Bond: A written legal contract that is a promise to repay with interest; issued by a

corporation, government or government agency.

Coupon payment: Savers buy these bonds and, in most cases, get paid interest in

return

...

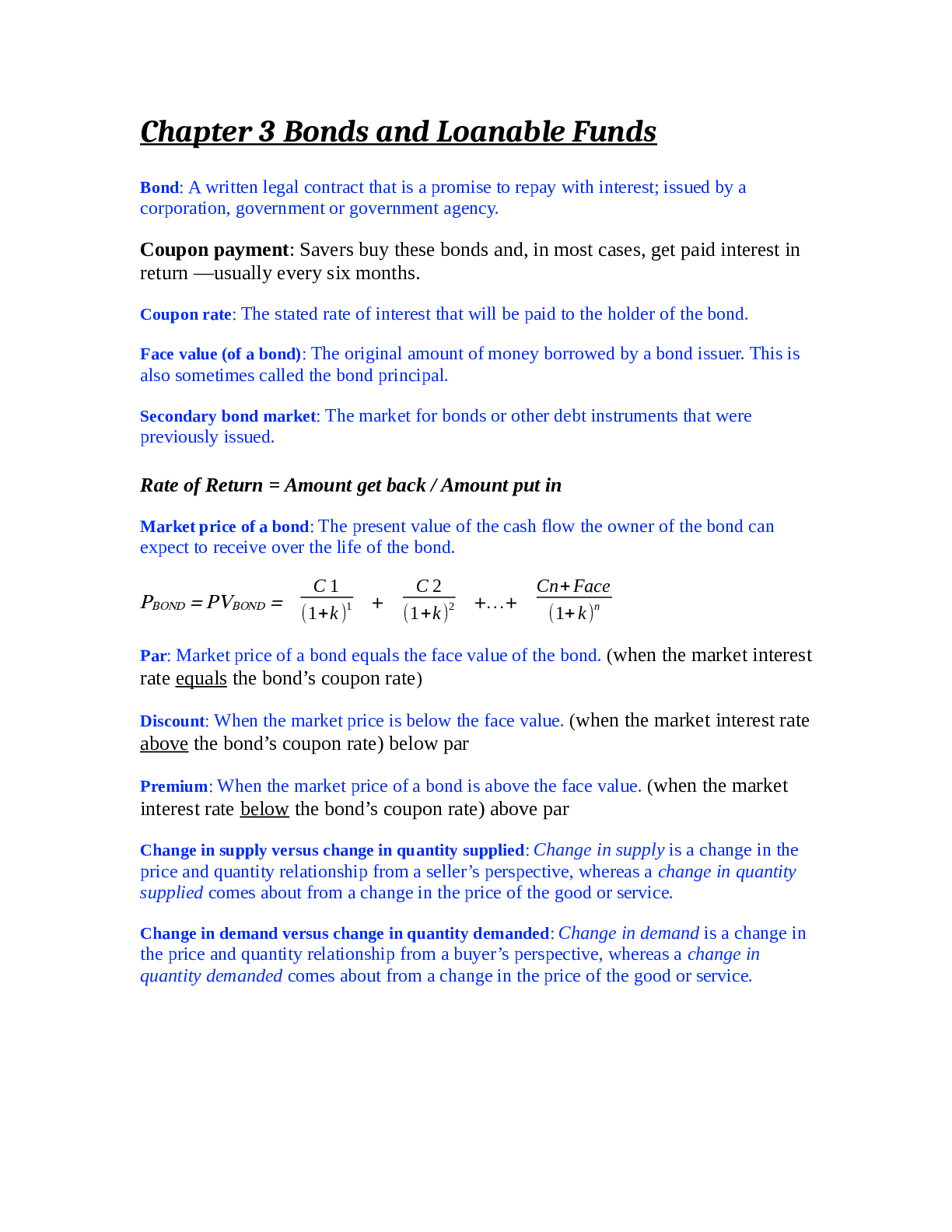

Bond: A written legal contract that is a promise to repay with interest; issued by a

corporation, government or government agency.

Coupon payment: Savers buy these bonds and, in most cases, get paid interest in

return —usually every six months.

Coupon rate: The stated rate of interest that will be paid to the holder of the bond.

Face value (of a bond): The original amount of money borrowed by a bond issuer. This is

also sometimes called the bond principal.

Secondary bond market: The market for bonds or other debt instruments that were

previously issued.

Rate of Return = Amount get back / Amount put in

Market price of a bond: The present value of the cash flow the owner of the bond can

expect to receive over the life of the bond.

PBOND = PVBOND =

C 1

(1+k)1 +

C 2

(1+k)2 +…+

Cn+Face

(1+k)n

Par: Market price of a bond equals the face value of the bond. (when the market interest

rate equals the bond’s coupon rate)

Discount: When the market price is below the face value. (when the market interest rate

above the bond’s coupon rate) below par

Premium: When the market price of a bond is above the face value. (when the market

interest rate below the bond’s coupon rate) above par

Change in supply versus change in quantity supplied: Change in supply is a change in the

price and quantity relationship from a seller’s perspective, whereas a change in quantity

supplied comes about from a change in the price of the good or service.

Change in demand versus change in quantity demanded: Change in demand is a change in

the price and quantity relationship from a buyer’s perspective, whereas a change in

quantity demanded comes about from a change in the price of the good or service.Primary market: The initial sale of a bond.

As the price of bonds increases, or their yields decrease, these issuers will want to

issue more bonds because the yield, or the interest rate the issuers have to pay to

bondholders, the borrowing costs of bond issuers decline.

Thus, in the primary market, as the bond prices increase, the quantity of bonds

in demand increases; that is, the supply curve of bonds slopes upward.

Secondary bond market: The market for bonds or other debt instruments preciously

issued.

As the price of bonds increases in the secondary market, we have an increase in

the quantity supplied of bonds.

The Supply for Bonds

1. Business Expectations

If businesspeople become more optimistic about the future, they will want

to borrow more money to expand their output.

2. Expected Inflation

If you think there will be inflation in the future, you want to borrow more

now.Inflation reduces the real cost of debt

Real cost of debt: The burden of debt measured in constant terms.

3. Government Deficits

4. Investment Tax Credits

To get this tax credit, imagine the consumer goods producer has to spend

$60 million to expand its headquarters. So, to get the $5 million tax credit,

Kimberly-Clark has to spend $60 million. Where will Kimberly-Clark get

that $60 million? It will most likely issue bonds.

The Demand for Bonds

1. Wealth

2. Expected Relative Returns to Bonds

3. Relative Riskiness of Bonds

Default risk: The risk that a borrower will not pay interest or principal as

promised.

4. Liquidity of Bonds

Liquidity: The ease and expense at which one asset can be converted into

another asset.5. Information Costs

Equilibrium in the Bond Market (Surplus & Shortage)

[Show More]