Financial Accounting > EXAM > Florida Atlantic University: ACG3141/ACG 3141 Intermediate Theory 2- Module 5. Includes Homework 2 a (All)

Florida Atlantic University: ACG3141/ACG 3141 Intermediate Theory 2- Module 5. Includes Homework 2 and 3. All worked Solutions and Illustrations. 100%.

Document Content and Description Below

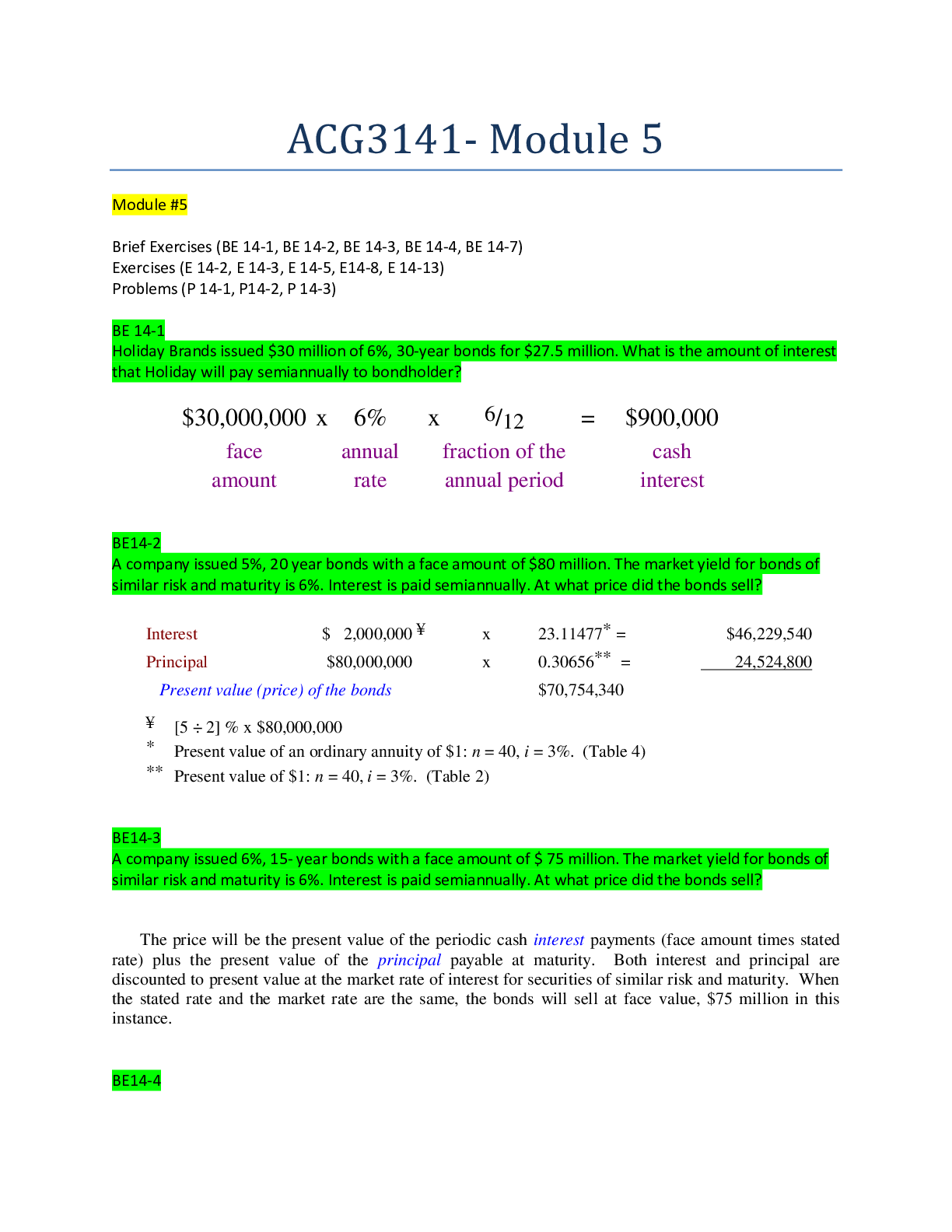

ACG3141- Module 5 Module #5 Brief Exercises (BE 14-1, BE 14-2, BE 14-3, BE 14-4, BE 14-7) Exercises (E 14-2, E 14-3, E 14-5, E14-8, E 14-13) Problems (P 14-1, P14-2, P 14-3) BE 14-1 Holiday ... Brands issued $30 million of 6%, 30-year bonds for $27.5 million. What is the amount of interest that Holiday will pay semiannually to bondholder? BE14-2 A company issued 5%, 20 year bonds with a face amount of $80 million. The market yield for bonds of similar risk and maturity is 6%. Interest is paid semiannually. At what price did the bonds sell? BE14-3 A company issued 6%, 15- year bonds with a face amount of $ 75 million. The market yield for bonds of similar risk and maturity is 6%. Interest is paid semiannually. At what price did the bonds sell? BE14-4 A company issued 5%, 20- year bonds with a face amount of $ 100 million. The market yield for bonds of similar risk and maturity is 4%. Interest is paid semiannually. At what price did the bonds sell? BE14-7 On January 1, a company issued 3%, 20- year bonds with a face amount of $ 80 million for $ 69,033,776 to yield 4%. Interest is paid semiannually. What was the straight- line interest expense on the December 31 annual income statement? Determine the price of a $ 1 million bond issue under each of the following independent assumptions: E14-3 The Bradford Company issued 10% bonds, dated January 1, with a face amount of $ 80 million on January 1, 2013. The bonds mature on December 31, 2022 (10 years). For bonds of similar risk and maturity, the market yield is 12%. Interest is paid semiannually on June 30 and December 31. Required: 1. Determine the price of the bonds at January 1, 2013. 2. Prepare the journal entry to record their issuance by The Bradford Company on January 1, 2013. 3. Prepare the journal entry to record interest on June 30, 2013 ( at the effective rate). 4. Prepare the journal entry to record interest on December 31, 2013 ( at the effective rate). Myriad Solutions, Inc., issued 10% bonds, dated January 1, with a face amount of $ 320 million on January 1, 2013 for $ 283,294,720. The bonds mature on December 31, 2022 ( 10 years). For bonds of similar risk and maturity the market yield is 12%. Interest is paid semiannually on June 30 and December 31. Required: 1. What would be the net amount of the liability Myriad would report in its balance sheet at December 31, 2013? 2. What would be the amount related to the bonds that Myriad would report in its income statement for the year ended December 31, 2013? 3. What would be the amount( s) related to the bonds that Myriad would report in its statement of cash flows for the year ended December 31, 2013? Universal Foods issued 10% bonds, dated January 1, with a face amount of $ 150 million on January 1, 2013. The bonds mature on December 31, 2027 (15 years). The market rate of interest for similar issues was 12%. Interest is paid semiannually on June 30 and December 31. Universal uses the straight- line method. (Note: This is a variation of the previous exercise modified to consider the investor’s perspective.) Universal Foods sold the entire bond issue described in the previous exercise to Wang Communications. Required: 1. Prepare the journal entry to record the purchase of the bonds by Wang Communications on January 1, 2013. 2. Prepare the journal entry to record interest revenue on June 30, 2013. 3. Prepare the journal entry to record interest revenue on December 31, 2020. E14-13 Federal Semiconductors issued 11% bonds, dated January 1, with a face amount of $ 800 million on January 1, 2013. The bonds sold for $ 739,814,813 and mature on December 31, 2032 ( 20 years). For bonds of similar risk and maturity the market yield was 12%. Interest is paid semiannually on June 30 and December 31. Required: 1. Prepare the journal entry to record their issuance by Federal on January 1, 2013. 2. Prepare the journal entry to record interest on June 30, 2013 ( at the effective rate). 3. Prepare the journal entry to record interest on December 31, 2013 ( at the effective rate). 4. At what amount will Federal report the bonds among its liabilities in the December 31, 2013, balance sheet? On January 1, 2013, Instaform, Inc., issued 10% bonds with a face amount of $ 50 million, dated January 1. The bonds mature in 2032 ( 20 years). The market yield for bonds of similar risk and maturity is 12%. Interest is paid semiannually. Required: 1. Determine the price of the bonds at January 1, 2013, and prepare the journal entry to record their issuance by Instaform. 2. Assume the market rate was 9%. Determine the price of the bonds at January 1, 2013, and prepare the journal entry to record their issuance by Instaform. 3. Assume Broadcourt Electronics purchased the entire issue in a private placement of the bonds. Using the data in requirement 2, prepare the journal entry to record the purchase by Broadcourt. Required: 1. What amount( s) related to the bonds would Baddour report in its balance sheet at September 30, 2013? 2. What amount( s) related to the bonds would Baddour report in its income statement for the year ended September 30, 2013? 3. What amount( s) related to the bonds would Baddour report in its statement of cash flows for the year ended September 30, 2013? In which section( s) should the amount( s) appear? On January 1, 2013, Bradley Recreational Products issued $ 100,000, 9%, four- year bonds. Interest is paid semi-annually on June 30 and December 31. The bonds were issued at $ 96,768 to yield an annual return of 10%. Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule by the straight- line method. 3. Prepare the journal entries to record interest expense on June 30, 2015, by each of the two approaches. HOMEWORK #2 BE14-10, E14-18, + P14 (12-13) BE14-10 On January 1, a company borrowed cash by issuing a $ 300,000, 5%, installment note to be paid in three equal payments at the end of each year beginning December 31. What would be the amount of each installment? Prepare the journal entry for the second installment payment. E14-18 American Food Services, Inc., acquired a packaging machine from Barton and Barton Corporation. Barton and Barton completed construction of the machine on January 1, 2013. In payment for the $ 4 million machine, American Food Services issued a four- year installment note to be paid in four equal payments at the end of each year. The payments include interest at the rate of 10%. Required: 1. Prepare the journal entry for American Food Services’ purchase of the machine on January 1, 2013. 2. Prepare an amortization schedule for the four- year term of the installment note. 3. Prepare the journal entry for the first installment payment on December 31, 2013. 4. Prepare the journal entry for the third installment payment on December 31, 2015. P14-12 At the beginning of 2013, VHF Industries acquired a machine with a fair market value of $ 6,074,700 by issuing a four- year, noninterest- bearing note in the face amount of $ 8 million. The note is payable in four annual install-ments of $ 2 million at the end of each year. Required: 1. What is the effective rate of interest implicit in the agreement? 2. Prepare the journal entry to record the purchase of the machine. 3. Prepare the journal entry to record the first installment payment at December 31, 2013. 4. Prepare the journal entry to record the second installment payment at December 31, 2014. 5. Suppose the market value of the machine was unknown at the time of purchase, but the market rate of interest for notes of similar risk was 11%. Prepare the journal entry to record the purchase of the machine. P14-13 Braxton Technologies, Inc., constructed a conveyor for A& G Warehousers that was completed and ready for use on January 1, 2013. A& G paid for the conveyor by issuing a $ 100,000, four- year note that specified 5% interest to be paid on December 31 of each year, and the note is to be repaid at the end of four years. The conveyor was custom- built for A& G, so its cash price was unknown. By comparison with similar transactions it was deter-mined that a reasonable interest rate was 10%. Required: 1. Prepare the journal entry for A& G’s purchase of the conveyor on January 1, 2013. 2. Prepare an amortization schedule for the four- year term of the note. 3. Prepare the journal entry for A& G’s third interest payment on December 31, 2015. 4. If A& G’s note had been an installment note to be paid in four equal payments at the end of each year begin-ning December 31, 2013, what would be the amount of each installment? 5. Prepare an amortization schedule for the four- year term of the installment note. 6. Prepare the journal entry for A& G’s third installment payment on December 31, 2015. HOMEWORK #3 BE 14-11, E 14-21, E 14-22, P 14-14, P 14-15, P 14-17 BE14-11 A company retired $ 60 million of its 6% bonds at 102 ($ 61.2 million) before their scheduled maturity. At the time, the bonds had a remaining discount of $ 2 million. Prepare the journal entry to record the redemption of the bonds. Brief Exercise 14–11 ($ in millions) Bonds payable (face amount) 60.0 Loss on early extinguishment (to balance) 3.2 Discount on bonds (given) 2.0 Cash ($60,000,000 x 102%) 61.2 E14-21 The balance sheet of Indian River Electronics Corporation as of December 31, 2012, included 12.25% bonds having a face amount of $ 90 million. The bonds had been issued in 2005 and had a remaining discount of $ 3 million at December 31, 2012. On January 1, 2013, Indian River Electronics called the bonds before their scheduled maturity at the call price of 102. Required: Prepare the journal entry by Indian River Electronics to record the redemption of the bonds at January 1, 2013. P 14-14 Three years ago American Insulation Corporation issued 10 percent, $ 800,000, 10- year bonds for $ 770,000. Debt issue costs were $ 3,000. American Insulation exercised its call privilege and retired the bonds for $ 790,000. The corporation uses the straight- line method both to determine interest and to amortize debt issue costs. P 14-15 The long- term liability section of Twin Digital Corporation’s balance sheet as of December 31, 2012, included 12% bonds having a face amount of $ 20 million and a remaining discount of $ 1 million. Disclosure notes indi-cate the bonds were issued to yield 14%. Interest expense is recorded at the effective interest rate and paid on January 1 and July 1 of each year. On July 1, 2013, Twin Digital retired the bonds at 102 ($ 20.4 million) before their scheduled maturity. Required: 1. Prepare the journal entry by Twin Digital to record the semiannual interest on July 1, 2013. 2. Prepare the journal entry by Twin Digital to record the redemption of the bonds on July 1, 2013. P14-16 The long- term liability section of Twin Digital Corporation’s balance sheet as of December 31, 2012, included 12% bonds having a face amount of $ 20 million and a remaining discount of $ 1 million. Disclosure notes indi-cate the bonds were issued to yield 14%. Interest expense is recorded at the effective interest rate and paid on January 1 and July 1 of each year. On July 1, 2013, Twin Digital retired the bonds at 102 ($ 20.4 million) before their scheduled maturity. Required: 1. Prepare the journal entry by Twin Digital to record the semiannual interest on July 1, 2013. 2. Prepare the journal entry by Twin Digital to record the redemption of the bonds on July 1, 2013. [Show More]

Last updated: 2 years ago

Preview 1 out of 24 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 13, 2020

Number of pages

24

Written in

Additional information

This document has been written for:

Uploaded

Oct 13, 2020

Downloads

0

Views

104

.png)