Financial Accounting > QUESTIONS & ANSWERS > Homework Ch5. ACC 625 Questions and Answers. (All)

Homework Ch5. ACC 625 Questions and Answers.

Document Content and Description Below

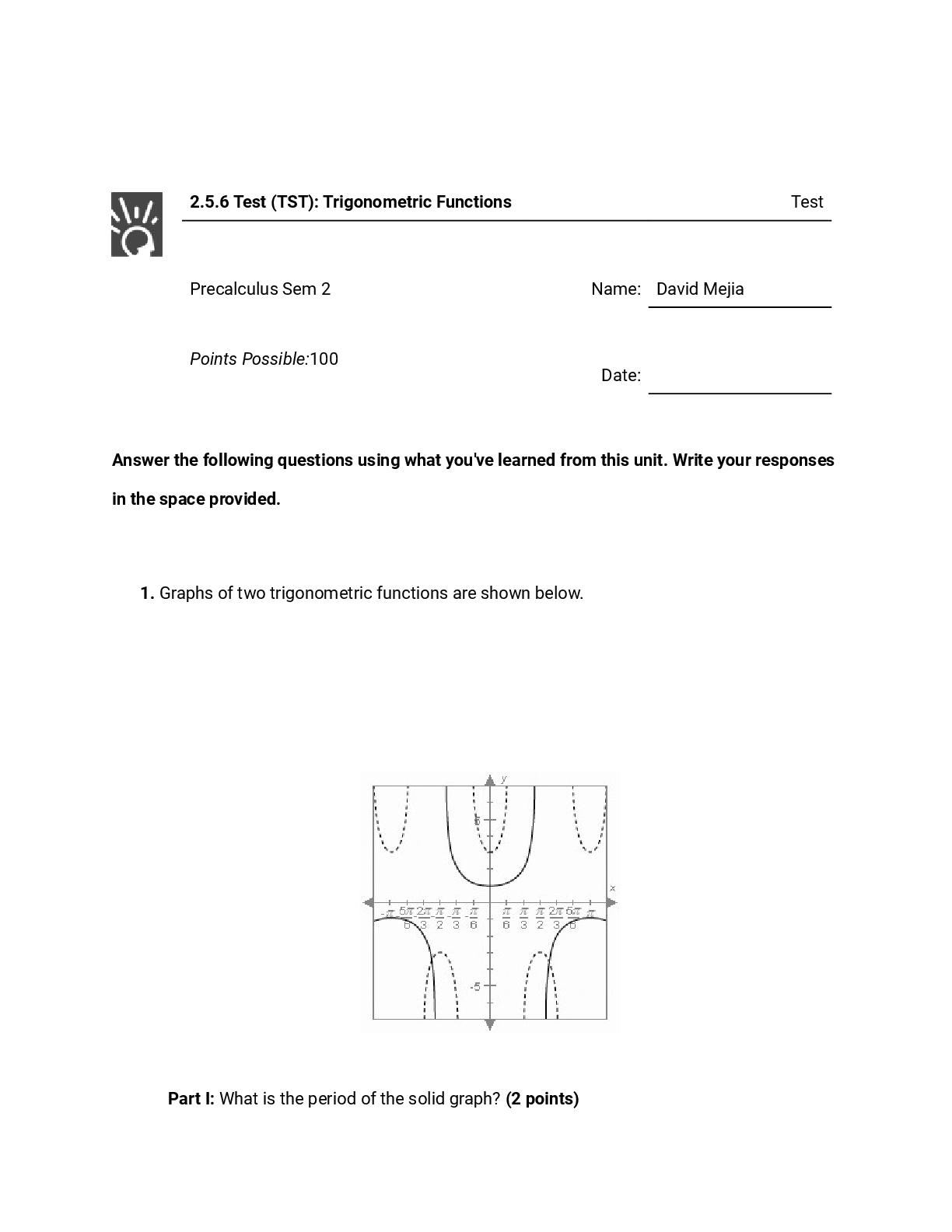

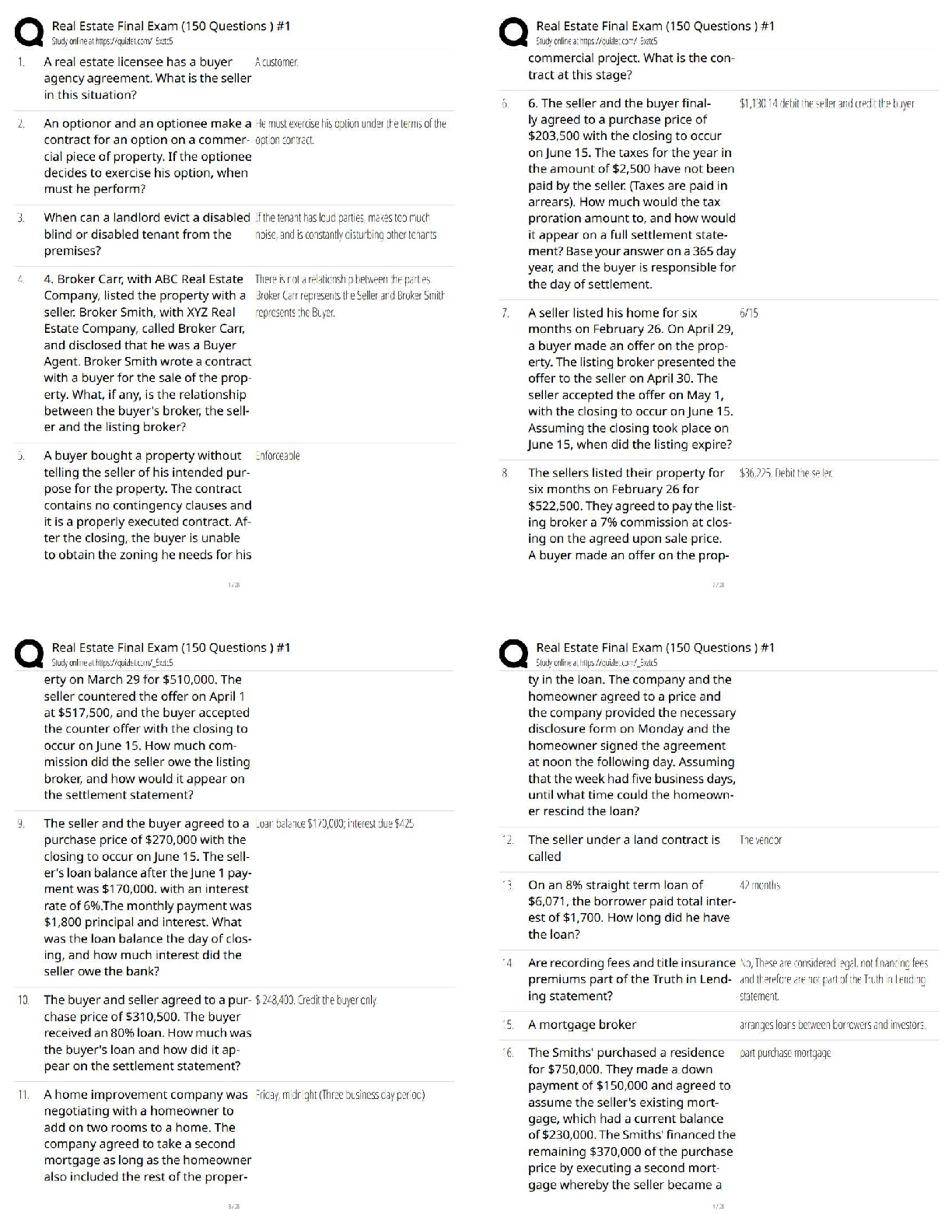

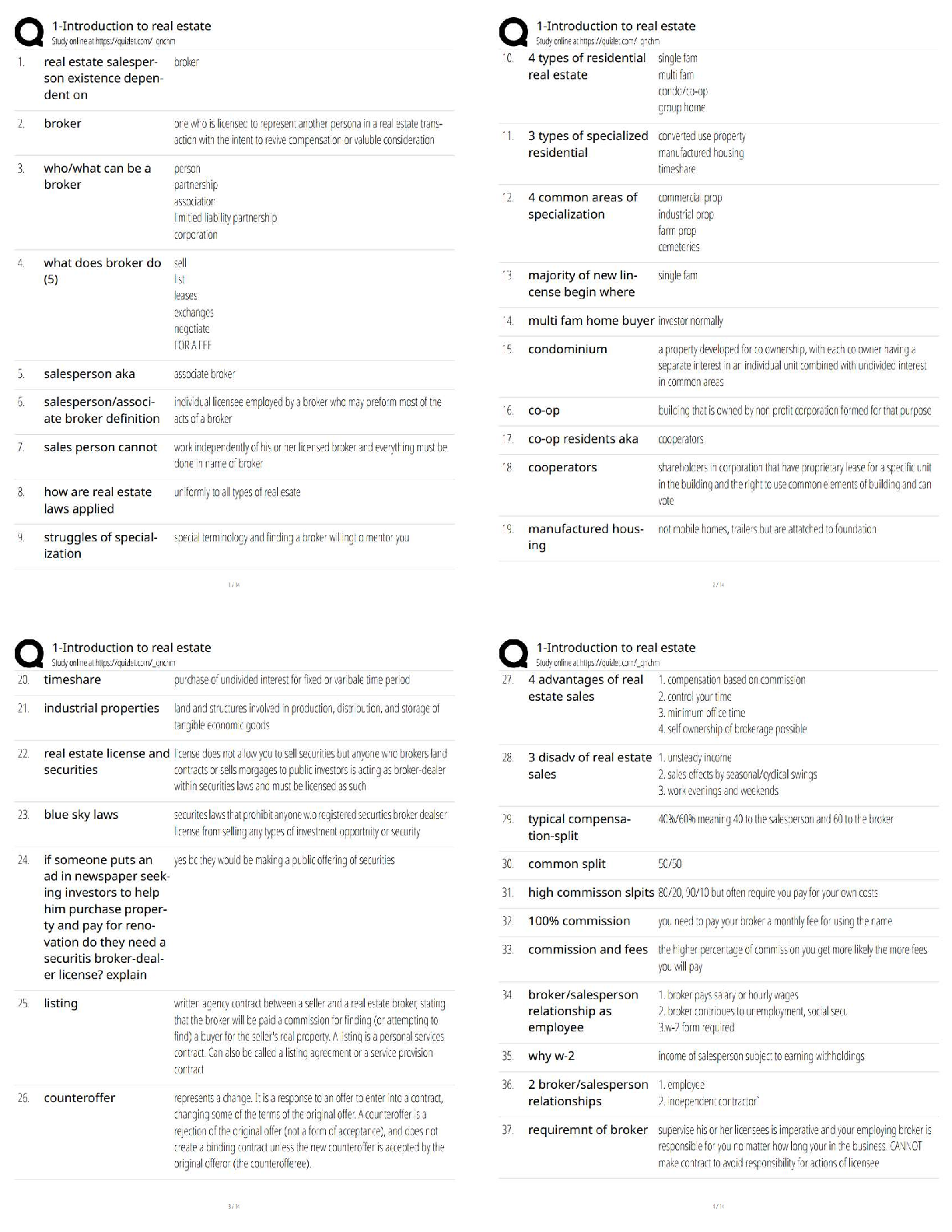

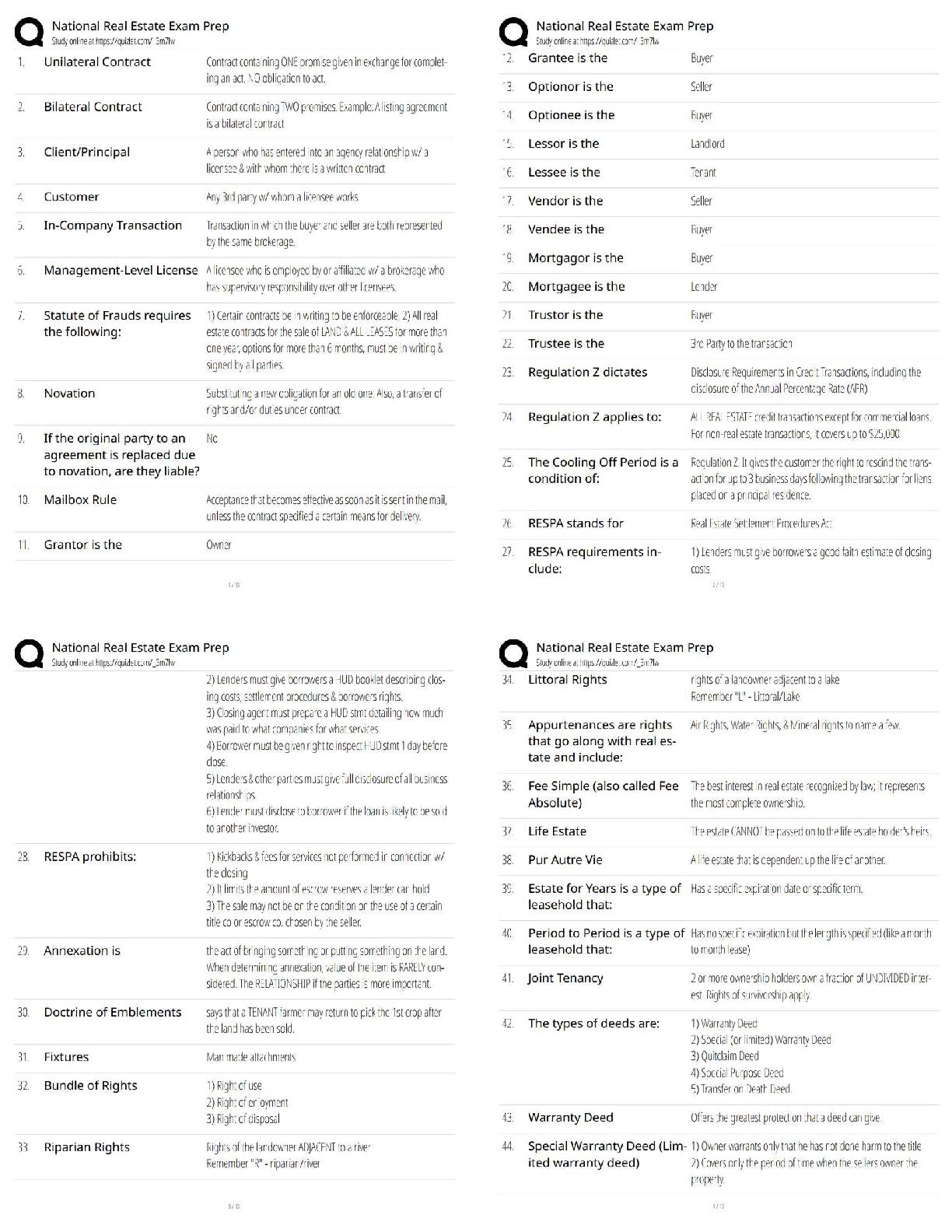

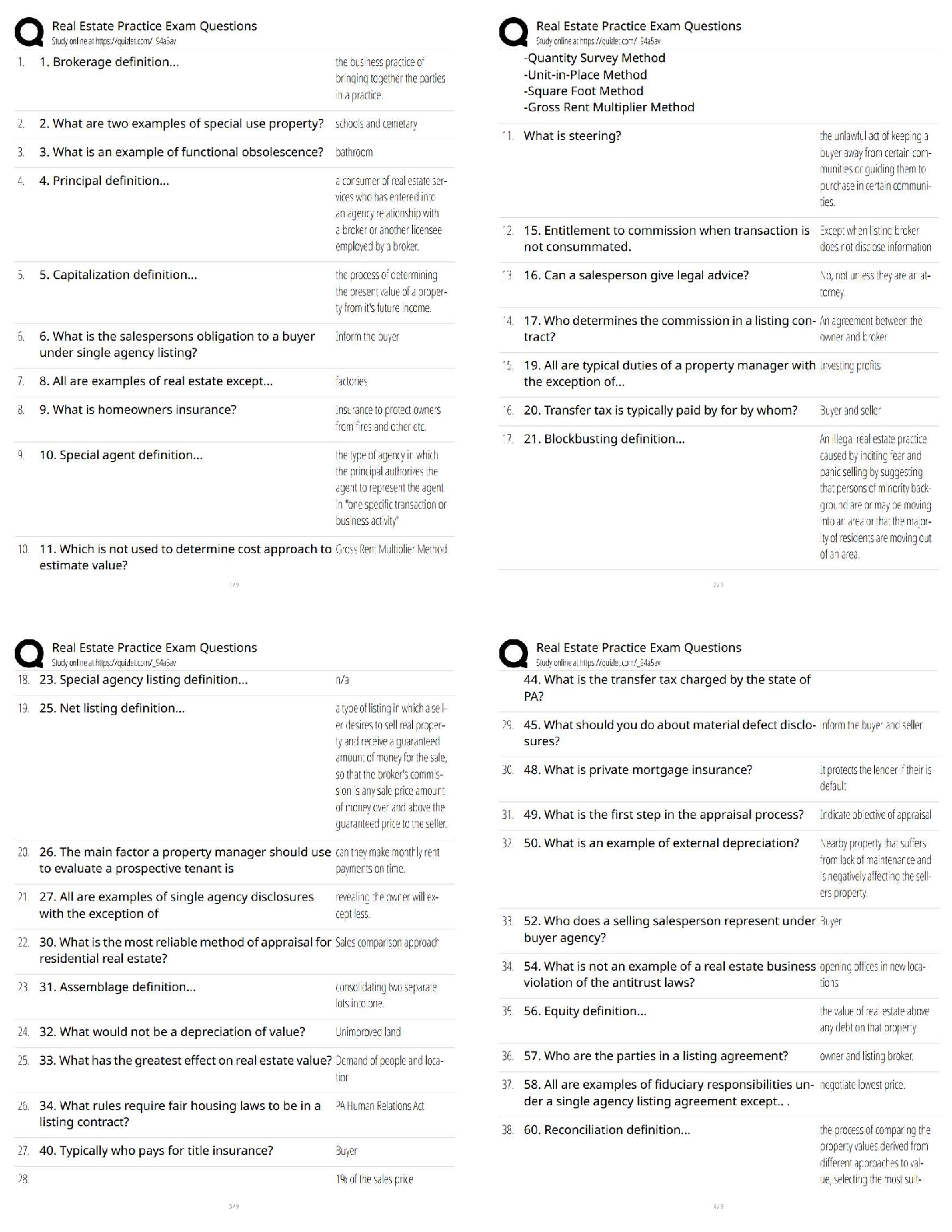

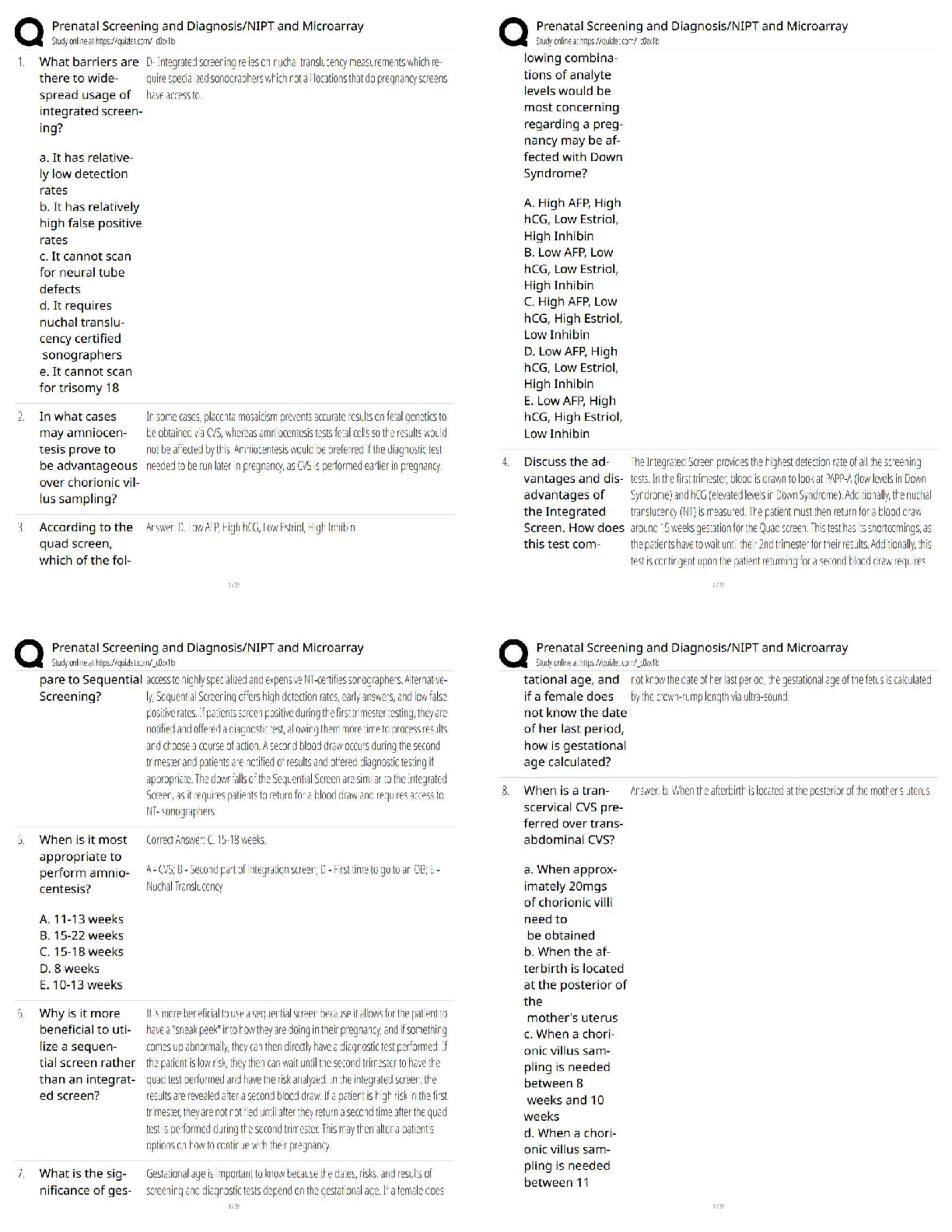

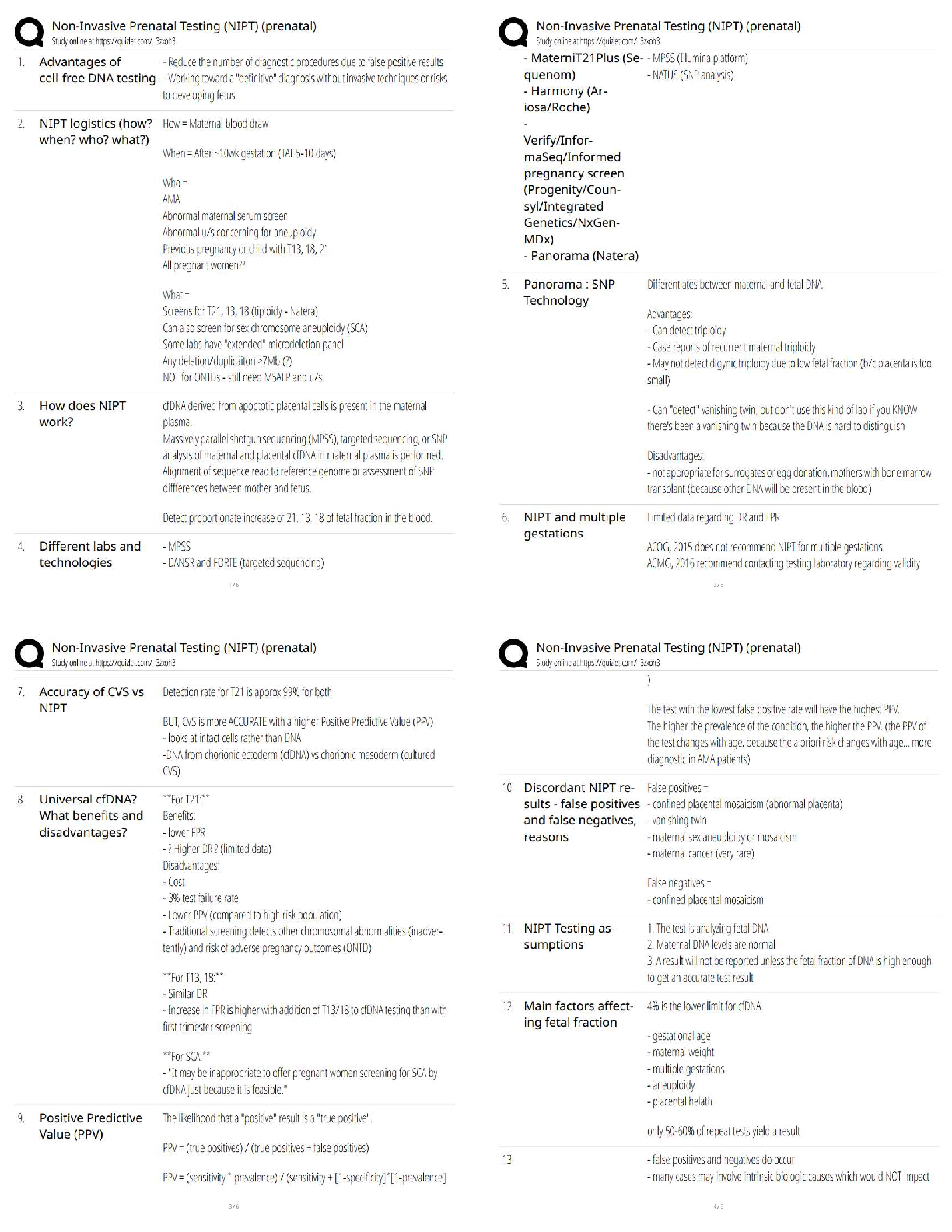

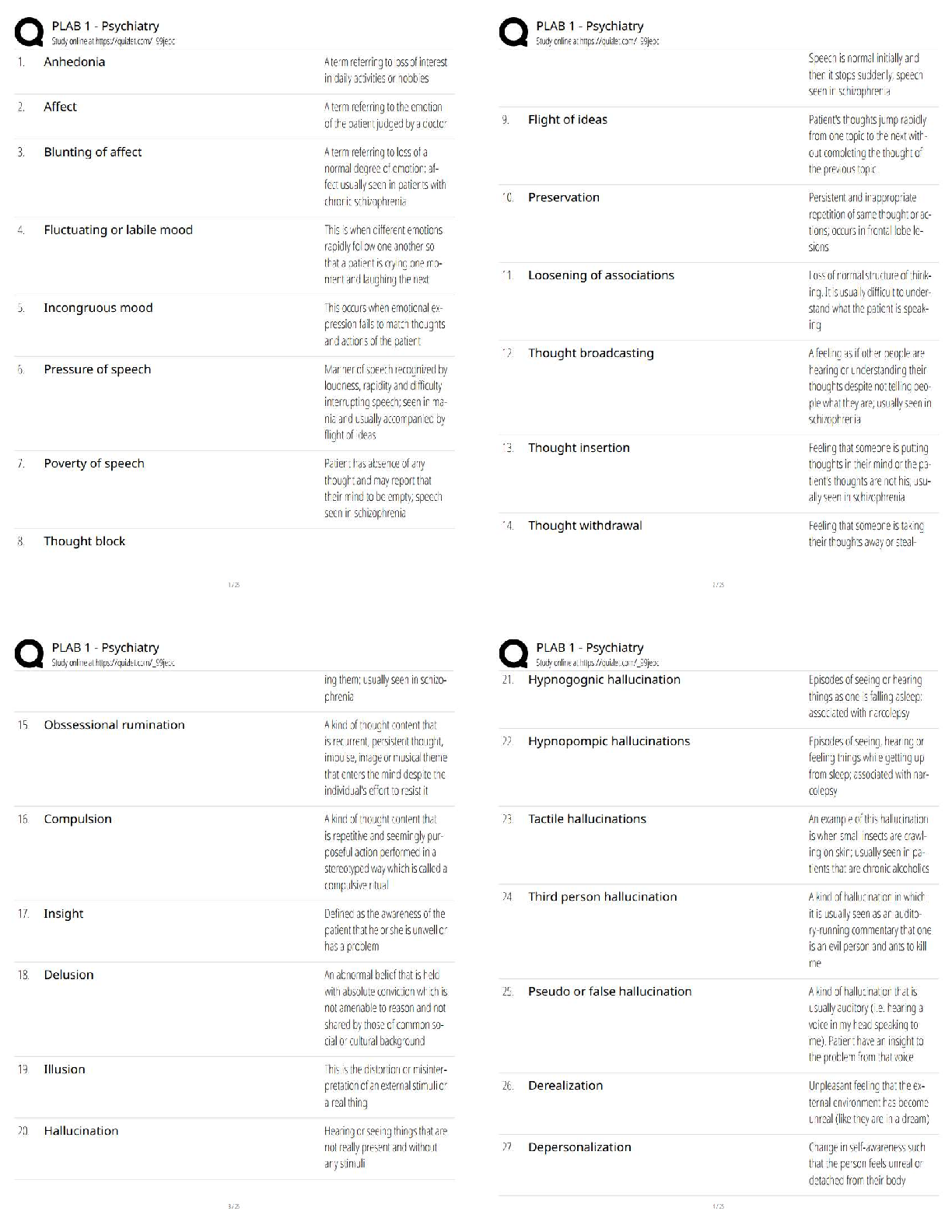

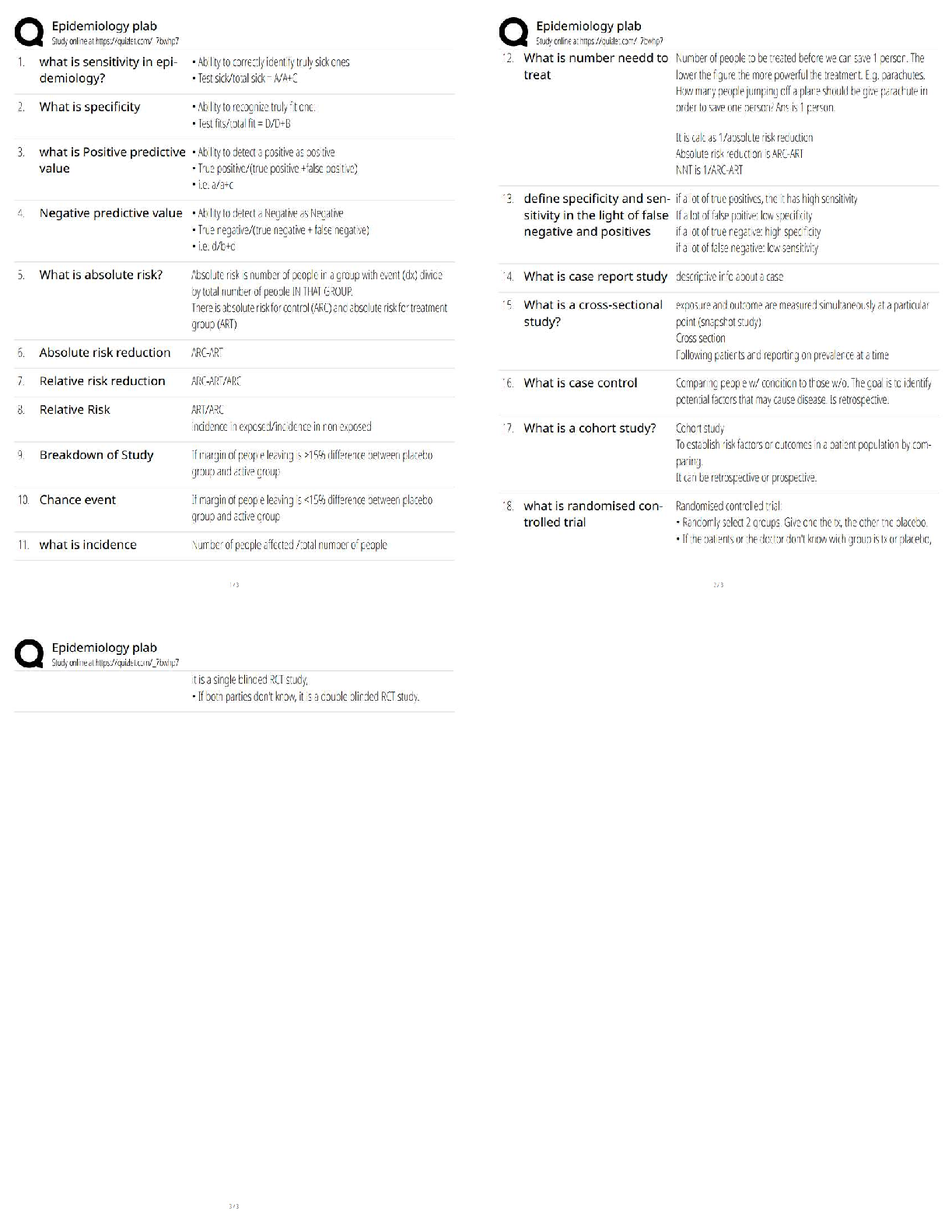

BE5-1 (L03) Harding Corporation has the following accounts included in its December 31, 2017, trial balance: Accounts Receivable $110,000, Inventory $290,000, Allowance for Doubtful Accounts $8,000, ... Patents $72,000, Prepaid Insurance $9,500, Accounts Payable $77,000, and Cash $30,000. Prepare the current assets section of the balance sheet, listing the accounts in proper sequence. BE5-3 (L03) Included in Outkast Company’s December 31, 2017, trial balance are the following accounts: Prepaid Rent $5,200, Debt Investments (to be held to maturity until 2020) $56,000, Unearned Fees $17,000, Land (held for investment) $39,000, and Notes Receivable (long-term) $42,000. Prepare the long-term investments section of the balance sheet. BE5-4 (L03) Lowell Company’s December 31, 2017, trial balance includes the following accounts: Inventory $120,000, Buildings $207,000, Accumulated Depreciation—Equipment $19,000, Equipment $190,000, Land (held for investment) $46,000, Accumulated Depreciation—Buildings $45,000, Land $71,000, and Timberland $70,000. Prepare the property, plant, and equipment section of the balance sheet. BE5-6 (L03) Patrick Corporation’s adjusted trial balance contained the following asset accounts at December 31, 2017: Prepaid Rent $12,000, Goodwill $50,000, Franchise Fees Receivable $2,000, Franchises $47,000, Patents $33,000, and Trademarks $10,000. Prepare the intangible assets section of the balance sheet BE5-9 (L03) Use the information presented in BE5-8 for Adams Company to prepare the long-term liabilities section of the balance sheet. BE5-10 (L03) Hawthorn Corporation’s adjusted trial balance contained the following accounts at December 31, 2017: Retained Earnings $120,000, Common Stock $750,000, Bonds Payable $100,000, Paid-in Capital in Excess of Par— Common Stock $200,000, Goodwill $55,000, Accumulated Other Comprehensive Loss $150,000, and Noncontrolling Interest $35,000. Prepare the stockholders’ equity section of the balance sheet BE5-12 (L05) Keyser Beverage Company reported the following items in the most recent year. Net income $40,000 Dividends paid 5,000 Increase in accounts receivable 10,000 Increase in accounts payable 7,000 Purchase of equipment (capital expenditure) 8,000 Depreciation expense 4,000 Issue of notes payable 20,000 Compute net cash provided by operating activities, the net change in cash during the year, and free cash flow. Net cash=40,000-10,000+7,000+4,000=41,000 [Show More]

Last updated: 3 years ago

Preview 1 out of 5 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 04, 2022

Number of pages

5

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 04, 2022

Downloads

0

Views

50