Financial Accounting > EXAM > Jackson State University ACC 545 Midterm Exam Fall 2017.pdf Midterm Exam Fall 2021 . (All)

Jackson State University ACC 545 Midterm Exam Fall 2017.pdf Midterm Exam Fall 2021 .

Document Content and Description Below

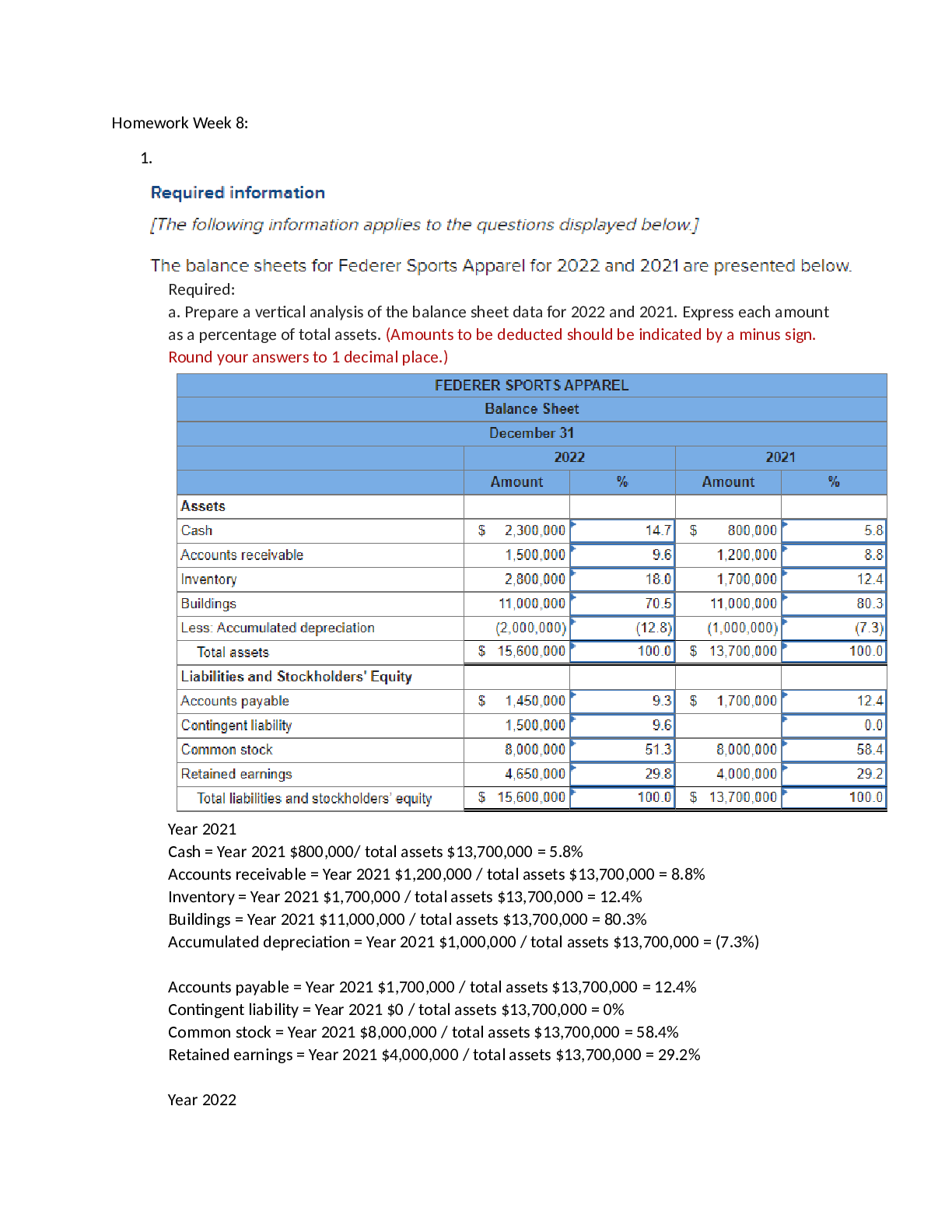

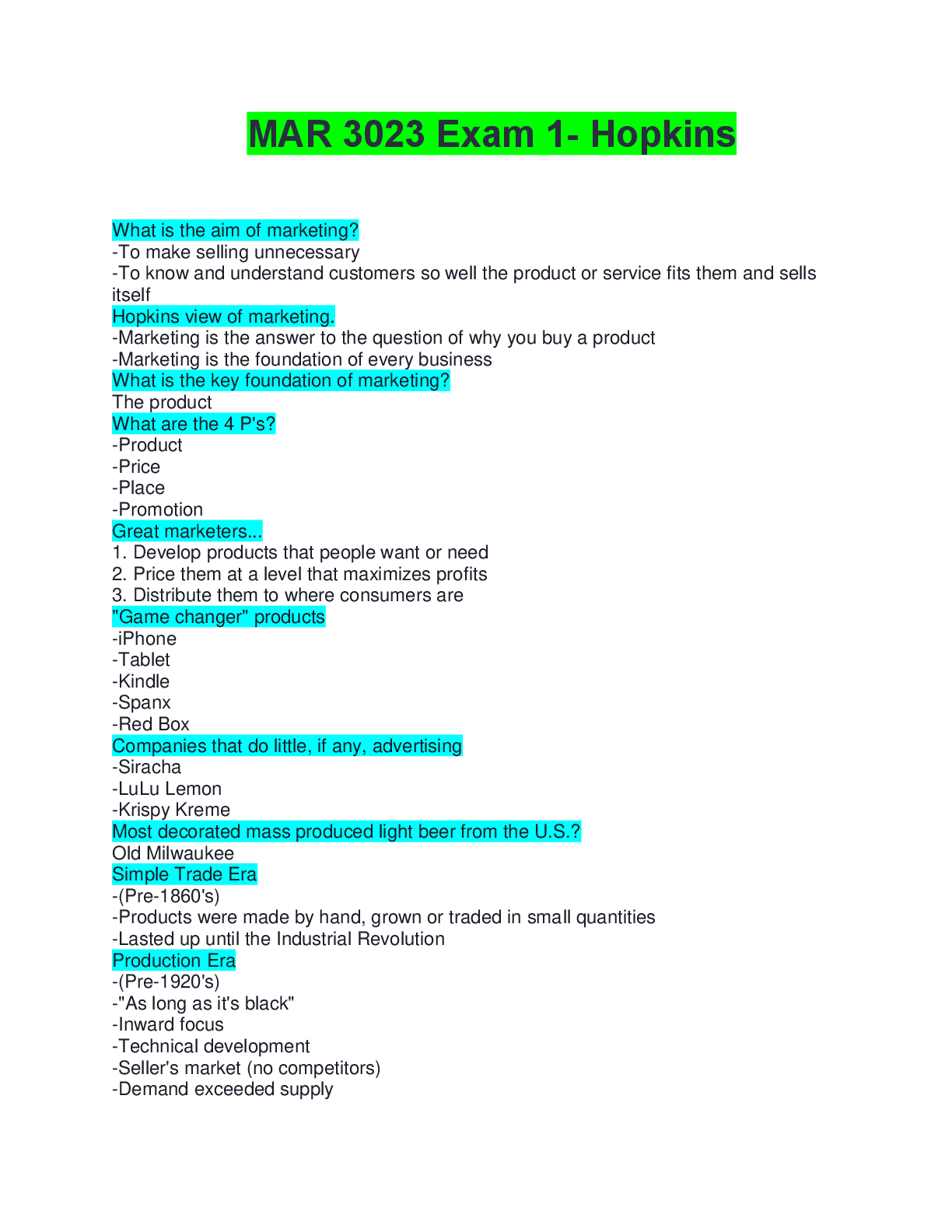

(b) Does the negative amount for cash from financing activities concern us? Explain. A negative amount for cash from financing activities implies that the company is unable to pay its debts as they ... come due and should be interpreted negatively. A negative amount for cash from financing activities is the result of additional borrowings. Because the additional funds are invested in earnings-generating assets, this should be viewed positively. A negative amount for cash from financing activities implies that the market value of the company's long-term debt has declined and this change should be viewed negatively. A negative amount for cash from financing activities reflects the reduction of long-term debt, which is a positive sign of the company’s ability to retire debt obligations. (c) Using the statements prepared for part a. compute the following ratios (for this part only, use the year-end balance instead of the average for assets and stockholders' equity). Round all answers to two decimal places. For example, asset turnover is rounded like this: 0.34567 = 0.35; all other percentage ratios are rounded like this: 0.12345 = 12.35%. (i) Profit margin 23.15 % (ii) Asset turnover 0.73 (iii) Return on assets 16.94 % (iv) Return on equity 24.76 % QUESTION 2 Complete Points out of 50.00 Midterm Exam Fall 2017 9/13/17, 9(29 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1310797 Page 4 of 22 QUESTION 2 Complete Points out of 50.00 Analyzing Transactions Using the Financial Statement Effects Template Following are selected transactions of Mogg Company. Record the effects of each using the financial statement effects template. 1. Shareholders contribute $10,000 cash to the business in exchange for common stock. 2. Employees earn $500 in wages that have not been paid at period-end. 3. Inventory of $3,000 is purchased on credit. 4. The inventory purchased in transaction 3 is sold for $4,500 on credit. 5. The company collected the $4,500 owed to it per transaction 4. 6. Equipment is purchased for $5,000 cash. 7. Depreciation of $1,000 is recorded on the equipment from transaction 6. 8. The Supplies account had a $3,800 balance at the beginning of this period; a physical count at period-end shows that $800 of supplies are still available. No supplies were purchased during this period. 9. The company paid $10,000 cash toward the principal on a note payable; also, $500 cash is paid to cover this note's interest expense for the period. 10. The company receives $8,000 cash in advance for services to be delivered next period. [Show More]

Last updated: 3 years ago

Preview 1 out of 22 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 27, 2022

Number of pages

22

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 27, 2022

Downloads

0

Views

138

.png)