Analyzing and Valuing

Equity Securities

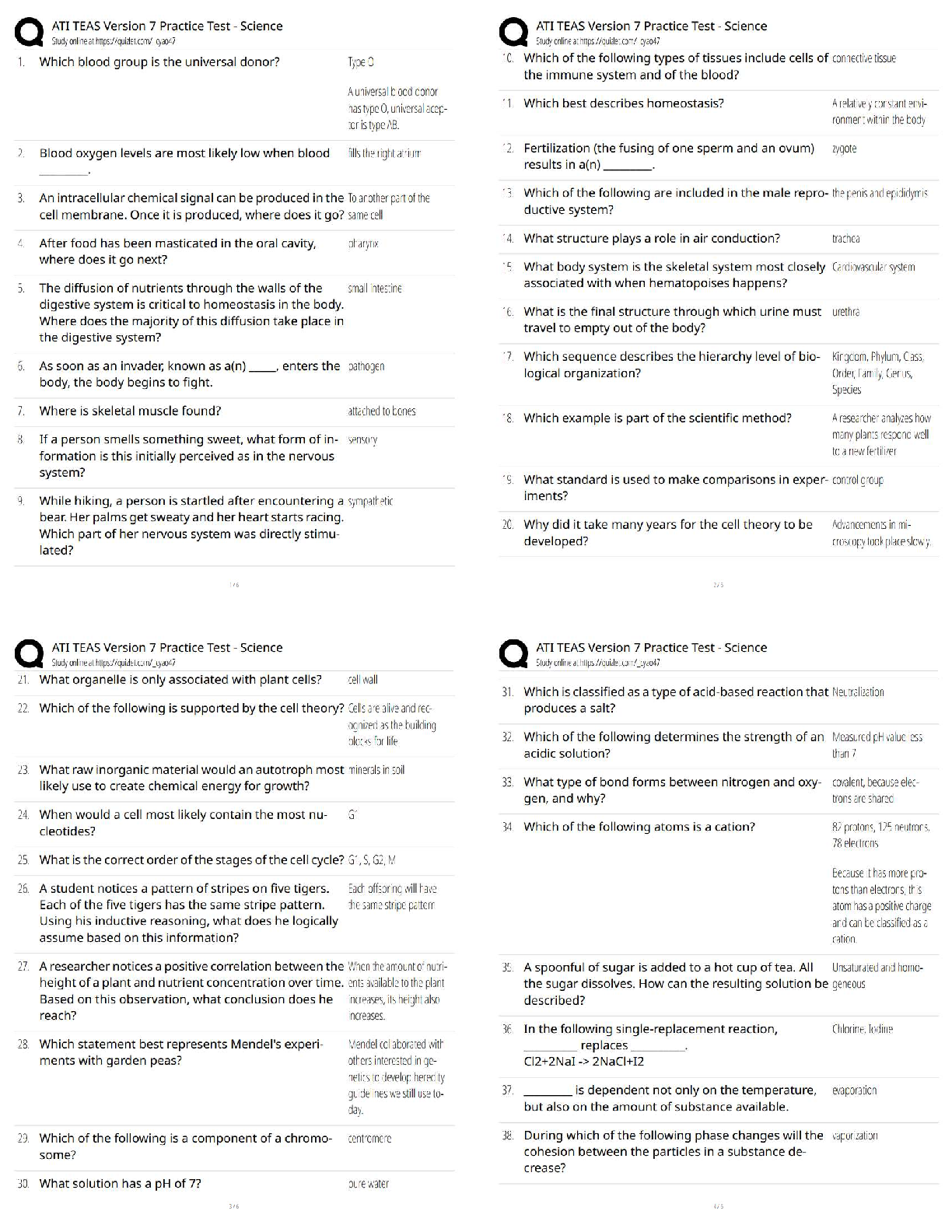

Learning Objectives – coverage by question

True/False Multiple Choice Exercises Problems Essays

LO1 – Identify equity

valuation models and explain

the information required to

...

Analyzing and Valuing

Equity Securities

Learning Objectives – coverage by question

True/False Multiple Choice Exercises Problems Essays

LO1 – Identify equity

valuation models and explain

the information required to

value equity securities.

1, 2 1-3 1-4 1 1, 2

LO2 – Describe and apply

the discounted free cash flow

model to value equity

securities.

3-12 4-15 5-14 2-8 3, 4

LO3 – Describe and apply

the residual operating income

model to value equity

securities.

9-15 4-9,

16-23 5, 15-23 2-4, 9-11 3, 5, 6

LO4 – Explain how equity

valuation models can inform

managerial decisions.

16 24, 25 24, 25 12 7, 8

©Cambridge Business Publishers, 2015

Test Bank, Module 12 12-1Module 12: Analyzing and Valuing Equity Securities

True/False

Topic: Valuation Models in General

LO: 1

1. Valuation models are typically based on payments investors expect to receive in the future.

Answer: True

Rationale: Most valuation models discount expected future streams. Common models include

expected dividends, expected free cash flows, or expected residual earnings.

Topic: Valuation Models: Debt vs. Equity

LO: 1

2. The chief difference between valuing debt securities and equity securities is that the latter includes an

assessment of non-financial information whereas the former relies only on financial information.

Answer: False

Rationale: Valuing either debt or equity involves assessing some non-financial information such as

the quality of the management team and the external market forces that affect future profits and cash

flows.

Topic: Free Cash Flows to the Firm

LO: 2

3. One definition of free cash flows to the firm is net cash flows from operations+/- net cash flows from

investing activities.

Answer: True

Rationale: FCFF is typically defined as net cash flows from operations +/- net cash flows from

investing activities. The sum of the two represents the net cash flows available to all providers of

capital to the firm, both its creditors and shareholders.

Topic: Discounted Cash Flow (DCF) Valuation Model

LO: 2

4. One advantage of the DCF model is that it only recognizes value evidenced by cash flow, which is

less easily manipulated by accrual accounting practices.

Answer: True

Rationale: The DCF model is based on accrual accounting principles. In fact, free cash flow is

defined as NOPAT – change NOA. Cash flow is not affected by accrual accounting practices, which

recognize revenue when earned and the matching of expenses when incurred.

©Cambridge Business Publishers, 2015

12-2 Financial & Managerial Accounting for MBAs, 4th EditionTopic: Free Cash Flow

LO: 2

5. Firms can increase free cash flow to the firm (FCFF) in the short run by cutting back on investment in

fixed assets.

Answer: True

Rationale: Capital expenditures are a deduction in the computation of FCF. As a result, firms can

increase FCF in the short run by cutting back on CAPEX. Long-run FCFF may be lessened by the

failure to invest in PPE.

Topic: Terminal Value

LO: 2

6. The higher the expected growth rate of the terminal free cash flow to the firm, the lower the present

value of the terminal value becomes.

Answer: False

Rationale: The terminal value is given by FCF/(r-g) where g is the growth rate and r is the discount

rate. As g increases, the terminal value increases as well.

Topic: Stock Price, Cash Flow and Discount Rate

LO: 2

7. The price one is willing to pay for a common stock is positively related to expected free cash flows to

the firm (FCFF) and negatively related to the required rate of return.

Answer: True

Rationale: Higher expected FCFF and lower required rate of return will lead to a higher valuation.

Topic: DCF Valuation Model

LO: 2

8. The DCF valuation of a firm’s equity involves the following three steps:

a. Forecast free cash flows to the firm (FCFF) for the horizon period.

b. Forecast discount FCFF for the terminal period.

c. Sum the horizon and terminal periods to yield firm value.

Answer: False

Rationale: To value the firm’s equity, we sum the present values of the horizon and terminal periods.

Topic: DCF Model and Accounting Policies

LO: 2 & 3

9. The Discounted Cash Flow model of valuation is superior to ROPI in that it addresses investors’

increasing concern with perceived earnings management by companies.

Answer: False

Rationale: The ROPI model is immune to the effects of differing accrual accounting practices.

©Cambridge Business Publishers, 2015

Test Bank, Module 12 12-3Topic: NOPAT

LO: 2 & 3

10. Net operating profit after tax (NOPAT) is equal to net income less interest expense incurred during the

year.

Answer: False

Rationale: NOPAT is computed from the income statement and equals operating revenues less

operating expenses, all of which is expressed on an after-tax basis.

Topic: Weighted Average Cost of Capital

LO: 2 & 3

11. The weighted average cost is computed as: WACC=(rd × % of debt) + (re × % of net income)

Answer: False

Rationale: Discount rate WACC = (rd × % of debt) + (re × % of equity)

Topic: RNOA, WACC, and Company Value

LO: 2 & 3

12. All else equal, when WACC is higher than RNOA, the company’s market value is increasing.

Answer: False

Rationale: For a given level of NOA, company value increases when RNOA > WACC.

Topic: Residual Operating Income (ROPI) Valuation Model

LO: 3

13. Differing accrual accounting policies have an impact on the estimated value of equity when using the

ROPI model.

Answer: False

Rationale: Expected ROPI offsets different levels of NOA resulting from differing accounting policies,

leaving estimated value unaffected by accounting policies.

Topic: Company Value under ROPI Model

LO: 3

14. The residual operating income (ROPI) model estimates firm value as the current book value of net

operating assets plus the present value of expected residual operating income.

Answer: True

Rationale: The ROPI model estimates firm value as the current book value of net operating assets

plus the present value of expected ROPI.

Topic: ROPI Valuation Model

LO: 3

15. The residual operating income (ROPI) model focuses on net income which is a more accurate

measure of future profitability than expected cash flows.

Answer: False

Rationale: NOPAT is the key value driver of the ROPI model.

©Cambridge Business Publishers, 2015

12-4 Financial & Managerial Accounting for MBAs, 4th EditionTopic: Insights from ROPI Model

LO: 4

16. The power of the residual operating income (ROPI) model is that it allows managers to focus on

either the income statement or balance sheet to increase firm value.

Answer: False

Rationale: The ROPI model focuses managers’ attention on both the income statement and the

balance sheet.

[Show More]

.png)