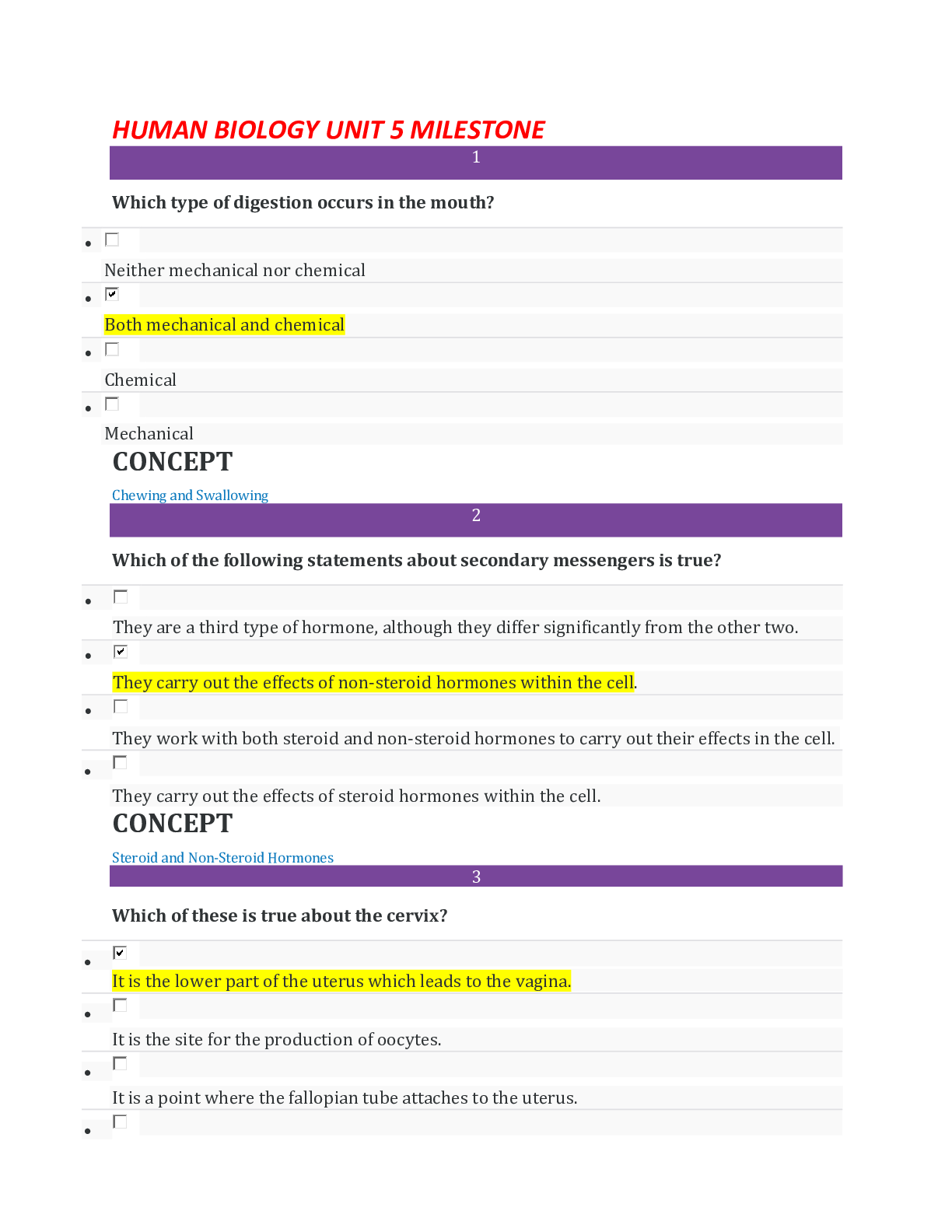

Stan was recently hired by a large corporation as a financial manager.

Which of the following is NOT considered to be one of his primary responsibilities?

• Stan analyzed returns for long-term investments.

• Stan fo

...

Stan was recently hired by a large corporation as a financial manager.

Which of the following is NOT considered to be one of his primary responsibilities?

• Stan analyzed returns for long-term investments.

• Stan forecasted hiring needs due to turnover.

• Stan obtained funding to make needed investments.

• Stan assisted in the risk evaluation process.

2

Which of the following is the basis for financial management?

• Determine the current and future needs of a business

• Fund potential investment opportunities for a business

• Develop accounting documentation for a business

• Minimize risks taken by a business

3

Which of the following can investors use to evaluate a company's potential earning power?

• Debt to owner's equity ratio

• Asset to liabilities ratio

• Earnings per share

• Current ratio

4

Which of the following is true regarding risk management?

• Large companies are more likely to require risk management plans.

• Pure risk typically results in potential gains for an organization.

• Large and small companies need to manage issues with speculative risks.

• Speculative risks are usually associated with natural disasters.

5

Which of the following is true regarding reserve requirements?

• Higher reserve requirements mean banks have less money to lend.

• Lower reserve requirements mean consumers have more difficulty borrowing money.

• Lower reserve requirements mean banks must hold more money in cash or deposit.

• Higher reserve requirements mean banks have more money to lend.

6

Darren believed in saving money and followed a strict monthly budget. He wanted to invest his savings in a safe option that paid more than his savings account and he was content with earning a lower, consistent amount of money. He did not want to worry about losing any money with market changes.

Which type of investment below should Darren consider?

• New stock offerings

• Junk bonds

• CDs

• Business startups

7

Which of the types of companies below is more likely to use secured short term financing?

• A company that provides services rather than products

• A company with a poor credit rating

• A company that has little collateral to provide to obtain a loan

• A company with an excellent credit history

8

A balance sheet provides which of the following?

• A snapshot of a company's financial situation

• The amount of cash going in and out of a business

• The money earned or lost by a business for a set time period

• A record of the company's operating expenses

9

Green Opt Inc. needed long term funding for a major expansion into the European market. The company was financially strong with an excellent credit rating and had no need to provide collateral to obtain funding. It also had time to develop the best funding option to meet its expansion needs.

Which type of financing option below will Green Opt Inc. likely use?

• Long term loan

• Trade credit

• Debenture bond

• Mortgage bond

10

Which of the types of short term loans below requires the borrower to pay a specific amount of money to the lender on a specific date?

• Trade credit

• Promissory note

• Debenture bond

• Mortgage bond

11

Which of the following best illustrates risk retention?

• A company makes a contractual agreement with another company to share the liability on a new project.

• A company decides not to participate in a venture that has high risks.

• A company installs fire detection devices in all of its office buildings.

• A company creates a reserve fund to handle possible financial problems that could occur.

12

Which of the following does a high debt to owner's equity ratio signal?

• The company is not credit worthy.

• The company assumes too much risk.

• The company is able to pay off current debts.

• The company relies too much on debt.

13

A financial institution and a business establish an arrangement that defines a maximum loan balance the institution allows the business to maintain.

What banking service is this an example of?

• Certificate of deposit

• Line of credit

• Revolving credit

• Letter of credit

14

Which of the following best describes the Federal Reserve?

• It provides loans to different organizations.

• It takes deposits from consumers.

• It backs insurance policies that protect businesses.

• It serves as a bank for the government.

15

When a credit-worthy business takes on an unsecured, short term loan, which kind of interest rate below will it likely be charged?

• Annual percentage rate

• Prime percentage rate

• Discount rate

• Prime percentage rate plus a percent

16

Which of the following is a characteristic of common stock?

• Owners of common stock are paid earnings before other investors.

• Owners of common stock pay a higher capital gains tax than other investors.

• Owners of common stock are the last group of investors to be paid earnings.

• Owners of common stock have voting rights for all company issues.

17

Select the item below that would NOT be included in the M2 money supply.

• Savings account

• Common stock

• Cash

• Certificate of deposit

18

Loraine was a successful businesswoman who earned her initial wealth in the real estate market. She was also an avid outdoor enthusiast, particularly water sports. She invested her own money in a startup business that created a new type of lightweight kayak.

Which of the following investor types is Loraine?

• Personal investor

• Angel investor

• Lending institution

• Venture capitalist

19

Financial accounting is different from managerial accounting in which of the following ways?

• Financial accounting is used by an organization to make financial plans for the future.

• Financial accounting provides financial information to people outside of an organization.

• Financial accounting involves creating financial documents for people to use within an organization.

• Financial accounting sets the performance goals for every division within a business.

20

Select the institution below that provides loan services but does NOT accept deposits.

• Credit union

• Security and investment dealer

• Mutual savings bank

• Commercial bank

[Show More]