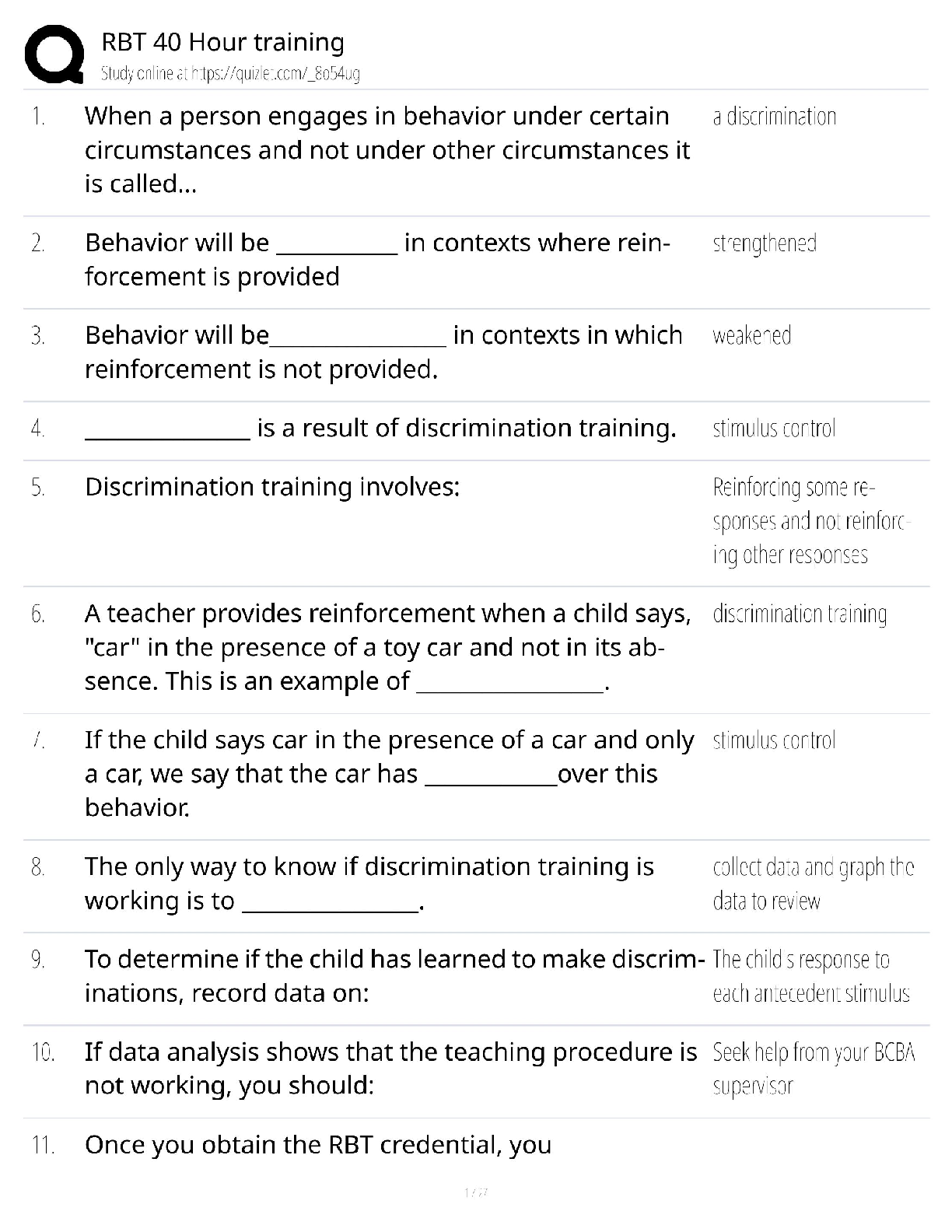

Learning Objectives – coverage by question

True/False Multiple Choice Exercises Problems Essays

LO1 – Describe accounting

for accounts receivable and

the importance of the

allowance for uncollectible

accounts in de

...

Learning Objectives – coverage by question

True/False Multiple Choice Exercises Problems Essays

LO1 – Describe accounting

for accounts receivable and

the importance of the

allowance for uncollectible

accounts in determining

profit.

LO2 – Explain accounting for

inventories and assess the

effects on the balance sheet

and income statement from

different inventory costing

methods.

LO3 – Describe accounting

for property, plant and

equipment and explain the

impacts on profit and cash

flows from depreciation

methods, disposals and

impairments.

Module 6: Asset Recognition and Operating Assets

True/False

Topic: Accounts Receivable

LO: 1

1. Accounts receivables (net) reported in the current asset section of a company’s balance sheet

represents the total amount owed by customers within the next year.

Answer: False

Rationale: A company makes two representations when reporting A/R in the balance sheet. The first

being that it expects to collect the amount reported on the balance sheet. The second is that it

expects to collect within the next year. The company may not expect to collect the total amount owed

by customers, thus, the statement is incorrect.

Topic: Collectibility of Accounts Receivable

LO: 1

2. In order to report accounts receivable, net, companies estimate the amount they do not expect to

collect from their credit customers.

Answer: True

Rationale: Companies must report the amount of accounts receivable that they expect to collect. To

do this, they estimate the amount they expect to not collect.

Topic: Income Shifting

LO: 1

3. Overestimating the allowance for uncollectible accounts receivable can shift income from the current

period into one or more future periods.

Answer: True

Rationale: By overestimating current accounts receivable provisions, current income decreases

because expenses are increased. However, due to the overestimation, future year provisions will

need to decrease to compensate, thus increasing future profitability. Income has been shifted to

future periods from the present.

Topic: Bad Debt Expense

LO: 1

4. The financial statement effects for uncollectible accounts occur when the company writes off the

account because that is when all the uncertainty is resolved.

Answer: False

Rationale: Under GAAP, costs relating to anticipated bad debts expense are matched with sales in

the period that the sales are recognized. Upon write-off, both the receivable and the allowance

account are reduced, leaving net receivables unchanged.

©Cambridge Business Publishers, 2015

6-2 Financial Statement Analysis and Valuation, 4th EditionTopic: Manufacturing Costs in Inventory

LO: 2

5. The three components of manufacturing costs are direct materials, direct labor, and manufacturing

overhead.

Answer: True

Rationale: These three components make up the manufacturing cost for manufacturing companies.

Topic: Inventory Costing and the Balance Sheet

LO: 2

6. LIFO inventory costing yields more accurate reporting of the inventory balance on the balance sheet.

Answer: False

Rationale: LIFO assumes that the most recently purchased goods are sold, thus the cost of the oldest

items remain in the inventory balance. Hence, the balance sheet reports inventories at less current

costs.

Topic: LIFO and FIFO Disclosures

LO: 2

7. Companies using LIFO are required to disclose the amount at which inventory would have been

reported had it used FIFO. Similarly, companies using FIFO are required to disclose what their

inventory would have been if the company had used LIFO.

Answer: False

Rationale: Only the first sentence is true. The disclosure of the LIFO reserve is required for those

companies using LIFO inventory costing. This disclosure allows analysts to adjust the balance sheet

and income statement for LIFO effects when comparing LIFO and FIFO companies.

Topic: FIFO Inventory Costing and Profit

LO: 2

8. In general, in a period of falling prices, LIFO produces higher gross profits than FIFO.

Answer: True

Rationale: Gross profit is affected by the choice of inventory costing method. Specifically, in periods

of rising costs and prices, FIFO produces higher gross profits then LIFO because lower- cost

inventories (i.e., first inventories bought are first out) are matched against sales revenues at current

market prices. The converse holds true in periods of falling prices.

Topic: Inventory Turnover

LO: 2

9. Increasing inventory turnover rate will improve profitability.

Answer: False

Rationale: Profitability depends on both turnover and profit margin on the inventory. A company could

increase turnover by dropping prices to zero. Items would fly off the shelves, but that would mean no

profit.

Test Bank, Module 6 6-3Topic: Asset Impairment

LO: 3

10. Impairment of long-term assets is determined by comparing the sum of the present value of the

asset’s expected future cash flows to the asset’s net book value.

Answer: False

Rationale: Impairment of long-term assets is determined by comparing the sum of expected future

(undiscounted) cash flows from the asset with its net book value. If the asset is deemed to be

impaired, it is written down to its market value and the write-down is recorded as an expense in the

income statement.

Topic: Percent Used Up

LO: 3

11. The percent used up ratio indirectly measures the likelihood of future capital expenditures that the

company will have to make.

Answer: True

Rationale: Percent used up of plant assets is equal to accumulated depreciation divided by the cost of

depreciable assets. If accumulated depreciation is high, the percent used up will be high, indicating

that the equipment is nearing the end of its life cycle. New equipment will likely have to be purchased

in the near future.

Topic: Depreciation Assumptions

LO: 3

12. In order to estimate depreciation expense using the double-declining-balance method, managers

must estimate the asset’s useful life and its salvage value.

Answer: False

Rationale: Salvage value does not enter into the calculation of double-declining-balance method

depreciation.

Topic: Gains on Sale of Assets

LO: 3

13. The gain or loss on the sale of the asset is computed by:

Gain/(Loss) on sale = Market value of asset – Net book value of asset

Answer: False

Rationale: The correct equation involves the proceeds received, which may differ from the asset’s

market value.

Topic: Capitalization of Assets

LO: 3

14. For self-constructed assets, a firm may capitalize any expenses required to place the asset in service.

This includes any interest expense on loans during the construction period.

Answer: True

Rationale: A firm may capitalize any costs to construct the asset providing the costs bring future

6-4 Financial Statement Analysis and Valuation, 4th EditionTopic: Depreciation for Tax Purposes

LO: 3

15. When a firm uses an accelerated method of depreciation for tax reporting in order to minimize its tax

burden, it will not really save any tax dollars in the end because depreciation method merely changes

the timing of the depreciation expenses but not the total.

Answer: False

Rationale: An accelerated method for taxes brings real savings. Paying lower taxes early on allows

the company to reinvest the additional cash flows into additional operating assets. As well, the

present value of a dollar of tax in the future is worth less than a dollar today.

[Show More]