Financial Accounting > QUESTIONS & ANSWERS > Excel Workbook > Strayer University ACC 303. All Questions Answered (All)

Excel Workbook > Strayer University ACC 303. All Questions Answered

Document Content and Description Below

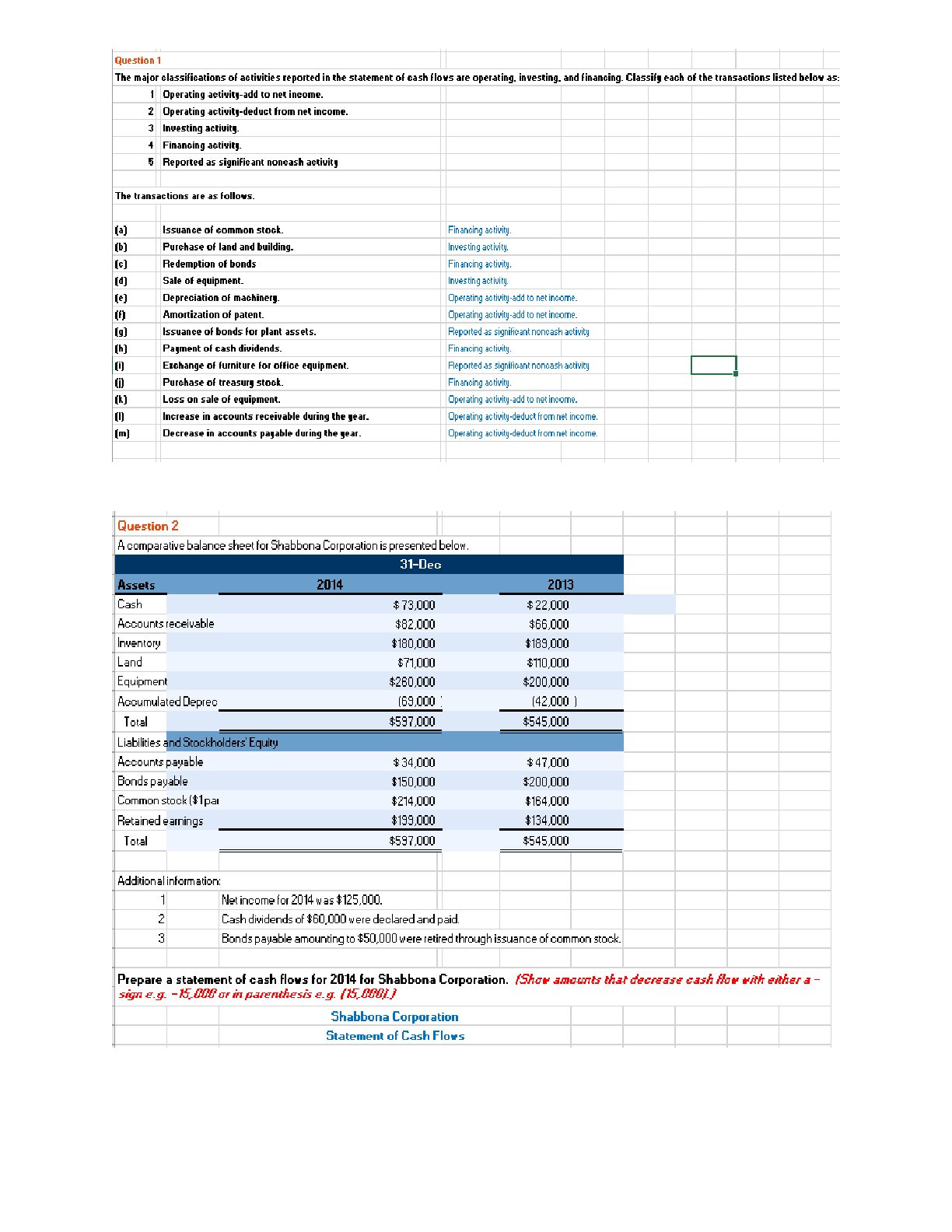

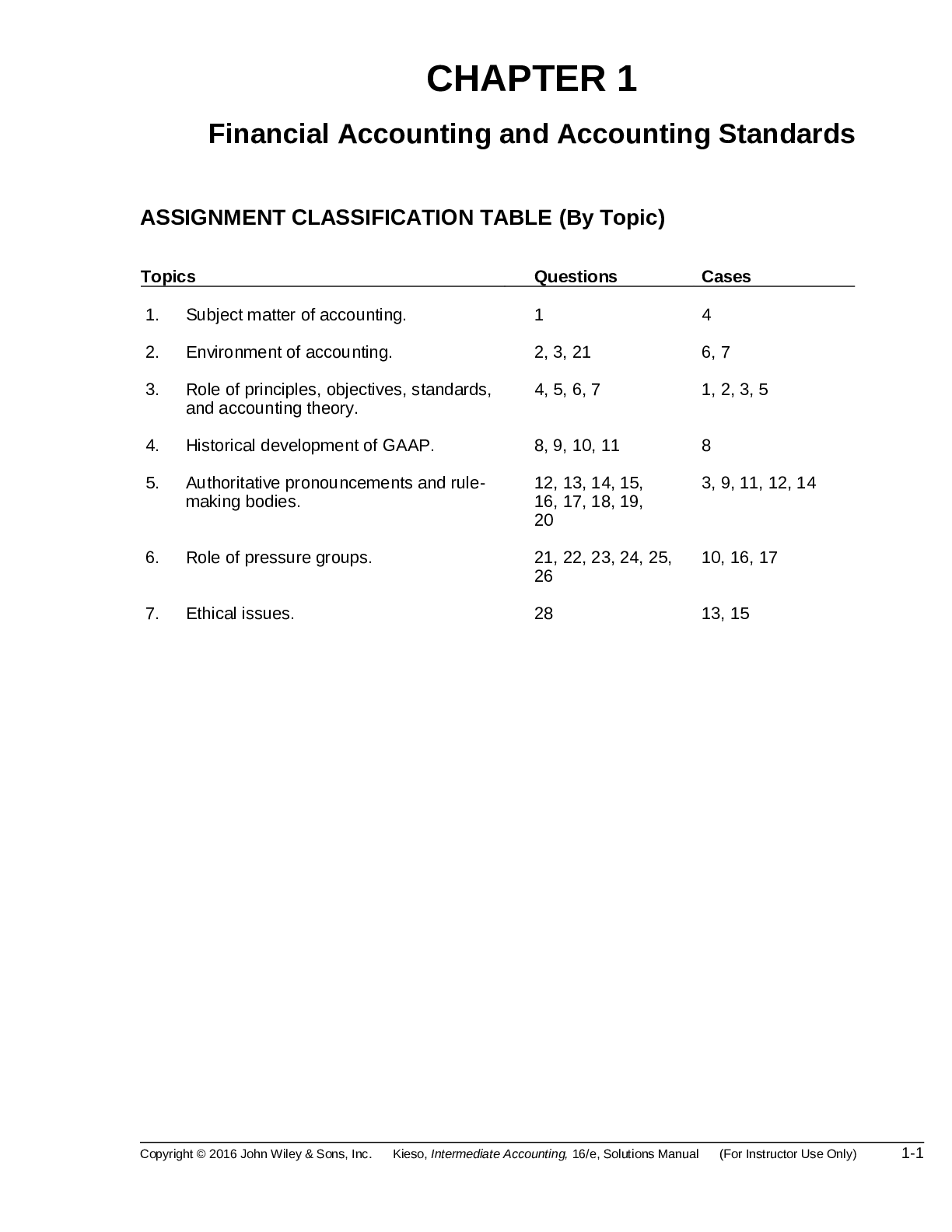

Question 1 | The major classifications of activities reported in the statement of cash flows are operating, investing, and financing. Classify each of the transactions listed below as: | 1 | | O... perating activity-add to net income. | 2 | | Operating activity-deduct from net income. | 3 | | Investing activity. | 4 | | Financing activity. | 5 | | Reported as significant noncash activity Question 2: A comparative balance sheet for Shabbona Corporation is presented below. Additional information: | 1 | | Net income for 2014 was $125,000. | 2 | | Cash dividends of $60,000 were declared and paid. | 3 | | Bonds payable amounting to $50,000 were retired through issuance of common stock. | | Prepare a statement of cash flows for 2014 for Shabbona Corporation. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) | Question 3 | Each of the following items must be considered in preparing a statement of cash flows (indirect method) for Turbulent Indigo Inc. for the year ended December 31, 2014. State where each item is to be shown in the statement of cash flows, if at all. | (a) | Plant assets that had cost $20,000 6 years before and were being depreciated on a straight-line basis over 10 years with no estimated scrap value were sold for $5,300. | (b) | During the year, 10,000 shares of common stock with a stated value of $10 a share were issued for $43 a share. | (c) | Uncollectible accounts receivable in the amount of $27,000 were written off against Allowance for Doubtful Accounts. | (d) | The company sustained a net loss for the year of $50,000. Depreciation amounted to $22,000, and a gain of | (e) | A 3-month U.S. Treasury bill was purchased for $100,000. The company uses a cash and cash-equivalent basis for its cash flow statement. | (f) | Patent amortization for the year was $20,000. | (g) | The company exchanged common stock for a 70% interest in Tabasco Co. for $900,000. | (h) | During the year, treasury stock costing $47,000 was purchased. Question 4 Condensed financial data of Pat Metheny Company for 2014 and 2013 are presented below. | Question 5 | Condensed financial data of Pat Metheny Company for 2014 and 2013 are presented below. [Show More]

Last updated: 2 years ago

Preview 1 out of 2 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 04, 2022

Number of pages

2

Written in

Additional information

This document has been written for:

Uploaded

Apr 04, 2022

Downloads

0

Views

143

(1).png)