Financial Accounting > EXAM > ACCOUNTING 6344 Midterm 2B | 60 Questions, Answers and Rationale | University of Texas, Dallas (All)

ACCOUNTING 6344 Midterm 2B | 60 Questions, Answers and Rationale | University of Texas, Dallas

Document Content and Description Below

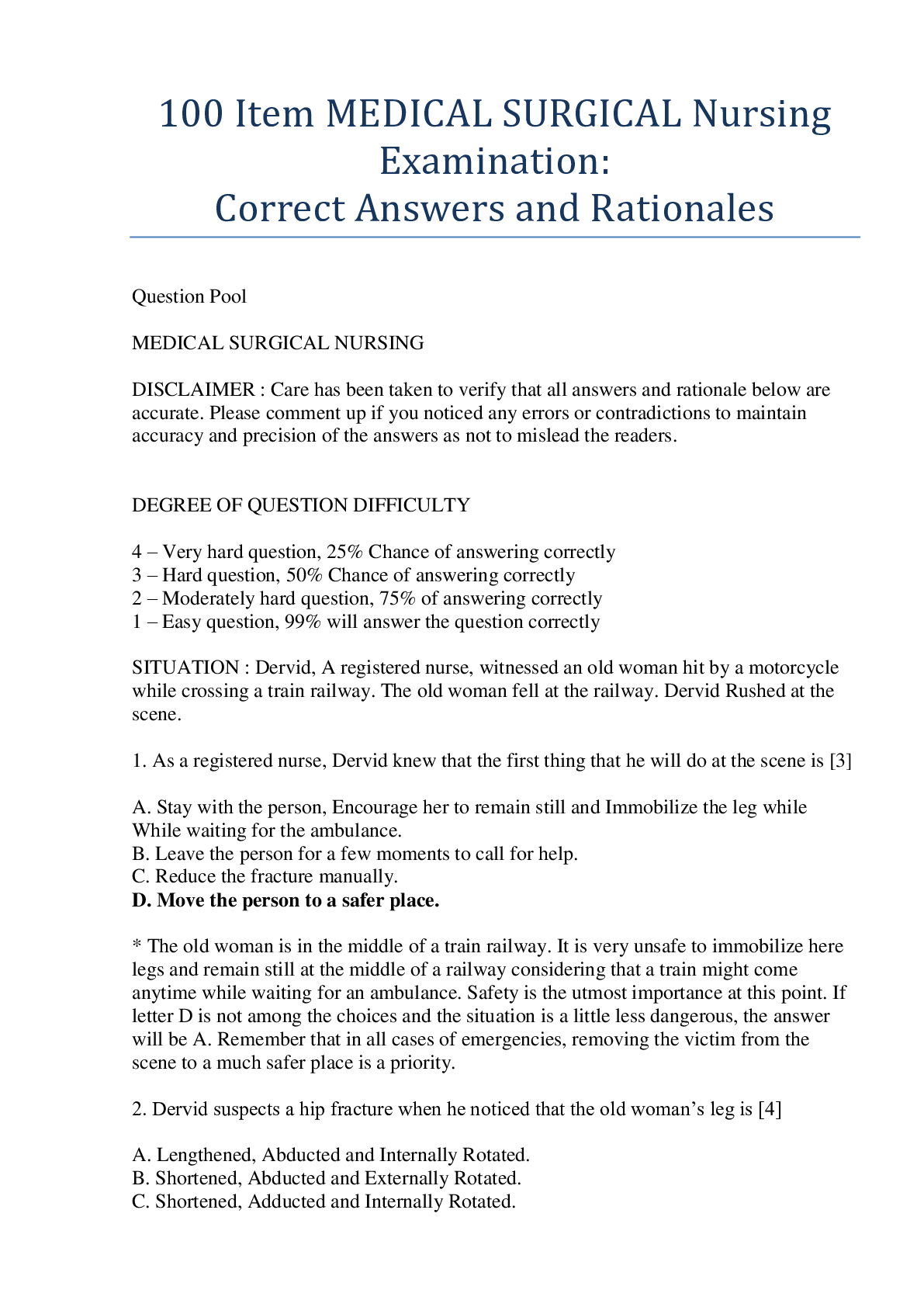

1. Boston Consulting Group (BCG) is a management consulting, technology services and outsourcing organization. Which of the following actions should managers take when there is evidence that a fixed... -rate contract is over budget and will generate a loss for the firm? A) Use the percentage of completion method to recognize the loss over the remaining term of the engagement. B) Recognize the loss in the current period rather than over the remaining term of the engagement. C) Restate the financial statements and recognize the loss in the earliest period of the engagement. D) Use the percentage of completion method and pro rate the loss over the entire term of the engagement. E) None of the above is an appropriate action. Answer: B Rationale: When contracts are over-budget, managers should estimate the new, revised, total engagement cost. If this results in a loss on the engagement, that loss should be recognized immediately rather than over the remaining term of the engagement. 2. On December 31, 2012, Tri-State Construction Inc. signs a contract with the state of Texas Department of Transportation to manufacture a bridge over the Rio Grande. Tri-State anticipates the construction will take three years. The company’s accountants provide the following contract details relating to the project: Contract price $420 million Estimated construction costs $300 million Estimated total profit $120 million During the three-year construction period, Tri-State incurred costs as follows: 2013 $ 30 million 2014 $180 million 2015 $ 90 million Tri-State uses the percentage of completion method to recognize revenue. Which of the following represent the revenue recognized in 2013, 2014, and 2015? A) $140 million, $140 million, $140 million B) $30 million, $180 million, $90 million C) $12 million, $72 million, $36 million D) $42 million, $252 million, $126 million E) None of the above Answer: D Rationale: ($ in millions) Year 1 Year 2 Year 3 Construction costs incurred $30 $180 $90 Percentage to total costs $30 / $300 = $180 / $300 = 60% $90 / $300 = 30% 210% Revenue recognized 10% × $420 = $42 60% × $420 = $252 30% × $420= $126 3. In spring 2012, Mainline Engineering Company signed an $80 million contract with the city of Duluth, to construct a new city hall. Mainline expects to construct the building within two years and incur expenses of $60 million. The city of Duluth paid $20 million when the contract was signed, $40 million within the next six months, and the final $20 million exactly one year from the signing of the contract. Mainline incurred $24 million in costs during 2012 and rest in 2013 to complete the contract on time. Using the percentage-of-completion method how much revenue should Mainline recognize in 2012? A) $32 million B) $60 million C) $20 million D) $40 million E) None of the above Answer: A Rationale: According to the percentage-of-completion method Mainline Engineering Company should recognize the revenues as shown in the table below: Year Total contract Percentage completed Revenue Recognized 2012 $80 million $24 million/$60 million = 40% 40% × $80 million = $32 million 4. Tickets Now contracts with the producer of Riverdance to sell tickets online. Tickets Now charges each customer a fee of $4 per ticket and receives $10 per ticket from the producer. Tickets Now does not take control of the ticket inventory. Average ticket price for the event is $150. How much revenue should Tickets Now recognize for each Riverdance ticket sold? A) $4 because the $10 from the producer is similar to a negative cost of goods sold B) $14 because both the fee from the customer and the producer are earned C) $150 because the $140 is cost of goods sold paid to the Riverdance producer D) $186 because the $140 is cost of goods sold paid to the Riverdance producer E) None of the above Answer: B Rationale: Tickets Now should record $14 revenue each time it sells a ticket. Of that $4 will be received in cash and $10 will be recorded as receivable from the Riverdance producers. 5. On its 2011 income statement, Yahoo! reported Product development expense of $1,005,090. Which of the following statements must be true? A) Yahoo spent $1,005,090 in cash to develop new products and improve old products. B) Product development expense reduced Yahoo’s 2011 net income by $1,005,090. 3C) Yahoo capitalized at least $1,005,090 of product development costs in 2011. D) The $1,005,090 included amortized product development costs from prior years that were not previously expensed, because Yahoo incurs such expenses each year. E) None of the above Answer: E Rationale: Yahoo included in product development expense certain non-cash expenses such as depreciation on related assets, thus a is not correct. Yahoo recorded deferred tax expense on the product development expense, thus net income was affected on an after-tax basis and b is therefore not correct. Under US GAAP, firms may not capitalize R&D costs, thus c is not correct. All R&D expenses must be included in the income statement in the period, thus d is wrong. 6. Life Technologies Corporation and Affymetrix Inc. are competitors in the life sciences and clinical healthcare industry. Following is a table of Total revenue and R&D expenses for both companies. Life Technologies Corporation Affymetrix Inc 2011 2010 2009 2011 2010 2009 Total revenue $3,775,672 $3,588,094 $3,280,344 $241,27 3 $277,743 $279,186 R&D expenses $377,924 $375,465 $337,099 $63,591 $67,934 $77,358 Which of the following is true? A) Life Technologies Corporation is the more R&D intensive company of the two. B) Life Technologies Corporation has become more R&D intensive over the three years. C) Affymetrix is more R&D intensive in 2011 than in 2010. D) Affymetrix is less R&D intensive in 2011 than in 2010. E) None of the above Answer: C Rationale: To make comparisons, we need to common size the R&D expenditures of both firms by scaling by total revenues. Life Technologies Corporation Affymetrix Inc 2011 2010 2009 2011 2010 2009 Common sized R&D 10.0% 10.5% 10.3% 26.4% 24.5% 27.7% Affymetrix spends proportionately more on R&D than Life Technologies, thus a is not true. Life Technologies has spent less on R&D in 2011 than in 2010 and 2009, thus b is not true. Affymetrix increased R&D from 24.5% in 2010 to 26.4% in 2011, thus C is true, but not D. 7. Dow Chemical recorded pretax restructuring charges of $689 million in 2009. The charges consisted of asset write-downs of $454 million, costs associated with exit or disposal activities of $66 million, and employee severance costs of $169 million. The company paid 4$72 million cash to settle these restructuring charges during the year (2009). At year end, the restructuring accrual associated with these charges was: A) $689 million B) $617 million C) $163 million D) $ 97 million E) There is not enough information to determine the amount. Answer: C Rationale: Of the $689 million total restructuring charge, only the exit costs and severance costs must eventually be settled in cash. The asset write downs are not accrued – they reduce the assets on the balance sheet. The company accrued $66 million + $169 million = $235 million as a liability. Thus, if the company paid $72 million cash, the remaining accrual is $163 million at year end. 8. Intelligentsia Corp. recorded restructuring charges of $157,028 thousand during fiscal 2012 related entirely to anticipated employee separation payments. Intelligentsia had never before incurred restructuring charges. At the end of the year, the company’s balance sheet included a restructuring accrual of $19,762. The cash flow effect of Intelligentsia’s restructuring during fiscal 2012 was: A) $19,762 thousand B) $157,028 thousand C) $176,790 thousand D) $137,266 thousand E) None of the above Answer: D Rationale: The total restructuring charge accrued was $157,028 of which $19,762 was still unpaid (a liability) at the end of the year. The difference of $137,266 must have been paid in cash during the year. The cash flow effect is $137,266. 9. The 2010 annual report of Dow Chemical Company disclosed a valuation allowance of $682 million related to various deferred tax assets. The 2009 valuation allowance had a balance of $721 million. What effect did this decrease in the allowance have on Dow Chemical’s net income in 2010? A) Increase net income by $39 million B) Decrease net income by $39 million C) Increase net income by $682 million D) Decrease net income by $682 million E) None of the above Answer: A Rationale: Changes in valuation allowance affect net income in the opposite direction, dollar for dollar. Dow Chemical decreased the allowance by $39 million ($721 million - $682 million). The effect was to increase Dow’s net income by $39 million in 2010. 10. As a result of using accelerated depreciation for tax purposes, The MED Corporation reported $186 million income tax expense in its income statement, while the actual amount 5of taxes paid by the company was $206 million. How did these tax transactions affect the company’s balance sheet? A) Increase deferred tax liability by $20 million B) Decrease deferred tax assets by $186 million C) Decrease retained earnings by $186 million D) Decrease cash by $186 million E) Both C and D Answer: C Rationale: The tax expense of $186 million will reduce net income by that amount and thus, retained earnings on the balance sheet will be $186 million lower. The company pays $206 million tax in cash, which reduces assets (cash). The difference of $20 million is recorded as an increase in deferred tax asset. [Show More]

Last updated: 6 months ago

Preview 4 out of 20 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 30, 2022

Number of pages

20

Written in

Additional information

This document has been written for:

Uploaded

Apr 30, 2022

Downloads

0

Views

135

.png)