Finance > QUESTIONS & ANSWERS > FSA3e Test Bank B Mod02 042712. Module 2 Overview of Business Activities and Financial Statements (All)

FSA3e Test Bank B Mod02 042712. Module 2 Overview of Business Activities and Financial Statements

Document Content and Description Below

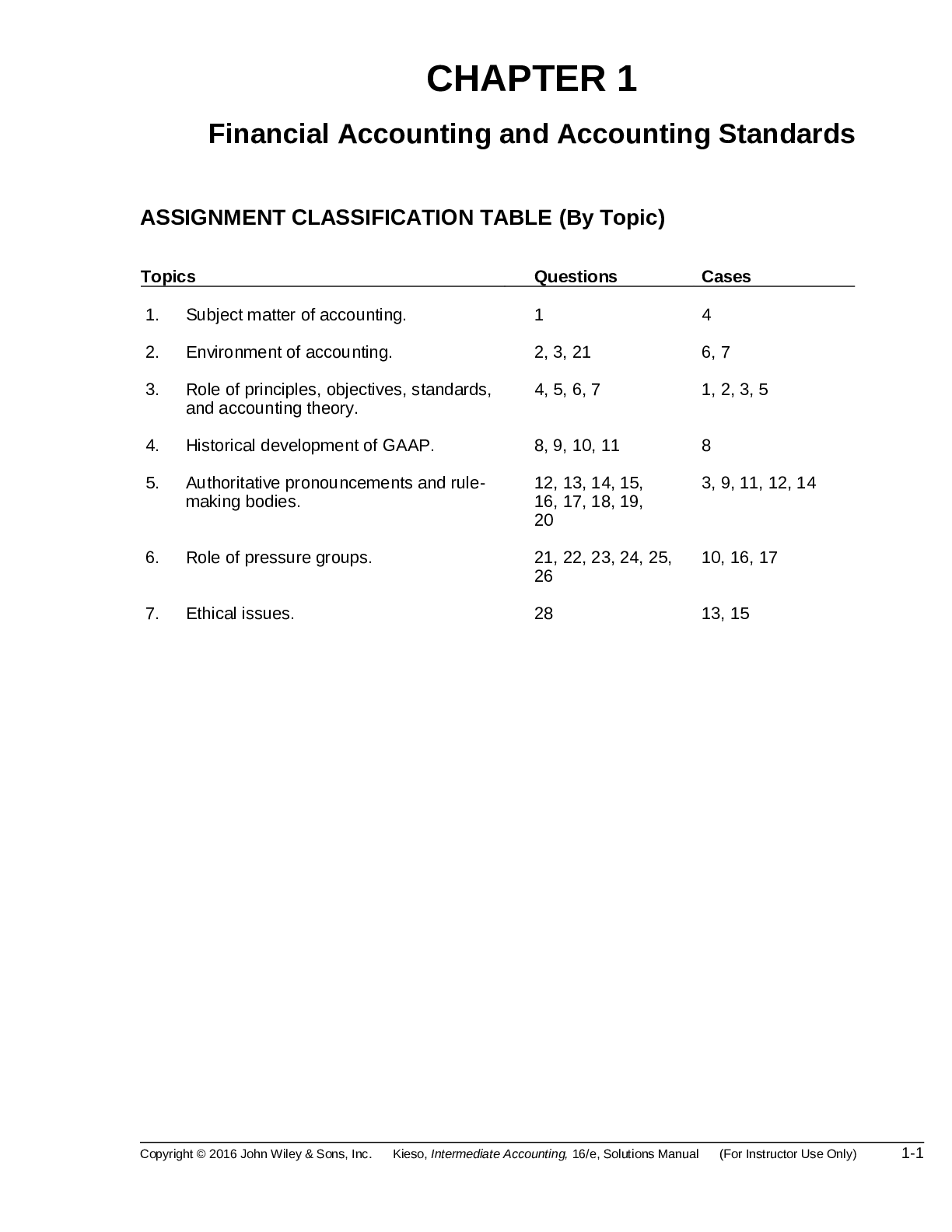

Module 2 Overview of Business Activities and Financial Statements Learning Objectives – coverage by question True / False Multiple Choice Exercises Problems Essays LO1 – Describe informatio... n conveyed by the financial statements. LO2 – Explain and illustrate linkages among the four financial statements. LO3 – Illustrate use of the financial statement effects template to summarize accounting transactions. Module 2: Overview of Business Activities and Financial Statements True/False Topic: Definition of an Asset LO: 1 1. In order for an asset to be reported on the balance sheet, it must be owned by the company and be expected to provide future benefits. Answer: False Rationale: Assets reported on the balance sheet must be owned OR CONTROLLED by the company and must be expected to provide future benefits. These benefits can relate to the expected receipt of cash or another asset, or the expected decrease in a liability. Topic: Historical Cost LO: 1 2. Assets are reported on the balance sheet at their current market value. Answer: False Rationale: Assets are generally reported at historical costs. An exception is marketable securities. Topic: Book vs. Market Value LO: 1 3. The book value of stockholders’ equity (the amount reported on the balance sheet) is most typically equal to the market value of the equity of a company. Answer: False Rationale: Book value and market value differ for many reasons, including reporting assets at historical costs instead of current market value, and differences between the accounting periods in which transactions are recognized in the financial statements and when the value implications of those transactions are recognized by the capital markets. Topic: Reporting of Assets and Liabilities LO: 1 4. Assets are listed on the balance sheet in order of liquidity and liabilities are listed in order of maturity. Answer: True Rationale: Assets are reported in the order that they are generally expected to be converted into cash. Receivables are, thus, reported before inventories, and inventories before PPE. Liabilities are reported in order of maturity, with current liabilities expected to be paid within one year and long-term liabilities expected to be paid over a longer period of time. ©Cambridge Business Publishers, 2013 2-2 Financial Statement Analysis & Valuation, 3rd EditionTopic: Unrecorded Assets LO: 1 5. In addition to purchased assets like inventories and equipment, companies also may report on their balance sheets intangible assets such as the value of a brand name. Answer: True Rationale: Companies may report intangible assets if they acquired them in an arms’ length transaction. But if the intangible was not purchased, if it was internally generated it may not be included on the balance sheet because its future economic benefits cannot be reliably measured. So, all internally generated intangible assets are excluded from the balance sheet under GAAP. Topic: Liabilities LO: 1 6. Liabilities and equities are both claims against the assets of a company. Answer: True Rationale: Both liabilities and equity are claims against the assets. In the event of default of a company, liabilities are settled first against the assets of the company. The owners, however, still have an interest in the remaining assets. Topic: Unearned Revenue and Revenue Recognition Principle (more challenging – involves unearned revenue and recognition thereof.) LO: 1 7. A customer’s prepayment for services not yet rendered is initially recorded as unearned revenue (a liability). Then, at the end of the accounting period, the unearned revenue is moved from the balance sheet to the income statement. This is an example of the revenue recognition principle. Answer: False Rationale: Unearned revenue is recorded for customer prepayments. But it is only moved to the income statement when the services have been rendered and not automatically at the end of the accounting period. Topic: Revenue Recognition Principle and Cash LO: 1 8. According to the revenue recognition principle, companies are required to record revenue when cash is received as this provides the most objective evidence for the auditors. Answer: False Rationale: The revenue recognition principle states that revenue may be recognized in the income statement when it is earned and realized or realizable. Cash is objective but not necessary for revenue to be earned. Topic: Accrual Accounting for Expenses LO: 1 9. Under accrual accounting principles, the cost of inventory should be reported as an expense in the income statement when it is sold, regardless of when it was purchased. Answer: True Rationale: Under accrual accounting, the cost of inventory is reported as expense in the period in which it is used up, typically at the point of sale. Purchased inventories that have not yet been sold are reported as assets, notwithstanding whether or not they have been paid for. ©Cambridge Business Publishers, 2013 Test Bank, Module 2 2-3Topic: Statement of Cash Flows LO: 1 10. The statement of cash flows has two main sections: cash flows from operating activities and cash flows from investing activities. Answer: False Rationale: The statement of cash flows has three sections: cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities Topic: Net working Capital LO: 1 11. Net working capital = Current assets + current liabilities Answer: False Rationale: Net working capital = Current assets less current liabilities. Topic: Articulation in General LO: 2 12. Articulation refers to the concept that financial statements are linked to each other and linked across time. Answer: True Rationale: Balance sheets are linked over time because the permanent accounts’ closing balance last period becomes the opening balance in the current period. The statements are linked to each other via cash (statements of cash flow and balance sheets), via retained earnings (income statements and balance sheets), and via equity accounts (statements of stockholders’ equity and balance sheets). Topic: Articulation in General LO: 2 13. The income statements of the prior and current year are linked via the balance sheet. Answer: False Rationale: The balance sheets of the prior and current year are linked via the income statement. Topic: Articulation of Retained Earnings LO: 2 14. Retained earnings articulate across time which means that last period’s retained earnings plus current period net income (or loss) is equal to the current period’s retained earnings. Answer: False Rationale: Last period’s retained earnings plus current period net income (or loss) less any dividends paid, is equal to the current period’s retained earnings. Topic: Preparing Financial Statements LO: 3 15. Preparing financial statements involves two steps: recording transactions during the period and adjusting records to ensure all events are properly recorded. Answer: True Rationale: Both steps are required to prepare accrual based financial statements. ©Cambridge Business Publishers, 2013 2-4 Financial Statement Analysis & Valuation, 3rd EditionMultiple Choice Topic: Reporting of Assets LO: 1 1. Assets are recorded in the balance sheet in order of: A) Market Value B) Historic Value C) Liquidity D) Maturity E) None of the above Answer: C Rationale: Liquidity refers to the ease of conversation to cash. Current Assets are to be used during the current operating cycle. Non-current assets, like equipment and goodwill are reported after current assets. Market value and historic value refer not to the order but to the valuation of assets. Maturity refers to the order in which liabilities are recorded in the balance sheet. Topic: Current Assets LO: 1 2. Which of the following are included in current assets? A) Prepaid rent B) Taxes payable C) Automobiles D) Common stock E) None of the above Answer: A Rationale: Taxes payable is a liability, automobiles is not a current asset but a long-term one, and common stock is an equity. Topic: Net Working Capital – Numerical calculations required LO: 1 3. In 2011, Southwest Airlines had negative net working capital of $(188) million and current assets of $4,345 million. The firm’s current liabilities are: A) $4,533 million B) $4,157 million C) $ 188 million D) $4,345 million E) There is not enough information to calculate the amount. Answer: A Rationale: Net working capital = current assets – current liabilities. Current liabilities = Current assets – Net working capital = $4,345 - $(188) = $4,533 ©Cambridge Business Publishers, 2013 Test Bank, Module 2 2-5Topic: Net Working Capital – Numerical calculations required LO: 1 4. In 2006, Delphi Corporation had current assets of $9,916 million and current liabilities of $8,404 million. The firm’s net working capital is: A) $ 9,916 million B) $ 1,512 million C) $ (1,512) million D) $18,320 million E) None of the above Answer: B Rationale: Net working capital = current assets – current liabilities. $9,916 - $8,404 = $1,512 million. Topic: Net Working Capital – Numerical calculations required LO: 1 5. In 2012, Kohl’s Corporation had net working capital of $2,185 million and current liabilities of $2,590 million. The firm’s current assets are: A) $ 405 million B) $ (405) million C) $2,590 million D) $4,775 million E) None of the above Answer: D Rationale: Net working capital = current assets – current liabilities. $4,775 - $2,590 = $2,185 Topic: Liabilities LO: 1 6. Which one of the following is not a current liability? A) Taxes payable B) Accounts payable C) Wages payable D) Wage expense E) None of the above Answer: D Rationale: Wage expense is an income statement account, not a balance sheet account. It is not a current liability. Topic: Stockholders’ Equity LO: 1 7. Which of the following is included as a component of stockholders’ equity? A) Buildings B) Retained earnings C) Prepaid property taxes D) Accounts payable E) Dividends Answer: B Rationale: Retained earnings is a component of stockholders’ equity. Dividends affect retained earnings but they are not reported as a separate component. ©Cambridge Business Publishers, 2013 2-6 Financial Statement Analysis & Valuation, 3rd EditionTopic: Recognition of Costs as Expense LO: 1 8. As inventory and property plant and equipment on the balance sheet are consumed, they are reflected: A) As a revenue on the income statement B) As an expense on the income statement C) As a use of cash on the statement of cash flows D) On the balance sheet because assets are never consumed E) Both B and C because the financial statements articulate Answer: B Rationale: As assets are consumed (used up), their cost is transferred to the income statement as expenses. Cash is not involved so c and e are incorrect. Topic: Income Statement LO: 1 9. Interest expense appears in which financial statement? A) Statement of stockholders’ equity B) Balance sheet C) Income statement D) Statement of cash flows E) All of the above Answer: C Rationale: Expenses, including interest expense, appear in the income statement. Topic: Gross Profit – Numerical calculations required LO: 1 10. During fiscal 2011, Mattel had sales of $6,266,037, total expenses of $5,497,529 and gross profit of $3,145,826. What was Mattel’s cost of sales for 2011? ($ in thousands) A) $ 768,508 thousand B) $2,351,703 thousand C) $3,120,211 thousand D) $8,643,355 thousand E) There is not enough information to calculate the cost of sales. [Show More]

Last updated: 2 years ago

Preview 1 out of 42 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$14.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 30, 2022

Number of pages

42

Written in

Additional information

This document has been written for:

Uploaded

Apr 30, 2022

Downloads

0

Views

94