property and equipment, net 52,363 50,070 Total assets 75,030 72,014 The 2013 property, plant and equipment turnover is: A) 0.39 B) 2.38 C) 0.43 D) 0.70 E) None of the above 52. Central Supply purchased a new printer for $45,000. The printer is expected to operate for nine (9) years, after which it will be sold for salvage value (estimated to be $4,500). How much is the first year’s depreciation expense if the company uses the double-declining-balance method? A) $10,000 B) $ 9,000 C) $ 4,500 D) $ 5,000 E) None of the above 53. One difference between straight-line and double-declining-balance depreciation methods is that: A) Straight-line method will fully depreciate the asset more quickly. B) Double-declining-balance method will fully depreciate the asset more quickly. C) Income taxes paid will be lower under the double-declining-balance method. D) Losses on disposal will be lower under the straight-line method. E) None of the above [Show More]

Last updated: 1 year ago

Preview 4 out of 22 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 13, 2020

Number of pages

22

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 13, 2020

Downloads

0

Views

270