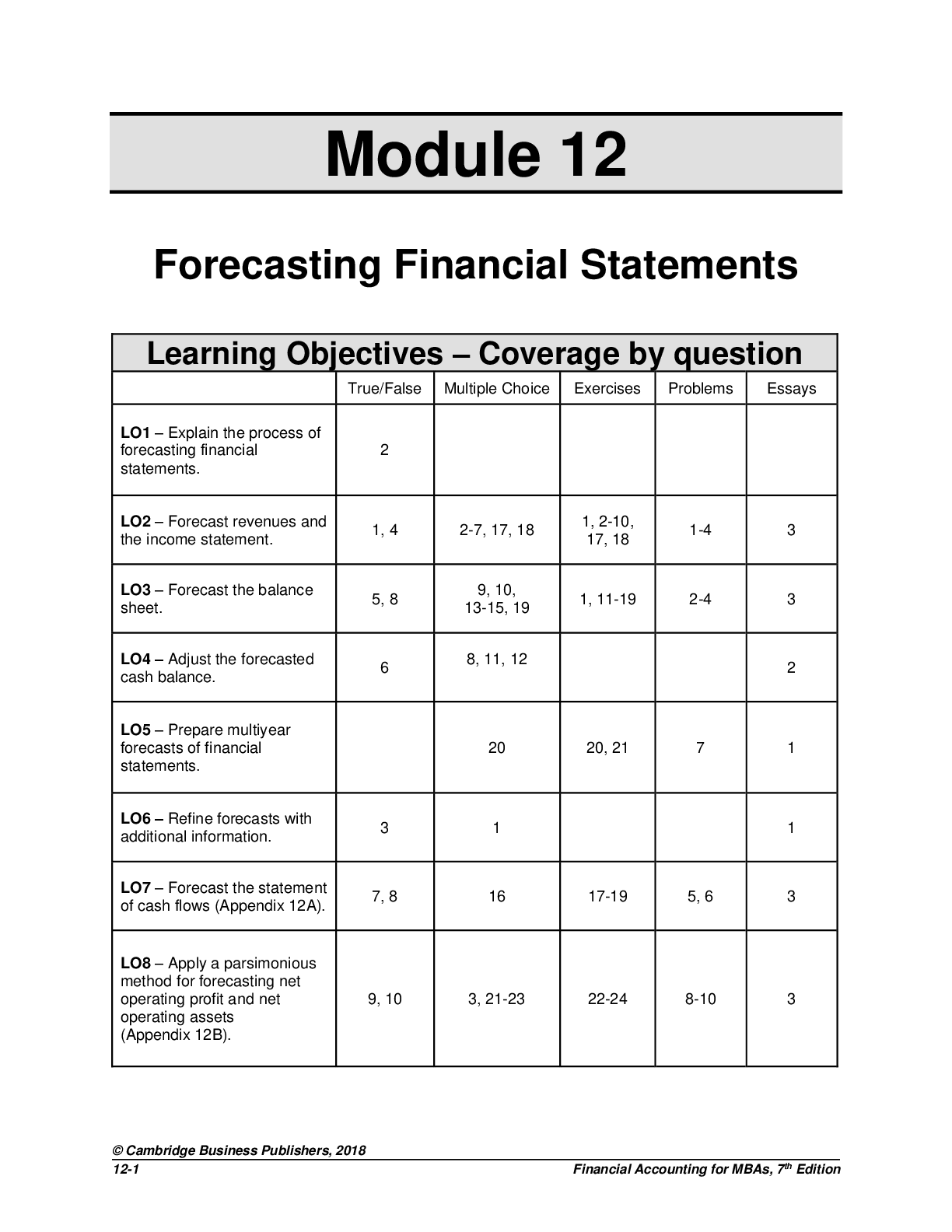

Learning Objectives – Coverage by question

True/False Multiple Choice Exercises Problems Essays

LO1 – Explain the process of

forecasting financial

statements.

2

LO2 – Forecast revenues and

the income statement.

...

Learning Objectives – Coverage by question

True/False Multiple Choice Exercises Problems Essays

LO1 – Explain the process of

forecasting financial

statements.

2

LO2 – Forecast revenues and

the income statement.

LO3 – Forecast the balance

sheet.

LO4 – Adjust the forecasted

cash balance.

LO5 – Prepare multiyear

forecasts of financial

statements.

LO6 – Refine forecasts with

additional information. 3 1 1

LO7 – Forecast the statement

of cash flows

LO8 – Apply a parsimonious

method for forecasting net

operating profit and net

operating assets

Module 12: Forecasting Financial Statements

True/False

Topic: Eliminating Transitory Items

LO: 2

1. To forecast future performance, we should first create a set of financial statements that reflects items

we expect to persist (continue).

Answer: True

Rationale: Persistent activities are those that will recur, that is the point of forecasting, to predict what

will recur.

Topic: Forecasting Order

LO: 1

2. The usual financial statement forecasting process is completed in the following order: balance sheet,

income statement, statement of cash flows.

Answer: False

Rationale: The usual forecasting process begins with the income statement, followed by the balance

sheet, and finished with the statement of cash flows.

Topic: Impact of Acquisitions

LO: 6

3. Forecasting future revenues includes revenue growth from mergers and acquisitions.

Answer: True

Rationale: The most accurate forecast of future revenue is one that considers both future organic

growth and future M&A revenue growth.

Topic: Forecasting the Income statement

LO: 2

4. Calculating sales estimates, derived from an estimate of the sales growth rate, is how the forecasting

process begins.

Answer: True

Rationale: Using an estimate of the sales growth rate, applied to prior year sales, allows forecasters

to estimate forecasted sales, which begins the forecasting process.© Cambridge Business Publishers, 2018

12-3 Financial Accounting for MBAs, 7th Edition

Topic: Forecasting the Balance Sheet – PPE Assets

LO: 3

5. To forecast property, plant, and equipment (PPE) we increase the prior year’s balance by estimated

CAPEX and reduce the estimate by forecasted depreciation expense.

Answer: True

Rationale:

Forecasted capital expenditures (CAPEX) = (Current year CAPAX / Current year sales) / Forecasted

sales.

Forecasted depreciation expense = (Current year depreciation expense / Prior year PPE, net) x

Current year PPE, net.

Topic: The Forecasted Cash Balance

LO: 4

6. The forecasting process assumes that the cash on the balance sheet is a plug.

Answer: True

Rationale: Our forecasting process estimates the balances of all assets other than cash, all liabilities,

and all equity accounts. The last step is to compute the amount of cash needed to balance the

balance sheet (the plug). The plug is computed as total assets (equal to total liabilities and equity)

less all other asset balances.

Topic: Forecasting the Statement of Cash Flows

LO: 7

7. The forecasted statement of cash flows uses either the forecasted income statement or the balance

sheet.

Answer: False

Rationale: The statement of cash flows uses both to explain the change in cash on the balance sheet.

Topic: Forecasting the Statement of Cash Flows

LO: 3, 7

8. Forecasted depreciation expense, commonly estimated as: [(Current year depreciation expense /

Prior year PPE, net) x Current year PPE, net], is added back to net income in the cash flow from

operating activities section of the Statement of Cash Flows.

Answer: True

Rationale: Depreciation is a noncash expense that does not affect cash.

Topic: Forecasting with the Parsimonious Method

LO: 8

9. The parsimonious projection method relies on sales growth, net operating profit margin (NOPM), and

asset turnover (AT) to project net operating profit after tax and net operating assets.

Answer: False

Rationale: The parsimonious projection method relies on net operating asset turnover (NOAT) and

not total asset turnover (AT).© Cambridge Business Publishers, 2018

Test Bank, Module 12 12-4

Topic: Forecasting Property Plant and Equipment with the Parsimonious Method

LO: 8

10. The parsimonious projection method is the more efficient method for projecting property, plant and

equipment.

Answer: False

Rationale: The parsimonious projection method does not project individual income statement and

balance sheet items; it is used to project net operating profit (NOPAT) and net operating assets

(NOA).© Cambridge Business Publishers, 2018

12-5 Financial Accounting for MBAs, 7th Edition

Multiple Choice

Topic: Refining Financial Statement Forecasts

LO: 6

1. Which of the following is not a typical adjustment made to the income statement for projection

purposes?

A) Adjusting net income for perceived under- or over-accruals

B) Adjusting revenues to only include organic revenue growth

C) Separating operating and non-operating items

D) Removing transitory items such as restructuring charges

E) None of the above

Answer: B

Rationale: When one company acquires another, the revenues and expenses of the acquired

company are consolidated, but only from the date of acquisition onward.

Topic: Forecasting Revenue (Numerical calculations required)

LO: 2

2. Ashbury Corporation reports 2016 and 2017 total revenues of $90.0 million and $100.8 million

respectively. If we expect prior growth to persist, we would forecast a revenue growth rate of:

A) 15%

B) 12%

C) 24%

D) 9%

E) None of the above

Answer: B

Rationale: ($100.8 / $90.0) – 1 = 0.12 = 12%

Topic: Forecasting Revenue (Numerical calculations required)

LO: 2, 8

3. Following are financial statement numbers and ratios for Snap-On Incorporated for the year ended

December 28, 2016 (in millions).

If we expected revenue growth of 5% in the next year, what would projected revenue be for the year

ended December 30, 2017?

NOPAT $590.4

NOA $3,567.8

Net operating profit margin (NOPM) 15.9%

Net operating asset turnover (NOAT) 1.04

A) $3,567.8 million

B) $3,551.0 million

C) $3,898.9 million

D) $3,713.2 million

E) None of the above

Answer: C

Rationale: $590.4 million / 15.9% = $3,713.2 million in revenue for 2016. 2017 projected revenue

would be $3,713.2 million x 1.05 = $3,898.9 million© Cambridge Business Publishers, 2018

Test Bank, Module 12 12-6

Topic: Forecasting Revenue (Numerical calculations required)

LO: 2

4. Following are financial statement numbers and ratios for Lockheed Martin Corp. for the year ended

December 31, 2016. If we expected revenue growth of 3.5% in the next year, what would projected

revenue be for 2017?

Total revenue (in millions) $47,248

Net operating profit margin (NOPM) 8.8%

Net operating asset turnover (NOAT) 3.3

A) $48,901.7 million

B) $48,240.2 million

C) $47,248.0 million

D) $51,169.6 million

E) None of the above

Answer: A

Rationale: $47,248 million × 1.035 = $48,901.7 million

Topic: Forecasting COGS (Numerical calculations required)

LO: 2

5. Payton Inc. reports in its 2017 annual report 10-K, sales of $8,180 million and cost of goods sold of

$3,272 million. For next year, you project that sales will grow by 3% and that cost of goods sold

percentage will be 1 percentage point higher.

Projected cost of goods sold for 2018 will be:

A) $3,304 million

B) $3,813 million

C) $3,454 million

D) $3,370 million

E) There is not enough information to determine the amount.

Answer: C

Rationale: $8,180 million ×1.03 × (($3,272 / $8,180) + 1%) = $3,454 million

Topic: Forecasting Interest Expense (Numerical calculations required)

LO: 2

6. Hudson Company reports in its 2017 10-K, sales of $332 million, long-term debt of $27 million, and

interest expense of $980,000.

If sales are projected to increase by 4% next year, projected interest expense for 2018 will be:

A) $1,019,200

B) $ 908,000

C) $1,007,000

D) $ 980,000

E) None of the above

Answer: D

Rationale: The most common approach to non-operating expenses is to assume that they do not

change from year to year, unless we believe interest rates are likely to shift greatly during the forecast

period.© Cambridge Business Publishers, 2018

12-7 Financial Accounting for MBAs, 7th Edition

Topic: Forecasting Tax Expense (Numerical calculations required)

LO: 2

7. Reed Corporation reports 2017 sales of $415 million, income before income taxes of $122.3 million

and tax expense of $35.9 million.

If sales are projected to increase by 4% next year, projected tax expense for 2018 will be:

A) $35.9 million

B) $37.3 million

C) $40.8 million

D) $42.3 million

E) There is not enough information to determine the amount.

Answer: E

Rationale: The tax expense will be a function of forecasted pre-tax income. Knowing the sales growth

rate is insufficient to determine pre-tax income because certain expenses may remain unchanged

from prior dollar levels.

Topic: Implication of the Forecasted Cash Balance

LO: 4

8. When forecasting balance sheet financials, an unusually high forecasted cash balance suggests

which of the following?

A) Sales are projected to increase in coming years.

B) The company will need to sell additional stock.

C) The company is generating a lot of cash, most typically from operations.

D) Account receivables have dipped to an unacceptable level.

E) None of the above

Answer: C

Rationale: Our forecasts might assume that such excess liquidity can be invested in marketable

securities, used to pay down debt, repurchase stock, increase dividend payments, or any combination

of these actions.

Topic: Forecasted PPE Based on Forecasted Sales (Numerical calculations required)

LO: 3

9. CVS Health Corporation reported sales of $177,526 million, property, plant and equipment (PPE), net

of $10,175 million, and capital expenditures of $2,224 million in 2016.

If sales are projected to increase 4% per year over the next five years, what is the projected capital

expenditures (purchases of new PPE) for 2017?

A) $7,951 million

B) $3,313 million

C) $2,224 million

D) $7,775 million

E) $2,400 million

Answer: E

Rationale: $2,224 / $177,526 = 1.3%

$177,526 million x 1.04 = $184,627 million x 1.3% = $2,400 million

[Show More]