Financial Accounting > QUESTIONS & ANSWERS > MGMT 59000-021 Module4 MCQ. (All)

MGMT 59000-021 Module4 MCQ.

Document Content and Description Below

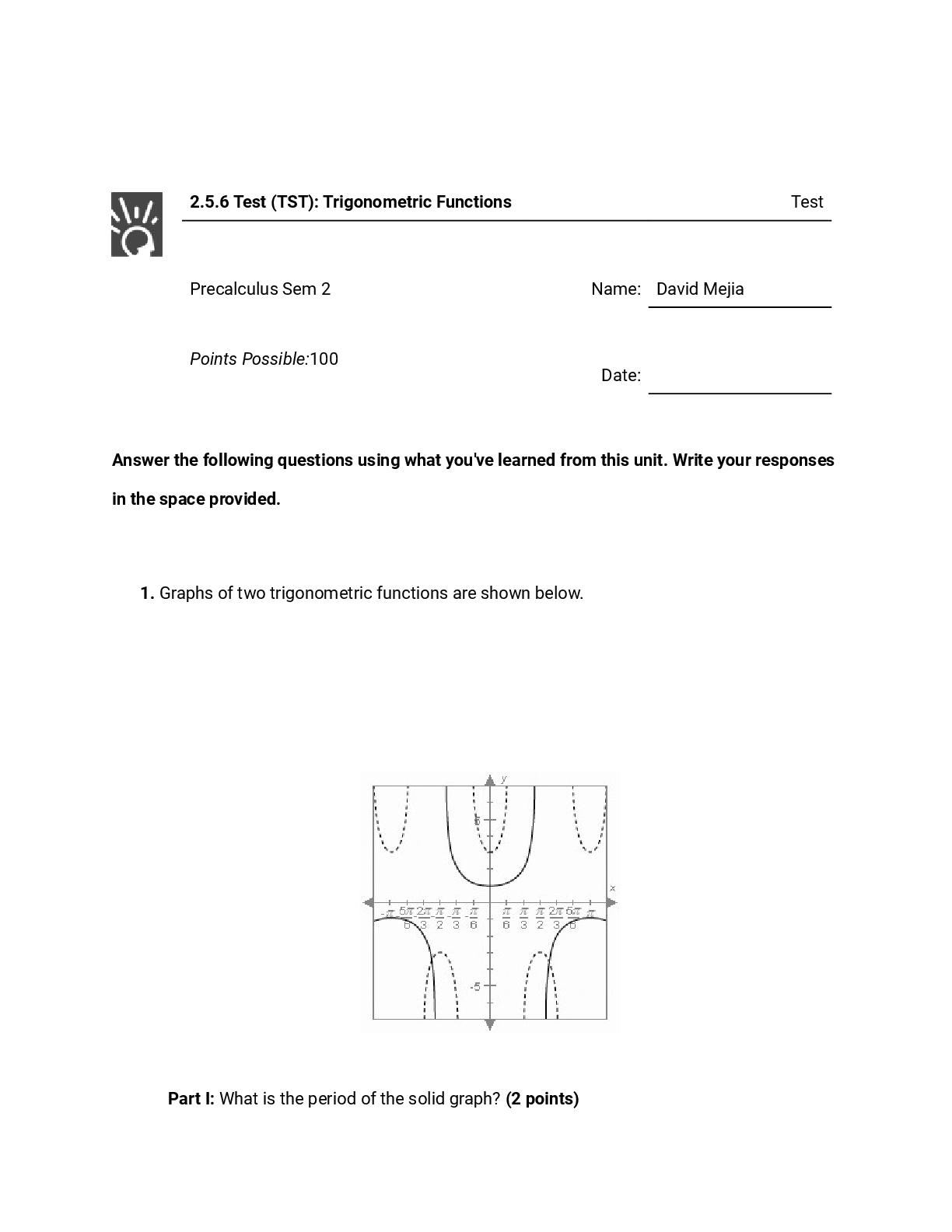

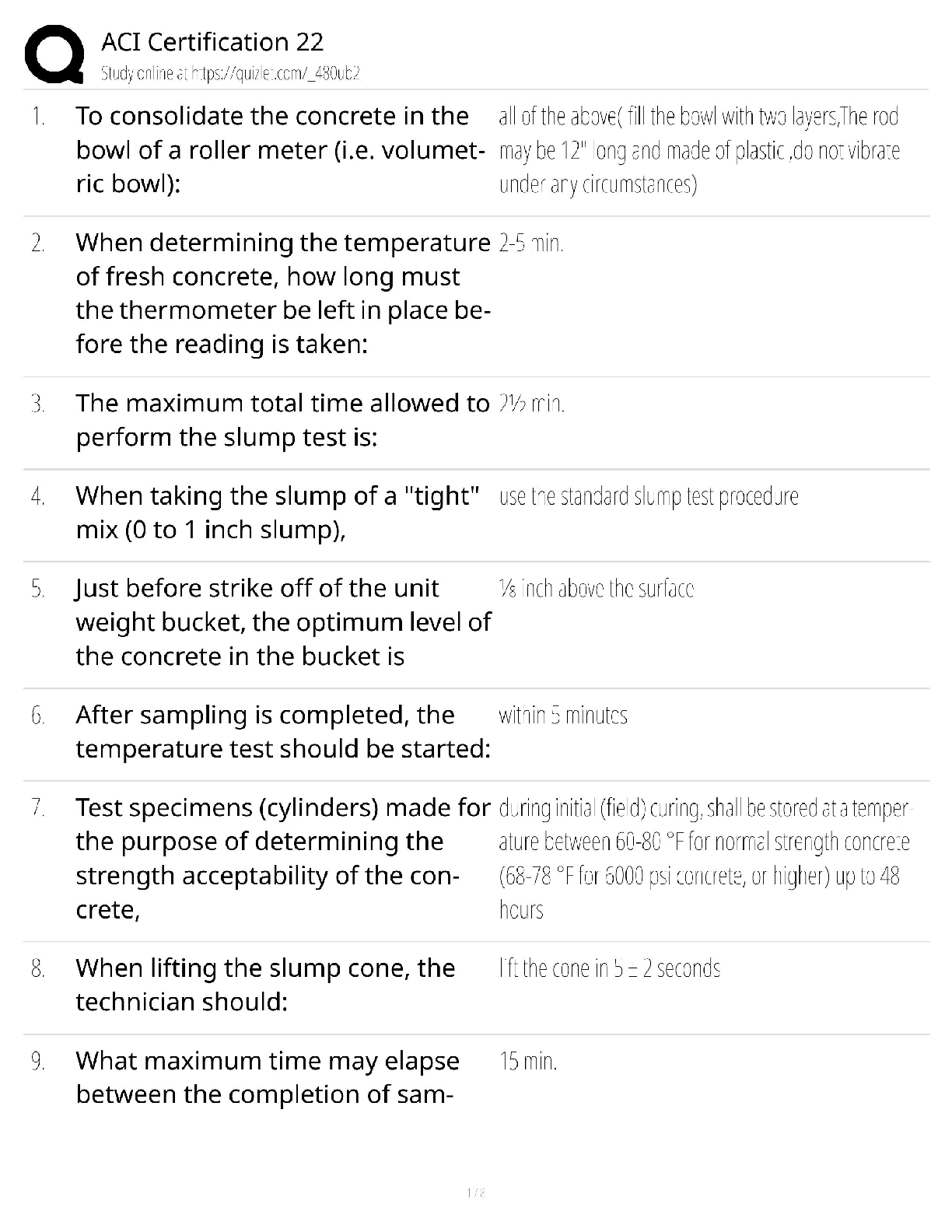

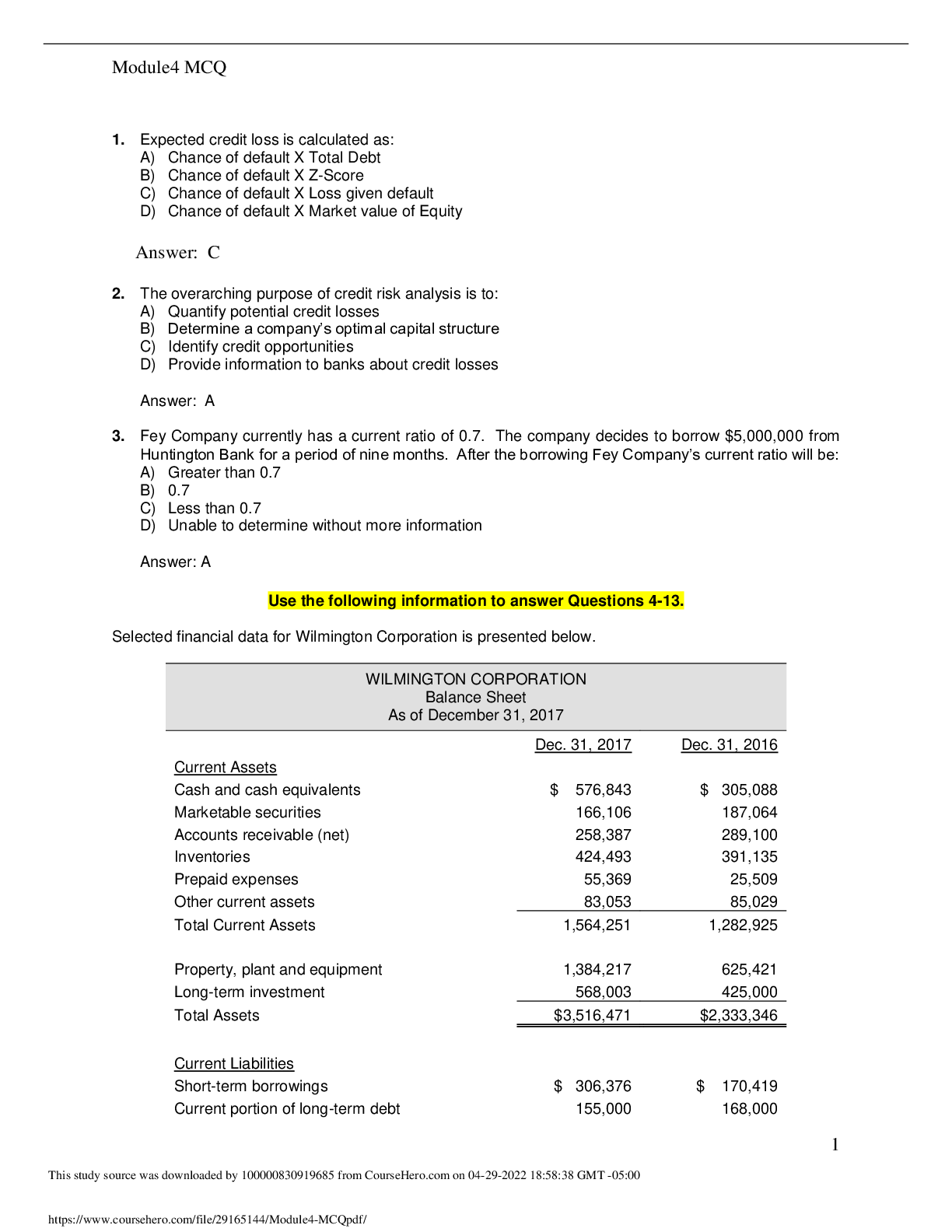

Module4 MCQ 1 1. Expected credit loss is calculated as: A) Chance of default X Total Debt B) Chance of default X Z-Score C) Chance of default X Loss given default D) Chance of default X Market v ... alue of Equity 2. The overarching purpose of credit risk analysis is to: A) Quantify potential credit losses B) Determine a company’s optimal capital structure C) Identify credit opportunities D) Provide information to banks about credit losses 3. Fey Company currently has a current ratio of 0.7. The company decides to borrow $5,000,000 from Huntington Bank for a period of nine months. After the borrowing Fey Company’s current ratio will be: A) Greater than 0.7 B) 0.7 C) Less than 0.7 D) Unable to determine without more information Use the following information to answer Questions 4-13. Selected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31, 2017 Dec. 31, 2017 Dec. 31, 2016 Current Assets Cash and cash equivalents $ 576,843 $ 305,088 Marketable securities 166,106 187,064 Accounts receivable (net) 258,387 289,100 Inventories 424,493 391,135 Prepaid expenses 55,369 25,509 Other current assets 83,053 85,029 Total Current Assets 1,564,251 1,282,925 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,516,471 $2,333,346 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 2 Accounts payable 254,111 286,257 Accrued liabilities 273,658 166,983 Income taxes payable 97,735 178,911 Total Current Liabilities 1,086,880 970,570 Long-term debt 500,000 300,000 Deferred income taxes 215,017 262,404 Total Liabilities 1,801,897 $1,532,974 Common stock $ 425,250 $ 125,000 Additional paid-in capital 356,450 344,335 Retained earnings 932,874 331,037 Total Stockholders' Equity 1,714,574 800,372 Total Liabilities and Stockholders' Equity $3,516,471 $2,333,346 Selected Income Statement Data for the year ending December 31, 2017: Net sales $4,885,340 Cost of goods sold (2,942,353) Selling expenses (884,685) Operating income 1,058,302 Interest expense (55,240) Earnings before income taxes 1,003,062 Income tax expense (401,225) Net income $ 601,837 Selected Statement of Cash Flow Data for the year ending December 31, 2017: Cash flows from operations $1,456,084 Capital expenditures $745,862 4. Wilmington Corporation’s current ratio in 2017 was: A) 0.92 B) 1.44 C) 0.69 D) 2.02 5. Wilmington Corporation’s quick ratio in 2017 was: A) 0.92 B) 0.81 3 C) 1.09 D) 1.44 6. Wilmington Corporation’s quick ratio changed by what percentage from 2016 to 2017? A) + 15.0% B) + 87.0% C) + 9.1% D) – 8.5% 7. Wilmington Corporation’s liabilities to equity ratio in 2017 was: A) 0.99 B) 1.09 C) 1.05 D) 1.79 8. Wilmington Corporation’s total debt to equity ratio in 2017 was: A) 1.31 B) 0.38 C) 0.56 D) 0.29 9. Wilmington Corporation’s times interest earned ratio in 2017 was: A) 18.15 B) 20.57 C) 10.89 D) 19.16 4 10. Wilmington Corporation’s cash flow from operations to total debt ratio in 2017 was: A) 0.80 B) 1.51 C) 1.92 D) 0.71 11. Wilmington Corporation’s free operating cash flow to total debt ratio in 2017 was: A) 1.57 B) 0.80 C) 0.74 D) 1.92 12. Wilmington Corporation’s return on equity in 2017 was: A) 35.1% B) 20.6% C) 17.1% D) 47.9% 13. Wilmington Corporation’s return on assets in 2017 was: A) 35.1% B) 20.6% C) 17.1% D) 47.9% LO: 3 19. Wilmington Corporation’s financial leverage in 2017 was: A) 2.33 B) 0.94 C) 1.75 D) 0.43 LO: 3 20. What was Wilmington Corporation’s return on net operating assets (RNOA) in 2017? Assume a statutory tax rate of 37%. A) 20.6% B) 44.2% C) 67.5% D) 32.9% 21. What was Wilmington Corporation’s net operating profit margin (NOPM) in 2017? Assume a statutory tax rate of 37%. A) 32.8% B) 13.0% C) 20.5% D) 13.9% 6 Topic: Analyzing Credit Risk LO: 3 22. Wilmington Corporation’s net operating assets (NOAT) in 2017 was: A) 0.19 B) 3.58 C) 0.72 D) 5.18 24. Covenants represent: A) The property that a company pledges to guarantee repayment B) The maximum that a creditor will allow a customer to owe at any point in time C) Promises the company makes to the creditor D) Terms and conditions set forth in a lending agreement to reduce the probability of nonpayment 27. When considering the results of an Altman Z-Score analysis a score of 3.85 would suggest? A) The company is in financial distress and there is a high probability of bankruptcy in the short term future. B) The company is exposed to some risk of bankruptcy. C) The company is healthy and there is a low bankruptcy potential in the short-term. D) The company is healthy and there is a low bankruptcy potential in both the short and long-term. [Show More]

Last updated: 3 years ago

Preview 1 out of 6 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 30, 2022

Number of pages

6

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 30, 2022

Downloads

0

Views

82