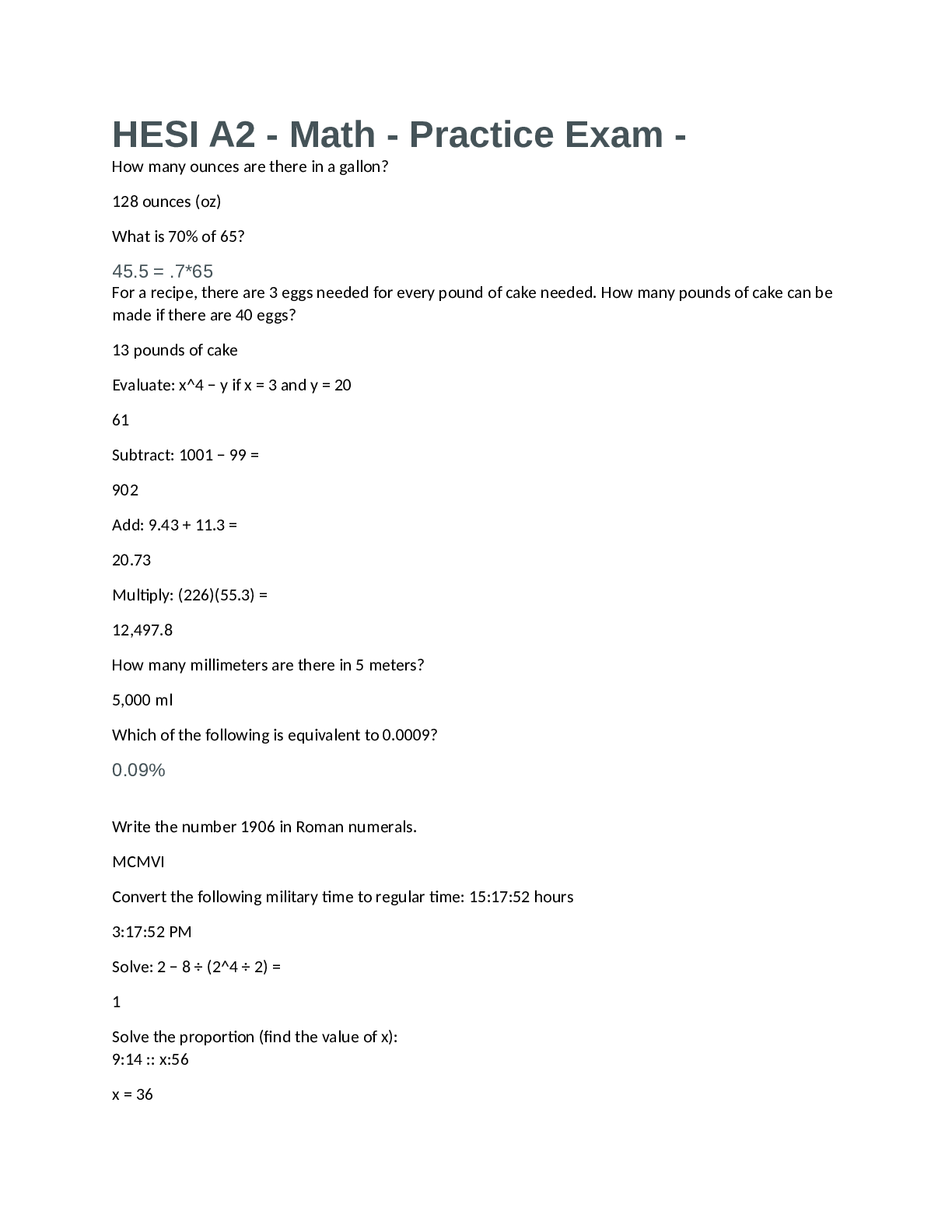

HEALTH SCI Bio1011 - HESI A2 - Math - Practice Exam.

$ 12

Pearson Edexcel Level 3 GCEOCRArabicPaper 1: Translation into English, reading comprehension and writing (research question) in Arabic

$ 11

Pearson Edexcel Advanced Level In Arabic (9AA0/02) Paper 2 Mark Scheme: Translation into Arabic and written response to worksOCRNovember 2021

$ 9.5

Cambridge International AS & A Level_Chemistry_9701/52 Question Paper_Feb/March 2021 | Paper 5 Planning, Analysis and Evaluation

$ 7.5

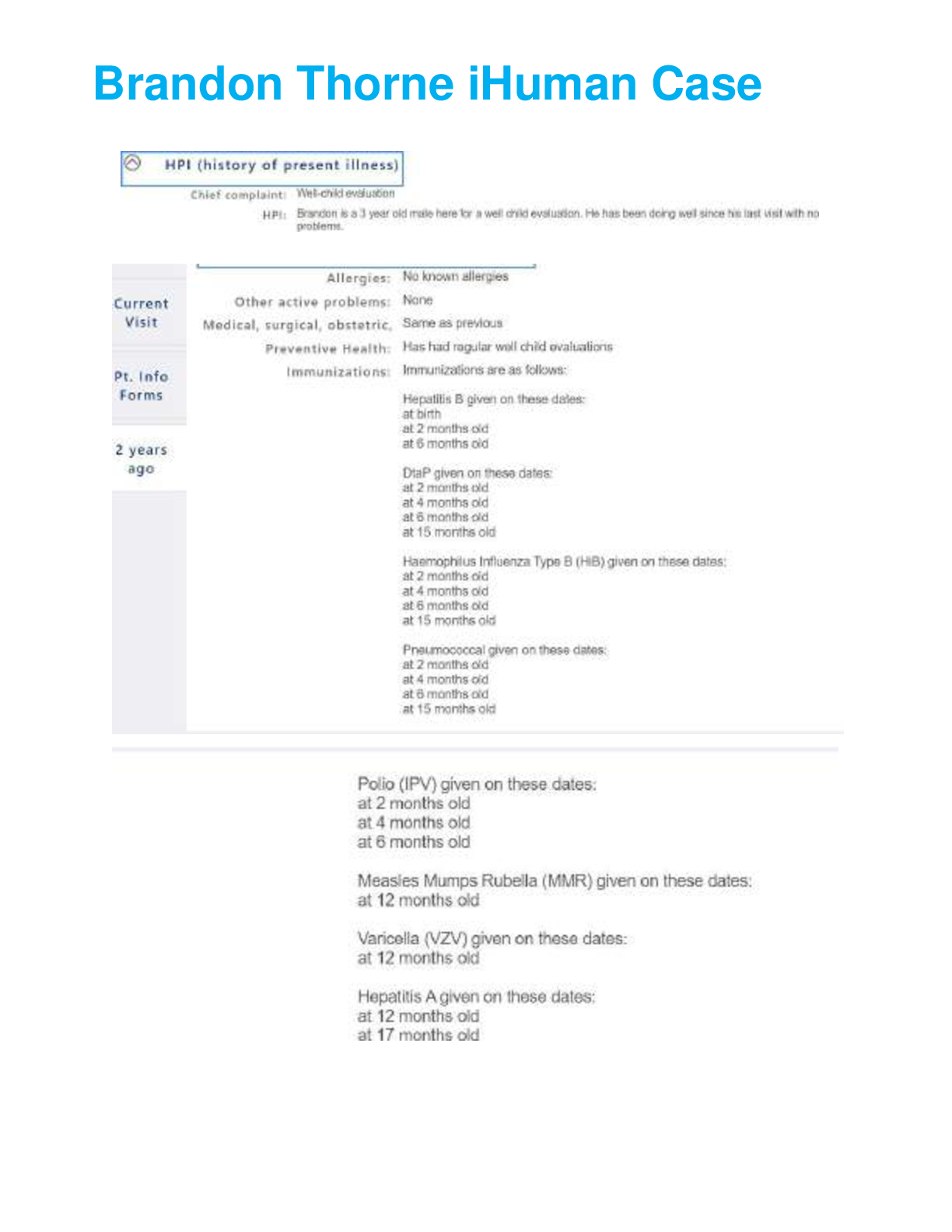

Brandon Thorne iHuman Case| Comprehensive Solutions

$ 15

AQA A-level CHEMISTRY 7405/2 JUNE 2022 FINAL MARK SCHEME >Organic and Physical Chemistry

$ 17

.png)

Module 09 Comprehensive Assessment-Tina Jones with complete solution

$ 6

UPenn BUSINESS OPERATIONS MANAGEMENT REVIEW EXAM Q & A 2024