Financial Accounting > QUESTIONS & ANSWERS > DeVry University, Keller Graduate School of Management ACCT 555. Week 5 Homework Chapters 13, 14 & 1 (All)

DeVry University, Keller Graduate School of Management ACCT 555. Week 5 Homework Chapters 13, 14 & 16 Problems 13-22-24, 14-21-23, 16-20-22, 24. Questions and Answers.

Document Content and Description Below

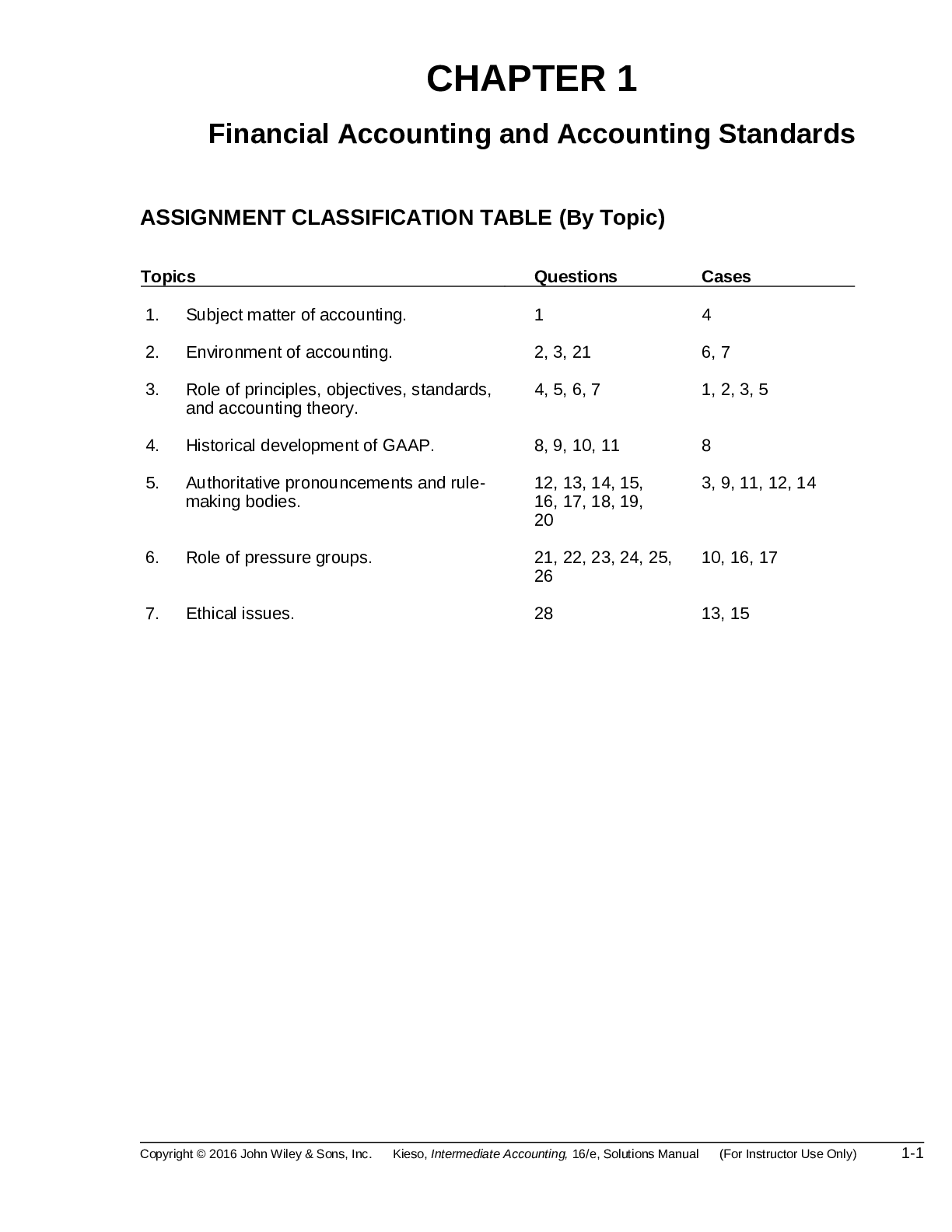

DeVry University, Keller Graduate School of Management ACCT 555. Week 5 Homework Chapters 13, 14 & 16 Problems 13-22-24, 14-21-23, 16-20-22, 24. Questions and Answers. Week 5 Homework Chapters 13, 14... & 16 Problems 13-22-24, 14-21-23, 16-20-22, 24 Chapter 13 13-22 The following questions concern types of audit tests. Choose the best response. a.The auditor looks for an indication on duplicate sales invoices to see whether the invoices have been verified. This is an example of (1) A test of details of balances. (2) A test of control. (3) A substantive test of transactions. (4) Both a test of control and a substantive test of transactions. b. Analytical procedures may be classified as being primarily (1) Tests of controls. (2) Substantive tests. (3) Tests of ratios. (4) Tests of details of balances. c.The auditor faces a risk that the audit will not detect material misstatements that occur in the accounting process. To minimize this risk, the auditor relies primarily on (1) Substantive tests. (2) Tests of controls. (3) Internal control. (4) Statistical analysis. d. A conceptually logical approach to the auditor’s evaluation of internal control consists of the following four steps: I. Determining the internal controls that should prevent or detect errors and fraud. II. Identifying control deficiencies to determine their effect on the nature, timing, or extent of auditing procedures to be applied and suggestions to be made to the client. III. Determining whether the necessary internal control procedures are prescribed and are being followed satisfactorily. IV. Considering the types of errors and fraud that can occur.What should be the order in which these four steps are performed? (1) I, II, III, and IV (2) I, III, IV, and II (3) III, IV, I, and II (4) IV, I, III, and II 13-23 The following questions deal with the tests of controls. Choose the best response. a.Which of the following statements about tests of controls is most accurate? (1) Auditing procedures cannot concurrently provide both evidence of the effectiveness of internal control procedures and evidence required for substantive tests. (2) Tests of controls include observations of the proper segregation of duties. (3) Tests of controls provide direct evidence about monetary misstatements in transactions. (4) Tests of controls ordinarily should be performed as of the balance sheet date or during the period subsequent to that date. b. To support the auditor’s initial assessment of control risk below maximum, the auditor performs procedures to determine that internal controls are operating effectively. Which of the following audit procedures is the auditor performing? (1) Test of details of balances (2) Substantive tests of transactions (3) Tests of controls (4) Tests of trends and ratios c.The primary objective of performing tests of controls is to obtain (1) A reasonable degree of assurance that the client’s internal controls are operating effectively on a consistent basis throughout the year. (2) Sufficient, appropriate audit evidence to afford a reasonable basis for the auditor’s opinion, without the need for additional evidence. (3) Assurances that informative disclosures in the financial statements are reasonably adequate. (4) Knowledge and understanding of the client’s prescribed procedures and methods. d. Which of the following is ordinarily considered a test of control audit procedure? (1) Sending confirmation letters to banks. (2) Counting and listing cash on hand. (3) Examining signatures on checks. (4) Preparing reconciliations of bank accounts as of the balance sheet date.13-24 The following are 11 audit procedures taken from an audit program: 1. Foot the accounts payable trial balance and compare the total with the general ledger. a. Tests of details of balances b. Reperformance 2. Examine vendors’ invoices to verify the ending balance in accounts payable. a. Tests of details of balances b. Documentation 3. Compare the balance in payroll tax expense with previous years. The comparison takes the increase in payroll tax rates into account. a. Analytical procedure b. Analytical procedures 4. Examine the internal auditor’s initials on monthly bank reconciliations as an indication of whether they have been reviewed. a. Test of controls b. Documentation 5. Examine vendors’ invoices and other documentation in support of recorded transactions in the acquisitions journal. a. Substantive test of transactions b. Documentation 6. Multiply the commission rate by total sales and compare the result with commission experience. a. Analytical procedure b. Analytical procedure 7. Examine vendors’ invoices and other supporting documents to determine whether large amounts in the repair and maintenance account should be capitalized. a. Tests of details of balances b. Documentation 8. Discuss the duties of the cash disbursements clerk with him and observe whether he has responsibility for handling cash or preparing the bank reconciliation. a. Tests of controls b. Inquiry and observation 9. Confirm accounts payable balances directly with vendors. a. Test of details of balances b. Confirmation10. Account for a sequence of checks in the cash disbursements journal to determine whether any have been omitted. a. Tests of controls b. Documentation 11. Inquire about the accounts payable supervisor’s monthly review of a computergenerated exception report of receiving reports and purchase orders that have not been matched with a vendor invoice. a. Tests of controls b. Inquiry Required a.Indicate whether each procedure is a test of control, substantive test of transactions, analytical procedure, or a test of details of balances. b. Identify the type of evidence for each procedure. Chapter 14 14-21 The following questions deal with internal controls in the sales and collection cycle. Choose the best response. a.When a customer fails to include a remittance advice with a payment, it is common for the person opening the mail to prepare one. Consequently, mail should be opened by which of the following four company employees? (1) Credit manager (2) Sales manager (3) Accounts receivable clerk (4) Receptionist b. A key internal control in the sales and collection cycle is the separation of duties between cash handling and record keeping. The objective most directly associated with this control is to verify that (1) Cash receipts recorded in the cash receipts journal are reasonable. (2) Cash receipts are correctly classified. (3) Recorded cash receipts result from legitimate transactions. (4) Existing cash receipts are recorded. c.Company personnel account for the sequence of shipping documents and verify than an entry for each shipment is included in the sales journal. This control relates most directly to the sales transaction-related audit objective of (1) Occurrence.(2) Accuracy. (3) Completeness. (4) Timing. 14-22 For each of the following types of misstatements (parts a through d), select the control that should have prevented the misstatement: a.A manufacturing company received a substantial sales return in the last month of the year, but the credit memorandum for the return was not prepared until after the auditors had completed their testing. The returned merchandise was included in the physical inventory. (1) Aged trial balance of accounts receivable is prepared. (2) Credit memoranda are prenumbered and all numbers are accounted for. (3) A reconciliation of the trial balance of customers’ accounts with the general ledger control is prepared periodically. (4) Receiving reports are prepared for all materials received and such reports are accounted for on a regular basis. b. Which of the following controls most likely will be effective in offsetting the tendency of sales personnel to maximize sales volume at the expense of high bad debt write-offs? (1) Employees responsible for authorizing sales and bad debt write-offs are denied access to cash. (2) Shipping documents and sales invoices are matched by an employee who does not have the authority to write off bad debts. (3) Employees involved in the credit-granting function are separated from the sales function. (4) Subsidiary accounts receivable records are reconciled to the control account by an employee independent of the authorization of credit. c.A sales invoice for $5,200 was computed correctly but, by mistake, was keyentered as $2,500 to the sales journal and to the accounts receivable master file. The customer remitted only $2,500, the amount on his monthly statement. (1) Prelistings and predetermined totals are used to control postings. (2) Sales invoice numbers, prices, discounts, extensions, and footings are independently checked. (3) The customers’ monthly statements are verified and mailed by a responsible person other than the bookkeeper who prepared them. (4) Unauthorized remittance deductions made by customers or other matters in dispute are investigated promptly by a person independent of the accounts receivable function.d. Copies of sales invoices show different unit prices for apparently identical items. (1) All sales invoices are checked as to all details after their preparation. (2) Differences reported by customers are satisfactorily investigated. (3) Statistical sales data are compiled and reconciled with recorded sales. (4) All sales invoices are compared with the customers’ purchase orders. 14-23 The following questions deal with audit evidence for the sales and collection cycle. Choose the best response. a.An auditor is performing substantive tests of transactions for sales. One step is to trace a sample of debit entries from the accounts receivable master file back to the supporting duplicate sales invoices. What will the auditor intend to establish by this step? (1) Sales invoices represent existing sales. (2) All sales have been recorded. (3) All sales invoices have been correctly posted to customer accounts. (4) Debit entries in the accounts receivable master file are correctly supported by sales invoices. b. To verify that all sales transactions have been recorded, a substantive test of transactions should be completed on a representative sample drawn from (1) Entries in the sales journal. (2) The billing clerk’s file of sales orders. (3) A file of duplicate copies of sales invoices for which all prenumbered forms in the series have been accounted. (4) The shipping clerk’s file of duplicate copies of bills of lading. c.Which audit procedure is most effective in testing credit sales for overstatement? (1) Trace a sample of postings from the sales journal to the sales account in the general ledger. (2) Vouch a sample of recorded sales from the sales journal to shipping documents. (3) Prepare an aging of accounts receivable. (4) Trace a sample of initial sales orders to sales recorded in the sales journal. Chapter 16 16-20 The following questions concern analytical procedures in the sales and collection cycle. Choose the best response.a.As a result of analytical procedures, the auditor determines that the gross profit percentage has declined from 30% in the preceding year to 20% in the current year. The auditor should (1) Express a qualified opinion due to inability of the client company to continue as a going concern. (2) Evaluate management’s performance in causing this decline. (3) Require footnote disclosure. (4) Consider the possibility of a misstatement in the financial statements. b. After a CPA has determined that accounts receivable have increased as a result of slow collections in a “tight money” environment, the CPA will be likely to (1) Increase the balance in the allowance for bad debt account. (2) Review the going concern ramifications. (3) Review the credit and collection policy. (4) Expand tests of collectability. c.In connections with his review of key ratios, the CPA notes that Pyzi had accounts receivable equal to 30 days’ sales at December 31, 2008, and to 45 days’ sales at December 31, 2009. Assuming that there have been no changes in economic conditions, clientele, or sales mix, this change most likely will indicate (1) A steady increase in sales in 2009. (2) An easing of credit policies in 2009. (3) A decrease in accounts receivable relative to sales in 2009. (4) A steady decrease in sales in 2009. 16-21 The following questions deal with confirmation of accounts receivable. Choose the best response. a.The negative form of accounts receivable confirmation request is useful except when (1) Internal control surrounding accounts receivable is considered to be effective. (2) A large number of small balances are involved. (3) The auditor has reason to believe the persons receiving the requests are likely to give them consideration. (4) Individual account balances are relatively large. b. The return of a positive confirmation of accounts receivable without an exception attests to the (1) Collectability of the receivable balance. (2) Accuracy of the receivable balance.(3) Accuracy of the aging of accounts receivable. (4) Accuracy of the allowance for uncollectible accounts. c.In confirming a client’s accounts receivable in prior years, an auditor found that there were many differences between the recorded account balances and the confirmation responses. These differences, which were not misstatements, required substantial time to resolve. In defining the sampling unit for the current year’s audit, the auditor will most likely choose (1) Individual overdue balances. (2) Individual invoices. (3) Small account balances. (4) Large account balances. 16-22 The following questions concern audit objectives and management assertions for accounts receivable. Choose the best response. a.When evaluating the adequacy of the allowance for uncollectible accounts, an auditor reviews the entity’s aging of receivables to support management’s balancerelated assertion of (1) Existence. (2) Completeness. (3) Valuation and allocation. (4) Rights and obligations. b. Which of the following audit procedures will best uncover an understatement of sales and accounts receivable? (1) Test of sample of sales transactions, selecting the sample from prenumbered shipping documents. (2) Test of sample of sales transactions, selecting the sample from sales invoices recorded in the sales journal. (3) Confirm accounts receivable. (4) Review the aged accounts receivable trial balance. 16-24 The following misstatements are sometimes found in the sales and collections cycle’s account balances: 1. Several accounts receivable in the accounts receivable master file are not included in the aged trial balance. a. Completeness b. An independent person should reconcile the accounts receivable master file to the control account periodically. c. Foot the aged trial balance and compare the total to the general ledger.2. One account receivable in the accounts receivable master file is included on the aged trial balance twice. a. Existence b. An independent person should reconcile the accounts receivable master file to the control account periodically c. Foot the aged trial balance and compare the total to the general ledger. 3. Cash received from collections of accounts receivable in the subsequent period is recorded as current period receipts. a. Cutoff b. A company policy that states that at the end of the month the cash cutoff should be reached by recording only the cash amounts received prior to the end of the month. c. The deposits in transit that are shown on the bank reconciliation should be compared to the deposits that reached the bank to determine if the delay is reasonable delayed. 4. The allowance for uncollectible accounts is inadequate because of the client’s failure to reflect depressed economic conditions in the allowance. a. Realizable value b. An analysis of the collectability of accounts receivable should be performed at the end of the year and communicated to the customers to determine the probability of collectability of individual accounts. c. The auditor can compare the year end cash receipts to the previous years’ cash receipts during the same period and look at any changes and their effect on the collectability of the accounts receivable. 5. Several accounts receivable are in dispute as a result of claims of defective merchandise. a. Accuracy b. Claims for defective merchandise should be recorded immediately by the client after the claim has been received to keep the account receivable balances as accurate as possible. c. The client’s correspondence files that come from the customers should be reviewed by the auditor. 6. The pledging of accounts receivable to the bank for a loan is not disclosed in the financial statements. a. Rights and obligations b. A scheduled should be kept containing all the required disclosure information by the controller. c. An inquiry should be kept as to any assets pledged for the indebtedness when the loan confirmations are sent by the auditor. 7. Goods shipped and included in the current period sales were returned in the subsequent period.a. Cutoff b. A record book should be kept to record any returns that apply to goods shipped and sales recorded. c. Recorded returns from the subsequent period should be reviewed by the auditor. 8. Long-term interest-bearing notes receivable from affiliated companies are included in accounts receivable. a. Classification b. Separate accounts should be kept for the receivables collected from affiliated companies. c. The trial balance of accounts receivable should be reviewed by the auditor to determine whether accounts from affiliated companies have been included in the accounts of the customers. 9. The trial balance total does not equal the amount in the general ledger. a. Detail tie-in b. The trial balance should be footed and the total reconciled to the balance in the general ledger. c. Per the general ledger, the trial balance of accounts receivable should be footed by the auditor and reconciled to the balance. Required d. For each misstatement, identify the balance-related audit objective to which it pertains. e.For each misstatement, list an internal control that should prevent it. f. For each misstatement, list one test of details of balances audit procedure that the auditor can use to detect it. [Show More]

Last updated: 2 years ago

Preview 1 out of 10 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 04, 2022

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Apr 04, 2022

Downloads

0

Views

107