Financial Auditing > QUESTIONS & ANSWERS > Financial Planning and Insurance Final Exam Study Guide Multiple Choice (All)

Financial Planning and Insurance Final Exam Study Guide Multiple Choice

Document Content and Description Below

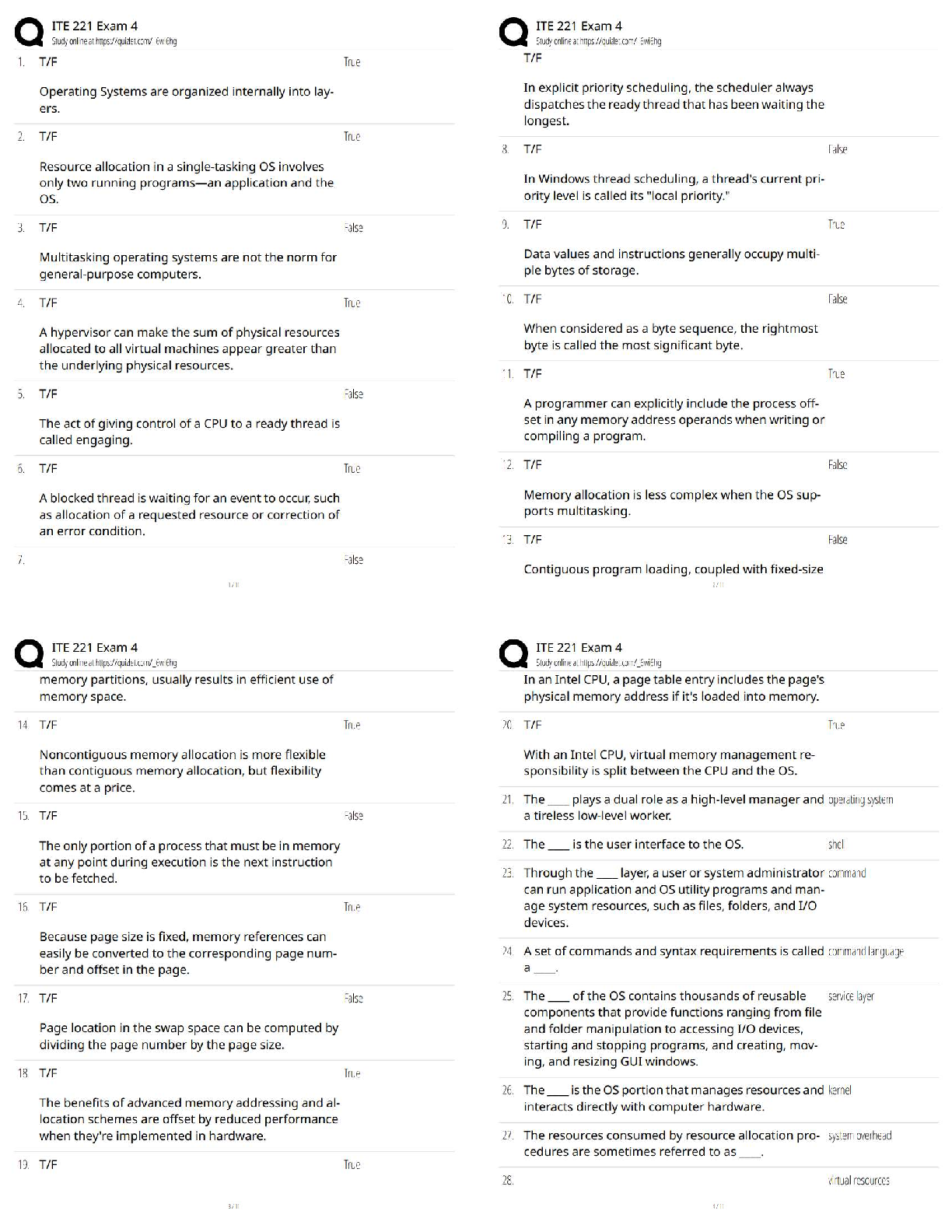

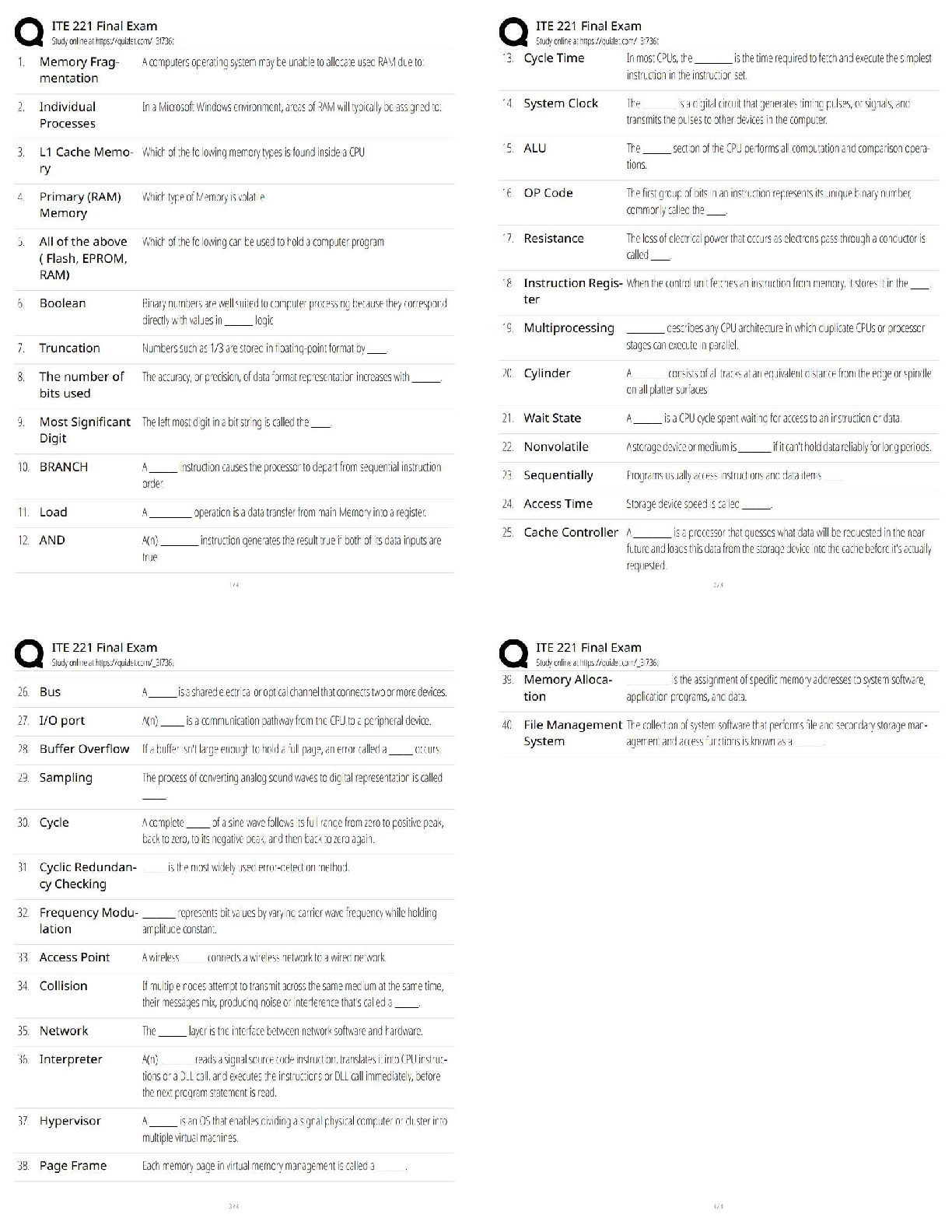

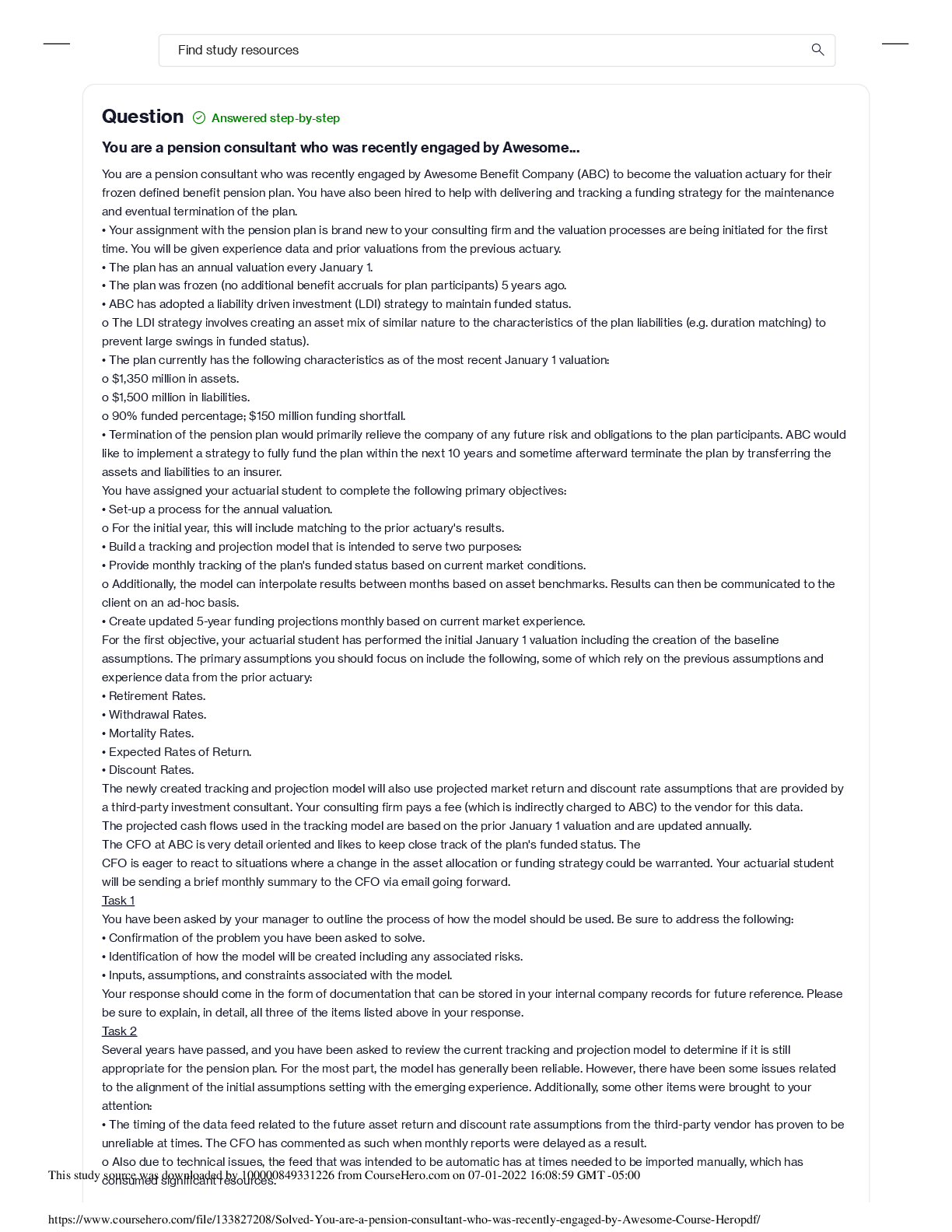

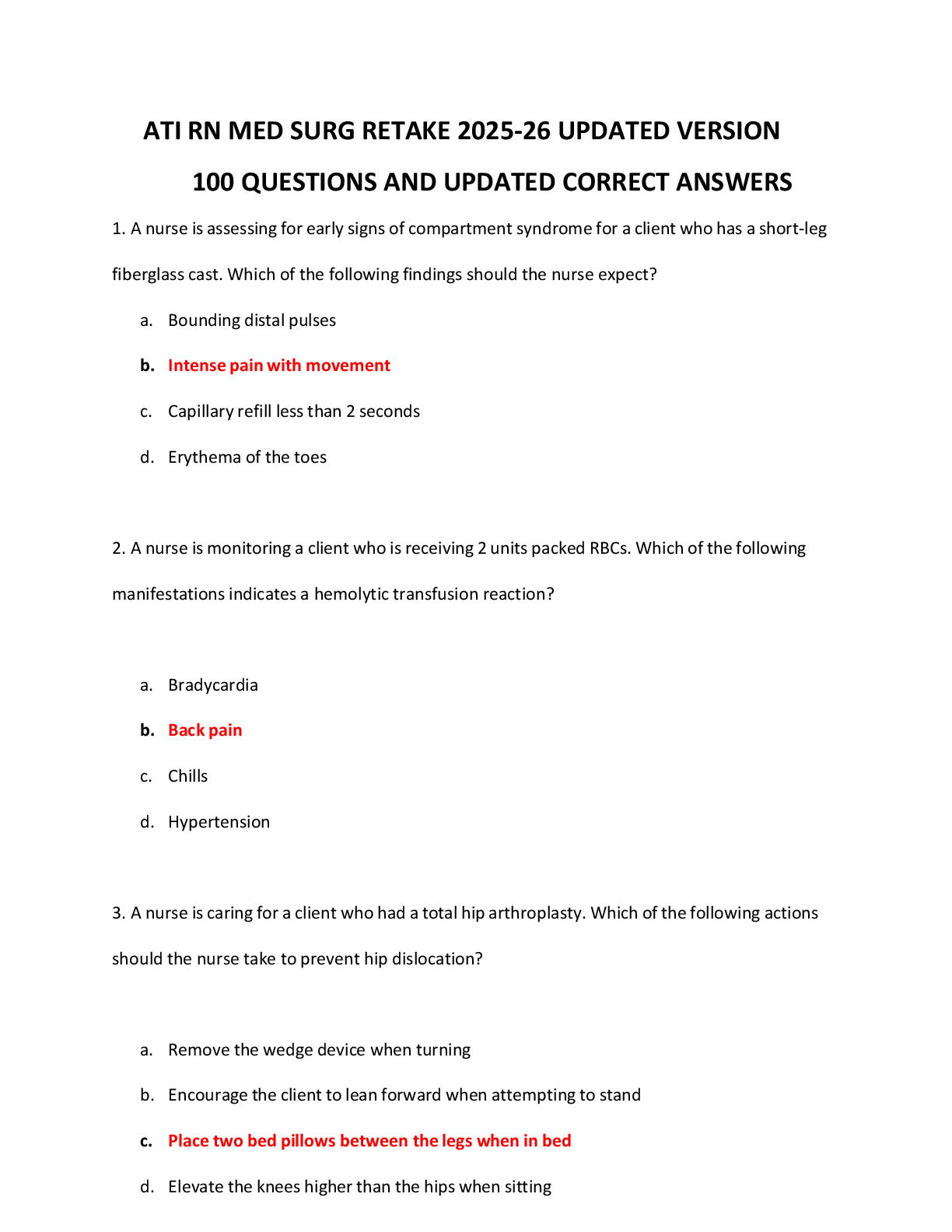

Financial Planning and Insurance Final Exam Study Guide Multiple ChoiceExam 4 Question 1 2 out of 2 points For estate tax purposes, life insurance Selected Answer: held by a revocable life ... insurance trust is includable in the grantor's estate Question 2 0 out of 2 points Which of the following goals can be achieved by the use of key employee life insurance? Assure shareholders of a public corporation that the price of the stock will not plummet at the death of a president or other senior executive. Question 3 0 out of 2 points Which of the following circumstances, if true, would make a nonqualified deferred compensation plan inadvisable? Answer s: the business is not likely to survive the death, disability or retirement of its key employees Question 4 0 out of 2 points All of these recent changes in qualified plan pension law have made nonqualifying deferred compensation plans more attractive, except easier nondiscrimination rules place fewer restraints on employer's discretion Question 5 2 out of 2 points Which of the following types of qualified plans provides the most advantageous treatment of life insurance? Selected Answer: defined benefit plan Question 6 [Show More]

Last updated: 3 years ago

Preview 1 out of 39 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 14, 2022

Number of pages

39

Written in

All

Additional information

This document has been written for:

Uploaded

Jun 14, 2022

Downloads

0

Views

119

.png)

.png)

.png)