ACCT 346 Week 3 Homework

1. For each of the following companies, specify whether the company would be more likely to use job costing or process costing.

a. Medical practice of six doctors & fou

...

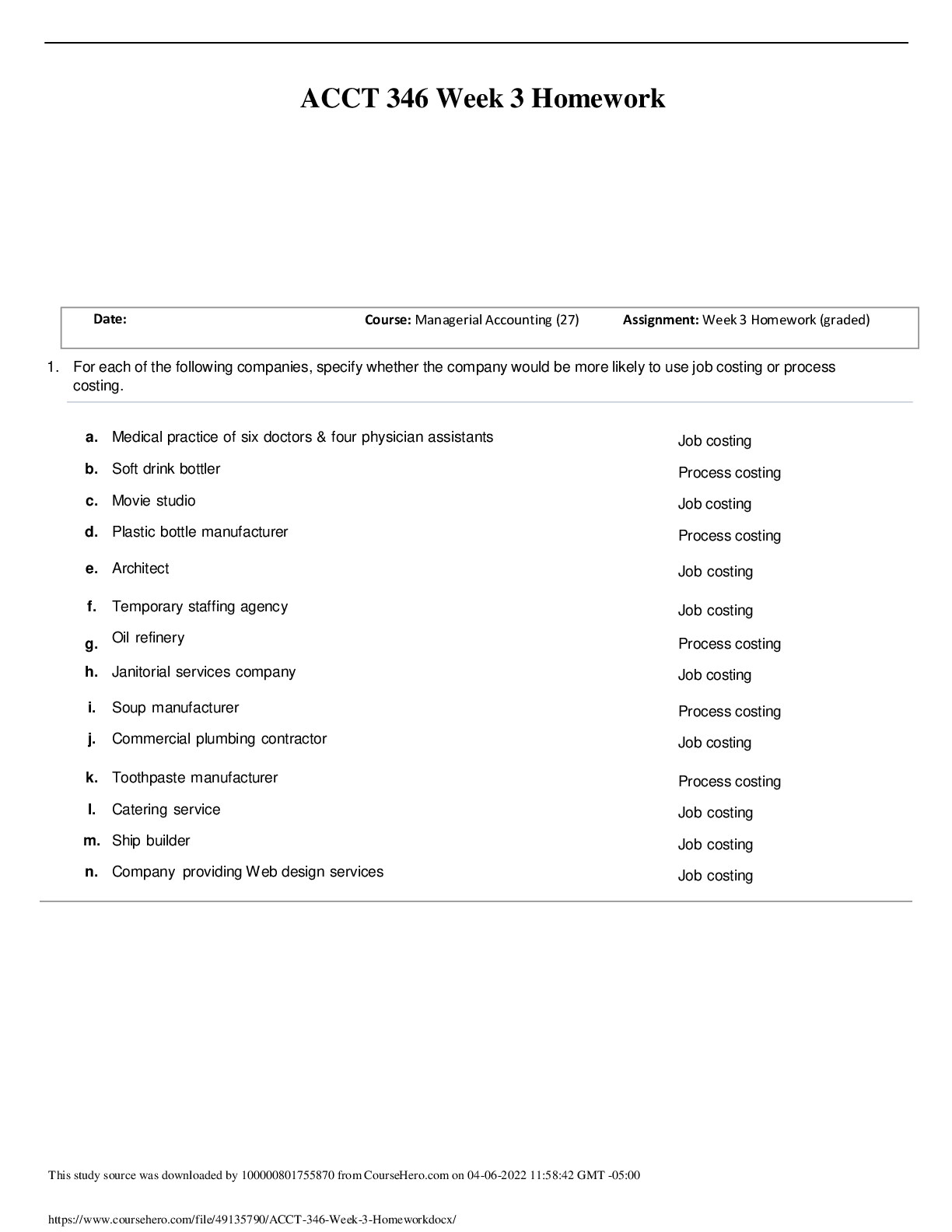

ACCT 346 Week 3 Homework

1. For each of the following companies, specify whether the company would be more likely to use job costing or process costing.

a. Medical practice of six doctors & four physician assistants Job costing

b. Soft drink bottler Process costing

c. Movie studio Job costing

d. Plastic bottle manufacturer Process costing

e. Architect Job costing

f. Temporary staffing agency Job costing

g. Oil refinery Process costing

h. Janitorial services company Job costing

i. Soup manufacturer Process costing

j. Commercial plumbing contractor Job costing

k. Toothpaste manufacturer Process costing

l. Catering service Job costing

m. Ship builder Job costing

n. Company providing Web design services Job costing

2. Patty's Pumpkin Pies collected the following production information relating to November's baking operations:

1(Click the icon to view the information.)

Requirements

Complete the first two steps in the process costing procedure:

1. Summarize the flow of physical units.

2. Compute output in terms of equivalent units.

Click the icon to see the Worked Solution.

Patty's Pumpkin Pies Equivalent Unit Computation

Flow of Equivalent Units Physical Direct Conversion

Flow of Production Units Materials Costs Units to account for:

Beginning work in process, November 1 207,000

Units accounted for:

Completed & transferred out 1,070,000 1,070,000 1,070,000

Plus: Ending work in process, November 30 157,000 117,750 133,450

Total physical units accounted for 1,227,000

Total equivalent units

Review Only

1: Data Table

Physical Direct Materials Conversion Costs

3. Paint by Number prepares & packages paint products. The company has two departments: (1) Blending & (2) Packaging. Direct materials are added at the beginning of the blending process (dyes) & at the end of the packaging process (cans). Conversion costs are added evenly throughout each process. Data from the month of May for the Blending Department are as follows:

2(Click the icon to view the data from May.)

Read the requirements3.

Click the icon to see the Worked Solution.

Requirement 1. Fill-in the time line for the Blending Department.

Review Only

Start

Complete

Complete

Requirement 2. Summarize the physical flow of units & compute total equivalent units for direct materials & for conversion costs. (For entries with a 0 balance, make sure to enter "0" in the appropriate column.)

Blending Department Equivalent Unit Computation Month Ended May 31

Flow of Equivalent Units Physical Direct Conversion

Flow of Production Units Materials Costs Units to account for:

Beginning work in process, May 1 0

Units accounted for:

Completed & transferred out 6,300 6,300 6,300

Total equivalent units

Requirement 3. Summarize total costs to account for & find the cost per equivalent unit for direct materials & for conversion costs. (For entries with a $0 balance, make sure to enter "0" in the appropriate cell(s). Enter the cost per equivalent unit to two decimal places.)

Blending Department Cost per Equivalent Unit Month Ended May 31

Direct Conversion

Materials Costs Total

Beginning work in process $ 0 $ 0 $ 0

Plus: Costs added during May 5,246 2,796 8,042

Total costs to account for $ 5,246 $ 2,796 $ 8,042

Divided by: Total equivalent units 8,600 6,990

Cost per equivalent unit

Requirement 4. Assign total costs to units (gallons): (a) Completed & transferred out to the Packaging Department &

(b) In the Blending Department ending work in process inventory. (Enter quantities first, then the cost per equivalent unit amounts in the same order as calculated in the preceding step.)

Blending Department Month Ended May 31 Assigning Costs

Direct Conversion

Materials Costs Total

a. Completed & transferred out:

Equivalent units completed & transferred out 6,300 6,300

Multiplied by: Cost per equivalent unit $ 0.61 $ 0.40

Costs assigned to units completed & transferred out $ 3,843 $ 2,520 $ 6,363

b. Ending work in process:

Equivalent units in ending work in process, May 31 2,300 690

Multiplied by: Cost per equivalent unit $ 0.61 $ 0.40

Costs assigned to units in ending work in process, May 31 $ 1,403 $ 276 1,679

Total costs accounted for

Requirement 5. What is the average cost per gallon transferred out of the Blending Department to the Packaging Department? Why would the company's managers want to know this cost?

First, identify the labels to compute the average cost per gallon transferred out, then compute the average cost per gallon transferred out of the Blending Department to the Packaging Department. (Round your answer to two decimal places.)

Average cost

/ = per gallon

/ =

Why would Paint by Number's managers want to know this cost?

Managers will want to know this cost to compare it to their budgeted target costs . They may also use the cost information when setting selling prices .

2: Data Table

Gallons:

Beginning work in process inventory . . . . . . . . . . . . . . . . . . . . . . 0

Started production. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,600 gallons Completed & transferred out to

Packaging in May . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,300 gallons Ending work in process inventory (30% of the way through

the blending process) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,300 gallons

Costs:

Beginning work in process inventory . . . . . . . . . . . . . . . . . . . . . . $ 0

Costs added during May:

Direct materials (dyes). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,246

Direct labo.r . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 700

Manufacturing overhead. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,096

Total costs added during May. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,042

3: Requirements

1. Fill-in the time line for the Blending Department.

2. Summarize the physical flow of units & compute total equivalent units for direct materials & for conversion costs.

3. Summarize total costs to account for & find the cost per equivalent unit for direct materials & conversion costs.

4. Assign total costs to units (gallons):

a. Completed & transferred out to the Packaging Department

b. In the Blending Department ending work in process inventory

5. What is the average cost per gallon transferred out of the Blending Department to the Packaging Department? Why would the company's managers want to know this cost?

4. The Assembly Department of ATG Surge Protectors began September with no work in process inventory. During the month, production that cost $37,243 (direct materials, $10,123, & conversion costs, $27,120) was started on

24,000 units. ATG completed & transferred to the Testing Department a total of 17,000 units. The ending work in process inventory was 30% complete as to direct materials & 80% complete as to conversion work.

Requirements

1. Compute the equivalent units for direct materials & conversion costs.

2. Compute the cost per equivalent unit.

3. Assign the costs to units completed & transferred out & ending work in process inventory.

4. Record the journal entry for the costs transferred out of the Assembly Department to the Testing Department.

5. Post all of the transactions in the "Work in Process Inventory—Assembly" T-account. What is the ending balance?

Review Only

Click the icon to see the Worked Solution.

Requirement 1. Compute the equivalent units for direct materials & conversion costs.

Assembly Department Equivalent Unit Computation Month Ended September 30

Flow of Equivalent Units Physical Direct Conversion

Flow of Production Units Materials Costs Units accounted for:

Completed & transferred out 17,000 17,000 17,000

Plus: Ending work in process, September 30

7,000 2,100 5,600

Total equivalent units

Requirement 2. Compute the cost per equivalent unit. (For entries with a $0 balance, make sure to enter "0" in the appropriate column. Enter the cost per equivalent unit to two decimal places.)

Assembly Department Cost per Equivalent Unit

Month Ended September 30

Direct Conversion Materials Costs

Beginning work in process $ 0 $ 0

Plus: Costs added during September 10,123 27,120

Total costs to account for 10,123 27,120

Divided by: Total equivalent units 19,100 22,600

Cost per equivalent unit

Requirement 3. Assign the costs to units completed & transferred out & ending work in process inventory. (Enter quantities first, then the cost per equivalent unit amounts in the same order as calculated in the preceding step.)

Assembly Department Month Ended September 30

Assigning Costs Direct Conversion

Materials Costs Total

This study source was downloaded by 100000801755870 from CourseHero.com on 04-06-2022 11:58:42 GMT -05:00

Completed & transferred out:

Equivalent units completed & transferred out 17,000 17,000

Multiplied by: Cost per equivalent unit $ 0.53 $ 1.20

Costs assigned to units completed & transferred out $ 9,010 $ 20,400 $ 29,410

Ending work in process:

Equivalent units in ending work in process, September 30 2,100 5,600

Multiplied by: Cost per equivalent unit $ 0.53 $ 1.20

Costs assigned to units in ending work in process, September 30 $ 1,113 $ 6,720 7,833

Total costs accounted for

Requirement 4. Record the journal entry for the costs transferred out of the Assembly Department to the Testing Department. (Record debits first, then credits. Exclude explanations from any journal entries.)

Journal Entry

Date Accounts Debit Credit

Requirement 5. Post all of the transactions in the "Work in Process Inventory—Assembly" T-account. What is the ending balance? (For entries with a $0 balance, make sure to enter "0" in the appropriate column.)

Work in Process Inventory—Assembly

Bal September 30 7,833

This study source was downloaded by 100000801755870 from CourseHero.com on 04-06-2022 11:58:42 GMT -05:00

[Show More]

Questions and Answers 100% VERIFIED.png)

Questions and Answers 100% correct Solutions.png)